Boeing, the second worst-performing Dow Jones constituent this year amid its continued and worsening whistleblower crisis, has been in a literal mess this year. While the company’s management has tried to blame employees for the safety incidents, lawmakers slammed the company’s management for these issues. Here’s our full breakdown of what has been happening with Boeing and how the continued crisis is taking a toll on the brand and its stock price.

For context, Boeing’s recent troubles began when two new 737 Max jets crashed in quick succession, just a few months apart, between 2018 and 2019, in Indonesia and Ethiopia. After the first crash, Boeing allowed 737 Max planes to fly again even though it didn’t know what caused it, directly leading to a second tragic crash where all 157 people on board were killed.

While it hasn’t had any other high-profile crashes on its watch yet, Boeing has been drowning in problems from whistleblower testimony to harsh congressional hearings.

Boeing seems to be falling apart, both literally and figuratively. Earlier this year, the door panel of a 737 Max jet blew off during an Alaska Airlines flight. In a more recent incident, the engine cover on a Southwest Airlines Boeing 737-800 fell off during takeoff in April.

A Boeing quality engineer and whistleblower, Sam Salehpour, claims managers overlook “𝐬𝐢𝐠𝐧𝐢𝐟𝐢𝐜𝐚𝐧𝐭 𝐝𝐞𝐟𝐞𝐜𝐭𝐬” in the company’s airplanes and when he raised concerns to Boeing, he was “𝐬𝐢𝐝𝐞𝐥𝐢𝐧𝐞𝐝, 𝐭𝐨𝐥𝐝 𝐭𝐨 𝐬𝐡𝐮𝐭 𝐮𝐩, 𝐈 𝐫𝐞𝐜𝐞𝐢𝐯𝐞𝐝… pic.twitter.com/Os139ROD4q

— RedWave Press (@RedWave_Press) April 17, 2024

Whistleblower Accused Boeing of Neglecting Safety Warnings

There was a general perception that while different departments probed Boeing over the security lapses, it did not have the desired impact as such events simply kept on repeating. The DOJ probed the company for nearly two years and accused the company of concealing information about its Max plane, but somehow, it didn’t charge Boeing or its executives with any criminal charges.

In his explosive testimony, whistleblower Sam Salehpour reiterated Boeing was very much aware of the safety issues. However, the company not only ignored them but also retaliated against him when he brought these to the notice.

Boeing has stressed multiple times that it does not retaliate against whistleblowers and instead encourages employees to come forward with their complaints. However, data tells a different story, and whistleblower John Barnett, who previously raised concerns about Boeing’s production process, received 40 calls from his manager in a span of two days.

According to Democratic Senator Richard Blumenthal, when Barnett, who died by apparent suicide, confronted the supervisor about the calls, they told him he would “push him until he broke.”

Calhoun Says Company Does Not Harasses Whistleblower

In his testimony, while Boeing’s CEO Dave Calhoun did not admit that the company harassed whistleblowers, he added “Something went wrong, and I believe the sincerity of their (whistleblowers) remarks.”

Notably, Boeing reached a $2.5 billion deferred prosecution agreement with the Department of Justice (DOJ) to avoid prosecution on a single charge of fraud. While the settlement shielded Boeing from prosecution it did not grant any immunity to employees who were found to be negligent and engaged in any misconduct (but it hasn’t gone after employees yet either).

Specifically, the FAA said that two Boeing employees “deceived the FAA” about MCAS which was a new flight control system on the 737 Max.

Lawmakers Accuse Boeing’s Top Leadership For the Problems

While Boeing has tried to apportion the blame for security-related incidents involving its aircraft on employees, lawmakers think otherwise and flagged the company’s top management for being the problem.

Boeing CEO Dave Calhoun kept his cool during that very harsh exchange with Hawley who called it a "travesty" that Calhoun has not yet resigned and heaped scorn on his $33M compensation https://t.co/pItYB2jOLv

— David Shepardson (@davidshepardson) June 18, 2024

Republican Sen. Josh Hawley, who was among the most vocal in grilling Calhoun, said, “I don’t think the problem’s with the employees.” He added, “I think the problem’s with you. You. It’s the c-suite. It’s the management. It’s what you’ve done to this company. That’s where the problem is.”

Terming Calhoun, who has already resigned from the company and would step down later this year as the “problem,” Hawley said “And I just hope to God you don’t destroy this company before it can be saved.”

Hawley also flagged the 45% rise in Calhoun’s 2023 compensation to $33 million, accusing him of “strip mining” the company. Hawley told Calhoun “Frankly, sir, I think it’s a travesty that you are still in your job.”

Here, it is worth noting that while Calhoun resigned from the job in March, Boeing hasn’t been able to find a replacement yet as apparently there are no takers for the job amid the crisis.

