The US dollar’s position as the world’s reserve currency was established in 1944 after the Bretton Woods Conference. While the Bretton Woods Agreement collapsed decades ago, the US dollar remains a de facto global reserve currency.

However, the US dollar’s appeal has lessened over the past ten years, and this trend has sped up in the last few years. Some experts think that the dollar might eventually fail and mention options like cryptocurrencies, gold, the Chinese renminbi, and even the upcoming BRICS (Brazil, Russia, India, China, and South Africa) currency as alternatives. Here’s why some believe the US dollar could collapse and what effects such an event might cause.

De-dollarization Has Been a Gradual Process

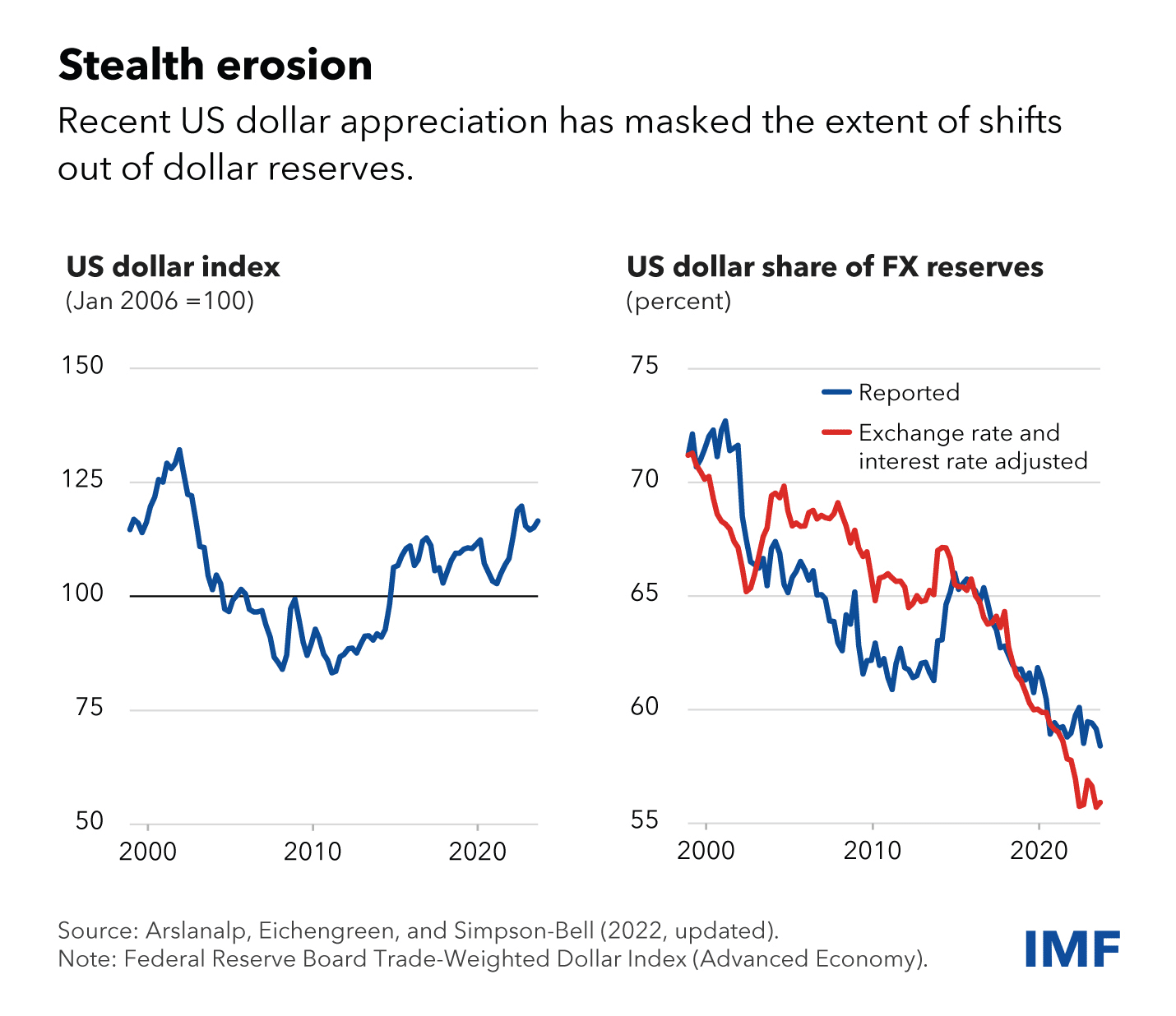

A recent report from the IMF highlights the trend of de-dollarization. According to the report, the dollar’s share of the global forex reserves is now just above 55% while the corresponding figure at the beginning of the century was over 70%. The IMF termed the falling share of the dollar in the global reserves as “stealth erosion.”

