The Bitcoin halving, the most sacrosanct event in the entire crypto world, is set to occur on Friday at about 9 PM EST. As soon as the 840,000 Bitcoin block goes live at around that time, the block reward will be halved from 6.25 BTC to 3.125 BTC.

Generally, the Bitcoin halving is seen as an incredibly bullish event, and for good reason. Simple supply and demand economics imply that decreasing the inflation rate of an asset without changing the demand for that asset should naturally push its value up.

It’s important to remember that demand for Bitcoin is quite volatile so even the halving may not necessarily push Bitcoin’s price up, at least in the short term.

Key Highlights of the Bitcoin Halving Event (2024)

- Event Overview: The upcoming Bitcoin halving will reduce the block reward from 6.25 BTC to 3.125 BTC, cutting the rate of new Bitcoin entering circulation in half. This has historically been seen as a bullish event, leading to significant price increases over the following months due to reduced supply.

- Market Sentiment: Analysts are divided; JPMorgan suggests that the price impact may already be priced in due to pre-halving moves, with potential for a downside. However, many in the crypto community believe that despite initial volatility, a longer-term rally could still occur post-halving.

- Spot Bitcoin ETFs Impact: The approval of Bitcoin spot ETFs in 2024 has introduced a new dynamic not seen in previous halvings, potentially driving further demand. With ETFs buying more Bitcoin than is produced daily, this could support prices post-halving despite the challenges miners face.

What Do the Experts Think Will Happen?

No one can look into a crystal ball and tell you exactly what will happen to Bitcoin after the halving, but there is plenty of historical data that can help us make educated guesses.

Every single halving in Bitcoin’s history has directly proceeded a massive bull run that pushed the coin to all-time highs. But this cycle has already proven to be unique in multiple ways.

Most notably, Bitcoin crossed its previous all-time high more than a month before the halving is set to occur. Most analysts seem to think that this happened because investors were trying to preempt an upward move supported by years of historical trends.

JPMorgan Weighs In

JPMorgan sent a research report to clients, reported by The Block, arguing that this preemptive move may be the only one this cycle. It read, “We do not expect bitcoin price increases post-halving as it has already been priced in. In fact, we see a downside for the Bitcoin price post-halving for several reasons.”

Nikolaos Panigirtzoglou, a managing director and strategist at JPMorgan, led the team behind the bearish report and gave a handful of reasons to back up their assertions. He pointed to the early jump to all-time highs, even though all previous cycles have extended much further beyond previous highs than the current cycle has so far.

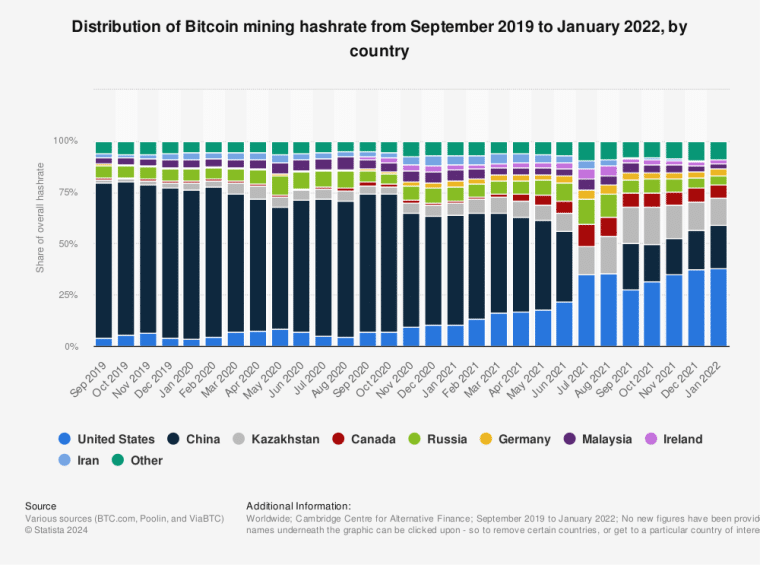

The analysts also point to various metrics relating to Bitcoin futures that suggest that they may be solidly in overbought territory. Naturally, JPMorgan expects Bitcoin miners, especially those in the US, to be hit the hardest as the halving will make mining unprofitable immediately for a large portion of them. Nevertheless, the network will likely have little problem stabilizing with mining giants utilizing cheap energy in countries like China and Kazakhstan.

