Amid the slowing adoption of electric vehicles (EVs) in the US, automakers are now pivoting to low-cost models. Elon Musk has long promised that Tesla would be the first to bring a $25,000 EV to the market to take over this slice of the industry, but it seems like Stellantis will beat him to the punch. Stellantis, one of Detroit’s Big Three automakers, along with Ford and General Motors, believes that it can offer an electric version of its iconic Jeep at $25,000.

For years, EVs have been synonymous with luxury because they are so expensive to build that the high margins of luxury vehicles were necessary to make them profitable. Tesla, arguably the main flagbearer of the EV revolution, started with the Roadster sports car in 2003. The Elon Musk-run company debuted the luxury Model S sedan in 2012, followed by the Model X SUV in 2015.

As electric cars became mainstream and battery technology got better and cheaper, it started to make more sense to dive into budget EVs so Tesla launched its Model 3 in 2017. It initially intended to offer some versions of the Model 3 for as low as $35,000. However, it killed the plan with Musk bluntly saying that selling a model for that low would mean Tesla would “die.”

With production, 1st you need achieve target rate & then smooth out flow to achieve target cost. Shipping min cost Model 3 right away wd cause Tesla to lose money & die. Need 3 to 6 months after 5k/wk to ship $35k Tesla & live.

— Elon Musk (@elonmusk) May 21, 2018

EV Prices Have Come Down

According to Car And Driver, the pricing for the Tesla Model 3 Performance variant was $65,200 in 2018 which has since dropped to $54,630. While the starting price for Tesla Model 3 is just above $40,000, it drops below $34,000 if you account for gas savings. Notably, some Tesla cars are eligible for the $7,500 federal EV tax credit, including the Tesla Model 3 Performance model (but not the other Model 3 trims).

Why Have Prices for Electric Cars Dropped?

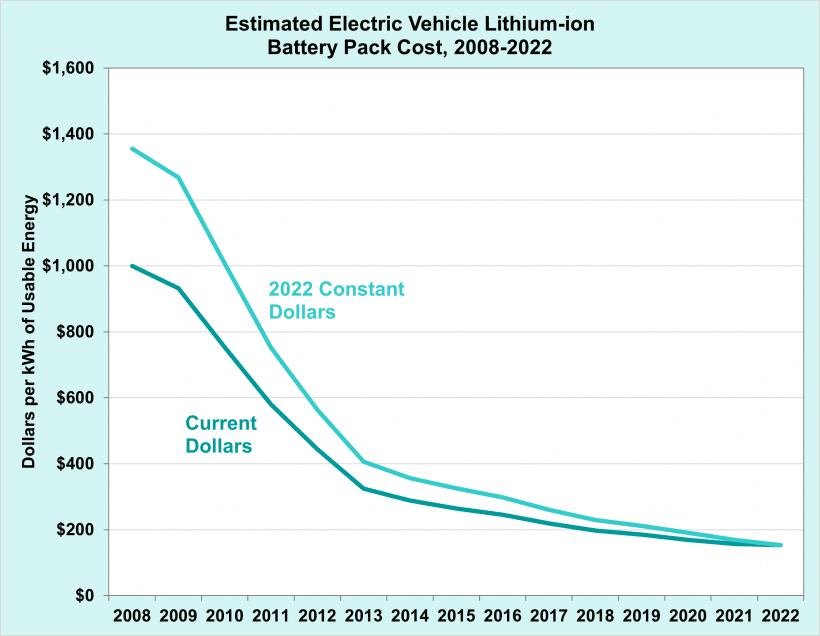

Several factors have contributed to the fall in EV prices. Firstly, battery costs, which account for the bulk of the costs for electric cars, have come down over the years. For instance, the US Department of Energy estimates that between 2008 and 2022, the costs of EV battery packs fell by a whopping 90%.

Automakers passed on the costs of lower battery costs to buyers by lowering prices. Many EV companies (especially Tesla) have also become a lot more efficient after years of improving their manufacturing strategy and technology. Far from the “production hell” that Musk talked about in 2018 during the Model 3 ramp-up, Tesla is now among the most efficient automakers in the world.

