US stocks tumbled yesterday and had their worst day in two years as tech stocks crashed following the Q2 earnings of Tesla and Alphabet – two of the constituents of the so-called “Magnificent 7” stocks that led the market higher in 2023 as well as the first half of 2024.

Adding to the gloom was dismal US economic data that showed that the S&P Global Flash Manufacturing PMI fell to 49.5 in July – down from 51.6 in June. Separately, existing home sales unexpectedly fell 5.4% in June on a monthly basis and fell short of estimates. Similarly, new home sales unexpectedly fell in June to a seasonally adjusted annual rate of 617,000 units which is the lowest since November.

Valuations of tech stocks have been a burning topic anyway. Now, with two tech giants failing to impress markets with their earnings reports, and Netflix also falling after its Q2 report last week, some analysts are warning that the bubble in tech stocks is about to pop.

Netflix and Alphabet Shares Fell Despite Not-So-Bad Earnings

While Tesla missed earnings estimates in Q2, both Netflix and Alphabet reported better-than-expected revenues and profits. Netflix even shattered its subscriber number forecast as the streaming giant continued to benefit from the password crackdown and ad-supported tier. Its Q3 revenue guidance was a bit light but, on another day, markets might have overlooked it for an otherwise stellar quarter.

As for Alphabet, YouTube revenues were a tad short of estimates but its overall performance was slightly better than what analysts were expecting. Also, markets seem a bit apprehensive about the higher investments that the Google parent is making in artificial intelligence (AI). While these initiatives are expected to drive long-term value, none of the tech companies are currently monetizing their AI investments in a big way. Nvidia is a notable exception as its revenues and profits have grown multifold as companies – big and small – queue in to buy its AI chips.

Tesla’s numbers were a disappointment though and the company missed EPS estimates even as the revenues were slightly higher than expected. The automaker is looking to justify the increased investments in AI and the multiple delays in software products, pushing back its deadline for its robotaxi project by 2 months.

The stock had risen sharply over the last month, and its mixed Q2 earnings came as a real dampener for markets, which led to a double-digit decline in its stock price.

Is There a Bubble in Tech Stocks?

The steep fall in tech stocks despite seemingly better-than-expected earnings looks worrisome and is a sign that their earnings are not enough to justify the lofty valuations.

Personally having been at my desk through the 1987 and 2000 crashes I'm surprised that anyone thinks this AI induced bubble is NOT going to end with M7/tech crashing back to earth. And when I say crash, I mean >50%. https://t.co/m77b3Cl7n9

— Albert Edwards (@albertedwards99) July 19, 2024

In a note last week, Albert Edwards, the chief global strategist for Societe Generale, warned of an impending crash, particularly in tech stocks. He said that markets have lofty expectations from tech companies and expect them to post earnings growth of 30% annually which is much higher than the 20% that they have historically delivered.

According to Edwards, “And to what extent is this EPS growth enthusiasm similar to the overinvestment in cabling by the Telecoms industry in the late 1990s, fuelled by ‘free’ money? We could be about to find out.”

He emphasized, “What might pop this Tech bubble? A simple decline in EPS optimism might do the trick.”

Analysts Agree That Tech Valuations Are Bloated

Edwards referred to the technology sector’s forward PE of 32 as a “ticking IT valuation timebomb.” He drew parallels with previous market bubbles and said, “As time marches on, there are few of us left who were in the industry during the 2000 Nasdaq crash, let alone the 1987 crash. I was there, and the one thing I have learnt is not to be complacent. Bad stuff happens and the warning signs are there if you look for them.”

