London-based global consumer goods giant Unilever has enlisted the help of Morgan Stanley and Evercore Inc. to help it sell off a basket of non-core companies under its control including Q-Tips and Impulse.

Unilever carved out this basket of beauty and personal care brands into a separate business in April of 2021, dubbing it Elida Beauty Limited. Along with Q-Tips and Impulse, the new company also owns TIGI, Timotei, St. Ives, Caress, Ponds, Zwitsal, Moussel, Alberto Balsam, and Matey.

According to Reuters, these brands brought in a total of $760 million in revenue in 2022. Despite the hefty revenue, Unilever’s previous attempt to sell Elida Beauty fell apart when it failed to attract enough interest from bidders.

Unilever only recently revived the attempts to sell the brands after it worked to make the new company more autonomous. The intention was to make it more enticing for private equity firms looking for stable revenue-generating assets but it is yet to be seen if the efforts were successful.

According to Reuter’s anonymous sources, both Morgan Stanley and Evercore have reached out to various prospective buyers on behalf of Unilever but it’s unclear whether there has been much, if any, interest.

Will Unilever Finally Sell Elida Beauty This Time?

The bundle of beauty and personal care brands may go unsold again despite the help of the investment bankers. The brands are still suffering from the same issues that they were struggling with when the sale failed to garner enough interest in 2021.

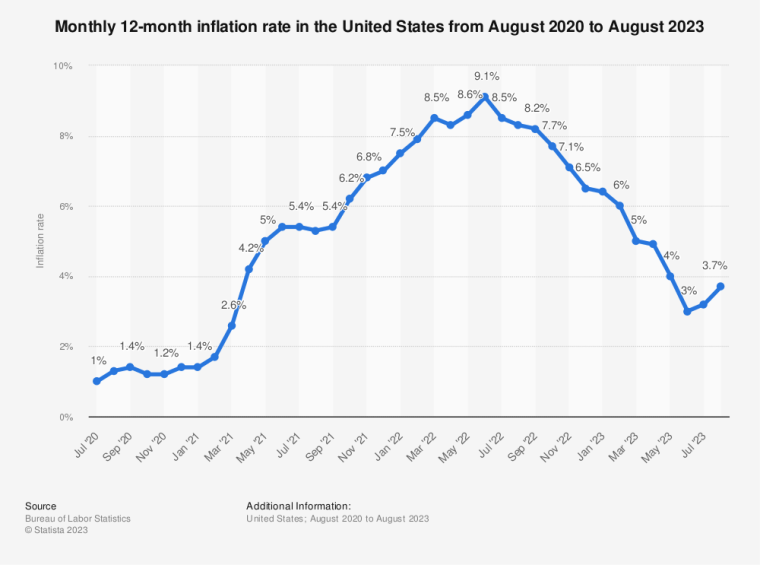

Investors may be too worried about their relatively poor growth potential along with supply chain issues, workforce struggles, and increased material costs due to inflation to excuse the acquisition. Inflation is much worse than it was in 2021, making the sale seem even less likely to happen this time.

Unilever gave up on the sale in November 2021 when the inflation rate in the US was a mere 6.2% YoY compared to 9.1% at the peak in June 2022. The inflation rate has since fallen dramatically but the dollar is still worth significantly less than it was in 2021.

Nevertheless, the basket of brands is certainly worth a hefty sum due to their name recognition and market share. Some of the issues Unilever was facing in 2021 such as supply chain disruptions and workforce shortages have since improved to a degree.

Inflation might end up being less of an issue than earlier thought. Some consumer goods companies, like Unilever, are experiencing lower sales volume due to inflation. In contrast, others, like Nestle, are doing well despite inflation by increasing prices without losing sales volume.

