Founded in 2002, SpaceX is one of the largest privately-held companies in the world, reaching the “centicorn” status with a valuation in excess of $100 billion. Because the company is private, most people don’t even consider investing in it but it turns out that it may be easier than it seems. Is there a way you can buy shares of the unlisted company, and whether you should really invest? Let’s explore.

How to Invest in SpaceX

Naturally, you can’t just go to any trading platform or broker and submit an order to buy SpaceX shares. But there are still a few ways to invest in private companies. To begin with, investors can invest in unlisted and privately-held companies like SpaceX if they are “accredited investor.”

One could get classified as an accredited investor based on income (and wealth) criteria as well as measures of financial sophistication. According to the SEC, an individual should have (individually or with spouse/partner) a net worth of $1 million excluding their primary residence. Otherwise, the person should have an annual income of $200,000 individually or $300,000 with their spouse.

You could become an accredited investor by fulfilling professional criteria. According to the SEC, among others, “Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82),” qualify as accredited investors.

How to Invest in SpaceX?

Becoming an accredited investor is only a battle half won – or perhaps just the start – when it comes to SpaceX where the demand for shares seems to far outstrip the supply. The new supply comes intermittently mostly from current and former employees of SpaceX looking to sell their shares.

However, this information is not available to the public at large and is usually communicated informally through phone calls or online lists, so you’ll have to get started networking. If you are willing to put in the time and effort, you may be able to find a SpaceX employee (through LinkedIn, X, or another platform) willing to sell you their shares.

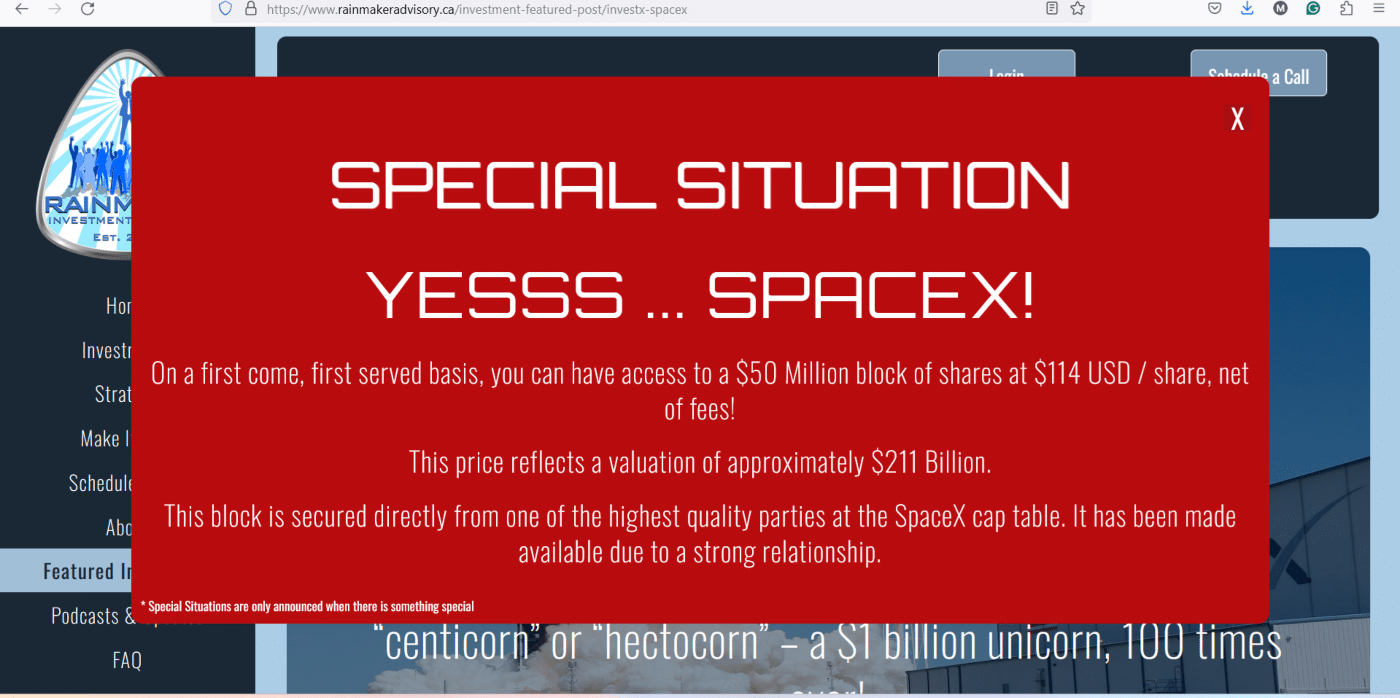

There are also investment firms that facilitate investment in SpaceX. Among them is Litquidity Syndicate which mailed investors about an opportunity to invest in SpaceX through a a special investment vehicle. According to the mail which was viewed by the Wall Street Journal, that investment vehicle was exposed to SpaceX through another investment vehicle. Rainmaker is another platform that is currently offering $50 million worth of SpaceX shares on its platform.

Costs of Investing in Unlisted Companies

Meanwhile, the transaction costs of investing in unlisted companies are significantly higher than their listed peers (especially for such high demand companies). Litquidity, for instance, would charge investors a 4% management fee in the first year. It also gets 5% of any future profits while another partner will get 20%.

