Vedanta chairman Anil Agarwal is an Indian billionaire based in London whose wealth makes him one of the wealthiest people in the city and the entire United Kingdom. He founded Vedanta Resources which became the first Indian company to list on the London Stock Exchange (LSE).

Anil Agarwal’s net worth is estimated at around $6 billion in 2024.

Let’s dive into his career, net worth, and life story to see what insights we can learn from the flamboyant yet controversial Indian billionaire.

How Much is Anil Agarwal Worth in 2024?

- Net worth: Estimated at $6 billion as of February 2024.

- Primary assets: Major stakes in Vedanta Resources and Hindustan Zinc through his investment vehicle Volcan Investments Limited.

- Debt obligations: Vedanta Resources faces a debt of $6.4 billion, impacting Agarwal’s overall wealth.

- Real estate: Valued at $50 million across the UK and India.

- Annual dividends and brand fees: An estimated $740 million in 2023.

Anil Agarwal’s Net Worth: Full Breakdown

Since most of Anil Agarwal’s wealth derives from his stake in listed companies, we can form a good estimate of his net worth.

Anil Agarwal’s investment vehicle, Volcan Investments Limited, owns a 61.7% stake in Vedanta Resources Limited, which has a majority stake in the India-listed Vedanta Limited and Hindustan Zinc.

Vedanta Limited has a market cap of around $12 billion which means that Vedanta Resources’ stake in the company is valued at around $7.1 billion.

Vedanta Resources Limited also holds a 64.9% stake in another listed company Hindustan Zinc Limited, valued at around $10.3 billion as of February 20, 2024. In addition, Vedanta Resources owns a stake in Konkola Copper mines, valued at around $100 million.

That said, Vedanta Resource has a debt of $6.4 billion which must be taken into account when calculating Anil Agarwal’s net worth. All things considered, we estimate Anil Agarwal’s net worth to be around $6 billion as of February 2024.

| Asset or Income Source | Contribution to Net Worth |

| Net stake in Vedanta Resources Limited | $5.85 billion |

| Real estate investments | $50 million |

| Annual dividends (adjusted for high 22′, 23′ dividends) | $500 million |

| Annual brand fee from Vedanta Limited, Hindustan ZInc | $240 million |

| Total Net Worth | $6 billion |

Latest News on Anil Agarwal (2024 Updates)

Anil Agarwal’s Vedanta Group is facing new challenges in 2024.

Vedanta Resources, struggling with debt, is in talks with JP Morgan for a $1 billion refinancing deal to manage its obligations. Additionally, Vedanta is pushing forward with its plan to enter semiconductor manufacturing in India, despite the collapse of its partnership with Foxconn.

The Indian government continues to support the initiative, aligning with its goal of reducing reliance on Chinese tech imports.

The Early Life of the “Metal King”

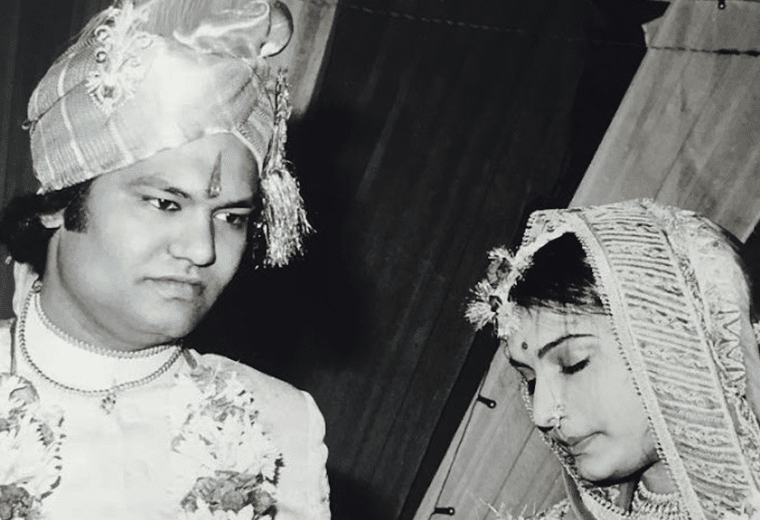

Anil Agarwal was born in September 1952 in a small village in Patna, Bihar, India, where his father, Dwarka Prasad Agarwal, ran a small aluminum conductor business. Coming from a Marwari family, Anil attended Miller High School in Patna but chose not to continue his education and instead joined his father’s business.