Higher production leads to an economy of scale and helps lower the per-unit production costs. Tesla has reached peak production levels at its older factor factories in Freemont and China.

More recently, EV prices have dropped across the board over the last two years due to the price war initiated by Tesla. The US EV giant has lowered prices across the world to spur deliveries. Other automakers were forced to follow suit and cut prices to keep their models competitive.

While the price war has meant lower prices for car buyers, it has also put pressure on the margins of automakers. For instance, Tesla, which once had industry-leading margins, reported an operating margin of a mere 5.5% in Q1 2024, less than half of the margin in the corresponding quarter last year.

However, when you compare Tesla to other EV makers, namely legacy automakers looking to make the shift, it’s doing quite well. Ford lost $100,000 for every EV it built in Q1 2024– which was twice as compared to the corresponding quarter in 2023. The company expects its EV business to post a pre-tax loss of $5.5 billion in 2024 which is wider than the $4.7 billion loss in the previous year.

Automakers Are Working on Low-Cost Models

In order to boost their sagging deliveries, automakers are turning to low-cost models. Tesla has worked on an affordable EV that could be priced as low as $25,000 for years now. During Tesla’s Q1 earnings call, Lars Moravy, Tesla’s Vice President of Vehicle Engineering, said that the company’s “mission (is) to get the most affordable cars to customers as fast as possible.”

He added, “These new vehicles we built on our existing lines and open capacity, and that’s a major shift to utilize all our capacity with marginal capex before we go spend high capex.”

Ford is also working on low-cost EVs. The company expects to make EVs for the $25,000-$30,000 price range though these offerings may take years to come to market.

General Motors is set to relaunch its Chevy Bolt EV next year which its North American president in January Marissa West says will be the “most affordable vehicle on the market by 2025.” Currently, Nissan LEAF is the cheapest EV model in the US and sells at around $28,000 though it is lambasted for it’s low range and small size.

All while US automakers are in a fierce struggle to be the first to offer an EV under $25,000, Chinese EV giant BYD already sells its Seagull for less than $10,000 (in China). No wonder, President Joe Biden has imposed a 100% tariff on EV imports from China amid fears that Chinese vehicles would flood the US market given the price differential. The European Union is also considering imposing tariffs on imports of electric cars from China over the alleged subsidies that Chinese companies receive.

Can Stellantis Sells Jeep EV Below $25,000?

Stellantis CEO Carlos Tavares is hopeful that the company can offer an electric version of its Jeep for $25,000 in the US market. Speaking at a Bernstein conference in New York, he said, “The same way we brought the €20,000 Citroën e-C3, you will have a $25,000 Jeep very soon, because we are using the same expertise.”

Currently, the cheapest electric car that the company offers in the US is the subcompact Fiat 500e which sells for around $32,500. In an interview with MotorTrend, Tavares said that the electric Jeep would be a subcompact SUV. He added that the model would be based on Stellantis’ STLA Small platform.

While Tavares did not provide more details on the cheap electric Jeep, it remains to be seen how the company could make it profitable. It would be a minor miracle to make a decent, profitable EV with workable range, charge time, and interior space for so cheap in the US.

The next couple of years look quite exciting for those looking to buy affordable EVs as automakers across the world are coming up with low-cost models. However, many experts, including Tavares himself, argue that the recent tariffs on Chinese EVs won’t help move things along for US automakers. At the Bernstein conference, he said, “Putting you behind a protectionist bubble is not going to help you to be competitive… If your strategy is to shrink and stay inside of the bubble, it will buy you time, but certainly, it will cut your future.”

The key for Western automakers would be to come up with compelling yet affordable cars that can compete based on the value proposition and not protective tariffs. If Stellantis can indeed come up with a $25,000 electric Jeep it would be a big boost for Detroit – a once formidable automotive cluster that has gradually lost its clout to other countries, more recently China which is trying to become a global EV leader with its affordable cars.