History repeats itself and meme stocks are a prime example. GameStop, the flagbearer of the meme stock frenzy of 2021, is again seeing shocking twists and turns. While GameStop shares are down from their recent highs, they have risen over twofold since early May.

This meteoric rise was primarily fueled by the return of Keith Gill, the former Reddit trader known as “Roaring Kitty” and “DeepFu*kingValue,” who played a pivotal role in the unprecedented 2021 meme stock mania that catapulted GME to its highest price levels on record.

Meanwhile, even as Roaring Kitty and some retail traders might have made a fortune from GameStop’s stellar rally, many others might also have lost, especially those who bought the shares at higher price levels. However, the ultimate beneficiary of the meme stock mania could be GameStop itself as the company capitalized on the spike to issue shares in a frenzy.

Analysts Have Been Advising Caution on GameStop

Quite a few analysts don’t even try to put a price target on stocks like GameStop, simply because they are too volatile and influenced by so many outside factors. The apathy is mutual as GameStop has also stopped taking analyst questions during the earnings calls. It is covered by only 2 analysts and both of them have a “sell” rating on the gaming retailer. Its median target price of $11 is less than half of the current price levels.

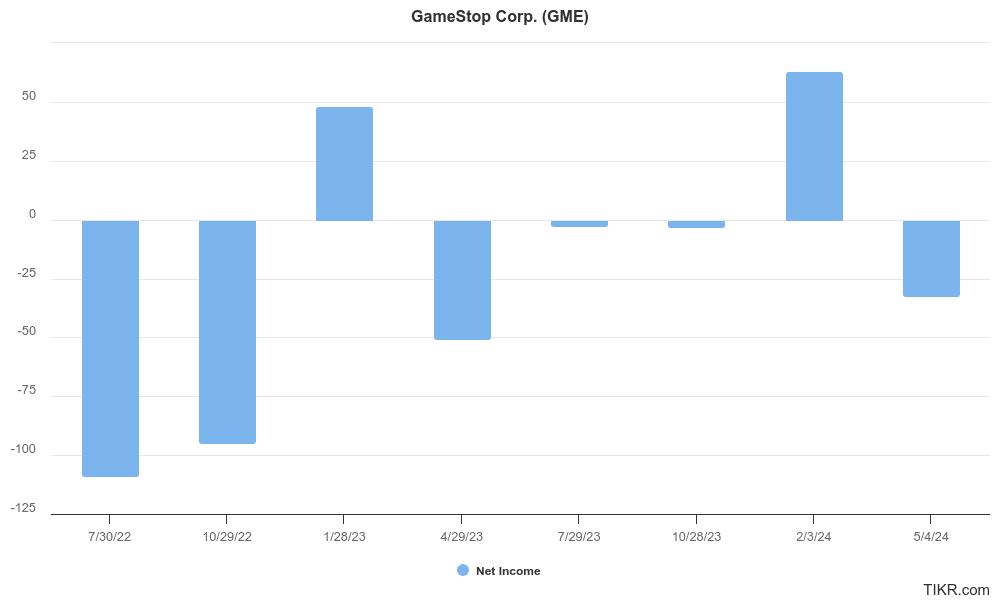

Wedbush in fact recently cut GameStop’s target price from $13.50 to $11. Analyst Michael Pachter doubts the company would be able to turn profitable, citing its $6 million loss last year.

In his note, Pachter said, “We expect them to lose $100 million a year going forward. It’s a race to see if they can close stores fast enough to limit losses, but they have no plan that would suggest they can grow revenues or profits, and their core business is in decline.”

To be sure, there is little denying GameStop’s precarious financials. The company reported a net loss of $32.3 million in the first quarter of 2024 while its revenues fell nearly 29% to $882 million.

Jim Cramer Sees a Bubble in GME Stock

Jim Cramer is also quite unequivocal about the bubble in GameStop and pointed to its valuation which almost hit $20 billion earlier this month. Cramer compared the company to Best Buy whose business he said was quite similar to GameStop.

As Cramer pointed out, Best Buy posted revenues of $43 billion in the most recent fiscal year while the corresponding figure for GameStop was a mere $5.3 billion. Best Buy is also a lot more profitable than GameStop and also pays a dividend with a healthy yield of 4.3%. Despite the financial disparities between the two companies, they commanded similar market caps earlier this month which is a clear sign of overvaluation in GameStop.

Commenting on GameStop, Cramer said that their “Current business is dying” and added that those buying the stock would have “eggs on their faces.”

GameStop’s Turnaround Remains a Work in Progress

To be sure, under the leadership of its biggest shareholder and CEO Ryan Cohen, GameStop has been trying to transform the business and even tried its hand at NFTs (non-fungible tokens). It has shut down many stores and has pivoted to ecommerce. The company also took additional steps to increase its target market amid the structural headwinds faced by the physical gaming industry as many gamers are now pivoting to online gaming.