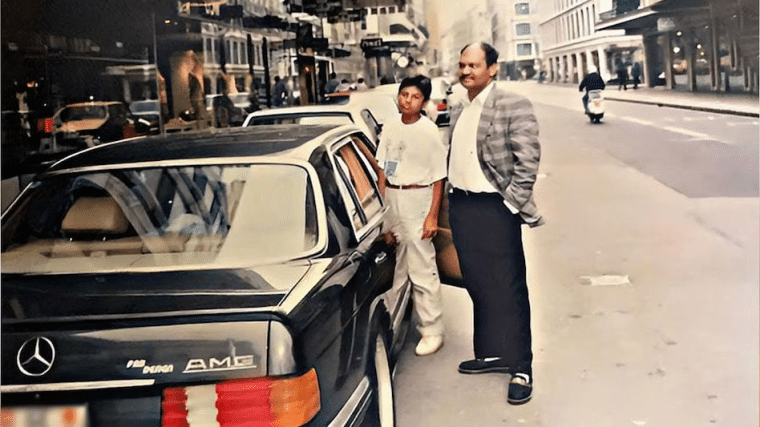

However, Anil Agarwal’s journey as a businessman and entrepreneur began in the 1970s when he left Patna for Mumbai (then Bombay), India’s financial capital. He started with a tiny scrap metal business and sold scrap metal in the city that he sourced from different parts of the country.

In 1976, he got a bank loan to acquire Sterling Corporation, which used to manufacture enameled copper. He tried his hand at various businesses but with little success.

In the early 1990s, the Indian government reformed the economy and opened up different sectors to private and foreign companies. Agarwal was among the businessmen who capitalized on the once-in-a-lifetime opportunity that India’s economic reforms presented.

Agarwal established Sterlite Industries in 1993, the first private sector company in India to set up a copper smelter and refinery. In 1995, Sterlite bought Madras Aluminum which had been shut down for 4 years by the country’s Board for Industrial and Financial Reconstruction.

Fortunately for Agarwal, despite political changes, India continued on the path of economic liberalization and the country privatized several state-owned assets to free up funds.

In 2001, Sterlite bought a controlling 51% stake in state-run Bharat Aluminium Company (BALCO) which was subsequently followed by a 26% stake in Hindustan Zinc Limited (HZL) in 2002. Later, Agarwal raised the stakes in Hindustan Zinc and now Vedanta Group has a controlling stake in the company.

As Agarwal’s business empire grew he incorporated Vedanta Resource Plc in London and the company became the first Indian company to be listed on the London Stock Exchange in 2003.

Agarwal kept growing his mining business and bought a 51% share in Konkola Copper Mines in 2004. Two years later, he started a lead smelter in India that could process 50,000 tonnes per year. In 2007, Vedanta went public on the New York Stock Exchange in what was the biggest IPO by a non-US company in the country.

The same year Vedanta Resources bought a 51% stake in iron ore miner Sesa Goa from Mitsui & Co for $981 million. Agarwal also diversified Vedanta Resources’ business into the hydrocarbon industry and in 2011 it completed the acquisition of a controlling stake in Cairn India.

In a corporate restructuring, in 2013 Agarwal merged Sesa Goa and Sterlite Industries into a single company called Sesa Sterlite whose name was soon changed to Vedanta Limited. Vedanta Ltd. and Cairn India shareholders approved a merger which was completed in 2017.

Just like Agarwal capitalized on India’s first-generation economic reforms in the 1990s and the early 2000s, he acquired several companies after the Indian government pushed for the sale of various bankrupt companies after 2016.

These include:

- The acquisition of Electrosteel Steels Limited in 2018

- Sindhudurg Unit of Global Coke Limited in 2019

- Ferro Alloys Corporation Limited in 2020

- Bachau and Khambalia Coke manufacturing units of Gujarat NRE Coke in 2021

Through these acquisitions, Vedanta was able to grab mining and manufacturing assets at reasonable prices. The company has also expanded its operations globally over the years and in 2010 it acquired zinc assets in Namibia, Ireland, and South Africa, including Gamsberg – the largest undeveloped zinc deposit in the world. Agarwal ventured into nickel mining with the acquisition of Nicomet in 2021 which made Vedanta the only nickel mining company in India.

Vedanta has also diversified into new industries and in 2017 it acquired over 51% stake in AvanStrate Inc. – a Japan-based manufacturer of LCD glass substrates. In 2023, the company also made a foray into semiconductor and glass displays.

The company also formed a joint venture (JV) with Taiwan’s Foxconn (the manufacturer of the iPhone) to produce semiconductors in India but the JV was canceled mutually. Nonetheless, Vedanta is committed to building semiconductor and display plants in India despite Foxconn pulling out from the JV.

Like most of his previous ventures, Agarwal is yet again looking to piggybank on supportive policies of the Indian government, which is looking to kickstart semiconductor production in the country as it along with other countries including the US looks to diversify and derisk their supply chains from overdependence on China.

All said, under Agarwal’s leadership, the Vedanta Group has grown into one of the leading metal and mining companies not only in India but also globally.

Semiconductor Push and Debt Concerns

Vedanta’s attempt to diversify into semiconductor manufacturing comes at a time when India is focused on becoming self-reliant in tech. Although Foxconn withdrew from their joint venture in 2023, Vedanta has continued its pursuit, committing billions to the project.

However, this push is also shadowed by significant debt challenges, with the company grappling with over $6 billion in obligations. While Anil Agarwal’s strategic initiatives remain ambitious, they face hurdles that could influence both Vedanta’s and Agarwal’s financial stability in the near future.

