US stocks crashed yesterday and had their worst day since 2022 amid the global market meltdown. Trading volumes invariably go up on such days as while a section of investors panics and exits positions, bargain hunters scout for opportunities. Algo trading also spikes up during periods of high volatility as many trades get triggered.

While yesterday’s stock market sell-off – which lifted the VIX volatility index to the highest level since 2020 intraday – was concerning for long investors, it got too hot to handle for some brokerages like Fidelity and several users complained of facing glitches.

Why Did the US Stock Markets Crash on Monday?

To be sure, more than one factor contributed to the crash in US stock markets yesterday. Last week, the Japanese central bank raised its benchmark rates which is expected to put a lid on the popular yen carry trade. Simply put, in a carry trade traders borrow in the currency of a country with low interest rates and invest in greener pastures.

Japan has among the lowest interest rates globally and it is only the second rate hike in the country since 2007. Even now, benchmark rates in Japan are “around 0.25%” from the previous range of 0% to 0.1%.

The sharp rise in the JPY/USD is causing a massive unwind of Yen carry trade positions and contributing to the sharp decline in US stocks. For those who do not understand how this works, a brief explanation

1) Many traders were borrowing Jap Yen (JPY) at low interest rates,… pic.twitter.com/sfi0Hva56M

— Adam Khoo (@adamkhootrader) August 5, 2024

Along with fears over the unwinding of the yen carry trade, concerns over the US economy were ignited after the unemployment rate rose to 4.3% in July. The escalating tensions in the Middle East are not helping matters either and adding to the risk-off sentiments in markets.

Q2 tech earnings have also failed to impress and given the sharp rally in these names over the last few quarters, investors are now wary of their high valuations, especially in light of tepid earnings.

Finally, with Warren Buffett – arguably among the best investors of all time – raising Berkshire Hathaway’s cash pile to a record $277 billion, fears of stock markets getting overvalued have further ignited.

The sell-off wasn’t limited to US markets though and all major stock markets fell globally on Monday. Trading volumes surged yesterday and some brokerages could not keep up with the trading frenzy.