The report provides some very interesting insights. For instance, it warned that the rising wave of US financial sanctions, especially against old rival Russia following its invasion of Ukraine, could turn away some countries from holding dollar reserves in their forex holdings.

However, and quite counterintuitively, in its report the IMF says, “statistical tests do not indicate an accelerating decline in the dollar’s reserve share, contrary to claims that US financial sanctions have accelerated movement away from the greenback.”

Notably, while central banks have their own reasons for moving to non-dollar currencies, there is a divergent trend among private investors. As the IMF said in its report, “This recent trend is all the more striking given the dollar’s strength, which indicates that private investors have moved into dollar-denominated assets.”

In the video above, IMF’s First Deputy Managing Director Gita Gopinath talks about geopolitics and its impact on the US dollar.

Chinese Renminbi Has Gained in Popularity

In its report, the IMF said that the other “big 4” currencies which are the euro, yen, and pound haven’t gained at the dollar’s expense. However, it adds that the share of nontraditional currencies like the Canadian dollar, Australian dollar, Chinese renminbi, and the South Korean won have risen in global reserves.

In particular, the share of Chinese currency has risen in global reserves and its “gains match a quarter of the decline in the dollar’s share.” The Chinese government has taken measures to internationalize its renminbi, as the IMF also stated in its report

The IMF is not too perturbed by the rise in Chinese currency gaining traction internationally and said, that its internalization when measured by its reserve share, shows signs of stalling out. It added that the recent data points don’t show any more increase in its share in global reserves.

Gold Is Slowly Replacing the US Dollar

Meanwhile, the IMF report confirms what the US Fed has also talked about in its previous report – gold has been steadily replacing the dollar in global reserves. The IMF highlights that gold holding in official reserve assets in terms of absolute tonnage is now the highest since World War II, led by central banks in emerging economies. However, the share of gold in relative terms is still low by historical standards.

The IMF also pointed out that even in the past whenever economic sanctions were imposed, central banks showed a tendency of moving away from currencies – which can be easily frozen – towards gold which is free from the threat of sanctions and can be stored safely within the country. It adds that during periods of global economic policy uncertainty and heightened global geopolitical risk, central banks tend to pivot towards gold. It added, “These factors may lie behind the further accumulation of gold by a number of emerging market central banks.”

The IMF summed up its report by saying the “international monetary and reserve system continues to evolve.” However, it added, “very gradual movement away from dollar dominance, and a rising role for the nontraditional currencies of small, open, well-managed economies, enabled by new digital trading technologies—remain intact.”

Why’s the Dollar’s Status as the World’s Reserve Currency Under Threat?

All said it is undeniable that the dollar’s status as the world’s reserve currency is under threat. Among the key factors driving the trend is the country’s loss of relative power especially against China.