Chart Warriors Weigh In

No one will blame you for not trusting JPMorgan on anything related to Bitcoin or cryptocurrencies. In fact, many of the most popular technical analysis experts on YouTube and X seem to mostly disagree with JPMorgan’s Wednesday report.

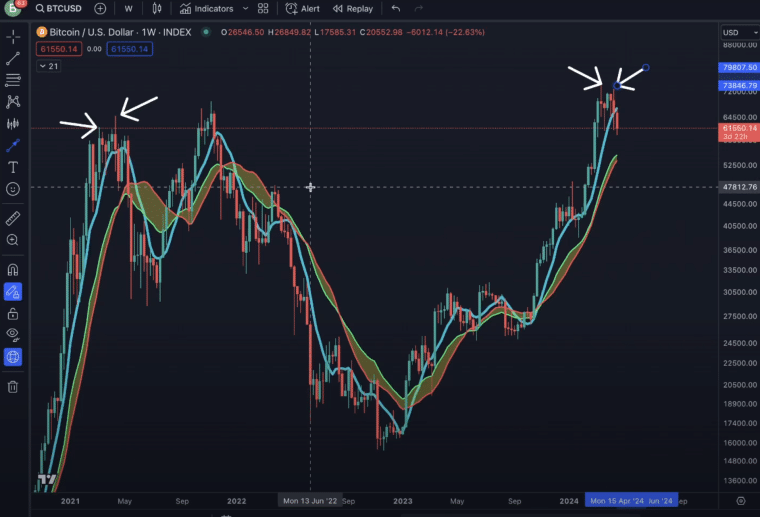

In a recent video, Benjamin Cowen, one of the best respected technical analysis whizzes in the cryptoverse, was hopeful but didn’t make a decisive determination either way. He pointed to 3 separate examples where Bitcoin closed below its eight week simple moving average (SMA) after a fevered pump (similar to this cycle’s price action): 2019, early 2021, and mid 2021.

Cowen suggests the recent Bitcoin dip following the explosion to over $73,700 looks eerily similar to BTC’s April 2021 local high where it crashed 55% before skyrocketing back to a new all-time high five months later. However, he noted that the 2 moves were actually quite dissimilar with BTC reaching a higher high in April 2021 after a dip below the eight week SMA whereas it only reached a lower high this year after a similar dip.

In other words, even though the two peaks look similar on the surface, they are actually quite different structurally and thus they will likely play out differently.

Cowen generally doesn’t like to give exact USD price predictions, though he has argued that Bitcoin dominance is likely to rise in the coming months for various reasons. He suggests that investors should watch BTC price action as we approach the halving to see if it can be bid back up to over the eight week moving average before the weekly close.

If it closes below that mark, it may develop into a full-blown correction, holding the market down for months. If it breaks back above it, we may see a full-fledged bull run like we were accustomed to for years.

What About Ethereum and Other Altcoins?

Importantly, Cowen and many top analysts on X and elsewhere like to examine Bitcoin and the crypto market within the greater context of the global economy.

They acknowledge that US Federal Reserve policy is generally considered to be one of the most influential factors in the prices of Bitcoin, Ethereum, and the crypto market as a whole (not to mention just about every other investment).

Because the Fed is still in its quantitative tightening phase and there are no signs that the end is neigh, Cowen warns that ETH and other altcoins will likely continue to languish against Bitcoin. Historically, riskier cryptos, including ETH, have performed best during times of low rates and quantitative easing.

If a recession eventually comes, whether it’s due to a global catastrophe like a regional war in the Middle East or just one too many months with a hawkish Fed, altcoins will almost certainly perform poorly against BTC because investors prioritize risk-adjusted returns.