Financial services giant Capital One has undoubtedly found itself in a lot of hot water in recent years. In July 2019, a class action suit was brought against the company because of a far-reaching data breach. And in 2023, the business was hit with another class action suit for overdraft fees in check and ACH transactions.

For many years, class action lawsuits like these have been a critical tool for consumers seeking justice for corporations’ wrongdoings. Having more people involved in a legal challenge makes it less costly to pursue per plaintiff. Furthermore, class action cases often bring about significant changes in company policies and procedures as well, giving consumers comfort in the fact that what happened to them is unlikely to happen to anyone else.

Below, you’ll learn about the class action lawsuits brought against Capital One, including how they work and the benefits they’ve brought to those who chose to participate in them.

The 2019 Data Breach Capital One Class Action Settlement

On July 19, 2019, Capital One found that a bad actor had gained access to sensitive information about its credit card applicants and other customers that previous March. On January 27, 2021, Capital One discovered an additional 4,700 bankers who had their data compromised, including items such as:

- Social Security numbers

- Bank account numbers

- Addresses

- Zip codes

- Phone numbers

- Emails

- Dates of birth

- Income information

The hacker was also able to obtain information about credit scores, limits, and balances, as well as transaction data. Altogether, approximately 100 million people were affected by the breach, and those involved in the suit alleged that Capital One did not put adequate cybersecurity measures in place to prevent it. Obviously, having such personal data leaked was devastating for many consumers so it only made sense to launch the class action lawsuit.

Only the 100 million people whose names were identified by Capital One as being affected by the data breach were allowed to be settlement class members. The deadline for making a claim was September 30, 2022.

In order to do so, class members had to visit capitalonesettlement.com, enter a unique ID number sent to them by the company, and upload proof of their losses. Alternatively, they were allowed to mail their claim and documentation. Each person could claim up to $25,000 for lost time and expenditures.

On February 7, 2022, a judge preliminarily approved a Capital One settlement valued at $190 million, with its final approval being granted on September 13, 2022. The business was fined $80 million and required to bolster its cloud security. Identity defense and restoration services will be provided to those affected through February 13, 2028.

Capital One Class Action Settlement Over Fees

In a class action lawsuit entitled Bob McNeil v. Capital One Bank, N.A., class representative Bob McNeil sued Capital One on behalf of current and past account holders, alleging that the company unfairly assessed and failed to reimburse overdraft and insufficient funds fees dating from September 1, 2015, through January 12, 2022.

These fees are levied when a check that a customer wrote bounces due to insufficient funds in the account. However, the lawsuit states that Capital One charged fees when they either represented a check (with the same check number and written for the same amount) or re-processed a check or ACH transaction, even though the account holders’ account funds were eventually able to cover it.

Attorneys representing class members have argued that those improperly assessed fees should have been refunded to account holders, all while Capital One asserted its own belief that it had done nothing wrong. Nevertheless, it has agreed to pay out $16 million to plaintiffs in the class action lawsuit who have been affected by the fees.

Eligible members of the settlement class include those who had an overdraft fee charged to them between September 1, 2015, and January 12, 2022. All eligible members should have received notice of their eligibility via email or postcard. The amount of payment or account credit they should receive will depend on how much they have paid out in fees.

Unlike other class action suits in the past, however, eligible members do not have to take any action in order to be a part of the lawsuit. Even if they opt to do nothing, they will still receive a settlement payment or Capital One account credit once the settlement is approved. Those who desired to opt out of the settlement should have sent a letter to the settlement administrator by June 17, 2024, stating their intention.

The final approval hearing for the settlement is scheduled for July 15, 2024, at 10:00 a.m. If there is no sustained objection, payments or credits should be made within 60 days.

@seansvv Massive Update In FB’s $725 Million Class Action Lawsuit Settlement For Context: @SEAN #classaction #classactionlawsuit #facebooklawsuit #facebooksettlement #legal #termsandconditions

Understanding the Class Action Lawsuit Settlement Process

In a class action lawsuit, a plaintiff files a suit against a company on behalf of others with similar claims. Attorneys then obtain class certification and notify class members of their status and next steps, allowing them to opt in or out of the process.

Those attorneys will then try the suit in court or negotiate a settlement, which must be approved by the court. In cases like those that Capital One has faced, having a thorough understanding of account terms and conditions is crucial. Attorneys need to be able to prove impropriety based on well-documented terms that both the company and the account holders have agreed to.

Most class action lawsuits, including those involving Capital One, employ a settlement administrator, an individual appointed by the court who is responsible for managing the settlement process. They validate claims with documentation and ensure legal compliance when distributing funds to class members.

Class members benefit from having that court-appointed neutral third party because it provides them with peace of mind, ensuring the process is free from bias and based solely on neutral eligibility criteria. It also helps move the process along quickly to ensure that payments reach class members in a timely manner.