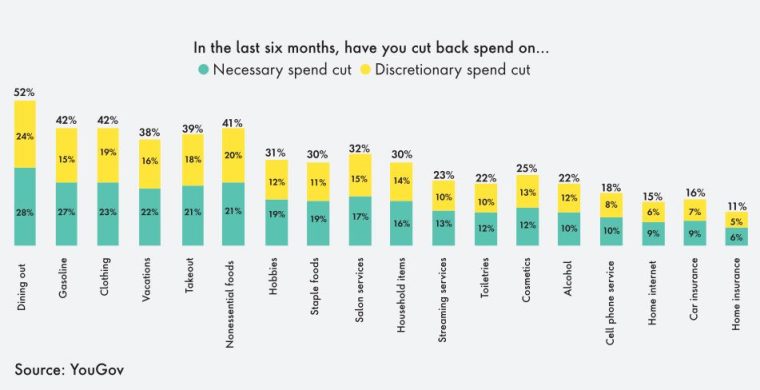

This particular basket of brands could actually be much more recession-proof than much of Unilever’s other moneymakers. While many consumers are cutting back on discretionary spending, beauty products seem to be the exception.

Nicknamed “the Lipstick Effect”, market researchers and media giants including NPD Group and Forbes found a unique phenomenon where sales of certain beauty products actually rise during hard times. For example, lipstick and other lip makeup sales rose 48% in Q1 2022 over the previous year.

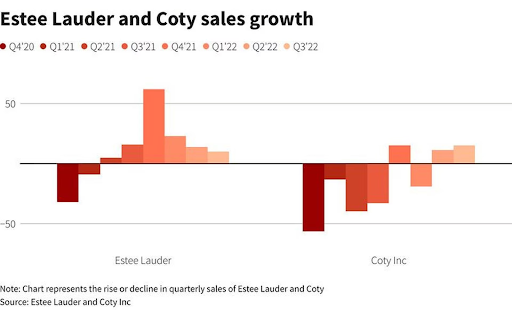

Other top beauty brands including Estee Lauder and Coty Inc have reversed their sales growth tremendously over the past 3 years, despite continuously rising inflation. Prospective buyers of Elida Beauty may see this as an opportunity to profit from this unique market phenomenon.

Is the Q-Tips Brand the Selling Point of Elida Beauty?

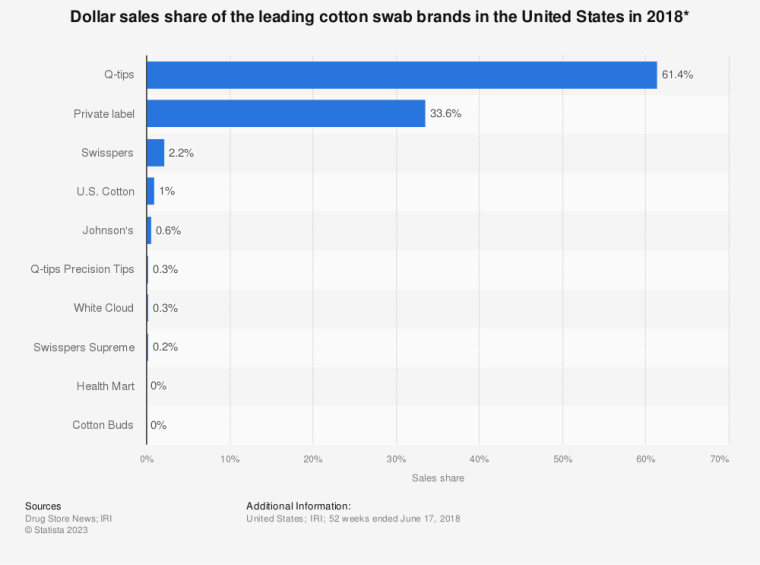

Q-Tips is a top brand under Elida Beauty thanks to its strong market share and positioning. The company was founded 100 years ago in 1923 and is still the leading brand of cotton swabs globally by a wide margin. In 2018, it held a 61.4% market share, while private-label brands lagged significantly at 33.6%.

Unilever has yet to publicize any more recent sales figures for the brand so it may have lost some of its astonishingly high market share since 2018. Consumers are already turning to private label brands for other kinds of products en masse. It would be strange if private labels couldn’t compete with a product as simple as a cotton swab.

Q-Tips may be more of a liability than an asset if these trends continue. Prospective buyers may focus more on the other beauty brands under the Elida Beauty umbrella like Impulse with higher moats that can compete better with private labels.