The US Fed announced its policy decision after the FOMC (Federal Open Market Committee) yesterday, and as expected kept rates unchanged. The so-called dot plot called for just one rate cut of 25 basis points in 2024 as US inflation has been a lot stickier than what most believed.

Yesterday, the US CPI (consumer price index) data was also released, showing that the annualized pace of price rise was 3.3% in May while prices were unchanged on a month-over-month basis. While both the data points were 10 basis points lower than what economists expected, the pace of rise is still higher than the Fed’s 2% target.

In its release, the Fed talked about “modest further progress” on its 2% inflation target. The language is a lot more dovish than the previous meeting when the Fed rued “a lack of further progress” on inflation.

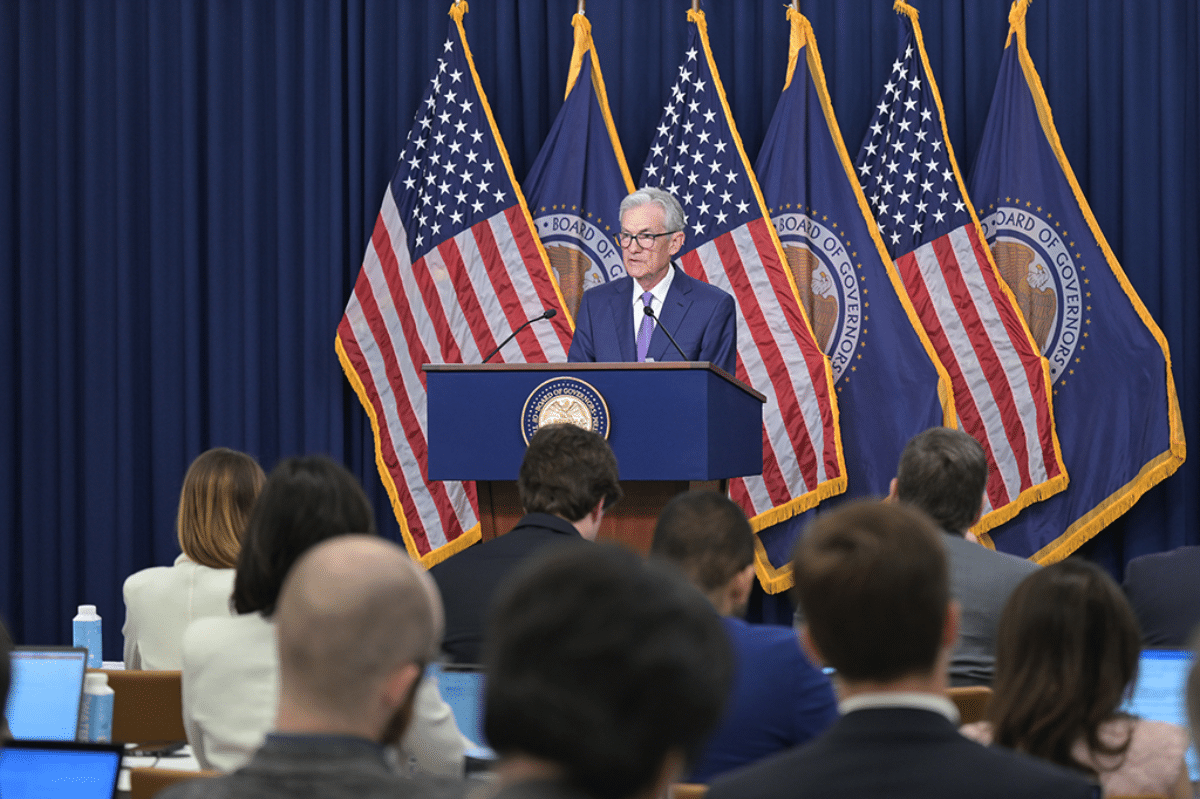

Commenting on the CPI data which was released hours before the FOMC meeting, Fed chair Jerome Powell said, “We see today’s report as progress and as, you know, building confidence.” However, he added, “But we don’t see ourselves as having the confidence that would warrant beginning to loosen policy at this time.”

Powell, who used the words “confident” or “confidence” 20 times during his press conference, emphasized, “We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.”

If you’re interested in hearing from Powell himself, he spoke about the Fed’s decisions following its most recent meeting.