Impact on Capital One Customers and the Company Itself

The rippling effects of the Capital One class action lawsuits, as well as the underlying problems that sparked them, are widespread. In the case of a data breach, for instance, an account holder’s information may already be sold by fraudsters multiple times on the dark web before the company even notices that its system has been infiltrated. What that means is that, in addition to the impacts on their net worth derived from money that may have been outright stolen from their accounts, those involved in the lawsuit run the risk of future identity theft.

Class action suits like these can have long-term negative impacts on Capital One’s relationships with customers, driving them to their competition. Undetected vulnerabilities that lead to large data breaches, like that which occurred in 2019, can paint the company as untrustworthy in the eyes of consumers, causing it to lose out on both existing and potential business opportunities. Improperly assessed fees may have made the company look as if it doesn’t care much for its customers, as well, especially since the company officially denied any allegations of wrongdoing.

As a prominent financial institution that prides itself on helping customers, these cases may have long-term effects on both Capital One’s economic outlook and the company’s operations. For example, it has already agreed to update its cloud cybersecurity protocols to prevent future data breaches and limit potential fraud issues for customers. That will cost the company financially and result in operational changes for its data security team.

Capital One hasn’t officially announced any changes to its overdraft fee, represented check, or ACH transaction handling policies, though those may come following the upcoming settlement distribution.

Consumer Rights and Class Action Participation

Regulations regarding class action lawsuits require class members to be notified of the suit and the terms of their participation in it. However, those wanting to stay informed about potential settlements or find and track open class action lawsuits can use resources such as ClassAction.org or Consumer-action.org.

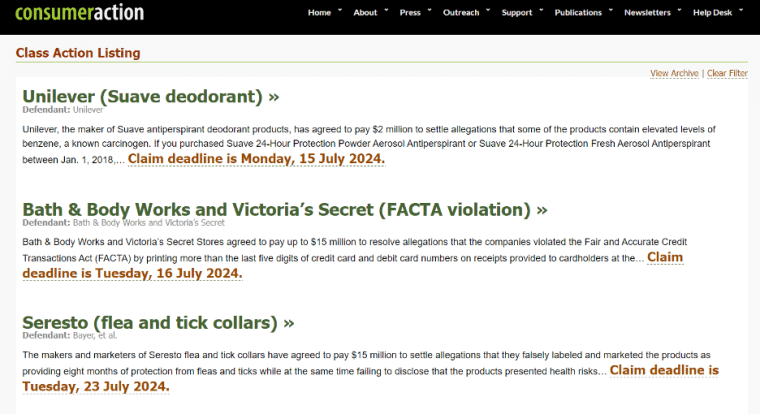

Sites like these gather class action lawsuit information from a variety of sources, including self-reports from class members, publicly available information, news highlights, and teams of lawyers. They typically maintain a list of open and potential lawsuits and deliver information directly to inboxes in the form of a newsletter like the one below.

If you believe you may have a claim, you can usually check the terms of eligibility on a specialized claim website (such as capitalonerepresentmentlitigation.com, the website set up specifically for the overdraft fee suit). Filing claims requires class members to follow instructions on those websites as well as those located in official materials received in the mail or via email.

In general, when it comes to class action lawsuits, meeting deadlines and providing accurate information to settlement administrators is crucial. If you fail to do either, it could jeopardize your ability to have your voice heard and receive settlement payments to alleviate financial burdens caused by a company’s adverse actions.

Other Open Class Action Lawsuits

While you may have missed out on the recent Capital One class action settlements, it’s important to stay informed so that you don’t let other opportunities slip by. When class members participate in these suits, they ensure that justice is served.

One similar open lawsuit going on right now involves claims that Victoria’s Secret and Bath and Body Works violated the Fair and Accurate Credit Transactions Act (FACTA) by printing too much of consumer’s credit card information on receipts.

You may be eligible if you made a purchase at one of these stores between May 10 and August 8, 2021. Vouchers for up to $15 are available as compensation, and interested parties can join the claim at factaclassactionsettlement.com. However, note that the claim filing deadline is July 16, 2024.

DIY online tax preparation provider TaxAct is also involved in a class action suit. The company has agreed to a $14.95 million settlement amid claims that it shared personal and financial information with third parties without permission. Eligible parties must have used the software to file a Form 1040 between January 1, 2018, and December 31, 2022. Class members can submit claims at taxactclasssettlement.com until September 11, 2024.

Companies and Consumers Benefit From Class Action Lawsuits

Capital One’s involvement in recent class action lawsuits underscores the broader need to ensure that financial institutions are held accountable for their actions. The banking and financial industries are some of the most regulated in the country, and it’s crucial that institutions in these sectors seek to stay compliant and do the right thing for their customers.

At the same time, it’s also essential that consumers stay vigilant about participation in potential class action lawsuits and settlements. These cases go a long way in protecting consumers, not only bringing financial justice and peace of mind to victims of wrongdoing but often resulting in policy (and sometimes legal) changes that further safeguard them.

Ultimately, it’s important to look at class action lawsuits as beneficial for both companies and consumers. While the consumer benefits from payouts, the company benefits from making long-term shifts that not only reduce their compliance risk and digital vulnerabilities but go on to enhance their ability to cater to their customers’ needs and ensure they are protected at every turn.