During its three-day D23 Expo, Disney announced some very exciting expansions to its theme parks. While the segment has been a money spinner for Disney, its lackluster performance in the most recent quarter spooked investors and the stock fell despite better-than-expected earnings for the fiscal third quarter of 2024. Here are the key announcements from the event and how they could impact the theme parks and the stock.

Notably, Disney previously committed to invest $60 billion into its parks over the next 10 years after heaps of customer complaints of long wait times and poor experiences. The planned expansions would help improve the appeal of Disney’s theme parks among visitors.

Disney Announces Expansions to Its Parks

Among the major announcements is the addition of a new villain land in Magic Kingdom, in Orlando, Florida. “Since the beginning, our Disney Villains have given us endless possibilities to tell new stories,” said Josh D’Amaro, chairman of Disney’s Experiences segment. He added, “In this new land, you’ll see storytelling on a grand scale that only Disney can deliver.”

Disney is also adding a new section of Frontierland inspired by the popular Cars franchise at the park. In its release, Disney said, “guests will leave Radiator Springs behind and head off into the wilderness with two new Cars attractions — one that will be an off-road thrilling rally race, and a family-friendly attraction that even the youngest racers will love.”

The company would double the size of the Avengers Campus in Disney’s California Adventure and add two new attractions based on the Marvel and Avatar movie franchises there.

In its prepared remarks, Disney termed the expansions as “unprecedented” and stressed Walt Disney’s comments at the opening of Disneyland on July 17, 1955 – “Disneyland will never be completed. It will continue to grow as long as there is imagination left in the world.”

Key Updates From the D23 Expo

The D23 Expo announcements are the most extensive updates that Disney has provided about the planned expansions and improvements to its theme parks. While the company teased some additions to its parks at the last D23 Expo in 2022 they were still in their infancy. However, the plans have made some progress now.

D’Amaro said, “Everything we’re going to share with you tonight is an active development.” He added, “I just want to be clear to all the fans out there: This isn’t blue sky,” – which means that the projects have moved beyond the initial conceptualization stage and would come to fruition.

While the company did not provide any timeline for the projects, it said, “Work is well under way on all of the new projects we announced, and fans will start to see them come to life in the near future.”

Disney Parks Are a Key Driver of Its Profits

Parks are part of Disney’s Experiences segment which also includes cruises and videogames. In the fiscal year 2023, the segment’s revenues rose 16% YoY to $32.54 billion and it accounted for 36.6% of Disney’s revenues. But that doesn’t tell the whole story. The segment is a cash cow for Disney and its contribution to the company’s operating income was 69% – or almost twice that of the revenue contribution.

Meanwhile, in the fiscal third quarter of 2024 which ended in June, the Experiences segment’s revenues rose a mere 2%. While the company’s combined streaming segment turned profitable in the quarter – which is no small achievement considering the fact that it lost a whopping $1.47 billion in the final quarter of fiscal year 2022 – Disney shares closed in the red following the fiscal Q3 earnings release earlier this month.

Disney spooked markets with its commentary on the Experiences segment and said, “we expect that the demand moderation we saw in our domestic businesses in Q3 could impact the next few quarters.”

Disney Earnings Call DISASTER! Stock DROPS when CEO reveals parks in TROUBLE!https://t.co/PT4rAbdhu9 pic.twitter.com/hCpkAkM3yE

— Flash (@YellowFlashGuy) August 7, 2024

Disney Sounded an Alarm Over Its Parks Segment During Q3 Call

The company added, “While we are actively monitoring attendance and guest spending and aggressively managing our cost base, we expect Q4 Experiences segment operating income to decline by mid-single digits versus the prior year, reflecting these underlying dynamics as well as impacts at Disneyland Paris from a reduction in normal consumer travel due to the Olympics, and some cyclical softening in China.”

Disney CFO Hugh Johnston said that while the lower-income consumer was feeling stress due to high inflation and macro slowdown, high-income customers are currently preferring to travel outside the US which is hurting its Parks segment.

He tried to downplay the downturn in the profitable segment though and stressed, “I don’t think I’d refer to it as protracted but just a couple of quarters of likely similar results.”

