Nvidia once again smashed Wall Street’s earnings expectations in its latest quarterly report, providing further evidence that artificial intelligence has hit an inflection point that is revolutionizing the technology industry. But some critics are worried that Nvidia’s gains are just contributing to a massive bubble similar to the dotcom bubble that could pop at any time.

Nvidia reported fiscal fourth-quarter revenues of $22.1 billion, resulting in a massive 276% jump compared to the numbers it produced a year before. Moreover, the figure exceeded analysts’ average estimate of $20.6 billion for the quarter.

Meanwhile, Nvidia’s adjusted earnings per share for the period soared to $5.16, far surpassing analysts’ consensus estimate of $4.64 per share as per the data compiled by the London Stock Exchange Group.

Nvidia shares rocketed up during after-hours trading and the rally continued through today’s opening bell, sending the stock up over 15% at the time of writing. This may not seem like a ludicrous move but, with the tremendous size of Nvidia, it would be the largest increase in market cap in a single day ever if it doesn’t crash back down. So far it has added nearly $240 billion in market cap in just a few minutes of trading.

Augmented AI Chip Sales Boosted Nvidia’s Top Line

Nvidia’s results were fueled by runaway demand for its AI chips, especially its flagship H100 GPU unveiled last year. The H100 is designed to help process the heavy workloads associated with large AI models and can be used to train them up to four times faster than previous generations.

Sales of data center chips and systems jumped 409% to $18.4 billion, making up the vast majority of Nvidia’s total revenue. The figure also beat analysts estimates by over $1 billion.

Accelerated computing and AI have driven exceptional growth over the past several years for Nvidia. In regards to the firm’s performance and prospects, the firm’s CEO Jensen Huang emphasized that demand continues to outpace the company’s ability to supply enough chips to eager customers but that Nvidia will do its best to keep up with this segment’s frantic pace of growth.

Nvidia’s Valuation Passes Amazon and Alphabet

Analysts noted that the quarter once again showed that Nvidia remains far ahead of any competitor in the red-hot AI chip space. Dan Ives from Wedbush deemed Nvidia as the “Godfather of AI” and went on to categorize this week’s earnings report as another ‘drop the mic’ moment for the tech company.

Much of the demand is coming from large cloud providers like Amazon (AMZN), Microsoft, and Google, all of which are investing heavily in AI infrastructure to support new services and expand their infrastructure. However, Nvidia also mentioned strength among automotive customers and noted that the metaverse could be the next major driver of growth.

Despite the record results, Nvidia’s quarter was not without challenges. Sales to China plunged significantly due to new export restrictions on advanced AI chips meant to limit military applications. However, the company was able to reconfigure some of its products to comply with regulations. “We reset our product offering to China”, explained Huang. The reconfiguration was meant to prevent any hacking that could result in the company’s chips being used for the wrong purposes.

Importantly, Nvidia expects no slowdown in sight. The company’s guidance calls for an 8.6% sequential increase in sales next quarter to around $24 billion, once again crushing analyst forecasts of around $22 billion for the period. The company believes that demand will keep outpacing supply all year long across an expanding range of industries.

The blockbuster report and outlook led to a nearly 10% pop in Nvidia’s stock in after-hours trading, adding to huge gains already made by shareholders. This morning, the price is jumped by 15% in the first minutes of stock trading action today.

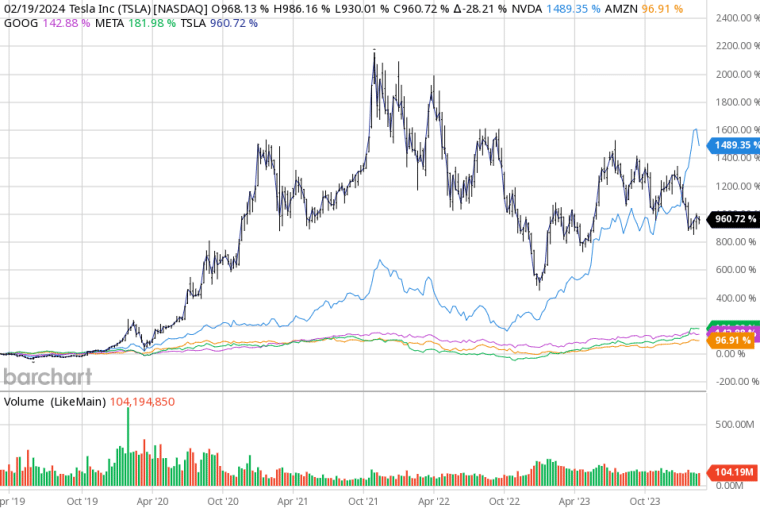

Despite the recent market turbulence, Nvidia’s shares have rocketed over 1,500% in the past five years on the back of the AI boom.

