Zhongzhi Enterprise Group, one of China’s largest financial services conglomerates, announced this week that it is facing severe insolvency, with total liabilities of up to $64 billion that more than double its assets.

This development has sent shockwaves through the global economy and sparked fears of financial contagion, given Zhongzhi’s substantial ties to China’s already floundering real estate sector.

In a letter to investors dated November 23rd, Zhongzhi expressed regret and clearly stated that its liabilities are between $58 and $64 billion, while its assets are about $27 billion. The large gap in its balance sheet raises serious concerns about Zhongzhi’s ability to fulfill its financial commitments and maintain regular operations.

As a major player in China’s $3 trillion shadow banking industry, Zhongzhi’s worsening situation is likely to reignite worries about the spillover effect from the ongoing property debt crisis into the broader Chinese and global financial system. Shadow banks in China often provide alternative lending and operate outside mainstream regulations, directing investors’ funds into real estate and other sectors.

Signs of Zhongzhi’s troubles first emerged in July this year, when its subsidiary Zhongrong International Trust missed payments on dozens of high-yield investment products. Zhongrong Trust managed over $100 billion in assets and was deeply intertwined with property developers.

In the November 23rd letter, Zhongzhi admitted that “the group is seriously insolvent and has significant continuing operational risks.” It went on to say: “The resources available for debt repayment in the short term are much lower than the group’s overall debt scale”

Zhongzhi’s Vast Interests May Dampen China’s Economic Growth

Zhongzhi holds ownership stakes in listed companies and its business empire spans a wide range of sectors, including mining, chipmaking, finance, insurance, and more. However, the firm acknowledged that its assets are largely illiquid, long-term investments concentrated in real estate. Attempts to raise emergency funding through asset sales, audits, and potential strategic investors have apparently failed.

Analysts warn that Zhongzhi’s insolvency could have ripple effects, further weakening confidence in China’s property sector which has already seen multiple developer defaults. While the government may step in to contain the fallout, the situation spotlights the underlying risks, lax oversight, and poor transparency plaguing parts of China’s financial system.

Zhongzhi’s woes may spread to the global economy if domestic instability leads to additional declines in the country’s economic growth. As the world’s second largest economy, financial turmoil and slowing demand from Chinese consumers and businesses could dampen global markets.

With Zhongzhi teetering on the brink, investors are anxiously monitoring authorities’ response for signs of a Lehman-style systemic crisis or whether the deterioration can be contained.

“Financial regulators are almost certain to intervene aggressively if there’s any sign that Zhongzhi’s troubles are spreading”, commented Christopher Beddor, from Gavekal Dragonomics.

However, he warned that authorities may not be willing to protect investors from their losses entirely.

“Officials could certainly make retail investors whole if they want to, but they’d basically be turning their backs on years of attempts to undermine implicit guarantees. I suspect they won’t.”, Beddor highlighted.

Regardless, insolvency at such a large conglomerate strongly indicates just how severely China’s real estate downturn is impairing its financial industry. For a heavily indebted sector already battered by sluggish sales, frozen projects, and jittery buyers, Zhongzhi’s unraveling delivers yet another shock.

Going forward, this situation will increase focus on the opacity of China’s financial system and intensify calls for greater transparency. It may also spur its risk-averse government to take a more proactive approach toward stabilizing the market. However, firmly reversing the downturn will prove challenging given how deeply problems are rooted.

For now, the news of Zhongzhi’s insolvency casts further gloom over China’s bleak economic picture. With a major company crumbling under $64 billion in unpaid debts, it serves as an alarming reminder that the cascading fallout from the property crisis continues to unfold.

Background on Zhongzhi and China’s Property Market Crisis

Zhongzhi Enterprise Group is a private Chinese conglomerate with a sprawling business empire spanning financial services, mining, electric vehicles, healthcare, and more. Headquartered in Beijing, it grew rapidly from its founding in the 1990s into one of China’s largest financial services providers.

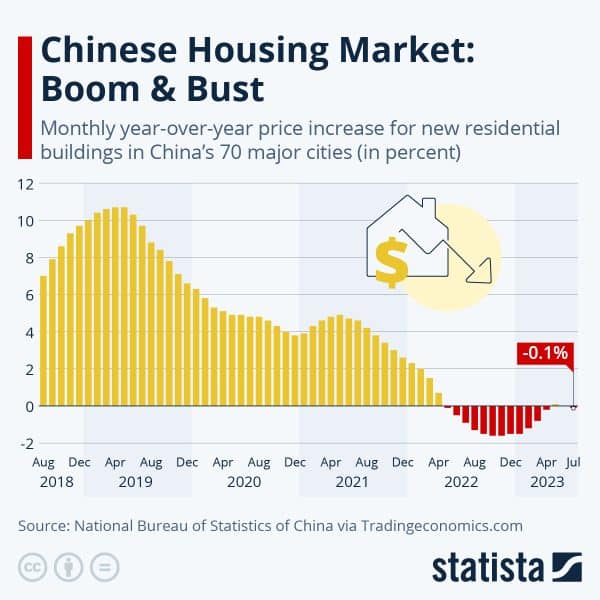

This heavy concentration in housing has proven disastrous given China’s ongoing property crisis. After years of breakneck growth, the sector has been in freefall, pummeled by debt woes, defaults, stalled construction, and slumping sales.

The downturn traces back to 2020 when Chinese authorities introduced the “three red lines” policy to rein in excessive leverage. This squeezed financing for stretched developers like Evergrande, sparking a liquidity crunch.

As housing demand dried up, builders struggled to complete projects, debt obligations mounted, and multiple major developers defaulted. The contagion also spread to adjoining sectors like construction, appliances, and raw materials.

Trust firms and other shadow banks with substantial real estate exposures have been hard hit as well. As property loans soured, it eroded their asset base and cash flows. Zhongzhi’s woes indicate that the property downturn continues to have a severe spillover impact.

While Beijing has rolled out measures to restore stability such as easing financing policies, the housing market continues to be on the brink of collapse. This overhang has been a key factor depressing consumer sentiment and China’s economic activity lately.

With Zhongzhi now warning of insolvency, it signals that the financial damage from the country’s property market turmoil may be even more severe and widespread than previously thought. The development will likely renew investors’ focus on systemic risks resulting from the real estate crisis.

Could Zhongzhi’s Fallout Have Implications for the Global Economy?

As a bellwether for China’s economy, persistent housing market weakness and widening financial turmoil will raise red flags globally. Slower mainland growth stemming from domestic woes will dampen worldwide demand and trade flows.

Additionally, Zhongzhi’s insolvency may trigger jitters about financial contagion if the impact of massive defaults cannot be contained. While China’s system remains largely closed, concerns over shadow banks’ asset quality could tighten credit conditions. Financial instability may spread fears of a hard-landing scenario.

Global growth is already forecasted to slow markedly in 2023 as recession risks loom in the U.S. and Europe as well. A Chinese economic slump or banking distress would exert further drags. Moreover, reduced spending from Chinese consumers and businesses would shrink imports, hitting trade partners.

Emerging Asian economies also face possible currency and outflow pressures if mainland uncertainty intensifies. Further, if Zhongzhi’s insolvency prompts investors to dump Chinese holdings, regional asset markets may suffer collateral damage.

In the worst case, if Beijing mismanages the situation, loss of confidence could stoke financial panic. Although the government still has tools to prevent a systemic collapse, global growth prospects would undoubtedly suffer if the turmoil spreads beyond Chinese borders.

While the overall damage may still be containable, Zhongzhi’s insolvency warning flags that the multi-year property debt crisis remains highly unpredictable.