Brokerages Faced Temporary Disruptions on Monday

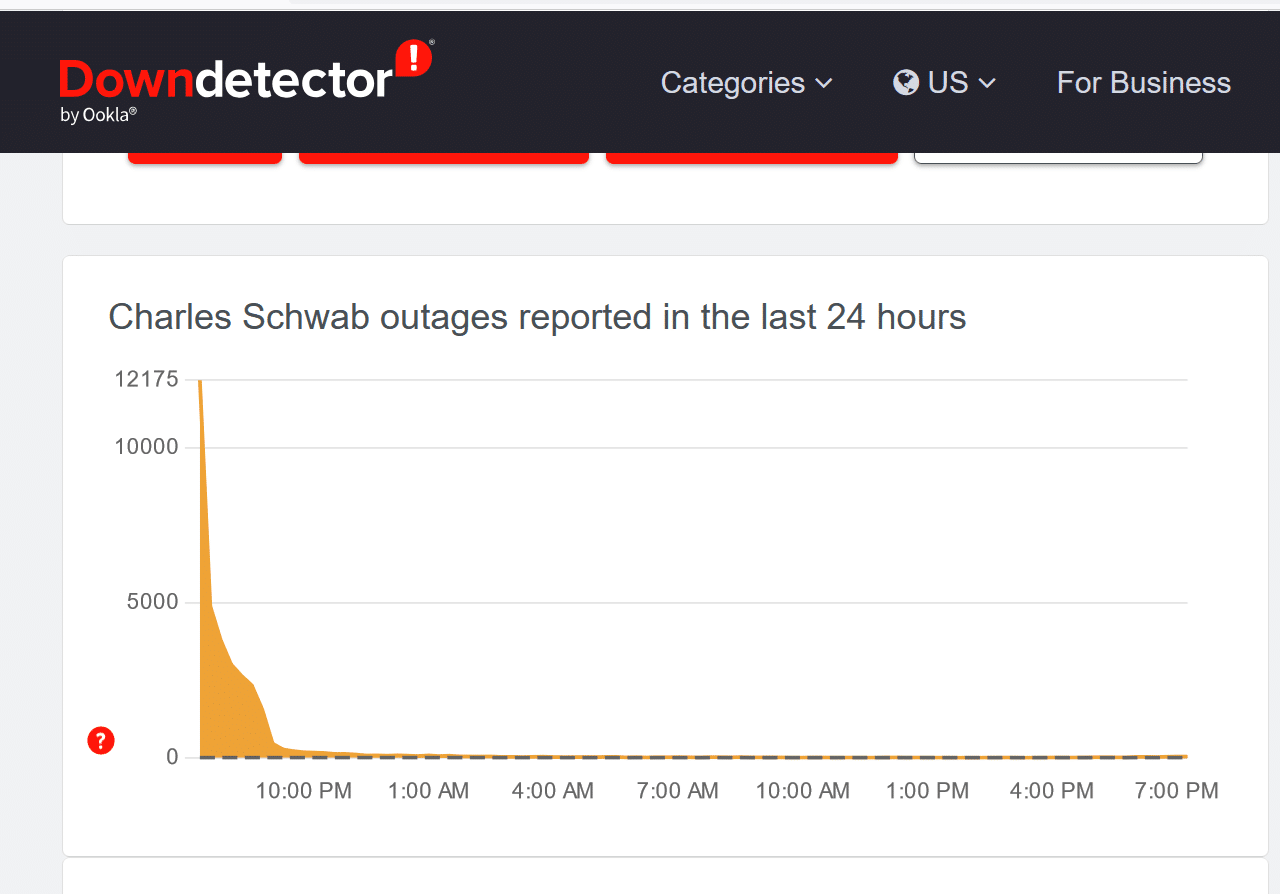

The last thing that any trader would want on a day like Monday is to have their broker go down. That’s exactly what happened with thousands of Charles Schwab and Fidelity Investments users who were not able to log into their accounts.

Even Vanguard faced a temporary glitch while Robinhood briefly paused overnight trading. According to Downdetector, there was a spike in glitches for brokerages like TD Ameritrade and E-trade also.

Many traders vented their ire at these companies online as they were not able to trade due to the glitches.

As Jason Britton, president and chief investment officer at Reflection Asset Management best summed up “What’s scaring people more than the fact that the market is selling off is that Fidelity’s and Schwab’s trading platforms crashed today.” He added, “Those are the things that cause real panic – when people can’t see what their portfolios are doing.”

Meanwhile, the issues seem to have been sorted now and there are no major reports of glitches with these brokers according to Downdetector.

What Caused the Glitch at Multiple Brokerages?

So far, we don’t know much about what caused the outage and Charles Schwab termed it a “technical issue.” With the sudden rise in trading volumes such issues can arise at times but what’s alarming is that it occurred with multiple brokers. Notably, all the brokers who were impacted are reputable firms that are expected to have the infrastructure to handle a sudden increase in volumes.

These brokerage firms are reporting errors for retail investors while institution investors are able to make trades.

That’s too many platforms to be a coincidence.

Controlled to stop panic selling in order to prevent a crash.

Go ahead, call me a conspiracy theorist, I could… pic.twitter.com/wyPfuUF7Xs

— Rep. Marjorie Taylor Greene🇺🇸 (@RepMTG) August 5, 2024

Conspiracy theorists also had a field day with Rep. Marjorie Taylor Green suggesting that it was a deliberate ploy to stop the selling. “Go ahead, call me a conspiracy theorist, I could care less,” tweeted the Republican lawmaker.

Many other users also tweeted that the outage was intentional and meant to ensure that big investors exited before the retail investors. While there is no evidence to suggest that brokerages connived to let institutional investors exit ahead of retail investors, it would have been a very bad ploy as US stock markets eventually recovered from their early morning lows.

Naturally, the most likely explanation for the outages is that these apps and websites got overloaded by a massive amount of traffic from users trying to check their positions.

Meanwhile, for investors, there is nothing much they can do with such “technical glitches.” One practical solution is to have accounts with more than one company so that one is not locked out of markets due to problems with one broker.

What’s the Outlook for US Stock Markets?

Analysts are advising caution after the sell-off in US stock markets. According to Morningstar DBRS the stock market sell-off could become a “self-fulfilling prophecy” and push the US economy into a recession.

“Our biggest concern is that the market sell-off becomes a self-fulfilling prophecy causing corporate CEOs to cut back on investments and consumers to pull back on spending leading to further cuts and a recession,” it said in its report.

Evercore ISI Chairman Ed Hyman also used the “R” word in his remarks and said, “With the soft employment report, the NASDAQ correction, the plunge in bond yields, and the plunge in commodity prices, it’s possible we’re seeing recession signals coming home to roost.”

Yardeni Research president Ed Yardeni meanwhile believes that the US economy is doing fine and stock markets will stabilize once the yen carry trade unwinds.

Raymond James’ chief investment officer Larry Adam sees the dip as an opportunity to buy tech stocks. Adam believes that the stock market bull market is only about 18 months old while the average bull market lasts for around 5.5 years. He is particularly bullish on tech stocks and stressed their valuations now appear attractive after the crash.

US stock markets however continue to be jittery today and are slightly in the green as investors seem to be cautious about buying the dip fearing more downside ahead.