In a surprising turn of events, the stock market is moving away from its long-standing focus on tech giants. Step beyond the familiar territory ruled by giants like Apple, Tesla, and Nvidia to discover a dynamic world where a new group of companies is making major impacts in the global financial markets.

From breakthroughs in technology to the rush of cryptocurrency and the revolution of online shopping, we’re seeing a major change in what drives Wall Street’s success. This is more than just a market rally; it’s a complete evolution of the market.

Join us as we explore this transformation and meet the new leaders forging paths to success.

The Shift Away from Big Tech

For quite some time, the story of stock market rallies has been largely about the impressive rise of the a handful of monolithic tech stocks (often dubbed the magnificent 7) like Nvidia, Apple, Microsoft, and Tesla. These giants haven’t just been at the forefront of innovation and market trends; they’ve also played vital roles in pushing the stock market to new heights. Their knack for consistently introducing groundbreaking technology and attracting massive numbers of consumers has turned them into investor favorites, sending stock indexes soaring.

Yet, the stock market is now seeing a significant shift. The focus is broadening, moving away from just big tech to include a wider array of companies that are contributing to the market’s success.

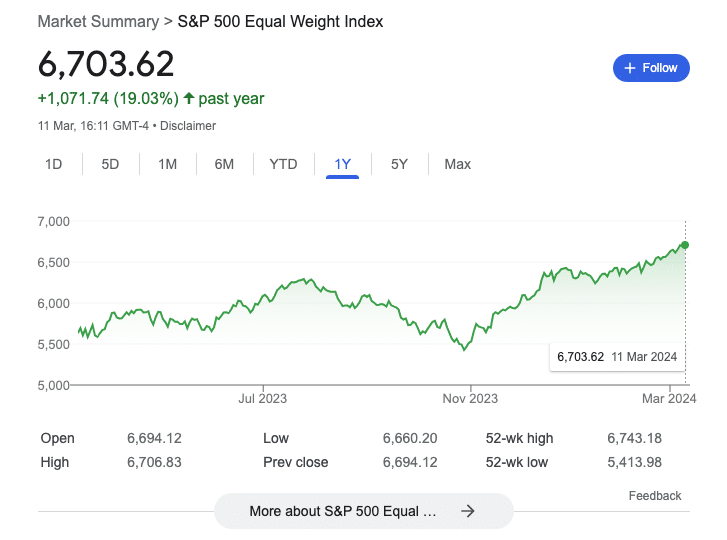

This move towards diversification is clearly seen in the performance of the equal-weighted S&P 500. This index treats each company the same, no matter how big it is, unlike the traditional market cap-weighted index that leans heavily on its biggest players. The equal-weighted version offers a look into the broader market mood and how a variety of sectors are doing.

Recent data highlights this change, showing that the equal-weighted S&P 500 has hit new highs, signaling strong activity across many industries. This is further supported by the fact that nearly 20% of the stocks in this index have reached new 52-week highs, a level of bullish activity not seen since May 2021.

These trends indicate that investors are gaining confidence in the economy’s overall health and are eager to explore opportunities beyond the big tech names.

Economic Indicators and Market Sentiment

The strength of the US economy, along with changes in interest rates and inflation, has a big effect on how investors feel.

US Economic Resilience

The strong performance of the economy has been a key source of confidence for investors, pushing them to look beyond just the big tech companies for investment opportunities. This confidence is based on the hope that the worst of the interest rate increases is over, making way for significant growth across various types of assets.

Interest Rate Trends

Signals from the Federal Reserve about possibly lowering interest rates are incredibly important for planning investment strategies. Lower interest rates can make borrowing cheaper, which can help the economy grow and make stocks more attractive than bonds. Higher interest rates can help curb inflation, but they also often dampen profits for most business sectors (outside of finance) and can hurt banks that invest in bonds and debt securities. Because of the major effects interest rate changes have on the market, any hint of change can quickly change how the market behaves and how investors make decisions.

Inflation Concerns

Although it seems like inflation is becoming less of a problem, there are still uncertainties. A sudden increase in inflation could make the Fed think about changing its plans to lower rates later this year, which could threaten the stability of the market. Investors are being careful, balancing their hope for economic growth with the unpredictable nature of inflation and what it means for interest rates.

In conclusion, investors are carefully balancing their hope for economic growth with worries about inflation and interest rates. This situation has led to more variety in the market as investors look for new growth opportunities while staying alert to changes in the economy.

Diverse Sectors Leading the Charge

The current uplift in the market is marked by impressive gains across various sectors, especially in industries like industrial and financial services, as well as a notable rise in small-cap stocks. Here are a few companies that have shown significant growth, driven by innovation and excitement from investors:

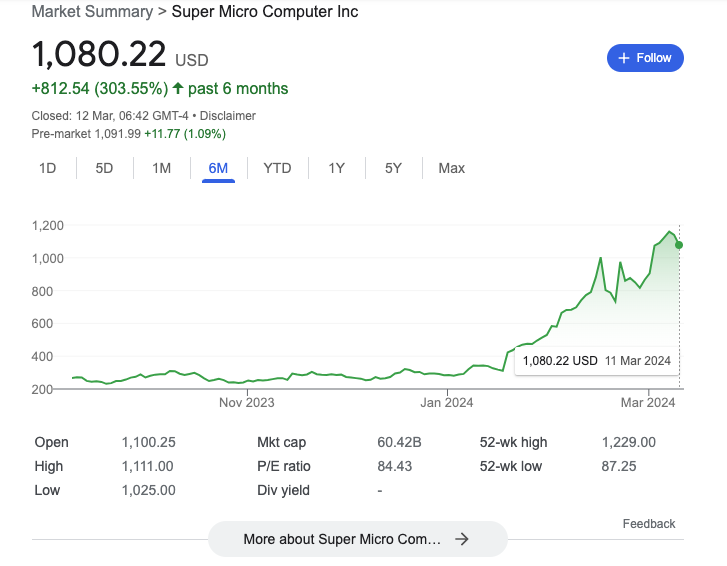

- Super Micro Computer: This chip manufacturer has greatly benefited from the artificial intelligence trend, with its stock jumping an incredible 304% over the past 6 months. This move has elevated it from the Russell 2000 to the S&P 500, highlighting its strong position in an essential technology sector and rising investor interest in AI.

