The US Chips Act was passed in 2022 to help regain America’s position in the semiconductor industry. For years, the global semiconductor market has been dominated by a small number of companies and countries outside the US, leaving the US economy heavily dependent on Taiwan and other trade partners. The CHIPS Act aims to develop our own semiconductor industry to become self-sufficient and improve the economy overall. But is it effective?

Major companies like Intel, Samsung, TSMC, and Micron Technology have already received this funding, and they have committed to a total of $327 billion in investments over the next ten years to transform the nation’s tech landscape and supply chain.

With $39 billion already granted to companies from the $52.7 billion that the government plans to spend to help them expand their manufacturing capacity, it’s a good time to analyze how successful the program has been.

America Aims to Manufacture Up to 20% of All Cutting-Edge Global Semiconductors by 2030

The primary goal of the Chips Act is to encourage companies to engage in the development and construction of additional facilities and manufacturing plants that can reduce the nation’s reliance on Asian (mostly Taiwanese) suppliers.

Nearly all cutting-edge chips and processing units are made in Taiwan at TSMC’s foundry. Its dominance is often attributed to Taiwan’s skilled workforce, targeted government subsidies, global supply chain integration, and economies of scale as the equipment necessary to produce these kinds of chips is ludicrously expensive. This situation is exposing America to major vulnerabilities as this is a disputed territory over which China claims to have sovereignty.

Tensions in the region have highlighted the importance of achieving domestic sufficiency and autonomy within US territory to prevent a military event – i.e. an invasion of Taiwan by China – from derailing the progress of America’s tech industry or even deprive the country of critical components required to assemble and manufacture key consumer electronics.

If the US is cut off from Taiwanese semiconductor chips, many facets of the economy, namely electronics and cars, would come to a screeching halt, similar to the chip shortage during the COVID-19 pandemic.

Also read: CHIPS Act-Funded US Chipmakers Want to Maintain Presence in China

The earliest results of the Chips Act appear to be positive as statistics show a stunning 15-fold increase in the construction of manufacturing facilities for computing and electronic devices.

The world’s leading chipmakers, including the ones cited above, are already building large manufacturing facilities in the country and Intel has already claimed that it will manufacture its most advanced chips in the US.

The US Commerce Secretary Gina Raimondo notes that by 2030, the US will likely produce around 20% of the world’s most advanced chips, up from zero percent today. This projection underscores the program’s success thus far in driving substantial investments within the sector to potentially reshape the global semiconductor landscape.

“I believe the US can be home to the entire silicon supply chain for the production of leading-edge chips – from polysilicon production to wafer manufacturing to fabrication to advanced packaging,” Raymondo commented as part of an update on the progress of the program provided in late February this year.

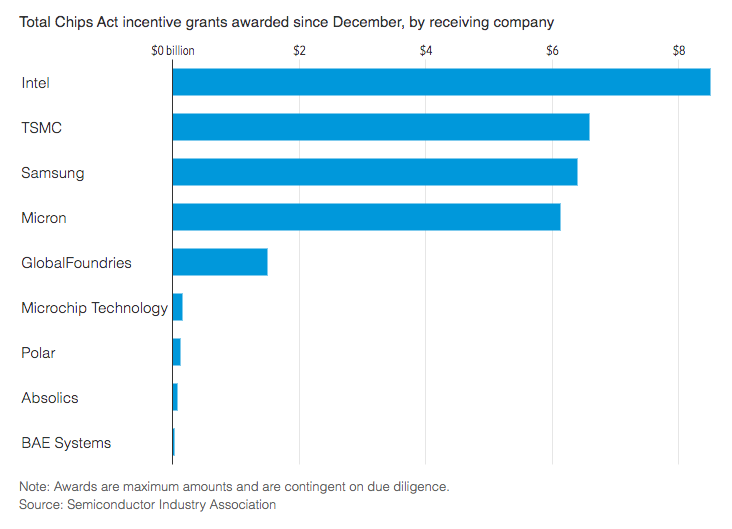

Four Large Grants Totaling $27.6 Billion Have Already Been Awarded

A table compiled by Semiconductor Intelligence (SI) reveals that major US fab projects announced in recent years add up to a total investment of $142 billion. Most of these projects were announced before the Chips Act’s passage, suggesting that companies were already gearing up for future US government subsidies.

This is a summary of some of the commitments and advancements that some of the most important companies in the industry have made thus far, according to SI data and other sources.

- TSMC: the largest advanced wafer foundry in the world by a massive margin, based in Taiwan, is building a manufacturing facility in Arizona. Both the US government and customers in the nation may have pressured the Taiwanese corporation to participate in the Chips Act to reduce their reliance on its overseas manufacturing capacity. They secured $6.6 billion from the government in April this year.

- Intel: Intel is building large facilities in multiple locations within the United States including Arizona, Oregon, and New Mexico. They received a total of $8.5 billion from the federal government for the construction and expansion of their facilities in the country, which makes them the largest recipient of these grants thus far.

- Micron Technology: They are already engaged in building new fabs in Boise, Idaho, and Clay, New York. Their decision to expand their manufacturing capacity in the US was highly influenced by the Chips Act. Micron received $6.1 billion from the Chips Act and they said they plan to invest over $50 billion through 2030 to build leading-edge memory manufacturing facilities in the country.

