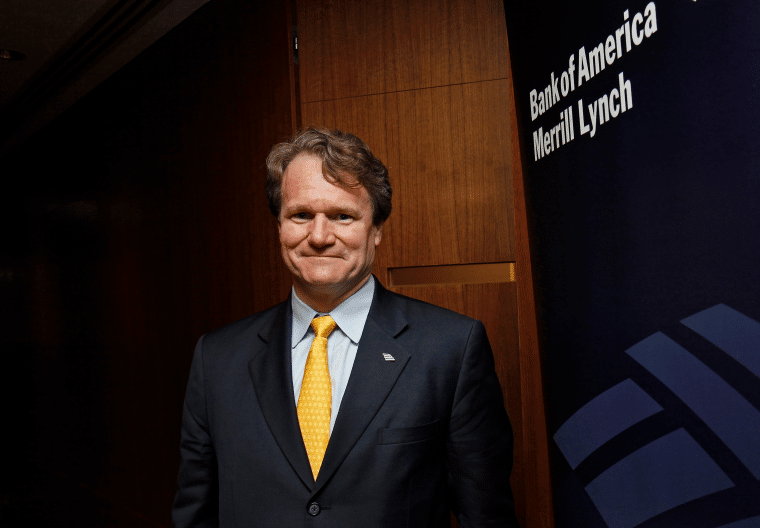

Brian T. Moynihan, the American lawyer and bank executive, is the current chairman and CEO of Bank of America. His incredibly successful career has made him one of the highest-paid executives in finance.

In 2024, Brian Moynihan’s net worth is estimated at over $243 million.

Moynihan has held the position of chief executive officer of Bank of America since the wake of the global financial crisis. His leadership skills have helped steer the bank through the pandemic and other crises.

To learn how he got this position and accumulated his fortune, keep reading.

How Much is Brian Moynihan Worth in 2024?

- Net Worth: Over $243 million

- Primary Sources of Income: Salary and stock options as CEO of Bank of America, previous banking positions.

- BoA Stock Holdings: 2.4 million shares worth approximately $88.6 million.

- Career Milestone: Steered Bank of America through the financial crisis and the COVID-19 pandemic.

- Compensation: Earned $29 million in 2023, a slight decrease from previous years.

- Board Memberships: Sits on several influential boards, including the World Economic Forum and Brown University.

- Latest Update: In 2023, Brian Moynihan saw a slight decrease in his total compensation to $29 million, reflecting the economic pressures faced by Bank of America. He continues to guide the bank through a challenging economic environment, maintaining its position as one of the largest financial institutions in the world.

Brian Moynihan’s Net Worth: Full Breakdown

Moynihan Brian is very private regarding his assets and personal spending, and he has revealed little about his earnings before he reached the CEO position at Bank of America.

His compensation as the organization’s CEO has been publicly disclosed throughout the years, allowing us to pinpoint how much exactly he has made from his high position at the bank. Most of his compensation comes in the form of shares, some of which he sold over the years, adding millions in the form of cash to his net worth.

Seeing how this is the biggest source of wealth for the businessman and most likely makes for most of his fortune, we gathered sufficient data to create a breakdown of his estimated net worth below:

| Asset or Income Source | Contribution to Net Worth |

| BoA salaries 2010-2023 | $242.55 million (including equity) |

| Previous salaries | Unknown |

| Board compensation | Unknown |

| BoA stock holdings | 2.4 million shares worth $88.6 million (partially vested) |

| Total Net Worth | $243+ million |

7 Fun Facts About Brian Moynihan

- Rugby Enthusiast: Co-captained the Brown University rugby team during his undergraduate years.

- Law Background: Earned a Juris Doctor from the University of Notre Dame before transitioning to banking.

- Long Tenure: Has been with Bank of America since 2004, rising through the ranks to become CEO in 2010.