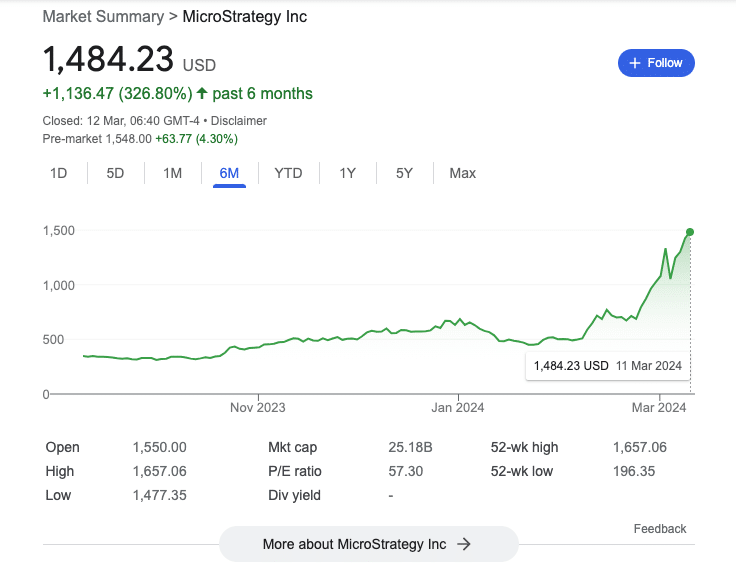

- MicroStrategy: Famous for its bold Bitcoin investments, MicroStrategy has seen its value increase by 327% over the past 6 months as it quickly becomes little more than a Bitcoin holding company. This boost reflects a wider interest from investors in cryptocurrency and companies deeply involved with digital currencies.

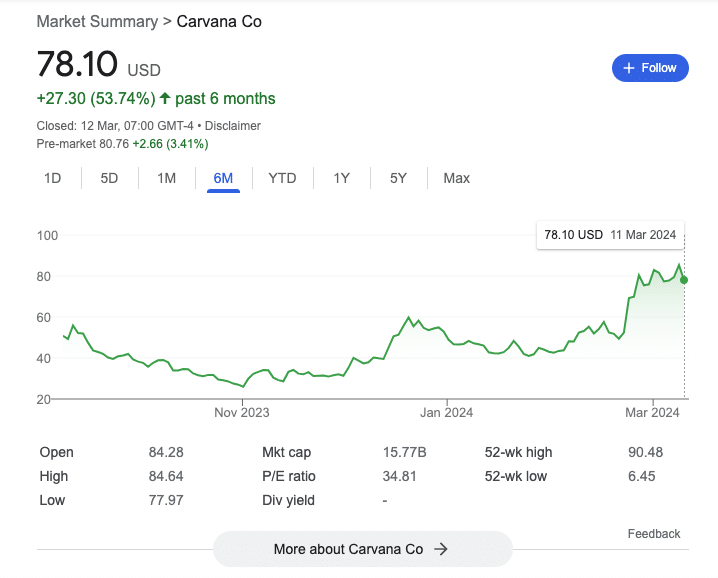

- Carvana: Known for its online car sales platform, Carvana, often called a meme stock because of its volatility and popularity with individual investors, has experienced a 54% increase in the past 6 months. This growth shows the high potential for companies that use technology to change traditional industries.

These cases point to a wider trend in the market that goes beyond the big names in technology, as investors spread their investments in the face of a strong economy and changing financial policies. The considerable success of these companies underlines a market full of opportunities for those looking to invest outside the usual tech giants.

Caution Amidst the Rally

During the current market rally, investors are advised to proceed with caution due to emerging risks:

Speculative Investments

- There’s a noticeable increase in speculative investments, with many seeking quick profits. This trend, especially common in tech and meme stocks, could lead to overvalued stock prices that aren’t sustainable long-term.

- Such speculation may risk major market adjustments if investor attitudes change.

Market Valuations

- The market’s rising values have reached points that worry some experts. For instance, S&P 500 companies are now valued at around 21 times their forecasted earnings for the next year, above the average and close to the highest seen in recent rallies.

- These high valuations raise doubts about the market’s ongoing strength, particularly if the economy starts to slow.

Earnings Forecasts

- There’s a challenge in meeting the optimistic earnings growth predicted by analysts, especially if economic growth falters. Although the economy grew significantly last year, S&P 500 companies only saw modest earnings increases.

- The gap between high earnings expectations and potential economic performance highlights the careful balance investors need to find between seeking growth and avoiding market downturns.

This brief overview highlights the necessity for investors to be vigilant, considering both the opportunities for growth and the inherent risks in the market.

The Bottom Line

After the excitement of the market rally that moved us away from the dominance of big tech, it’s clear that the investment landscape is changing. We’re now looking at a broader range of sectors and innovative smaller companies, indicating a stronger and more versatile market.

However, with these new opportunities, investors need to be careful. It’s important to watch out for potential risks like speculative bubbles and high stock prices, mixing the excitement of new possibilities with careful planning based on past experience.

In this new phase where the market is open to more players, wise investors who spread their investments strategically and stay open to new ideas while still paying attention to basic investment principles are set to do well.