- Samsung: The South Korean tech giant was granted up to $6.4 billion in direct funding by the federal government in April this year to build a new manufacturing facility in Taylor, Texas. They plan to invest at least $40 billion in the state within the next few years to transform Taylor into one of the country’s largest semiconductor manufacturing hubs.

The US Must Keep the Pace with International Competition

While the Chips Act has prompted companies to pledge significant investments that will be made in the country within the next five years or so, it is worth noting that the US is not alone in this endeavor.

Various European countries, South Korea, Japan, Taiwan, and China are also stepping up their effort to bolster and strengthen their respective chip industries. This global race is expanding and accelerating the production of advanced semiconductors worldwide.

Also read: UK Commits a Paltry $1.2 Billion to Semiconductors

A Boston Consulting Group study commissioned by the Semiconductor Industry Association forecasts that the US share of global chip production will rise to about 14% by 2032, compared to 12% in 2020. While this overall increase seems modest, it represents a significant turnaround from the expected 8% decline that would occur without the Chips Act.

Notably, in the arena of cutting-edge chip factories, which require tens of billions in capital outlays, the study forecasts that the US share will grow from zero to 28% by 2032. This estimate is even more optimistic than Secretary Raimondo’s recent prediction of 20% by the end of the decade.

Labor Disputes and Lengthy Environmental Studies Emerge as Key Risks

Despite its early success in harnessing the interest and commitment of large corporations in the sector, the Chips Act and its ultimate victory hinges on these projects’ ability to navigate complex challenges including labor disputes, higher-than-expected construction costs, and lengthy environment reviews that may delay their expected inauguration dates.

Moreover, building chip factories is quite an expensive endeavor. In fact, you would be hard-pressed to find anything more expensive (nuclear reactors don’t even compare). Some estimates point out that a single facility that produces cutting-edge products costs around $20 billion. To put this into perspective, the federal government’s grants may, at best, single-handedly build a maximum of three facilities by itself.

“This could only support maybe a few big fabs, but I think that’s the starting point,” commented Ajit Manocha, a former chip maker CEO.

This means that collaboration with large corporations within the sector remains crucial to achieving the ambitious goal of turning the United States into a semiconductor superpower.

He added: “I’m pretty sure that the Department of Commerce and the government in general understands that we have a huge gap to close.”

Three Companies (And Stocks) That Stand to Benefit Most from the Chips Act

Swarms of investors are looking for the best ways to profit from the massive subsidies within the CHIPS Act and there are a few clear front-runners. Here’s who is set to benefit most from the bill:

#1 – Intel (INTC)

As the largest recipient of grants thus far, Intel is well-positioned to boost its domestic manufacturing capacity. The company’s plan to manufacture its most advanced chips in the US aligns perfectly with the Act’s goals. If successful, this could solidify Intel’s position as a leading-edge chip manufacturer in the region and allow it to offer more competitive prices and faster delivery times. In the long term, this could result in a larger market share in the continent.

#2 – Micron Technology (MU)

With over $6 billion in funding already granted for its projects in Idaho and New York, Micron is set to become a major player in domestic DRAM production. The company’s strategy to eventually produce 40% of its DRAMs in the US could significantly reduce its reliance on overseas fabs. As demand for memory chips grows, particularly for AI applications, Micron’s increased domestic production could fit perfectly with the ambitions of big companies in this nascent and growing sector like Microsoft (MSFT), Alphabet (GOOG), and Amazon (AMZN).

#3 – NVIDIA (NVDA)

Although not a direct recipient of grants from the Chips Act, NVIDIA stands to benefit enormously from the increased domestic production of advanced chips from companies that plan to build domestic manufacturing facilities.

As a leading designer of AI chips, NVIDIA relies on foundries like TSMC to manufacture its products. With TSMC and others building cutting-edge fabs in the US, NVIDIA could enjoy faster time-to-market, enhanced supply chain processes, and, possibly, lower costs.

Given the exploding demand for AI chips, a more robust domestic supply chain could help NVIDIA meet this demand more effectively.

Also read: Can Nvidia Keep Its Throne as King of AI? These Challengers Are Fighting to Take It

If you’re interested in learning more about the fight for chip supremacy in the US, check out Financial Times’ great YouTube documentary on the topic below.

A Strong Start, But Most of the Work is Still Ahead

In just two years, the Chips Act has taken the first steps in its mission to revitalize the US semiconductors industry. However, the road ahead is still full of unknowns and road bumps as companies now have to set things in motion and overcome the many obstacles involved in building large manufacturing facilities.

The journey is far from over. The global race in semiconductor manufacturing is intensifying and the sheer cost of producing cutting-edge chips limits what even a historic program can achieve by itself.

In the words of Commerce Secretary Raimondo, “We are moving fast, but much more importantly, we are focused on getting it right and relentlessly pursuing our national security goals.”

She added: “Together, we are rebuilding our industrial base, supercharging American innovation, creating hundreds of thousands of good-paying jobs, and meeting the monumental challenges of our time.”