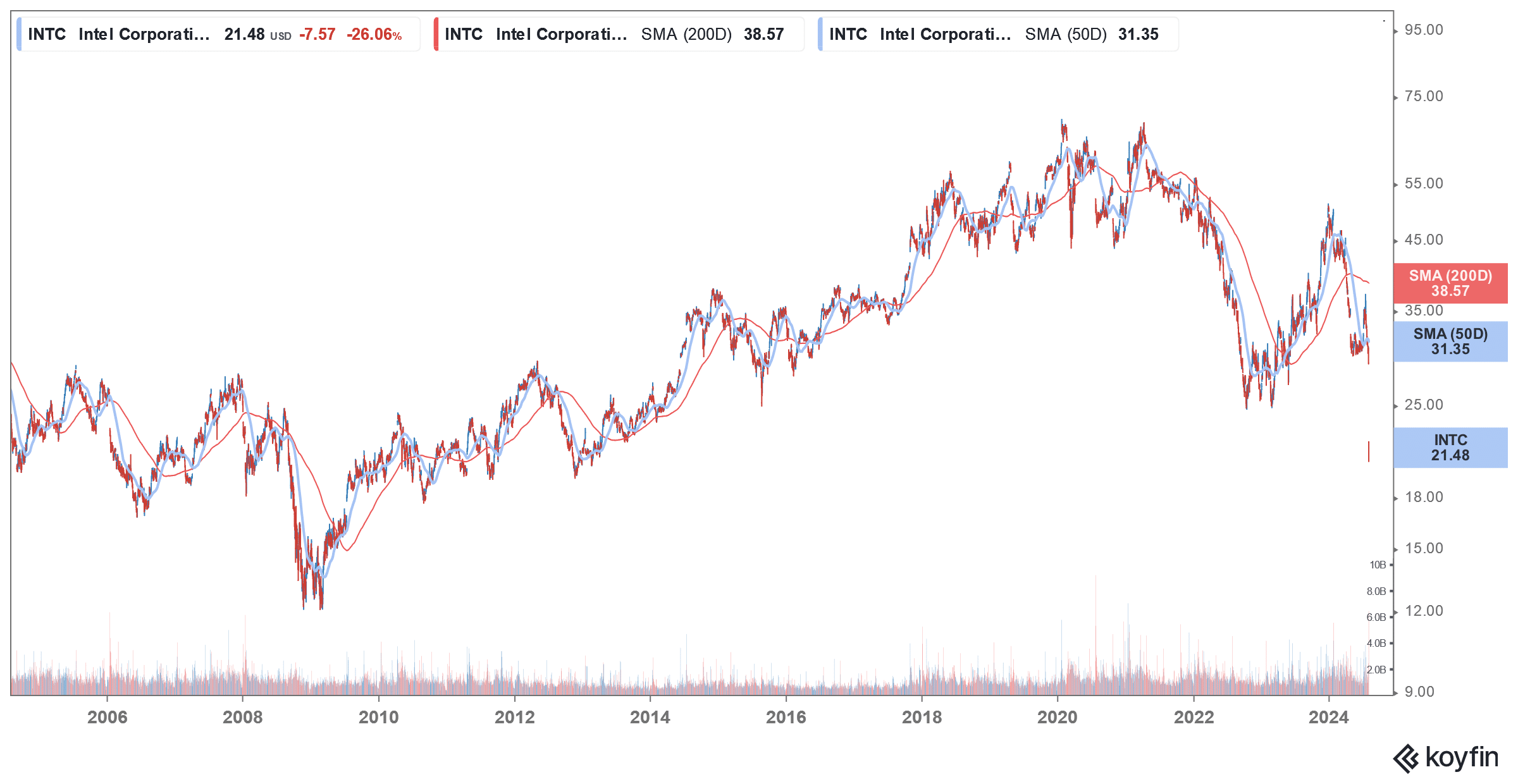

While the past week has been quite challenging for tech stocks with the Nasdaq Composite plunging into the correction zone, things were particularly bleak for chip giant Intel. The stock, which has struggled to finally reach its dotcom era valuation again, has now fallen to levels last seen during the 2008-2009 global financial crisis.