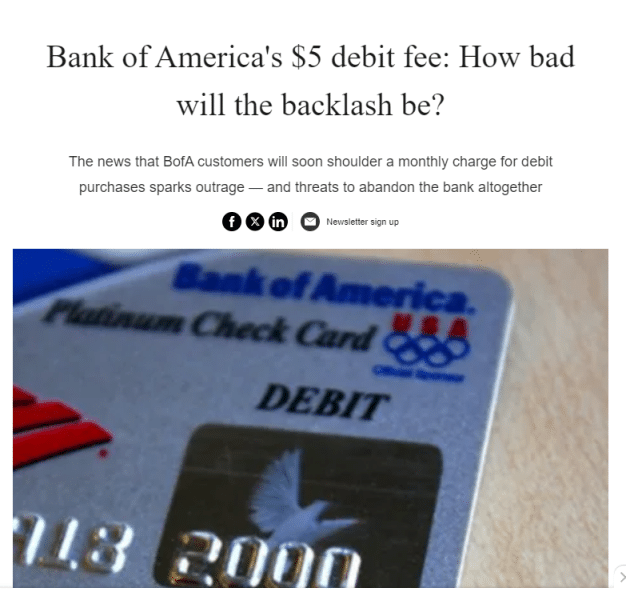

- Controversial Fee: Introduced a $5 debit card fee in 2011, which was quickly retracted after public backlash.

- Corporate Turnaround: Credited with reviving Bank of America after the 2008 financial crisis.

- Compensation Cuts: Despite being one of the highest-paid CEOs, he has had his pay cut several times due to economic downturns.

- Chancellor Appointment: Set to become the Chancellor of Brown University in July 2024.

Latest News & Controversies

In 2024, Brian Moynihan has remained an influential figure in both the banking and academic worlds.

Recently, he addressed concerns about consumer spending amidst inflation. Moynihan pointed out that, while consumers are still spending on travel and dining, they are cutting back on other expenses and seeking bargains at grocery stores. He emphasized that many consumers are now using their savings to maintain their lifestyle, reflecting broader economic challenges in the U.S.

He also shared concerns about the growing level of consumer debt, particularly credit card debt, which reached a new high of $1.14 trillion in 2024.

Additionally, in the academic arena, Moynihan is set to take on a significant role as the Chancellor of Brown University, his alma mater, starting in July 2024. This new position highlights his strong connection to the institution and his leadership experience, as he transitions to this prestigious role after serving on Brown’s Corporation Board.

Brian Moynihan Early Life and Education

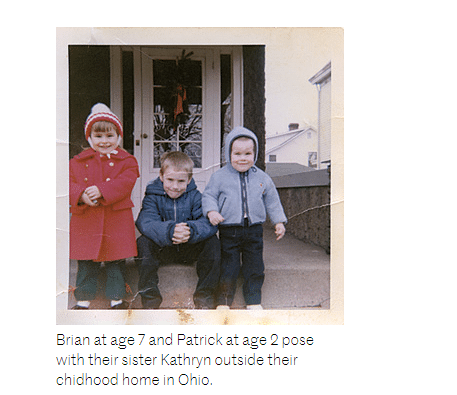

Brian Thomas Moynihan was born on October 9, 1959, in Marietta, Ohio, as one of eight siblings in a Catholic family.

In 1981, he graduated from Brown University with a major in History. This is also where he met his wife, Susan E. Berry, and co-captained the school’s rugby team.

Following this educational success, he enrolled at the University of Notre Dame Law School where he earned a Juris Doctor.

Today, Brian T. Moynihan is still married to Susan Berry and has three children with her.

Brian Moynihan Net Worth: Early Days of a Star-Studded Career

Moynihan’s path to becoming the chief executive officer of one of the world’s leading banks was gradual and full of successes. He didn’t immediately land this high role. Instead, he held numerous banking positions at different companies, starting straight out of university.