The company’s turnaround remains a work in progress as Cohen tries to revamp the business. GME’s core gaming business is facing structural headwinds and while Cohen hired several tech executives – some of whom have either quit or have been asked to leave – GME is far from becoming a tech company (and attracting those valuations.)

GME’s Rally Might Not Have Been Organic Afterall

While GameStop’s rally might seem organic, analysis done by Interactive Brokers market strategist Steve Sosnick shows that towards the end of April, there was a massive buying in $25 and $30 calls on GME which were set to expire on May 17.

The only way anyone buying these calls would have made money was if GME stock – which was trading at just above $11 towards the end of April – rose steeply.

Clearly, someone (whether it was just RoaringKitty or not) made an extremely risky bet that GME was set to explode before May 17, and that’s exactly what happened. Those holding these call options look set for great payoffs, assuming they did not sell it before the rally.

While we don’t know how much money “Roaring Kitty” ultimately made on his multi-million dollar bet on GME, we know for sure that GameStop has made the most of the rally.

Kitty buys calls

Retail follow him

Stock goes up

GameStop sells shares

Stock dropsKitty buys calls

Retail follow him

Stock goes up

GameStop sells shares

Stock drops (to a higher floor)💰Kitty buys calls… 🔁

Nobody can hear you scream in an infinity squeeze#gme

— Stonkfather 🏴☠️ (@Stonkfather2021) June 24, 2024

GameStop Has Been on a Stock Selling Spree

No matter how much sane investors might frown about the rally in meme stocks, these spikes have been nothing short of a lifeline for many companies who capitalized on the frenzy to issue shares.

For instance, GameStop has raised over $3.1 billion through two at-the-market stock offerings. Notably, GameStop did not have any real requirement to raise money, and it has negative net debt (more cash than debt) on its balance sheet – thanks to its stock sales during the meme stock mania of 2020-2021.

GameStop sold the maximum number of shares that it filed for (45 million and 75 million respectively) in these two tranches and said that it intends to use the proceeds for “general corporate purposes, which may include acquisitions and investments.”

WARREN BUFFETT WARNS STOCK MARKET IS TURNING ‘CASINO-LIKE’ (The UBJ)

Warren Buffett’s annual letter to Berkshire Hathaway investors has drawn attention to the increasingly volatile nature of the stock market, fueled in large part by retail investors and the popularity of meme… pic.twitter.com/wSYw4UOCeP

— FXHedge (@Fxhedgers) March 24, 2024

Warren Buffett Compared Meme Stock Mania to a “Casino”

During Berkshire Hathaway’s annual shareholder meeting in 2021, which happened at a time when the meme stock mania was at its peak, Warren Buffett compared the phenomenon to a “casino.”

To be sure, Buffett is hardly the only observer who compared trading in meme stock to gambling, and veteran NYSE floor trader Peter Tuchman also echoes similar views.

“It’s irresponsible for the newcomer into the market to think that this [GameStop trading activity] is anything else except gambling,” said Tuchman speaking with Yahoo Finance.

He added, “So many young traders who come to me … are still long GameStop at $480 from the first [meme stock] debacle, and now they’re going back to the well again to get themselves in trouble.” He was referring to the record highs that GME shares made during the 2021 rally which it has no realistic chance of revisiting.

We can also draw a corollary between GameStop’s frequent stock sales and the “Oracle of Omaha’s” comments on share repurchases. Warren Buffett supports buybacks when they are done at prices that are below a stock’s fair value and the company does not have other avenues to deploy the cash.

In GameStop’s case, the company raked in billions selling its seemingly overpriced shares even as it had no stated need. But we shouldn’t be blaming the company as it’s quite prudent to sell shares at inflated prices – just as it is a good strategy to repurchase them when they trade at depressed levels.

$GME GAMESTOP JUST SHOCKED THE ENTIRE STOCK MARKET AND IN THE PAST 20 MINUTES HAD OVER $3 MILLION DOLLARS WORTH OF CALLS LOADED🚨

THERE WAS JUST NOW DOZENS OF WHALES FLOODING MILLIONS INTO GME🎱

THIS COULD POTENTIALLY BE RYAN COHEN OR ROARING KITTY 👀

$150+ #GME INCOMING…💎🙌 pic.twitter.com/XsAMflKPuu

— Mike Investing (@MrMikeInvesting) June 25, 2024

As for GameStop, the “game” looks far from over and some see the recent increase in GME call options as a sign that he is yet again getting active in the meme stock. All said, with the core business struggling, GameStop might need to figure a way out to reboot its financials and a value accretive acquisition from the massive cash it recently raised could do the trick.