Grocery giants Kroger and Albertsons announced an expanded divestiture plan on Monday, agreeing to sell 579 stores to rival C&S Wholesale Grocers in a bid to secure regulatory approval for their proposed $24.6 billion merger.

The updated package increases the total number of stores sold to C&S by 166 locations compared to the original plan revealed in September.

Key Takeaways: Kroger and Albertsons Divestiture Plan Amid Merger

- Expanded Store Divestiture: Kroger and Albertsons expanded their divestiture plan, selling 579 stores to C&S Wholesale Grocers to address antitrust concerns.

- FTC Concerns: The FTC and nine state attorney generals initially blocked the merger, citing concerns over competition and rising grocery prices.

- Commitment to Workers: Kroger promises no store closures, continued employment for frontline workers, and retention of union benefits.

- Ongoing Legal Battle: The merger faces significant legal opposition, with regulators skeptical that C&S can adequately maintain competition in the grocery sector.

- Latest Updates: The Federal Trade Commission (FTC) remains unconvinced about the divestiture plan. Analysts indicate that even the expanded sale of stores may not be sufficient to address concerns over reduced competition and potential price hikes for consumers. The case is ongoing .

What Is the Story Behind the Merger?

The move represents the latest effort by the supermarket chains to address antitrust concerns raised by federal and state regulators who argue that the deal would eliminate competition and lead to higher food prices for consumers across wide swaths of the country.

“We have reached an agreement with C&S for an updated divestiture package that maintains Kroger’s commitments to customers, associates and communities, addresses concerns raised by regulators, and will further ensure that C&S can successfully operate the divested stores as they are operated today”, said Kroger’s Chairman and CEO Rodney McMullen.

He added: “The updated divestiture plan continues to ensure no stores will close as a result of the merger and that all frontline associates will remain employed, all existing collective bargaining agreements will continue, and associates will continue to receive industry-leading health care and pension benefits alongside bargained-for wages”.

Also read: How to Invest During Inflation – Best Investment Strategies

Under the revised terms, C&S – which currently operates just 23 supermarkets – would acquire a high number of stores located across 36 states and multiple regional banners currently owned by Kroger and Albertsons.

Most of the stores that will be acquired are located in Washington (124), Arizona (101), Colorado (91), and California (63).

The agreement also provides C&S with increased distribution capacity through larger facilities, an expanded corporate infrastructure to operate the divested stores, and rights to use certain private label brands like Debi Lilly Design, Primo Taglio, and Open Nature.

Albertsons and Kroger Were Forced to Revise their Merge Following FTC Block

The divestiture efforts aim to resolve a major roadblock for the Kroger-Albertsons merger as a lawsuit was filed in February by the Federal Trade Commission (FTC) and a bipartisan group of state attorney generals from nine different states.

In its complaint, the FTC alleged that the original divestiture proposal was “inadequate” and went on to deem it a “hodgepodge of unconnected stores, banners, brands and other assets” that falls short of replicating the competition that currently exists between the two supermarket chains.

“Kroger’s acquisition of Albertsons would lead to additional grocery price hikes for everyday goods, further exacerbating the financial strain consumers across the country face today”, FTC Bureau of Competition Director Henry Liu said at the time.

The revised plan shows that Kroger and Albertsons are doubling down on divestitures in an attempt to resolve regulators’ concerns.

If approved, the deal would create an industry behemoth operating around 5,000 stores, 4,000 retail pharmacies, and 700,000 employees across 48 states.

The Merger Raises Concerns About Increased Pricing Power and Employee Retention

In addition to the FTC’s objections, the proposed merger faces widespread opposition from consumer advocates, labor unions, and food industry groups who argue that concentrated ownership in the grocery sector could undermine competition and negatively impact stakeholders from consumers to workers.

“Grocery Goliaths often make this claim when they announce plans to merge. In reality, mergers give these large companies the power to dictate prices. That means, at some point, they become higher”, said Rebecca Wolf of Food & Water Watch. “As big companies keep getting bigger, their competitors disappear and prices keep going up.”

