The venture capital (VC) industry is always looking for new ideas. With the growing euphoria towards artificial intelligence (AI), investors are looking for startups of all shapes and sizes within the sphere to gain exposure to the technology. Two high school teens took this advice to heart and built an AI API automation startup. Amazingly, they just raised $500,000, and their future is bright. Here’s everything we know about the startup and insights on how you can also start your own company.

Christopher Fitzgerald and Nicholas Van Landschoot who recently graduated from high school started their company APIGen which is working on a platform that will help build customized APIs from natural language prompts. The company is looking to build complex custom APIs that can do more than one task at a time.

According to Landschoot, “We’re actually generating the code for the APIs so that you can have business logic, actual custom functionalities within those APIs as well.” Along with web apps and databases, the company would also target IoT devices. In a nutshell, the company is working to marry artificial intelligence and APIs and automate it for complex tasks.

Fitzgerald told Tech Crunch, “They (APIs) can range from just new connectors that take one entry of data, one row of data from a table of a database, to entire back ends. And that’s really what we’re trying to target there, for entire web apps for entire IoT applications.”

🚀 Two high school teens just raised $500K for their AI startup, #APIGen! 🌟 Christopher Fitzgerald and Nicholas Van Landschoot are revolutionizing API creation with natural language prompts. Talk about innovation! 💡 #AI #Startup

What do you think of their journey? 🌐✨ pic.twitter.com/EtBh3N0CeD

— Artificial Intelligence (@cloudbooklet) June 24, 2024

Here’s Who Landschoot and Fitzgerald Built Their Startup

Both Landschoot and Fitzgerald have a shared love for coding and met at their school’s debate team. They first worked on a chatbot that let people chat with data. However, the duo abandoned the idea after discovering it wasn’t original.

Meanwhile, while working on that project they realized that their app relied a lot on APIs which were quite cumbersome to create. They then created an alpha version of their idea and started seeking feedback from programmers in their circle.

The duo also started approaching VCs on LinkedIn and sending cold messages to anyone they thought would be interested in the idea. Among those they approached was Philip Broenniman, founder of Varana Capital who agreed to meet them.

VC Firm Funds an API Startup Backed by Two Teens

To be sure, Broenniman, whose company eventually funded the startup, was circumspect of the outcome – as after all, he was meeting two teens who had little experience in running a business.

Speaking with TechCrunch, Broenniman said, “We went into the meeting thinking we were going to provide some fatherly, avuncular advice; provide some words of wisdom.”

However, after the meeting, he and Varana COO Ankur Ahuja were quite impressed with Landschoot and Fitzgerald. According to Broenniman, “We walked out after two hours of their presentation thinking that this was the best presentation we had heard in the last five years. We were blown away by the cogent insights these two 18-year-olds gave.”

Varana did its due diligence on the market for automated APIs and was impressed with the potential. The market is not without competition though and RapidAPI, Salesforce’s MuleSoft, as well as big cloud companies, are working on the idea.

According to Broenniman, “This is a $7 billion-plus market. They are entering with some elements of competition there but are carving out their own space. The opportunity for return from our standpoint is insane.”

AI Companies Are Quite Popular Among Investors

AI companies are quite popular among investors – both in the public as well as private markets. Nvidia, which recently surpassed Apple and Microsoft to become the world’s biggest company (albeit briefly) is a testimony to the premium that investors are willing to pay for AI companies.

We see a similar bullishness in private markets and Elon Musk’s new AI company xAI is now valued at $24 billion after securing a $6 billion investment.

According to Crunchbase, AI startups raised a cool $50 billion last year, and while OpenAI, Inflection AI, and Anthropic raised billions of dollars each, several small startups also secured funds.

