A District Judge in San Francisco has ordered Wells Fargo (NYSE: WFC) to go to trial over claims from shareholders that it misled them with its diversity statements. The fourth largest bank in the US is accused of holding fake interviews for women and diverse candidates despite having no plans to hire them for the jobs.

US District Judge Trina Thompson, who last August dismissed a previous version of the suit, found both direct and indirect evidence about Wells Fargo misleading shareholders about its hiring policies and ruled that the San Fransico-based bank would face a lawsuit.

Here’s everything about the case and what it means for Wells Fargo and investors.

Wells Fargo Controversy Explained

- Legal Challenge: Wells Fargo is facing a lawsuit over allegations that it conducted fake interviews to meet diversity targets without intending to hire the candidates.

- Policy Background: The lawsuit is linked to a 2020 policy requiring that at least half of the candidates for high-paying positions be from diverse or disadvantaged groups.

- Whistleblower Evidence: Shareholders cited internal emails and interviews with former employees, as well as the abrupt retirement of a senior manager, to support their claims.

- Judicial Ruling: US District Judge Trina Thompson found sufficient evidence to allow the lawsuit to proceed, suggesting possible fraudulent intent in Wells Fargo’s hiring practices.

- Reputational Damage: This lawsuit adds to a series of controversies that have plagued Wells Fargo, affecting its reputation and stock performance over the years.

Wells Fargo to Face Lawsuit Over Fake Interviews

The case relates to a hiring policy that Wells Fargo adopted in 2020 which mandates that for posts that pay $100,000 or higher, at least half of the candidates in the first round of interviews are to be women, minorities, or people in other disadvantaged groups.

🚨🇺🇸WELLS FARGO FACES LAWSUIT OVER ALLEGEDLY FAKE DIVERSITY INTERVIEWS

The bank allegedly defrauded shareholders by claiming a commitment to diversity while conducting sham job interviews with non-white and female applicants it had no intention of hiring.

The court found… pic.twitter.com/nAc2wEtM82

— Mario Nawfal (@MarioNawfal) July 29, 2024

After allegations of its window dressing hiring process popped up in 2022, Wells Fargo finetuned the process. In its DEI (diversity, equity, and inclusion) report, Wells Fargo says, “In 2022, we recommitted to our diverse candidate slate guidelines with enhancements focusing on simplicity of process and improving the experience of all candidates, internal and external.”

Among others, it updated the training guidelines for recruiters and managers on hiring diverse candidates.

Wells Fargo’s DEI report lists several initiatives it has taken to increase diverse representation in the bank, including hiring veterans and people with physical disabilities. It also talks about working with diverse suppliers and points out that over half of its employees globally are females.

It further stressed that 46% of its US employees come from racially or ethnically diverse communities. Meanwhile, the allegations from shareholders seem to suggest that the bank is “diversity washing” – contrary to what the data points and stated diversity policy says.

Wells Fargo is now under federal investigation for violating anti-discrimination laws for allegedly held fake job interviews for minorities. https://t.co/0uOgX7XiIz

— TheShadeRoom (@TheShadeRoom) June 9, 2022

Allegations Against Wells Fargo Window Dressing Interviews

Wells Fargo shareholders cited an internal whistleblower email and interviews with former employees to support their claims of the bank conducting fake interviews for diverse candidates. They also pointed to the abrupt retirement of a senior wealth manager who allegedly pressured the whistleblower into conducting fake interviews.

When the New York Times broke the story in 2022, it cited one particular employee Joe Bruno, who said he was fired for speaking out against these fake interviews.

Meanwhile, Judge Thompson sided with the shareholders and said, “The employee-submitted complaints, the peculiar timing of [the manager’s] departure, and defendants’ demonstrated focus on diversity issues supports a strong inference of [fraudulent intent] that is cogent and at least as compelling as an opposing inference that defendants remained oblivious.”

WFC Stock Is Flat Despite Report of Lawsuit

WFC stock is up slightly in today’s price action despite reports of it having to face a lawsuit over fake interviews.

However, the stock crashed over 10% in a span of two days in June 2022 when the New York Times reported on the Justice Department’s investigation into its hiring policies.

After that report, there was much furor with even Senator Elizabeth Warren writing a letter to the bank’s CEO and head of human resources expressing concern over the allegations.

“The information uncovered by The New York Times is not only highly offensive and suggestive of systemic bias and discrimination at the bank, but also may represent a pattern of misleading shareholders and federal and state regulators in oversight of Wells Fargo’s execution of nondiscrimination laws and broader, public commitment to diversity, equity, and inclusion,” she said in her letter.

The letter emphasized that it was not the first incident where Wells Fargo was facing scrutiny over its hiring policies and cited two similar cases. In said that in 2018, the Labor Department accused the bank of discriminating against thousands of Black and hundreds of women candidates, a case it settled for $8 million.

In another such case, 320 Black financial advisers alleged that the bank deliberately kept them away from new opportunities and filed a class action suit in 2013. Wells Fargo settled that case too, paying a hefty $36 million.

Wells Fargo Has Faced Many Controversies

To be sure, Wells Fargo has been embroiled in multiple controversies including the infamous case where its employees opened fake accounts for customers as they were under pressure to meet sales targets.

The bank settled that case in 2020 paying a whopping $3 billion fine.