Anil Agarwal Net Worth: Philanthropy and Charity Work

Like most other billionaires, Anil Agarwal is also associated with various social causes and Vedanta Resources has a philanthropic arm known as Vedanta Foundation which was founded by his father Dwarkaprased Agarwal.

Among others, the Vedanta Foundation works towards quality education, affordable healthcare, livelihood development, and community empowerment.

In 2014, Anil Agarwal signed “The Giving Pledge” and committed to giving 75% of his wealth to charity along with many other billionaires like Ray Dalio, Warren Buffett, Bill Gates, Elon Musk, Michael Bloomberg. He became only the fourth Indian billionaire to join the pledge and said:

“I am keen to build a world-class ecosystem around early childhood development and nutrition which would, in the long run, ensure that all children get the opportunities and a level playing field to reach their full potential, irrespective of the background they come from,” said Agarwal in his letter.

Anil Agarwal Net Worth: Real Estate Investments

Anil Agarwal owns properties in the UK as well as India which are valued at over $50 million. However, he hasn’t revealed much about any other personal investments like stocks outside the massive stakes that he holds in Vedanta Limited and Hindustan Zinc.

We do know that he earns hefty dividends from both these companies. Incidentally, in 2023 both Hindustan Zinc and Vedanta Limited announced fat interim dividends at a time when Vedanta Resources Limited was battling a massive debt pile – including near-term maturities.

Anil Agarwal Controversies

While Anil Agarwal is among the richest Indians, he along with the Vedanta Group has often been in controversies (like most mining companies and magnates).

In 2010, the Church of England sold its £3.8m stake in Vedanta Resources, which was then an FTSE company over human rights issues. In its statement, the Church said its investment in the mining conglomerate “would be inconsistent with the church investing bodies’ joint ethical investment policy.” It added,

“We are not satisfied that Vedanta has shown, or is likely in future to show, the level of respect for human rights and local communities that we expect.”

The decision was related to a project that Vedanta was pursuing in the Indian state of Orissa (now Odisha) which faced opposition from local communities and several people including celebrities like Bianca Jagger protested at Vedanta’s annual meeting in London over the issue.

Vedanta’s track record on issues related to the environment is also far from clean and its smelter unit in the Indian state of Tamil Nadu was shut for dumping arsenic-bearing slag near the factory. The company was also accused of dumping hazardous waste in the Kafue River in Zambia.

Meanwhile, the Indian Supreme Court has formed a panel of experts to study the way forward for the Tamil Nadu plant.

The plant has been shut down since 2018 when over a dozen protestors died after police starting shooting. However, the court believes that the plant is of national importance and keeping it shut indefinitely would serve no purpose. Notably, India’s imports of copper skyrocketed after the plant was shut down.

Vedanta has also been accused of lobbying to weaken the environmental rules in India to boost its business. While mining companies are often at loggerheads with green activists and human rights watchers, Vedanta has been in the crosshairs with activists more often than many of its peers.

The Vedanta Group hasn’t been a shining example of corporate governance also and the company has resorted to multiple corporate restructurings including the proposed demerger which experts allege is meant as a bailout for Agarwal and the massive debt that Vedanta Resources Limited has on the balance sheet rather than any value add for minority shareholders.

What Can We Learn from Anil Agarwal’s Life?

Anil Agarwal’s journey of becoming one of the most well-known names in the mining industry was far from easy and had humble beginnings from a small scrap metal business that he started in the 1970s.

According to Agarwal, “When I first arrived in Mumbai, bahut mushkil waqt dekha (saw very hard times). I had very little but always knew I wanted to do something big.”

When I first arrived in Bombay, I knew only two words in English, ‘yes’ and ‘no’. I held on to my dreams of making it big. Socha ki safar bohot lamba hai, par isse taye karna hai. Bohot mehnat ki, mushquilein sahin, phir bhi ubharta chala gaya…(1/4) pic.twitter.com/IwQaST5ssK

— Anil Agarwal (@AnilAgarwal_Ved) March 14, 2022

His determination and hard work were vital drivers of his becoming one of the most successful mining barons.

His story is not of instant success as many dream of – but of hard work and resilience. In 2022, Agarwal became the first Indian to speak at the Oxford Union in London where he shared insights about his journey as a businessman. He said,

“My journey from a small village in Bihar to London Stock Exchange has been one filled with many learnings, lots of hard work, and self-belief. My advice to the students was simple: be fearless (because luck favours the brave), be humble (because growth happens when you look inwards), and be flexible (because there is no substitute for hard work).

Budding entrepreneurs can also learn a lot from Anil Agarwal’s journey as his LinkedIn profile says “If you don’t dream, how would these dreams be fulfilled (translated.)” In a LinkedIn post, he advises, “Entrepreneurship can be a very lonely experience and if you know someone who is on this journey, try to empower them in some way, big or small.”

Finally, it’s important to realize his mistakes and wrongdoing when it comes to the many environmental issues with his companies. Mining is an essential part of the global economy but it doesn’t have to come with human rights violations and yet they are unfortunately common.