Early Career

Moynihan started working straight out of school. Once he obtained his degree from the University of Notre Dame, he moved back to Providence, Rhode Island, where he started working for the city’s largest law firm, Edwards & Angell LLP. He stayed for nine years at the company, which was later renamed Edwards Angell Palmer & Dodge LLP.

While at the company, Brian T. Moynihan did work for Fleet Financial Group Inc. In 1993, he was allowed to start working at Fleet Boston as their deputy general counsel, so he left his position at Edwards & Angell.

FleetBoston Financial Corp.

In April 1993, Brian Moynihan left his first job to join Fleet Boston Bank. Proving his worth at the new workplace, he started climbing ranks almost immediately, and, in 1999, the bank appointed him their executive vice president, a position he held until April 2004.

Brian Moynihan Net Worth: Merging With Bank of America

In 2004, Fleet Boston Financial merged with Bank of America Corp. (BofA). Following the merger, Brian Moynihan became president of global wealth and investment management.

At the time of this merger, FleetBoston was a major success. It was the seventh-largest bank in the United States, handling $197 billion in assets and catering to over 20 million customers. The merger caused hundreds of people to lose their jobs or be demoted.

Four years later, he was named chief executive officer of Merrill Lynch after Bank of America in September.

By 2009, Brian T. Moynihan was the corporation’s first choice to replace Ken Lewis in the position of chief executive officer of Bank of America. In January 2009, he became president of consumer and small business banking and, in 2010, when Ken Lewis stepped down, Moynihan became the CEO of Bank of America Corp.

Ken Lewis lost the title of chairman of the board and announced his retirement as CEO effective December 31, 2009, amid many controversies and legal investigations surrounding the acquisition of Merrill Lynch.

Moynihan as the CEO of Bank of America

When Brian Moynihan was selected to replace Lewis as the CEO of Bank of America Corp., the bank was seriously struggling. The US government accused the bank of defrauding state and local government organizations using illegal activities such as investing proceeds from municipal bond shares, which resulted in BoA paying $137.7 million to the affected organizations.

During 2011, under his leadership, the bank started reducing personnel and letting go of 36,000 people, contributing to the plan to save $5 billion yearly by 2014.

In December 2011, Forbes ranked the organization’s financial wealth 91st out of the US’ largest 100 banks.

After a long financial crisis, Bank of America sold some of its branches in 2014. In the first quarter of the year, they sold 20 branches to Berkshire Bank in New York for $14.4 million, followed by 13 other branches in Michigan sold to Huntington Bancshares in April and May.

The new strategy of the bank was to focus on increasing its mobile services, so starting from 2014, Bank of America counted 31 million active online users and 16 million mobile users. This number increased to 25.3 million in the following four years, decreasing the retail banking branches in the process.

In 2015, Bank of America started returning to its former glory and expanded organically, creating new branches all over the country. They opened shop in Denver, Minneapolis-Saint Paul, Indianapolis, Pittsburgh, Cleveland, Columbus, and Cincinnati.

In 2019, Brian Moynihan announced that the bank would increase minimum wages to $17 an hour in 2019 until they reach a goal of $20 an hour in 2021. The bank later raised its minimum hourly wage to $22 as part of the newest goal to increase it to $25 by 2025.

These days, Bank of America generates 90% of its revenue domestically and is one of the biggest banks in the country. The bank is now a national giant, a lot of it thanks to Brian Moynihan who took it from a serious downfall to becoming one of the leading banks in assets and market capitalization.

As of 2022, Bank of America had an employment figure of over 138,000 people and was the fourth largest employer in the banking sector in the US. The corporation has gone a long way from firing hundreds of thousands of employees.