Without including today’s expected uptick, Nvidia’s market cap now stands at nearly $1.7 billion, making it more valuable than companies like Walmart, Johnson & Johnson, and Meta Platforms, all of which generate far more revenue than the latter. Nvidia is also nearly four times larger than Intel and AMD combined in terms of market cap.

Today’s price action made Nvidia’s market cap exceed that of both Alphabet (GOOG) and Amazon in terms of valuation. It’s now the 4th most valuable company in the world, behind Saudi Aramco by a about $100 billion. To put this in perspective a bit, Alphabet, Google’s parent company, brings in about 4 times the revenue of Nvidia each quarter. Amazon captures about 7 times more quarterly revenue than Nvidia too.

This soaring valuation and hype have led some analysts to warn of a bubble. However, quarters like this continue to show that AI is likely just beginning to transform the technology landscape. Of course, that’s what most analysts said at the height of the dotcom bubble too so you never know what’s going to happen.

However, Nvidia expects to roll out its next-generation AI chip later this year which could drive another massive upgrade cycle.

Bullish Analysts See Multiple Waves of Growth Ahead

While Nvidia has already seen astronomical growth in recent years, analysts believe that the company is still in the early stages of riding several AI waves that will drive continued expansion.

“Long term: The story is intact”, wrote the veteran tech investor Gene Munster in a post published on the social media X.

$NVDA stock is up 5% 10 mins after numbers came out.

There is the near term and the long term.

Near term: Stock is up because April revenue guidance was 9% higher than the Street inline ahead of the up 5% whisper number. They guided April revenue to 200% YoY growth, vs. the…

— Gene Munster (@munster_gene) February 21, 2024

“The business is powering along despite the headwind from China restrictions. The reason is we are still early in the first wave of the AI infrastructure wave, selling to hyper-scalers and AI startups.”, he further commented.

Munster sees the current demand from big cloud platforms as just the initial stage. Several other key markets are still ramping up AI adoption, including enterprises, automakers, healthcare systems, and governments. Each of these industries represents massive addressable markets for Nvidia’s chips over the next decade.

Meanwhile, the capabilities of AI itself are still evolving rapidly. Analysts see the recent explosion of generative AI as kicking off a second wave of infrastructure spending to power even larger language models. Nvidia’s new H100 chip and the next generations are designed specifically to train these models most efficiently.

CEO Jensen Huang told analysts this week that “fundamentally, the conditions are excellent for continued growth”.

With multiple waves driving upgrade cycles across various industries, analysts think that Nvidia has a long runway for expansion ahead. Its guidance already calls for sales to almost double again this year. Meanwhile, if supply constraints ease, some analysts think that $50 billion in quarterly revenue could be possible within just a couple of years.

For comparison, Nvidia’s sales were just $3 billion per quarter in Q1 2021. Next year, sales jumped to nearly $6 billion. The rapid acceleration since then shows why bullish analysts see Nvidia’s edge over its competitors only increasing in the AI chip race specifically.

Chinese Market Headwinds May Limit Nvidia’s Growth in the Asian Region

However, risks remain that could disrupt Nvidia’s momentum. The most pressing is China, where sales plunged last quarter due to some newly-introduced export restrictions. These restrictions were enforced by US authorities to limit China’s military use of AI chips.

Nvidia is working to configure specialized chips that meet the new export rules. However, if the restrictions keep tightening, analysts warn that they may hamper the company’s growth.

“China represented a mid-single digit percentage of our data center revenue in Q4. And we expect it to stay in a similar range in the first-quarter”, admitted Nvidia CFO Colette Kress during yesterday’s earnings conference.

Losing a large portion of sales from the world’s second largest economy would hurt results. It also gives rivals a chance to gain share in the region. Some analysts think that companies like Advanced Micro Devices (AMD) could benefit if China opts to buy more homegrown AI chips instead.

Still, Nvidia’s dominance in the most performance-demanding sectors like training giant AI models remains unmatched globally. Moreover, the firm claims to have made progress in reconfiguring products for the Chinese market.

“Although we have not received licenses from the U.S. government to ship restricted products to China, we have started shipping alternatives that don’t require a license for the China market”, Kress stressed.

If successful, China could become once again a growth driver rather than a headwind for Nvidia. However, geopolitical tensions continue to pose an ongoing risk for investors to monitor closely this year.