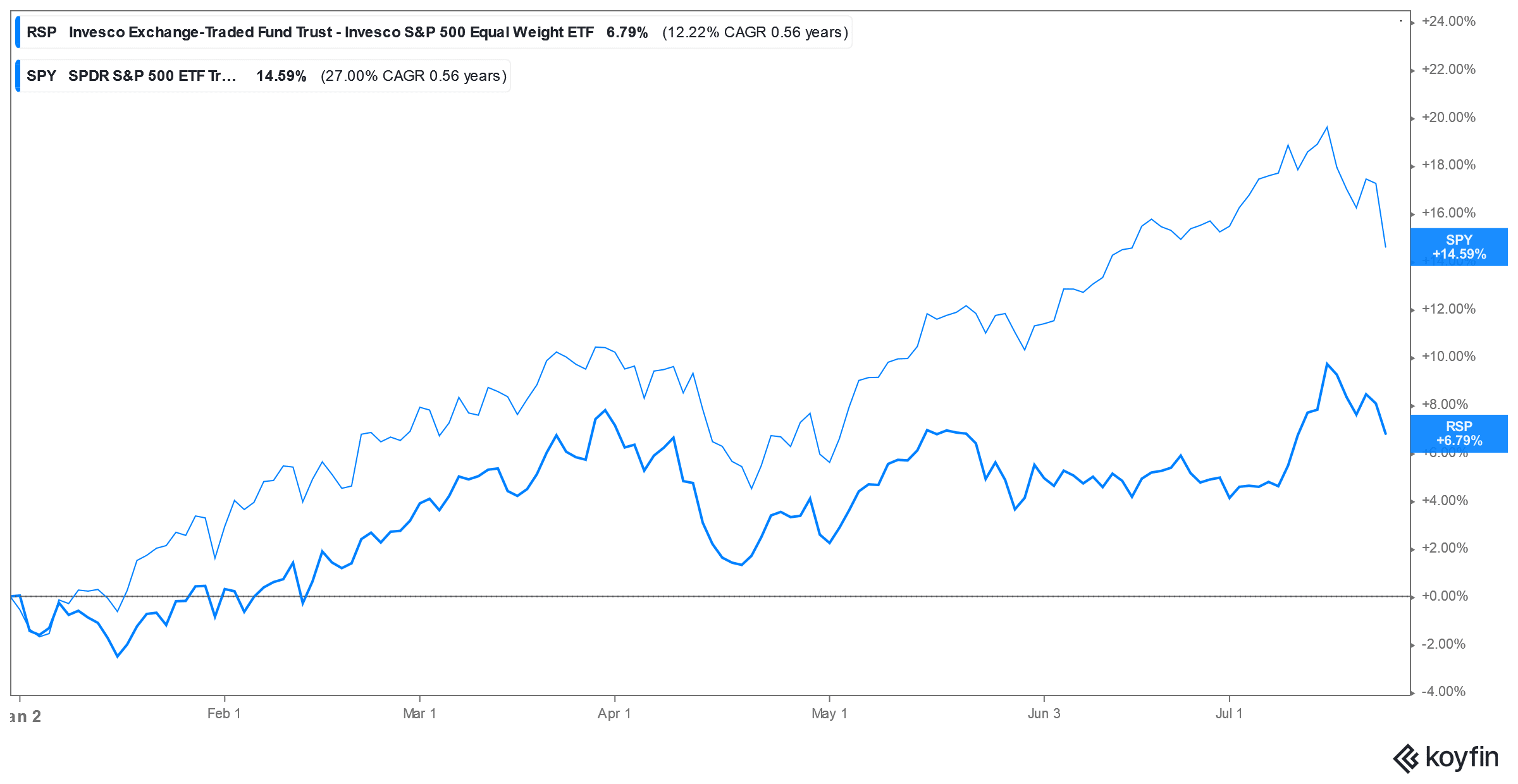

Notably, while tech stocks rallied in the first half of 2024, many of the other sectors sagged and nearly 200 constituents of the S&P 500 were in the red. Thanks to the massive divergence between tech and other sectors, the percentage of tech stocks in the market cap-weighted S&P 500 approached 30% earlier this month.

The spread in total returns between the S&P 500 and its index’s equal-weighted counterpart was 10.21% in the first half of the year which is the widest since 2009. Also, the percentage of the top 10 S&P 500 stocks in the total index is now approaching 40% – a similar level reached during the dot com crash.

Magnificent 7 stocks and Nvidia in particular led the market rally in the first half. In fact, if we exclude the returns from these seven stocks, the S&P 500 was up just around 6% which is a fraction of the nearly 15% that the index delivered.

Bank of America Also Warns on AI Euphoria

While euphoria towards AI has been a key driver of the rally in tech stocks, Bank of America has a word of caution, especially for retail investors. “Credit spreads say the stock rally is unstable, flashing the biggest warning since the dotcom bubble,” said Bank of America’s Jared Woodard.

He warned, “The narrow U.S. market rally, premised as it is on extended capex cycles and quiescent capital, looks shaky.”

The view on AI’s impact on corporate earnings is nuanced though. While a section of the market sees AI as a “bubble” like the dot com bubble, many others see the technology’s impact on corporate earnings as real. Last year Goldman Sachs said that AI could increase productivity by 1.5% annually which can increase S&P 500 profits by 30% or higher over the next 10 years.

The initial AI bubble has already popped.

— Hiten Shah (@hnshah) July 25, 2024

Is It Time to Buy the Dip in Tech Stocks?

Meanwhile, while buying the dip in tech stocks might sound tempting, hedge fund manager Dan Niles has a word of caution and expects them to fall further. “The way the market reacted to Google tells me that people are finally starting to wake up to the reality of ‘yeah, at some point we’d like to see revenues for all this [artificial intelligence] spend,” said Niles.

However, he sees the long-term bull run in tech stocks remaining intact and said, “So, you just have to live through this period of time much like you had to live through three horrific drawdowns in Cisco on the way to the stock being up 4,000%,” – a reference to parabolic rally in Cisco stock during the dot com days.

Meanwhile, after the steep fall from their peaks, tech stocks are taking a breather today and the Nasdaq is nearly flat in premarkets. However, investors should brace for heightened volatility over the next week as tech giants including Meta Platforms, Apple, and Amazon report their quarterly earnings.