Central Banks Have Started to Cut Rates

The Fed has maintained a status quo on interest rates even as its counterparts in Canada and the EU have cut rates. Last week, ECB President Christine Lagarde, who cut interest rates despite inflation being above the target range, said, “Overall, our confidence in the path ahead, because we have to be forward-looking, has been increasing over the last months.”

Previously the Fed’s mandate was to keep inflation below 2% in absolute terms all the time. However, in 2020 it changed its approach to average inflation which gives it the flexibility to cut rates even if the inflation as measured by its preferred gauge is above 2%. Similarly, it can hold on to rate hikes even if inflation crosses 2% if it believes it would average 2%.

US Fed Looks Once Bitten Twice Shy

To be sure, the Fed’s cautious stance on rate cuts isn’t all that surprising, given that the US Central Bank misread the price rise in 2021.

In 2021, as inflation started to rise, the Fed maintained that the price rise was due to factors like supply chain issues, strong post-pandemic demand, and higher commodity prices. It expected prices to come down once the supply-demand scenario improved (at least that’s what it claimed).

In November though, Powel said that the term transitory can be discarded. By then, it was amply clear that inflation was not withering away on its own; if anything, it was on an upward trajectory.

Powell Fed policy summary:

2020: Inflation is too low, here's our plan

2021: Inflation is transitory

2024: Inflation is still too damn high— Sven Henrich (@NorthmanTrader) June 12, 2024

Many economists found Powell’s classification of inflation as transitory controversial from the very onset. The Fed’s plan to save the market from a severe crash increased the money supply dramatically, and the idea that such a move wouldn’t cause inflation was considered ridiculous. However, the Fed did not apparently want to dampen the fragile recovery in US markets and started reversing its accommodative monetary policy only towards the end of 2021.

Several economists believe that the Fed’s actions now are the proverbial “once bitten twice shy” as it does not want to go wrong by cutting rates too early. As Goldman Sachs chief economist Jan Hatzius said, “After an event like that, you’re going to be more worried about your credibility. You don’t want to make the same mistake twice.”

Is the Fed Being Too Conservative?

Some believe that by delaying the rate cuts, the US Fed would put the US economy, especially the housing market, at risk. Notably, Powell had stated multiple times previously that its rate cuts might push the US economy into a recession even if that’s not an outcome it is pushing for. Many, including the mercurial Elon Musk, have blamed the Fed for amplifying the slowdown in the US economy.

At his press conference yesterday, Powell acknowledged the risk of acting too slow and said, “We completely understand that that’s the risk—and that’s not our plan, to wait for things to break and then try to fix them.”

BREAKING: The Fed releases updated dot-plot showing just 1 interest rate cut in 2024, down from 3 in March.

The Fed has not moved interest rates for 7 straight meetings. pic.twitter.com/1IsEpeUvhs

— The Kobeissi Letter (@KobeissiLetter) June 12, 2024

When Will the Fed Cut Rates?

The CME FedWatch Tool shows that only about 10% of traders expect a rate cut at the Fed’s next meeting in July while the probability rises to almost 63% for the September meeting. 45.6% of traders see the Fed cutting rates by 50 basis points by the end of 2024 while 25.1% see only one rate cut of 25 basis points over the period.

It is worth noting that traders have misread the Fed’s resolve to tackle US inflation multiple times and their predictions are often more dovish than the Fed. Notably, markets started talking about a Fed pivot – or a move from rate hikes to rate cuts – many months back. However, even as the Fed has stopped raising rates and has maintained the status quo for the last many meetings a rate cut has looked evasive so far.

Rate Cuts Could Help Rate Sensitive Sectors

While the US economy has held off well and the imminent recession and hard landing that many economists predicted hasn’t materialized, many sectors of the economy – especially rate-sensitive industries like housing and automotive – are reeling under the impact of higher interest rates.

Fed’s rate cuts would help spur demand in these sectors while also lifting market sentiments. Lower rates are also positive for stocks and other risk assets like cryptocurrencies which tend to do well in a lower interest rate environment.

Specifically, growth stocks that bore the brunt of higher interest rates stand to benefit as investors pivoted away from these names after interest rates rose to multi-year highs.