Regulators have placed an asset cap of $1.95 trillion on the bank after that scandal which CEO Charlie Scharf has admitted is hurting its trading business as well as the ability to rake in more deposits from corporates.

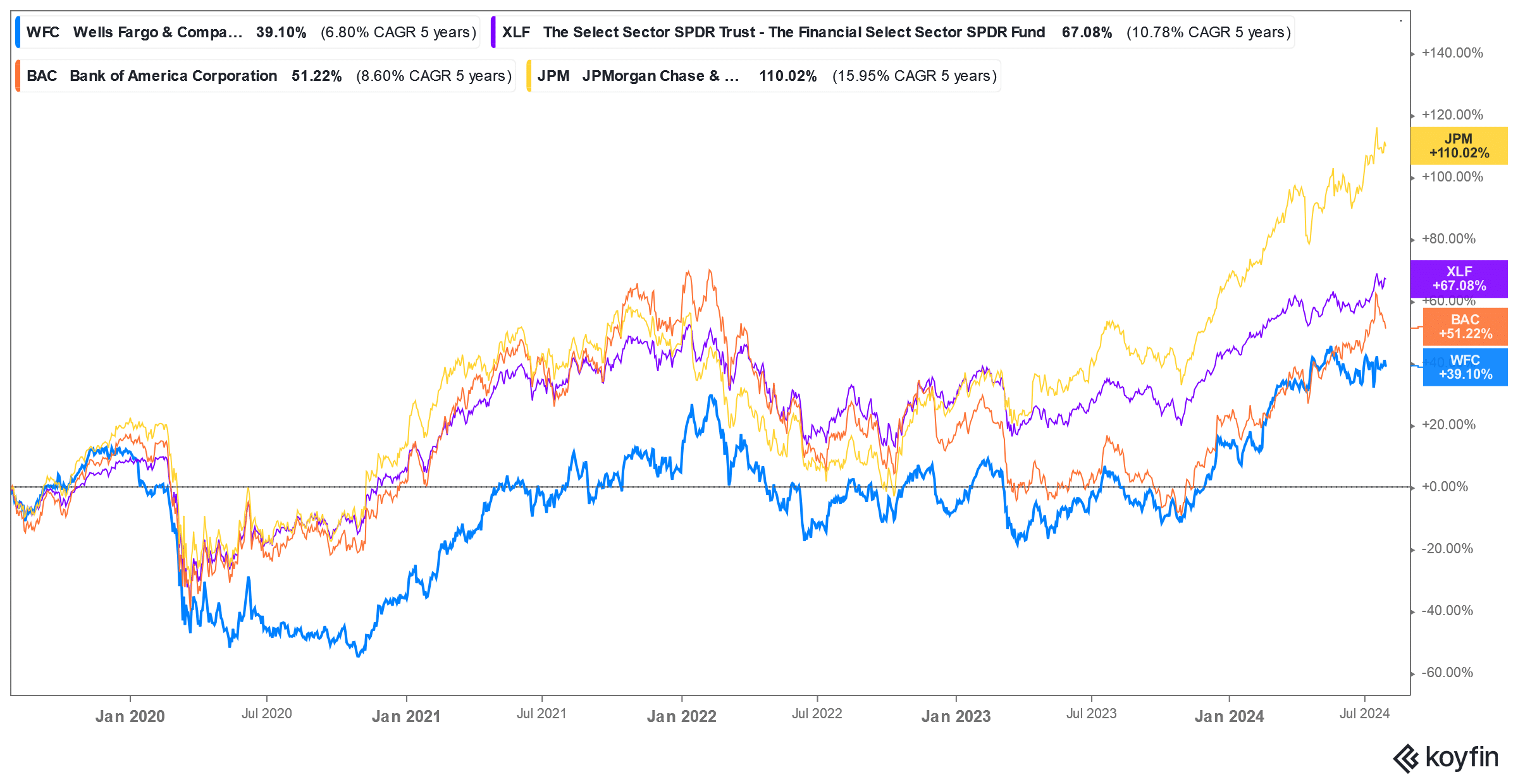

While WFC stock might not be reacting to the reports of the lawsuit today, these recurring controversies have taken a toll on its stock price which is up by just about 40% over the last five years. The stock’s returns trail peers like Bank of America and JPMorgan Chase as well as the Financial Select Sector SPDR ETF.

Incidentally, Warren Buffett – whose Berkshire Hathaway was once Wells Fargo’s biggest shareholder – has also exited the bank after having previously stood by the management during the fake account scandal.

As for the lawsuit over fake job interviews, if correct it would be yet another case of diversity washing by a large US enterprise. On a related note, while many companies have policies around supporting renewable energy, in practice many of these are no more than “green washing.”

Meanwhile, it remains to be seen how the fake job interviews lawsuit against Wells Fargo progresses and if it leads to notable changes in the company. All said, these recurring issues are doing no good to the bank’s reputation as the controversies surrounding the bank simply refuse to die down.

What Can We Learn from the Wells Fargo Fake Interviews

Wells Fargo’s ongoing legal challenges underscore the critical importance of genuine diversity and inclusion practices in corporate governance.

The lawsuit over fake interviews highlights the risks associated with superficial diversity efforts and the potential for significant reputational damage. Moving forward, it will be essential for Wells Fargo and other corporations to ensure their diversity policies are implemented with integrity and transparency to restore trust among stakeholders and the public.