The latest chapter of the saga involving the stock of the troubled videogame retailer, GameStop, is unfolding this week as Keith Gill, the popular investor also known as Roaring Kitty and DeepFuck*ingValue, finally took the first steps to unwind his position on the company.

On June 2, Gill disclosed a multi-million-dollar bet involving millions of GME shares and 120,000 options contracts with a strike price of $20 that will expire on June 21.

The position required an upfront investment of around $106 million on the stock holdings and approximately $68 million on the options, resulting in a total exposure of $176 million for the retail investor.

Twelve days later, the price of GME stock has experienced sizable fluctuations, surging at some point to $48 per share and pushing the value of Keith’s options bet to over $500 million if the contracts were exercised and exchanged for the corresponding 12 million shares.

However, the price went down days after to the mid to high 20s, resulting in temporary paper losses for Gill.

Research Firms Spotted Roaring Kitty’s Actions with His Options

BREAKING: RoaringKitty, AKA DeepFuckingValue, has sold his $20 GameStop, $GME, calls for profit as well as exercised for more shares.

He now owns 9 million shares, up from 5 million.

Unusual Whales noted his position change yesterday. We were first to note his original position… pic.twitter.com/ZGcofIXYh1

— unusual_whales (@unusual_whales) June 13, 2024

On June 13, data from research firms indicated that Roaring Kitty may have cashed out of his options position before the expiration date on a day when the price of GameStop (GME) stock closed at around $29 per share.

The day before, the price had dropped by around 16.5% to around $25 per share and may have triggered Gill to take action as any additional drops could push his position to negative territory and would result in the loss of millions of dollars in premium paid for the contracts.

On this day, trading activity for the $20 call options expiring on June 21 held by Gill experienced a spike, with a total of 93,266 contracts changing hands – a figure that exceeded the 30-day average volume for these securities.

The cost of these options fell sharply as a wave of supply flooded the market. Meanwhile, GME stock’s value plummeted, likely because traders sensed that Gill was exiting the trade and wanted to avoid missing out if the meme stock trend ended.

The sudden increase in trading activity, along with the steep drop in option prices and the stock’s value, offered clear proof that this might be true. Market experts shared their thoughts, with Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, telling Reuters, “It appears he is closing the position.”

However, the plot thickened when open interest data for the $20 strike calls expiring on June 21st revealed a decline to 111,818 contracts as of June 15th – already below Gill’s original holdings of 120,000 contracts.

This discrepancy, combined with the lack of definitive confirmation from Gill himself, left the investment community guessing about his true intentions.

Roaring Kitty is Now the 4th Largest GME Shareholder

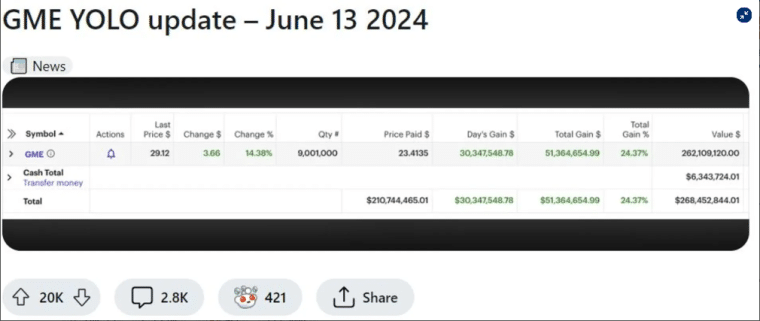

In a new Reddit post on June 13, Gill finally revealed that he had sold or exercised his 120,000 call options and increased his stock holdings in GameStop to a total of 9,001,000 shares.

This large position, worth over $262 million at the time of his post, made Gill the fourth-largest shareholder in the company according to data from FactSet as of the end of March. However, it’s worth noting that these figures do not account for GameStop’s recent $2 billion equity sale.

The timing of Gill’s post was particularly intriguing, as it coincided with GameStop’s annual shareholder meeting, which was plagued by technical difficulties and had to be postponed due to overwhelming interest from investors and fans who were attempting to tune in, possibly to see if Gill would use his voting power to win over a position in the company’s board or influence other decision-making.

The meeting’s abrupt postponement is leaving these questions unanswered, leaving Gill’s faithful following intrigued about what his next steps would be. GameStop has already rescheduled the meeting for next Monday.

ComputerShare, the software company that provides the platform for these meetings to occur is already gearing up for the event which is expected to attract thousands of investors.

How Much Money Did Roaring Kitty Make on His GME Options Trade?

Observers noted that Gill may have used some of the profits he obtained from the stock options he sold to fund this purchase. He may have also exercised some of the contracts to purchase GME stock at $21 per share.

However, the screenshot shows that the cost basis increased from $21.27 he paid on the lot he showed in June to $23.41 by 13 June. This means that Gill bought this additional lot of over 4 million shares at a higher price, which indicates that he did not exercise the options.

His screenshot also shows that he had $6.34 million in cash – a $23 million drop compared to the June 2 screenshot.

Assuming that he did not make any additional cash deposits to the account, Gill’s investment position jumped from $210.68 million on June 2 to $268.45 million just 11 days after – an eye-popping $58 million profit in less than 2 weeks.

Gill’s intentions are unclear now that he has amassed this significant stake in the embattled videogame retailer. Investors and fans are hoping that he will hold another livestream soon to explain his plan and motivations, but one has yet to be scheduled.

However, the last time he went on air, he said that he had no game plan for GME and that he was just following his heart and supported, for some reason, Ryan Cohen, the current Chief Executive Officer of GameStop, and his views for the firm.

The truth is, the GameStop saga seems quite far from being over despite Gill’s decision to liquidate his options holdings. In practice, there was little that Gill could do with less than a week left before the options expired.

He had the chance to exercise the contracts but he would have to put up around $240 million to do that or, otherwise, E*Trade, his brokerage firm, would have to make a decision on his behalf.

What’s Next for GME Stock? There’s Enough Material for Another Documentary

A lot has happened since May 14 when Gill returned to social media via a cryptic image of a man leaning forward as a hint that he was paying close attention to everything that was happening in the financial world.

Speculation regarding the timing and reason for Gill’s comeback has started to surface in messaging boards and social media.

Some argue that this could have been an orchestrated move from GameStop to capitalize on Gill’s influence on retail investors and the marketplace to raise additional capital for the company.

Meanwhile, short-sellers allege that Gill’s action have to be backed by somebody behind the curtains due to his lack of financial resources to pull this off by himself.

These conspiracy theories are adding a layer of secrecy and obscurity to the whole situation documentary producers are probably working on their scripts as I finish writing this piece.