For the first time in three years, Keith Gill, the popular retail investor and Reddit hero, known in online circles as Roaring Kitty or DeepFuc*ingValue, showed his face to an audience of thousands in a highly anticipated livestream. Many fans hoped that the livestream would be the beginning of an exciting campaign to reinvigorate excitement around the meme stocks GameStop ($GME) and AMC ($AMC).

The event had been announced days in advance and the anticipation pushed the price of GME stock up nearly 50%. Fans and investors rallied behind their leader, expecting him to make sense of the reasoning behind his 9 figure bet on the struggling video game retailer.

However, the result was perhaps the opposite of what investors expected as the stock sank shortly after the live stream ended as Gill failed to provide a reasonable explanation for why he is backing GameStop except for statements concerning the company’s Chief Executive Officer, Ryan Cohen, who Gill believes is a crucial piece of the puzzle and possibly the centerpiece of his investment thesis.

You can still watch the entire livestream on YouTube if you want to learn more:

Rallying the Troops – Gill Discloses $300M Position on GME Days Before Livestream

For weeks, the financial communities on social media platforms like X (formerly Twitter) and Reddit were shocked by the reappearance of Gill. He had been radio silent for three years after leading the controversial meme stock craze of early 2021 that ended up with him seating in a Congress hearing, explaining his involvement and actions to lawmakers.

