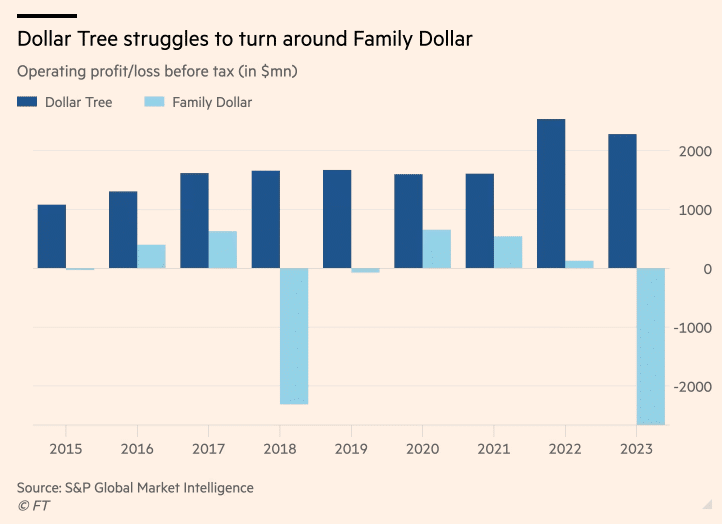

The once-booming dollar store industry is facing turbulent times as high inflation, stagnant consumer spending, and increased competition keep pressuring major players like Dollar General, Dollar Tree, and Family Dollar.

Recent announcements from these companies have shed light on the challenges confronting the discount retail sector.

Key Takeaways: Dollar Store Industry Challenges in 2024

- Store Closures at Dollar Tree: Dollar Tree plans to close nearly 1,000 Family Dollar stores and 30 Dollar Tree locations by 2025, a response to inflation and reduced government benefits impacting low-income customers.

- Family Dollar Struggles: Mismanagement, poor store conditions, and a recent $41.6 million fine for rat infestations have hampered Family Dollar, leading to deteriorating consumer trust and store closures.

- Dollar General Expansion: While Dollar Tree struggles, Dollar General continues its aggressive expansion, planning to open 800 new stores in 2024, leveraging its dominance in rural areas where competition is minimal.

- Inflation and Shrinkflation: Rising product costs have pressured dollar stores to downsize product sizes without reducing prices, a tactic known as “shrinkflation,” which has affected consumer trust and squeezed profit margins.

- Changing Consumer Behavior: Inflation has shifted consumers towards online retailers like Amazon and Temu, while competition from discount offerings at Walmart and Target further impacts dollar stores’ sales.

- Industry Outlook: Despite challenges, the dollar store sector is expected to grow to $83.1 billion in revenue by 2027, but future success may be uneven, with Dollar General better positioned to capitalize on growth than Family Dollar.

Store Closures and Strategic Shifts at Dollar Tree

In a move that stunned the industry, Dollar Tree announced plans to shutter nearly 1,000 Family Dollar stores by early 2025. The closures, comprising approximately 600 stores this year and 370 more over the next few years as leases expire, represent a significant downsizing for the struggling chain. An additional 30 Dollar Tree-branded stores will also be closed.

Also read: How Hackers Stole $50,000 of Yoghurt – Cargo Theft Skyrockets to $130M in 2023

Rick Dreiling, CEO of Dollar Tree, cited “persistent inflation and reduced government benefits” as major factors impacting the company’s lower-income customer base, which comprises a sizable portion of Family Dollar’s clientele.

Moreover, the reduction in Supplemental Nutrition Assistance Program (SNAP) benefits has left many struggling families with less than $250 per month to spend.

Mismanagement and Poor Conditions Hamper Family Dollar

Family Dollar has grappled with years of mismanagement and poor store conditions, which have tarnished the brand’s reputation. The company was recently fined a record $41.6 million for a rat infestation at a warehouse that forced hundreds of stores to temporarily close.

“Family Dollar stores were in worse condition than Dollar Tree expected when it acquired the business”, analysts surveyed by CNN highlighted. “Even though Family Dollar has renovated thousands of stores in recent years, many stores are still poorly maintained.

Stores are often understaffed, and boxes block aisles.” Low staffing costs are a major factor that help make dollar stores so profitable but there are clear downsides to the practice.

The closures are expected to improve Dollar Tree’s profitability but will leave a void for Americans with limited shopping choices as Family Dollar stores are often located in areas with few supermarkets, big-box stores, and other retail options.