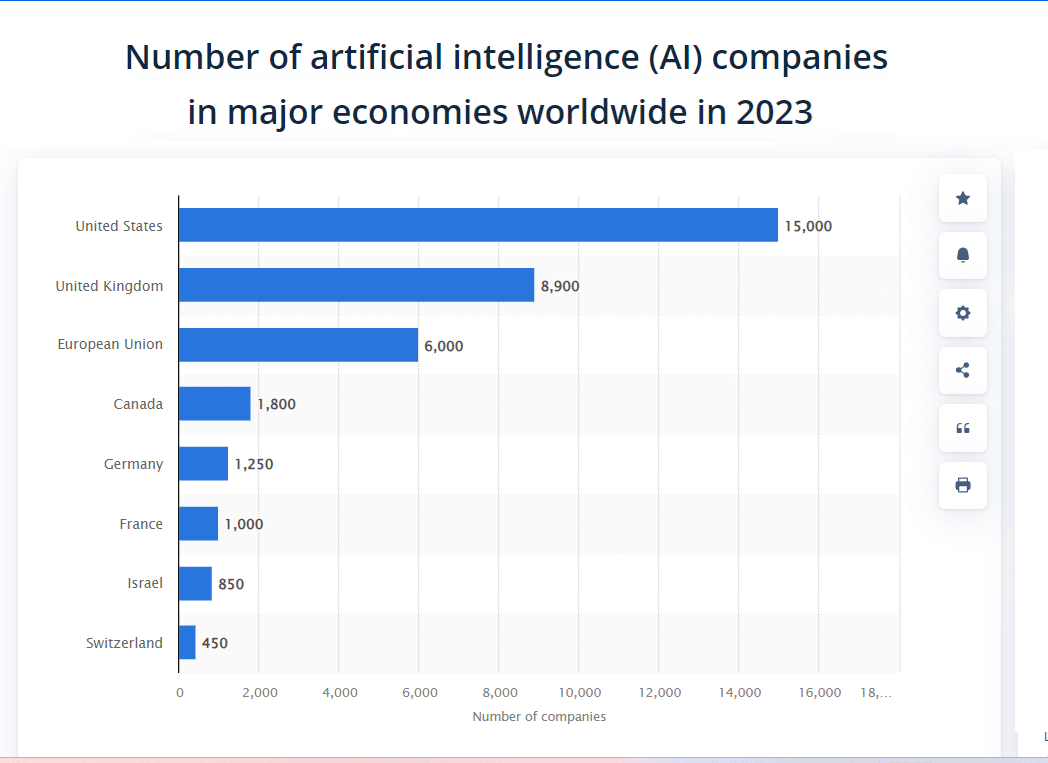

The number of AI companies is also exploding and there are 15,000 such companies in the US alone, followed by the UK which had 8,900 AI companies at the end of 2023.

How to Start Your Own Company from Scratch

Startups are becoming an integral part of the economy, and from building innovative products and services to providing employment to many, they are a force to reckon with. Here’s how you can build a successful startup from scratch.

- Understanding Market Needs and Targeting Growing Market: As we saw with Landschoot and Fitzgerald, understanding the market needs and building a company in a growing and popular industry makes the job easy. With a record number of S&P 500 companies talking about AI in their earnings call, starting a company in that industry is a smart decision.

- Validate the Business Idea: Like Landschoot and Fitzgerald, founders should approach their peer group for validation of their business idea and seek their input and feedback.

- Build a Business Plan: Along with having a business idea, you would also need a strong business plan that you can pitch to investors. Also, don’t forget to do your due diligence and get the numbers right – as the VC who might want to invest would do his homework before putting funds in your company.

- Aggressively Reach Out to VCs and Potential Investors: APIGen cofounders did not shy away from cold messaging VCs and while cold calling might be an old-school idea, it still works (though it isn’t for the faint of heart). Make sure that you are properly prepared for the VC meetings as you don’t want to be seen as too casual.

- Don’t Blow Away Funds: Getting the seed funding is the first step in growing your company. While it might be tempting to buy/rent luxurious office space for your company, try keeping the expenses in control as the business might not generate much revenue in the early days.

Running a Startup Might Not Be That Easy

All said while starting a business is now getting easier, running one is as difficult as ever. As the funding winter of 2022 showed, startups should maintain strong liquidity as the macro environment might not always be favorable. Also, founders should be quite open-minded and realistic when seeking funds in a downturn and not try to benchmark against the previous valuations.