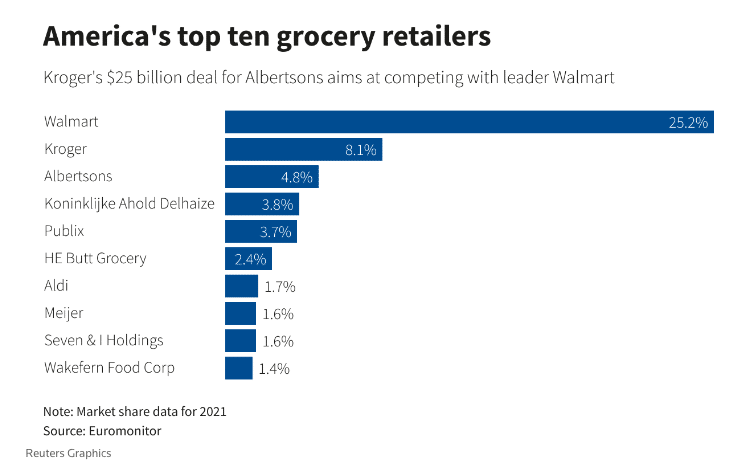

Research from the Food & Water Watch group indicates that almost 70% of all grocery sales within the United States come from just four companies. The problem is especially severe in small towns where there is only one grocery brand in town.

Also read: AI in Ecommerce – Revolutionizing Online Shopping in 2024

The Stop the Merger coalition, formed by a large group of unions and advocacy groups, argues that the deal could trigger store closures, job losses for grocery workers, and weaker bargaining power for the employees and unions that they represent. Kroger has pledged to retain all front-line employees and honor union contracts, but workers remain skeptical based on experiences with past mergers.

“They always hurt the little guy to get the bottom line to look better”, said Jane St. Louis, a 30-year Safeway employee in Maryland. “I always thought mergers were going to be for [employees’] benefit; it would be better. As the years go on, that hasn’t been the case.”

Food producers and farm worker groups have also voiced concerns that increased buying power by the combined company could depress wages and pricing from suppliers. Just like mergers reduce competition for consumers, they also reduce competition for workers, allowing companies to lower wages.

“If a farmer’s just trying to get by with thin margins, they’re going to find ways to make ends meet. And usually it’s by paying workers less”, said Edgar Franks of the Familias Unidas por la Justicia farmers’ union. “That’s been a big issue from the labor perspective about how much power the grocers have over the lives of not just the farms, but the actual people that are picking and harvesting.”

Is Consumer Choice at Risk?

Healthy competition is at the center of a great free market, and it affects more than just prices and wages.

Beyond higher grocery bills, the FTC warned that the merger could diminish incentives for Kroger and Albertsons to compete on quality and services like fresh produce, private labels, and pharmacy hours that benefit shoppers today.

There are also concerns about potential store closures in underserved areas if the merger rationalizes redundant locations, exacerbating food deserts. Unfortunately, these food deserts have been found to contribute to obesity.

“It’s highly likely if it goes through it will result in more communities not having a grocery store”, said Stacy Mitchell of the Institute for Local Self-Reliance. “This merger is incredibly dangerous.”, she further stressed.

Also read: Best Shopping Cashback Apps in 2024 | Top 5 Reviewed + Compared

Kroger has countered that it will invest $1.3 billion in upgrading Albertsons stores and increase local product assortment by 10% to bolster consumer choice and experience. The company also claims that by combining their operations they will unlock significant cost savings resulting from their synergies that can fund investments to lower product prices.

“Our proposed merger with Albertsons will bring lower prices and more choices to more customers and secure the long-term future of unionized grocery jobs.”, McMullen stated in the press release issued this Monday.

Kroger and Albertsons Seem Willing to Withstand a Lengthy Legal Fight

Whether the revised divestiture plan satisfies regulators’ antitrust concerns remains to be seen.

The FTC previously described C&S as an insufficient buyer lacking the scale and capabilities to restore competition potentially lost through the merger.

Kroger and Albertsons said that they “remain committed to defending the merger in court and unlocking the many benefits it offers”. The next step could be a preliminary injunction hearing to temporarily block the transaction while the FTC’s in-house proceeding on the matter continues to advance.

Given the significant projected cost synergies resulting from combining the two companies, Kroger and Albertsons have massive financial incentives to engage in a protracted legal fight if their updated package is not enough to appease regulators.