Dollar General Forges Ahead with Expansion Plans

While Family Dollar reels, its rival Dollar General has continued its aggressive expansion strategy, announcing plans to open 800 new stores this year, bringing its total to nearly 21,000 locations across the United States.

Dollar General’s success can be attributed, in part, to its focus on rural areas where it faces minimal competition. The company’s real estate occupancy costs are nearly a third lower than Family Dollar’s, giving it a significant competitive advantage.

Dollar General operates predominantly in rural areas where they usually face little (and sometimes 0) competition, emphasized Mark Sigal, CEO of Datex Property Solutions. Family Dollar, by contrast, is concentrated in more expensive urban and suburban areas, where a variety of discounters compete for market share.

Dollar stores work best in tiny towns that are too small for a full grocery store. They replaced the general stores of decades prior, forcing residents to get most of their regular supplies from the dollar store. If you’re interested in how these stores took over America, check out Wendover Production’s brilliant mini-documentary on the subject.

Inflation and Shrinkflation Squeeze Profit Margins

One of the most significant challenges facing dollar stores is the impact of inflation on their profit margins. As product costs have risen, these retailers have been forced to either raise prices or engage in “shrinkflation” – downsizing products while keeping prices the same or higher.

Reports have indicated that dollar stores have become some of the worst offenders of shrinkflation, even more so than grocery chains. This is particularly bad because of the monopolies that dollar stores have over thousands of small rural towns across the US.

Brian Numainville, principal of retail consulting firm The Feedback Group, explained: “Instead of raising prices and alienating customers, these retailers opt to cut the size of their products while keeping the prices the same. This allows dollar stores to create the illusion of a good deal while keeping their profit margins wide.”

Meanwhile, consumer advocate Bill Wilson noted that “at least three out of four Americans are concerned with shrinkflation, but many dollar store shoppers are locked into their go-to place for groceries because there are no other options.”

Changing Consumer Behavior and Competition is Hurting Dollar Stores

Inflation has not only impacted dollar stores’ costs but has also altered consumer behavior, with some shoppers shifting to online retailers like Amazon (AMZN) and the rapidly growing Chinese e-commerce platform Temu for bargain prices.

“When you’re a dollar store, the problem is the necessities have lower margins than the discretionary purchases where you might be able to make up some of the money,” said Jerry Storch, CEO of Storch Advisors told Fox News. “But if they’re not buying discretionary goods, then your margin as a whole is lower, so that’s one of the reasons their profitability is getting squeezed.”

Additionally, dollar stores face increased competition from larger retailers like Walmart and Target, both of which have expanded their discount offerings to capture a share of the budget-conscious consumer market.

Another factor weighing on dollar stores’ profitability is the issue of shrink or inventory loss due to theft and shoplifting. Dollar Tree cited “elevated shrink” as a factor contributing to its decline in gross profit margins.

Retail security expert Matt Kelley warned that shrink at dollar stores goes beyond just profitability concerns.

“Oftentimes those dollar stores might only have one or two people in the building, so they’ve got limited resources by way of being able to staff those stores”, Kelley commented.

“So just that alone is a safety concern, and when you think about shrink and theft and the things that are happening across the US, and maybe globally, the bad actors that are stealing from these places are becoming more and more brazen in their attempt to take things that they haven’t paid for, and oftentimes those can get violent.”

Each time shoplifters get away with stealing with no consequences, it only eggs them on further, worsening the problem exponentially.

Government Response and Industry Outlook

Recognizing the impact of shrinkflation on consumers, the government has taken steps to address the issue. In February, Sen. Bob Casey (D-Pa.) introduced the Shrinkflation Prevention Act to “crack down on corporations that deceive consumers by selling smaller sizes of their products without lowering the prices.”

President Joe Biden has also criticized the practice, calling on companies to “put a stop to this” and accusing them of “trying to pull a fast one by shrinking the products little-by-little and hoping you won’t notice.”

Also read: Top 10 Food Companies in the World by Market Capitalization

Despite these challenges, the dollar store industry is expected to reach a combined $83.1 billion in annual revenues by 2027, nearly a 26% increase from 2022, according to estimates by S&P Global Market Intelligence.

However, the sector’s future growth may be uneven, with companies like Dollar General better positioned to capitalize on the demand for budget-friendly merchandise, while others, like Family Dollar, struggle to overcome operational and reputational hurdles.

Dollar stores will need to adapt their strategies to navigate inflationary pressures, changing consumer preferences, and intensifying competition while addressing concerns over shrinkflation and shrink-related issues.