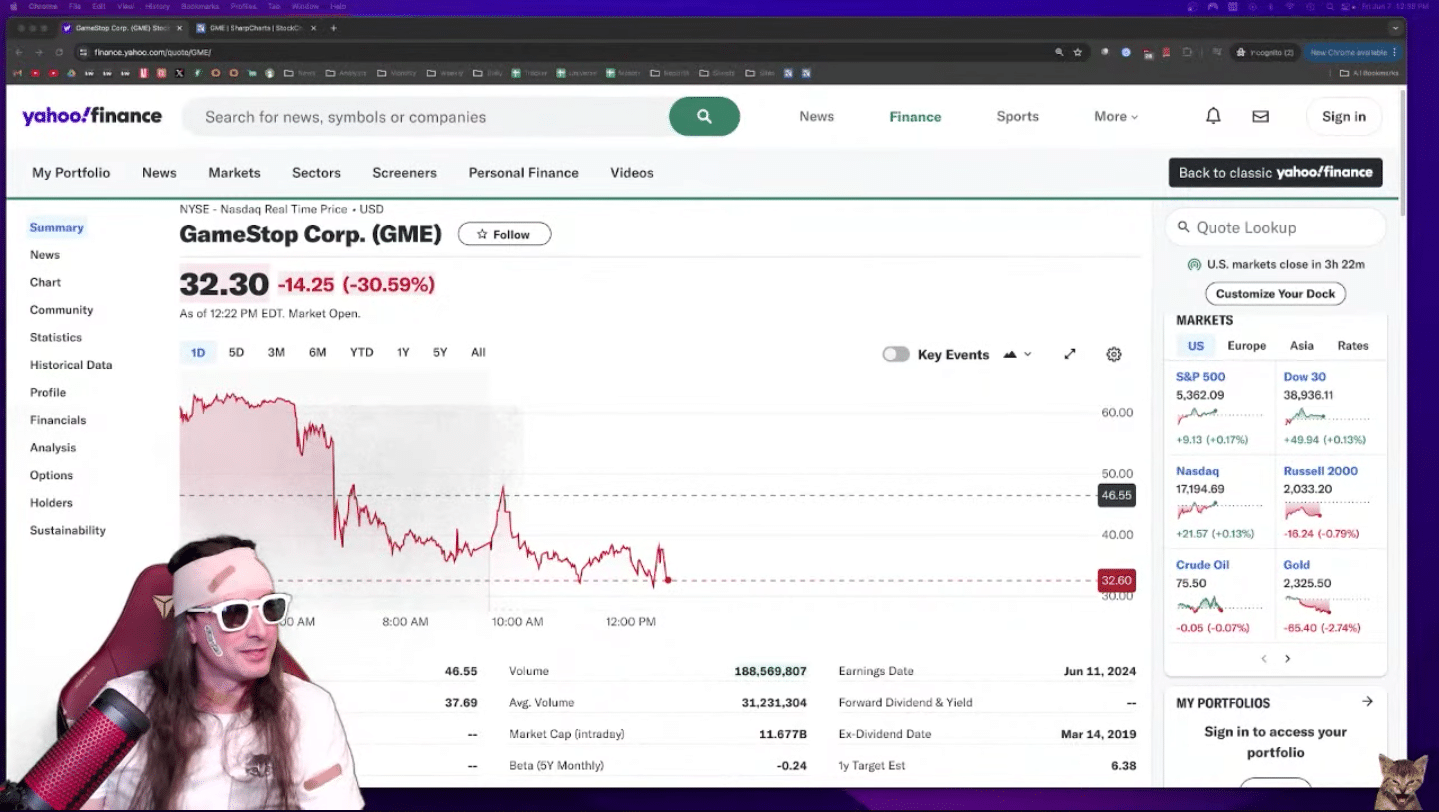

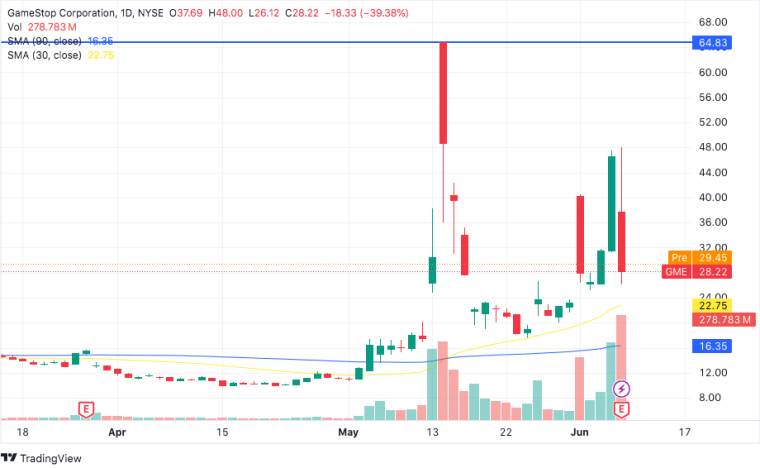

On Thursday, when Gill announced that he was holding a livestream, he sparked a significant jump in the price of GME stock, which surged by over 47% during that session, reaching a session high of $47.5 per share and then ultimately settling at $46.6 apiece.

The appointment came just days after Gill revealed a sizable position in GME stock that included 5 million common shares and 120,000 options contracts that would entitle Roaring Kitty to another 12 million shares if these were exercised. The options contracts had a strike price of $20 and expired on 21 June – just eleven days from now.

The price of GME shares was, of course, propelled by this disclosure. The subsequent move ended up pushing Gill’s option position into in-the-money territory. Estimates back then resulted in unrealized gains of around $260 million on the options position alone if he had cashed out at that time.

The stage seemed perfectly set for Gill’s triumphant return. Just hours before his livestream, GameStop unexpectedly released its first-quarter earnings report, revealing a 29% decline in sales and plans to sell up to 75 million additional shares.

The company’s dismal performance and dilutive share offering unsurprisingly spooked investors, setting the scene for Gill to potentially reinvigorate confidence in GameStop’s long-awaited turnaround.

A Head-Scratching Appearance Causes GameStop Stock Price to Tank

Since the moment Gill went live on YouTube on Friday, it was obvious that this livestream would be anything but conventional. The former employee of Mass Mutual and popular Reddit character wore a headband, a sling, and sunglasses – pretty much his regular outfit and similar to what he wore back in 2021 when he first rose to popularity.

“You post a couple of memes, you post a couple of screenshots, and everyone loses their minds,” he joked.