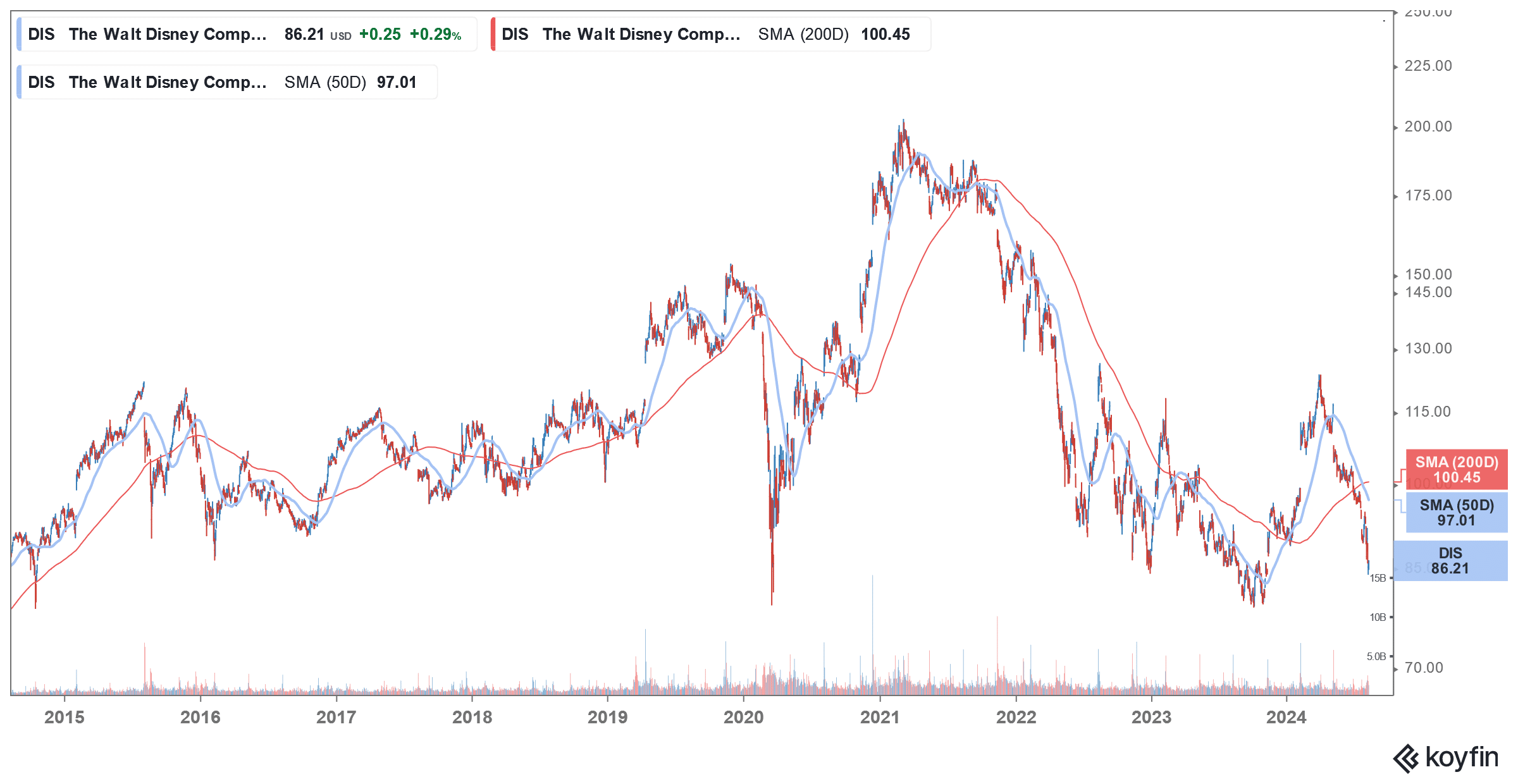

DIS Stock Has Underperformed

Meanwhile, it was quite natural for markets to punish DIS stock for the tepid performance of its Parks segment. While Disney’s streaming business is growing at a brisk pace and the company is optimistic about that business eventually hitting double-digit margins, for now, the Parks segment is the biggest earnings driver for Disney – especially as the Linear TV business continues to be in a structural downtrend.

Notably, Disney stock has been a long-term underperformer, and last year it fell to the lowest level since 2014. Also, the stock is in the red this year even as the S&P 500 Index is up in double digits.

With the new additions to its theme parks, Disney is trying to maintain its moat and competitive advantage in the lucrative business. The company is among the most popular and iconic brands globally and has something to offer to practically every age group.

Morgan Stanley Maintained DIS Stock as Overweight

Meanwhile, after Disney’s announcements of expansion to its theme parks, Morgan Stanley reiterated the stock as an “overweight.”

In its note, the brokerage that recommends buying Disney stock said, “We view Experiences expansion as notable given its long history of high and rising ROIC… Last Fall, Disney revealed plans to double capex in its Experiential assets over the next decade. We now see its plans for both US parks and its cruise fleet.”

DIS stock is trading flat today in line with the broader markets. The company brought back old-timer Bob Iger to head the company in late 2022, but the stock has failed to generate much return for investors so far despite short bouts of uptrend – including one earlier this year. The D23 announcements are among the series of steps that Disney is taking to transform the company and restore the “magic” but they are yet to have a lasting impact on its sagging stock price.