Here’s what went wrong with Intel which was once a formidable chip company but now risks losing its position as a Dow Jones constituent.

Intel Has a Glorious Past

Founded in 1968, Intel has a glorious past, and among others, it developed metal oxide semiconductors and the world’s first programmable microprocessor. It released the dynamic random-access memory (DRAM) which established semiconductors as the new standard for the industry. The company’s hardware was used in Altair 8800 which was among the world’s first personal computers (PCs). By 1992, it became the largest semiconductor manufacturer in the US and four years later it featured among the top 10 most admired companies in the US.

Intel’s stock price peaked at $74.88 in August 2020 – a price level it hasn’t reached. The stock has lost almost 40% over the last decade and is barely in the green over the last 20 years.

While Intel’s fortunes have nosedived, other chip companies have raced ahead, and last year Nvidia’s revenues surpassed that of Intel. As for the valuation, the lesser said the better as while Nvidia’s market cap topped $3 trillion this year and it briefly became the world’s biggest company, Intel’s market cap has slumped below $100 billion.

Intel, which was once the biggest chip company by market cap, is now valued at just about one-sixteenth of what Nvidia is valued at. As ironic as it might sound, while two of the top S&P 500 companies this year are chip companies (Nvidia and Super Micro Computer), Intel is the worst performer.

It has the lowest weightage in the price-weighted Dow Jones Index, and some fear it is at risk of getting booted out of the index in favor of another chip company.

What Went Wrong with Intel?

The past two decades haven’t been kind to Intel in many ways. Most importantly, it misread the smartphone market and turned down the offer to supply processors for Apple iPhone, a catastrophic mistake. The company believed that Apple might not be able to sell enough phones and it was a tiny market to bet on. As things turn out, global smartphone sales now far exceed PCs and in 2023 Apple sold over 234 million iPhones.

2000s: intel passed on the original iphone.

2020s: intel missed the AI boom.seems like leadership doesn't fundamentally get consumers – and they're paying for it. pic.twitter.com/YI43ctATFW

— Thomas Smale (@ThomasSmale) August 2, 2024

Intel was quite slow with innovation so AMD gradually ate up its market share in the PC market. Intel’s situation worsened when Apple stopped using Intel chips for its Mac and instead pivoted to its own chips.

Intel’s woes are far from over and Nvidia, AMD, and Qualcomm are looking to further eat its PC market share with Arm-based semiconductors. Intel is still working with the x86 technology that it created in 1981

More recently, Intel lost out on the race in artificial intelligence (AI) chips even as rivals, especially Nvidia, are absolutely printing money selling AI chips.

According to Vish Narendra, CIO of Atlanta-based paper packing company Graphic Packaging International, “Intel has consistently missed some key technology waves.” He added, “With the emergence of AI, they ceded more ground to AMD, Nvidia.”

Intel Was Slow in AI Pivot

Intel is set to launch its Gaudi 3 AI chip in Q3 and expects to realize $500 million in revenues from the product. During the Q2 2024 earnings call, Intel’s CEO Pat Gelsinger said, “we expect Gaudi 3 to deliver roughly 2x performance per dollar in both inference and training versus H100” – referring to Nvidia’s top-of-the-line chip.

Other chip companies are also working on AI chips and AMD forecast that sales of its MI300 AI chip will be around $4 billion this year. These numbers however pale in front of the $120 billion revenues (the bulk of which is expected from sales of AI chips) that Nvidia is expected to report in the current fiscal year.

With our differentiated IDM 2.0 model and global footprint, including investments to expand our manufacturing in both the EU & U.S., @Intel is in a unique position to help anticipate and prepare for the continuous increase in long-term semiconductor demand.