Gill was upfront in saying that he had “no real gameplan” in regard to the livestream and clarified that there was no lawyer present during the event.

During the next 50 minutes or so, Gill reiterated his long-standing belief in GameStop’s ability to transform its business under the leadership of CEO Ryan Cohen but offered little to no evidence regarding how he thought the company could pull this off.

Ultimately, Gill stated that he is betting on Cohen more than anything. “I believe this guy,” Gill stressed.

“It’s kind of based on feeling,” he told investors outright, leaving no doubt that there is essentially no objective foundation that justifies why he is investing in GameStop apart from a hunch.

Gill’s YouTube livestream was reportedly being viewed by over 600,000 people at one point.

GME Drops Precipitously Following Gill’s Livestream

As Gill’s bizarre livestream unfolded, the price of GME stock price became even more volatile than usual, triggering multiple trading halts due to its erratic pace. By the end of the session, shares of the videogame company had plummeted by nearly 40% to $28.22 – marking the worst day for GME since February 2021.

The steep sell-off erased nearly $100 million from the value of Gill’s stock position. Meanwhile, his options contracts, which were worth almost $600 million by the end of Thursday, lost over $220 million of their unrealized value. Moreover, if Gill moves to take custody of the 12 million common shares that his options entitle him to receive, he would have to pledge nearly $240 million.

This gargantuan commitment may test the limits of Gill’s conviction in his GME position as he would end up holding 17 million common shares in the videogame retailer. The selling pressure that could result from him dumping those kinds of volume on the market would likely immediately push the price down.

Although Gill’s influence on a growing audience of retail investors is undeniable, his remarks seem to have backfired, at least for now, as thousands appear to have lost their faith in the future of GME following his livestream.

Does Roaring Kitty Faces Any Regulatory or Legal Risks?

Gill’s actions in the past couple of months have raised eyebrows among industry professionals. Regulators in the state of Massachusetts recently confirmed that they opened an investigation concerning his involvement with these meme stocks that could result in the beginning of a legal proceeding against him.

Meanwhile, although the United States Securities and Exchange Commission (SEC) has not made any comments on this latest chapter of the GME saga, the whole situation has probably invited some degree of scrutiny.

“You can’t trade and tweet. You just can’t,” said Lisa Bragança, a former SEC branch chief. “You are just inviting an investigation.”

Also read: What is the Next Gamestop Stock? Top 10 Contenders

While posting content supporting a certain stock is not illegal per se, lawyers say that Gill’s actions could be interpreted as deliberate attempts to inflate the price of GME stock by leveraging his large following to benefit his own interest. This could be a breach of securities laws and their provisions against market manipulation, though it’s hard to imagine that he would ever be prosecuted for it. Institutional investors, financial personalities, and hedge fund managers do this kind of thing on CNBC and other platforms all the time.

“Was his purpose to influence the movement of stock price? Did he, in fact, affect demand for the stock? Will he profit from these activities?”, asked Richard Schulman, a partner at law firm Adler & Stachenfeld. “These are the kinds of issues a regulator will want to investigate.”

Gill Has to Inform the Public if He Dumps His Position

Gill’s legal issues could escalate significantly if he chooses to either exercise his options or sell his GME stock. According to Bragança, securities regulations may require the influencer to provide his followers with an advance warning of any changes to his investment portfolio – even if such a disclosure undermines his potential profits.

“The problem is when you change your position,” Bragança explained. “Before you sell, you’d better tell the marketplace. Most people on social media don’t think that way. The initial posts are not the thing that is going to get him in trouble – it’s the stuff we can’t see.”

Although Gill’s comments seem to be no different than those made by individuals who use platforms like CNBC or Yahoo Finance to discuss a specific financial instrument, its prospect, and performance, financial regulators will scrutinize if appropriate disclosures were provided to his audience to protect them from market manipulation.

“Market manipulation is not necessarily a rigid concept,” Schulman highlighted. “The SEC is not unused to trying to apply concepts to new situations in the world that has developed.”