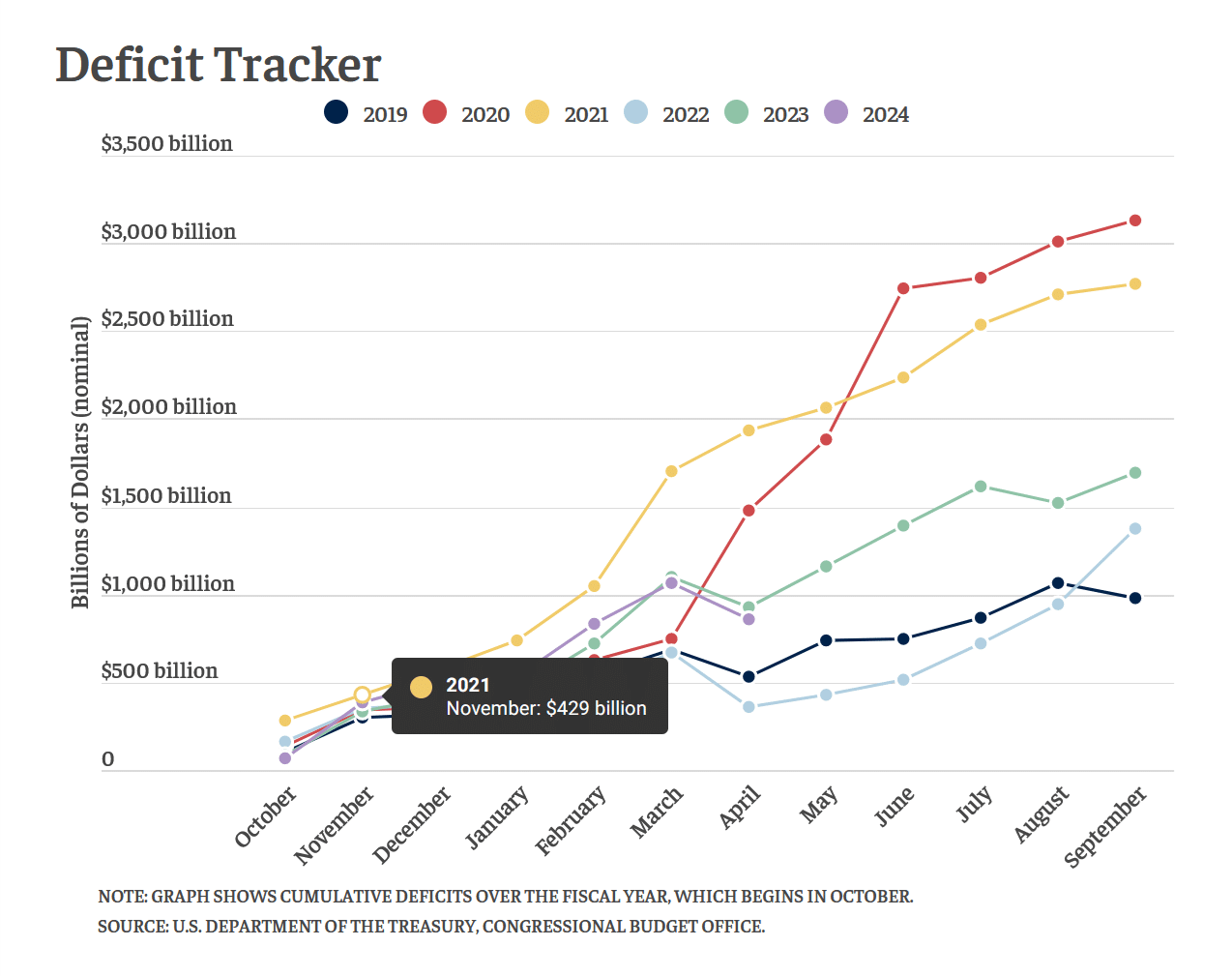

A Fed rate cut would also help address the burgeoning US national debt that is now over 120% of GDP and rising. Earlier this year, the Congressional Budget Office (CBO) projected that US annual net interest costs would be $870 billion in 2024. A Fed rate cut would help the government borrow at lower rates and lower the interest outgo. This would somewhat address the issue of soaring fiscal deficit which many believe is a ticking time bomb for the world’s biggest economy.