Controversies

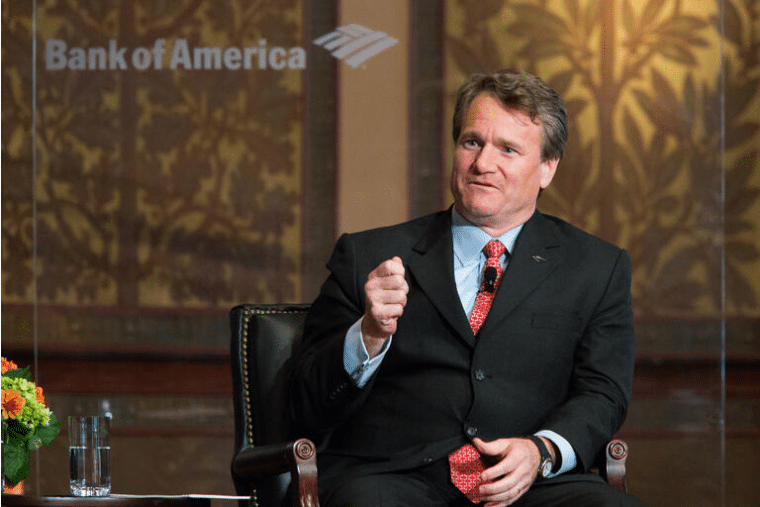

Brian T. Moynihan has remained in the CEO position for over a decade, making major changes and helping Bank of America Corp. grow even more. However, his leadership hasn’t been without controversies.

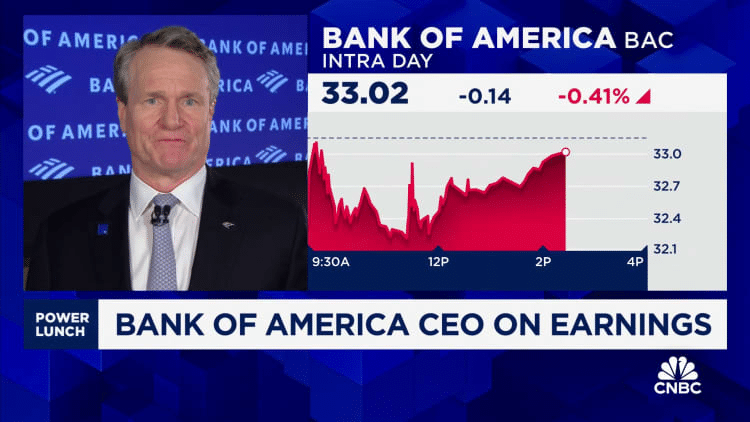

When Brian T. Moynihan was placed at the helm of the corporation, Bank of America announced that they didn’t need to raise capital. However, on August 25, 2011, CNBC reported that Moynihan did indeed accept $5 billion in capital from the investor Warren Buffet, claiming that his investment counts as Tier 1 Capital. However, this move led to major controversy with traders questioning the new CEO’s credibility. The markets also ignored the investment, seeing it as a debt instead of capital.

In October of that same year, it was reported that the bank was the “worst performer in the Dow Jones Industrial Average for two-quarters”. The bank has received a flood of criticism for charging $5 monthly fee for debit card purchases.

While he felt strongly about the fee at the time, Moynihan changed his mind in 2011 when he told Business Insider that the proposed fee “wasn’t the best idea”. He proceeded to say: “We struck a chord with customers that no one anticipated. We learned our lesson and stopped it”. Reportedly, this single error led to a 20% increase in account closures in only three months so it’s not exactly surprising that they scrapped the idea.

Earnings as CEO of Bank of America

During the most challenging period for Bank of America, when Brian Moynihan became the CEO, the corporation kept his salary level relatively low (for the industry and size of the company) at $950,000. In comparison, in 2010 when he earned $950,000, Jamie Dimon, the CEO of JPMorgan Chaise received a $19 million raise.

As the corporation grew under his leadership, his salary increased tremendously, leading Moynihan to become one of the highest-paid CEOs in the sector.

His compensation package quadrupled in the following year when the bank paid him nearly $8.1 million. In 2012, though, his earnings dropped to $7.5 million, but they nearly doubled in 2013 when he earned over $12 million. His total compensation for 2014 was $13 million a year, followed by $16 million in 2015 and $20 million in 2016.