I'm thrilled to…

— Pat Gelsinger (@PGelsinger) June 17, 2023

Intel Bets On IDM 2.0 Strategy

In 2021, Intel brought back its previous CEO. Pat Gelsinger, amid the company’s sagging fortunes. Gelsinger embarked on what he termed the IDM 2.0 strategy which has two key pillars. Firstly, Intel pivoted to the foundry model, and like Taiwan-based chipmakers like TSMC, it too would make chips for other companies. While it has a relatively low margin, it’s a fast-growing business as countries, including the US work on onshoring chip manufacturing.

Intel was incidentally the biggest beneficiary of the Biden administration’s CHIPS and Science Act which allocated $52 billion to chip design and manufacturing in the US.

The next pillar of IDM 2.0 strategy was innovation and making advanced chips, including AI chips. However, the turnaround hasn’t been easy and full of potholes. Intel’s foundry business lost a whopping $7 billion last year and the company hasn’t been able to come up with many compelling products even after three years of transformation. Its earnings calls have largely disappointed over the last two years as investors keep waiting for ground results in the elusive transformation.

Counterpoint analyst Akshara Bassi perhaps best summed up Intel’s woes and said, “I think everyone has been hearing them say the next quarter will be better for two, three years now.”

INTC Stock Had Worst Day in 50 Years

On Friday, Intel had its worst day in 50 years as the stock lost over 26% in value after it reported a massive earnings miss. It suspended its dividend and said that it would slash 15% of its workforce. It fell another 7% this morning, following the stock market correction.

In an interview, Gelsinger said, “this is the most substantial restructuring of Intel since the memory microprocessor transition four decades ago.” He added, “We have laid out an audacious journey of rebuilding this company, and we’re going to get that done.”

In a note to employees, Gelsinger said that Intel’s revenues haven’t “grown as expected” and the company “must align our cost structure with our new operating model and fundamentally change the way we operate.”

Analysts Turn Bearish on Intel After the Earnings Release

After Intel’s disappointing Q2 earnings and even more dismal outlook, analysts lowered the company’s earnings estimates for the year and multiple brokerages downgraded the stock.

Raymond James analyst Srini Pajjuri downgraded Intel stock from “outperform” to “market perform.” While Pajjuri expects Intel’s cost cuts to improve the company’s cash burn, he does not see a topline recovery anytime soon.

“As such, we expect profitability to remain under pressure and are moving to the sidelines despite the attractive valuation and our view that an eventual foundry separation could unlock significant value, said Pajjuri in his note.

Cantor Fitzgerald analyst C.J. Muse also lowered Intel’s target price from $40 to $27 and said, “The good news is that post-restructuring, the top line will not need to accelerate too meaningfully to offer strong operating leverage and return to positive free cash flows.”

Muse however added, “The bad news is that Intel remains a ‘show me’ story as it relates to internal success on [Intel’s power delivery architecture] as well as the company’s ability to truly become a leading-edge foundry.”

Bank of America also Downgraded INTC Stock

Bank of America analyst Vivek Arya also downgraded Intel stock to an underperform. Arya cut his target price from $35 to $23 and said that he expects the company’s profitability to be challenged into 2026.

Arya said that there is “no quick or easy fix” for Intel and its strategy is not “equipped to simultaneously compete against focused and agile fabless (NVDA, AMD) and foundry (TSMC) rivals.”

Amid the steep fall in Intel’s stock, its valuations have also plummeted, and it trades at a next 12-month price-to-sales multiple of 2.2x, which is considerably below the 3.3x that the multiple has averaged over the last five years.

With a sagging topline and the uncertainty over its turnaround, markets have de-rated INTC shares which is reflected in its valuations. The management has a lot on its table and needs to convince markets that it can execute the ambitious business forecasts that it has outlined – one quarter at a time.