As for Rainmaker, it is offering SpaceX shares at $114 each, including a massive premium compared to the most recent employee stock sale at $97. It would charge a 4.5% commission to be paid to the dealer which is built in operating expenses. Additionally, the fund would share 15% of the future profits on the investment.

There are also liquidity costs associated with investing in SpaceX as these funds typically don’t provide an early exit option and have long tenures. The target tenure for the Rainmaker fund is between three to five years.

Given the profit sharing that’s embedded in these funds, an investor would end up paying a hefty fee when the fund closes – assuming SpaceX shares trade at a higher price on exit.

Why Are SpaceX Shares So Popular Among Investors

Let’s now understand SpaceX and what makes it so popular among investors. The company has three lines of business which are; communication satellites, satellite launch business, and rocket travel & space exploration. The company’s communication satellite business is also a geopolitical force to reckon with as is illustrated by the Russia-Ukraine war.

The company was last valued at $180 billion in the official employee sale plan, but platforms offering shares now are offering them at a much higher price and the $114 asking price on Rainmaker implies a valuation of $211 billion.

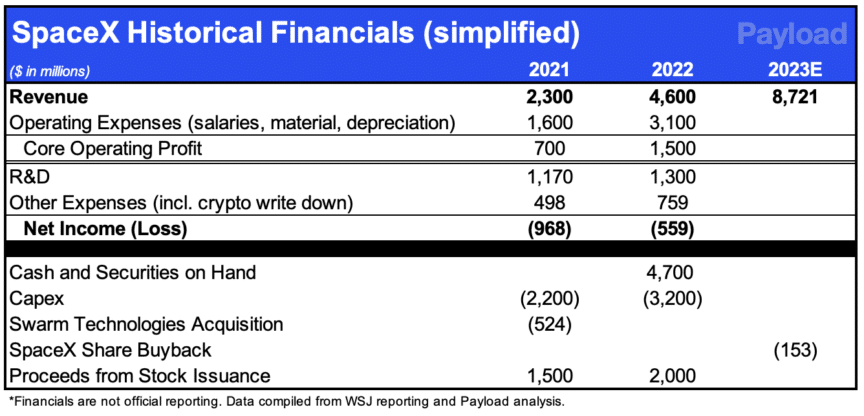

The company reported revenues of $4.6 billion in 2022 which was twice of 2021. It posted a net loss of $559 million in 2022 which was narrower than the $968 million loss in 2021. According to the Wall Street Journal, SpaceX posted a profit of $55 million in Q1 2023 on revenues of $1.5 billion.

Elon Musk Has Multiple Commitments

While SpaceX seems quite promising in many ways, some investors worry that Musk simply doesn’t have enough time to dedicate to the company to see it through.

Meanwhile, Musk is now leading Tesla, SpaceX, Neuralink, The Boring Company, X.ai (the latest AI startup), and also X (formerly Twitter) all at once. Three of these – Tesla, X, and SpaceX – are multi-billion-dollar companies that require a significant time commitment from Musk.

A Delaware judge struck down Musk’s 2018 Tesla compensation plan, worth $56 billion, because it didn’t ask for more of Musk’s time among other reasons. At the same time, Musk has become quite the polarizing figure, and in a recent investment offering, SpaceX noted, “Mr. Musk has become an increasingly public personality and makes public statements regularly, with many of those statements causing controversy.”

Musk has always been a controversial figure, partially because he tends to speak his mind on various issues often without considering the consequences. His association with his many companies (including SpaceX) has always been a net positive, at least until recently.

However, of late there are concerns that Musk’s antics are hurting Tesla (and X) and are turning off some potential car buyers, specifically those on the left of the political divide.

Is SpaceX a Good Investment?

Tesla went public at a split-adjusted price of $1.13 in 2010 and now trades at above $175 making it one of the most successful IPOs of all time. Given the stellar returns that Tesla has delivered since going public, some investors see his other companies following similar trajectories.

However, SpaceX’s valuation has grown dramatically even though it still hasn’t gone public yet. Importantly, the company’s valuation continued to rise even during the funding winter of 2022-2023 when many startups suffered painful down rounds.

Perhaps SpaceX’s greatest feature is that it is a leader in two industries that are expected to grow tremendously in the coming years and decades: rocket launch and satellite internet. As Morgan Stanley analyst and noted Tesla bull Adam Jonas said in 2021, SpaceX is “challenging any preconceived notion of what was possible and the time frame possible, in terms of rockets, launch vehicles and supporting infrastructure.”

He went on to add, “More than one client has told us if Elon Musk where to become the first Trillionaire…it won’t be because of Tesla. Others have said SpaceX may eventually be the most highly valued company in the world – in any industry.”

Generally, it has been risky to bet against Musk as is highlighted by the billions of dollars that short sellers have lost on their Tesla positions. When it comes to SpaceX though, it comes with an increased risk of being a private company whose recent financials and by its extension valuations are not publicly available.

Tesla’s Valuations Have Also Plummeted

At a $200 billion valuation though, SpaceX does not look very cheap. This valuation implies a 2023 price-to-sales multiple of almost 23x, based on estimated 2023 sales of $8.72 billion. This isn’t unheard of with startups in high growth industries but it’s still something to consider.

Even Tesla’s market cap has fallen by half after peaking in late 2021 as markets are wary of giving the EV giant the premium valuations that it has historically enjoyed. While SpaceX does not face the kind of price war that Tesla has faced for years, investing in the company comes with its own set of risks even as the company looks on a strong growth path with revenues almost doubling every year.