In 2017, CEO Brian Moynihan received $23 million in total compensation, which was an increase of 15% compared to 2016 when he earned $20 million. He reportedly earned $26.5 million per year in total compensation as chair and chief executive officer in 2018 and 2019.

During the pandemic, the profits at the bank dropped 35%, causing Bank of America to reduce the CEO’s compensation to $24.5 million in 2020. However, following the pandemic, Moynihan’s total compensation was boosted by 30.6%, which landed him in the $30 million club of earners in 2021.

In 2022, Bank of America cut CEO Brian Moynihan’s total compensation to $30 million, compared to $32 million the year before. The bank’s net income fell 14% in a single year, causing this drop in his earnings. Even so, this is still the bank’s third-highest net income on record.

His 2022 salary breaks down to a base salary of $1.5 million and $28.5 million in restricted stock, which will be vested through 2025.

In 2023, CEO Moynihan Brian was paid $29 million, another cut from the previous year, which made him the only CEO from a top-six bank in the country to have his compensation cut.

Stake in Bank of America and Insider Trading

For the most part, the compensation Moynihan has earned as part of his package comes in the form of shares at Bank of America, meaning that, at this point, Moynihan owns a significant stake in the organization.

Today, Moynihan owns 2.4 million shares or 0.03% of the company’s total shares outstanding, which makes him one of the top individual shareholders of the business. However, considering that some of the packages came with restricted stock, some of these shares are not fully vested yet.

As for insider trading, he reportedly cashed out over 1.4 million shares worth $19.9 million in 2018.

Brian Moynihan Net Worth: Other Investments and Assets

Brian Moynihan lives a rather private life, hardly ever disclosing details on how he spends his fortune or what assets he owns.

In addition to his roles as chairman and CEO of Bank of America, he is also a member of several other organizations and boards:

- Member of the Council of Competitiveness

- Member of Partnership for Rhode Island

- Chair of the International Business Council Stakeholder Capitalism Metrics Initiative at the World Economic Forum

- Member of the Financial Services Forum

- Member of the Bank Policy Institute

- Chair of The Clearing House Association

- Member of the Business Roundtable

- Co-Chair of the American Heart Association CEO Roundtable

- Co-chair of the Steering Committee of the Council for Inclusive Capitalism

- Chair of the Sustainable Markets Initiative

- Member of the advisory council for the Smithsonian’s National Museum of African American History and Culture

- Member of the Board of Fellows at Brown University (slated to become the Chancellor in July 2024)

- Chair of the Watson Institute Board of Governors

What Can We Learn from Brian Moynihan’s Story?

Based on our detailed account of the life and financial trajectory of Brian T. Moynihan, it is clear that his journey is marked by strategic leadership, resilience, and adaptability. His rise to the helm of one of the world’s largest banking institutions, Bank of America, is impressive at the very least and has plenty of lessons to teach us.

The famed businessman started modestly, working as an investment banker and gradually climbing the ranks in the industry, which teaches us the importance of hard work and patience.

The fact that he has remained working at the same company for decades, even following several mergers and a change in his position as vice president of Fleet Boston Bank, demonstrates his loyalty toward a company, which was eventually rewarded with the highest position available – chief executive officer – along with a fat paycheck.

Bryan T. Moynihan started his incredible CEO journey at one of the organization’s most challenging times.

His rise to prominence reflects his commitment to excellence and ability to navigate through complex challenges, including financial crises and regulatory scrutiny. His tenure as the CEO of Bank of America, particularly during the turbulent economic times, shows his capability to steer the organization toward growth.

Despite facing controversies and setbacks, as well as making mistakes along the way, Moynihan’s steadfast leadership has contributed to the bank’s resilience and continued success. His compensation these days is reflective of his instrumental role in the company’s growth and performance, placing him among the highest-paid executives in the industry.