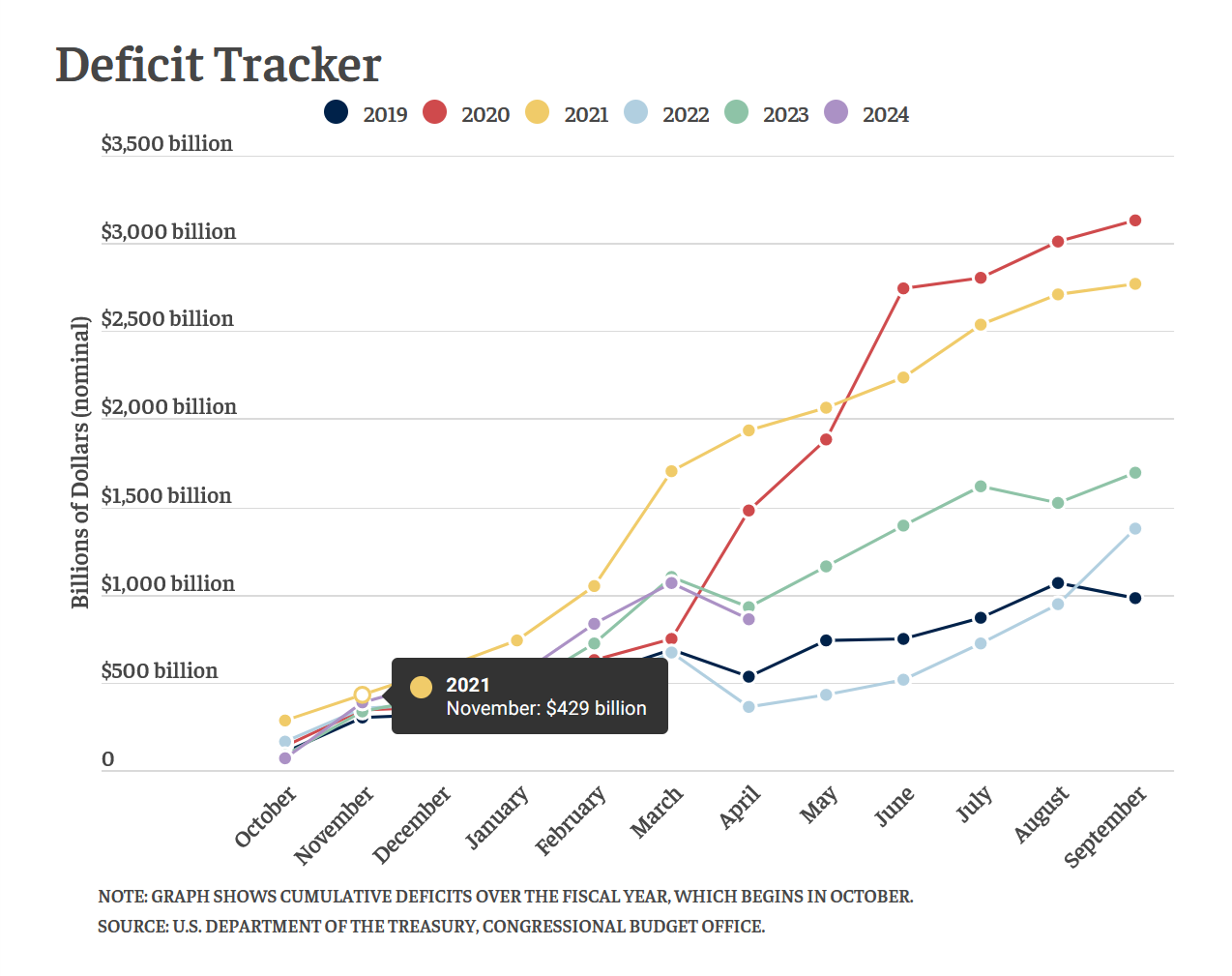

Also, the US government’s finances now look in terrible shape amid the near reckless spending and money printing since the COVID-19 pandemic. The country’s debt to GDP is now above 120% while the annual interest outgo is at $1 trillion.

In February, Federal Reserve Chairman Jerome Powell told CBS’s “60 Minutes” that “The U.S. federal government is on an unsustainable fiscal path.” Powell acknowledged that the COVID-19 pandemic was a “special event” and called for unprecedented actions. Nevertheless, he stressed, “It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

What Could Replace the US Dollar?

While the gradual process of countries diversifying their reserves from dollars might continue, the other alternatives have their own share of problems. For instance, the finances of other developed economies are not much healthier either, and nor are regions like the EU and UK becoming any stronger – either financially or geopolitically.

As for China, its currency is not free-floating, and unless a country lies in the China bloc, it might have little interest in increasing the renminbi’s share in its reserves. The same logic, coupled with the China-India rivalry – two of the biggest economies of the BRICS bloc – make the region’s common currency an almost nonstarter.

The so-called nontraditional currencies do remain an alternative, but none has the kind of wherewithal to absorb much of global reserves.

This leaves us with gold, but it has various issues too, especially as it becomes more difficult to find and mine. It is an attractive investing option with great inherent value and liquidity. It’s also a hedge against inflation as well as geopolitical shocks.

BREAKING: Elon Musk is giving Donald Trump advice on crypto policies! 🤯🚨

Is this a good combo for crypto folks?!

Dogecoin to replace the US dollar? pic.twitter.com/8gd7nbWiZ3

— MASON VERSLUIS (@MasonVersluis) May 30, 2024

Will Cryptocurrencies Someday Form Part of Reserves?

Some experts, including special purpose acquisition (SPAC) king Chamath Palihapitiya, believe that bitcoin could replace gold as more countries adopt digital assets.

That said, while many retail and institutional investors have adopted cryptocurrencies and the market has rebounded, central banks that print fiat currencies (and in a way compete with cryptocurrencies) adopting and coopting cryptocurrencies would be a radical idea, at least for now.

However, as countries try to diversify their reserves and also seek to make more returns from their holdings, they might need to look beyond the traditional assets, and while the idea looks far-fetched for now it is not something that we can rule out in the future as the crypto markets mature.

All said, while the gradual process of countries diversifying their assets might continue, we don’t seem headed for a dollar collapse. Such an event, if it were to happen, could be catastrophic for the markets and lead us into uncharted waters as the system of dollar dominance has worked quite well for the world over the last many decades.