How’s the Crisis Impacting Boeing’s Stock?

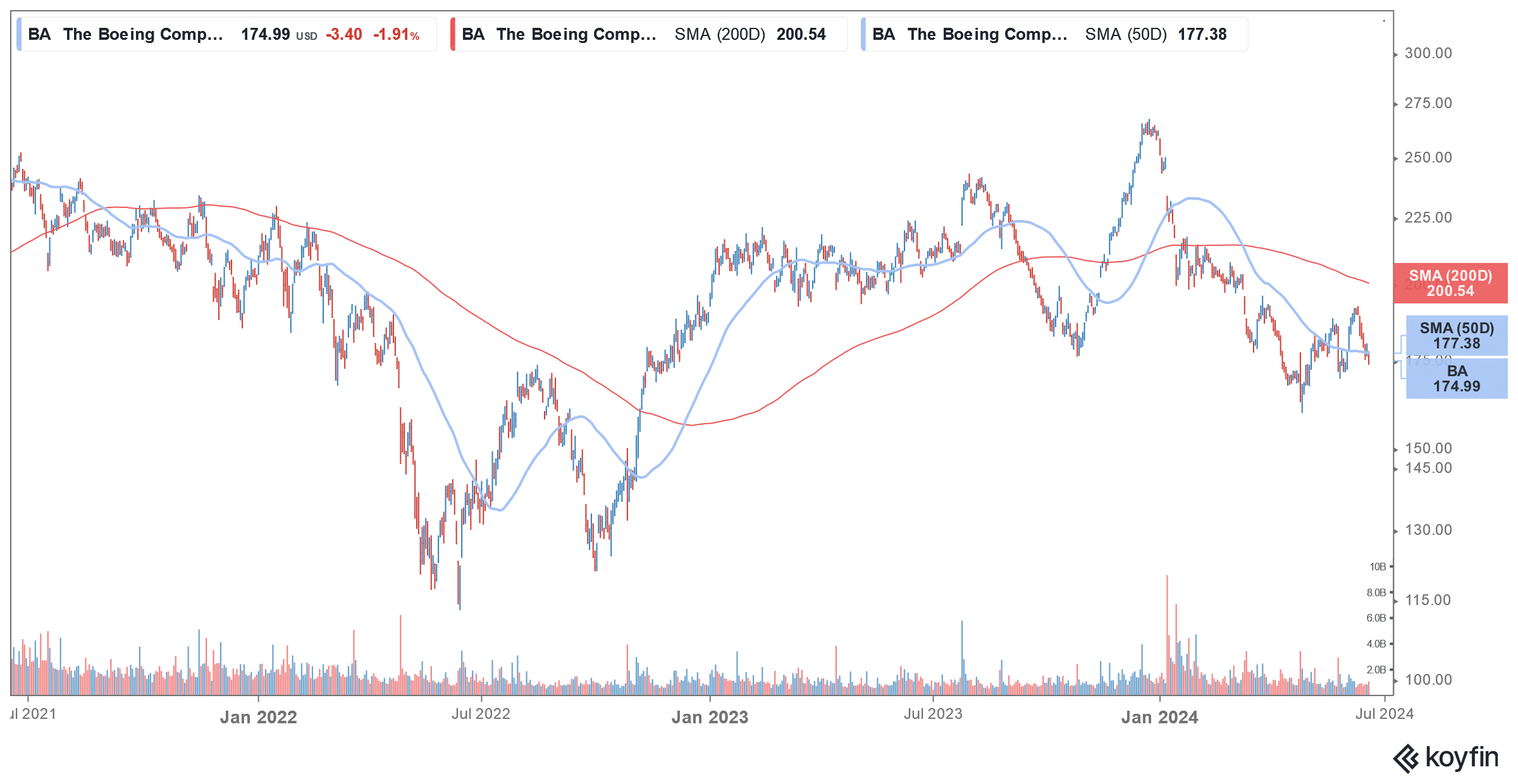

The seemingly unending crisis has taken a toll on Boeing’s stock price which is among the top 10 S&P 500 losers this year. The price action is not surprising considering the financial impact of the crisis as well as the disastrous PR. Earlier this year, the FAA halted the production expansion of the Boeing 737 Max which is the company’s best-selling model.

The crisis has also hit Boeing’s deliveries and the company now expects to burn $8 billion in cash in the first half of the year. Notably, in the aircraft manufacturing industry, companies receive the bulk of the payments when they deliver the aircraft to the buyer. However, as Boeing has been proceeding cautiously with the production by prioritizing safety and quality its deliveries have lagged that of peer Airbus.

Meanwhile, some analysts believe that, despite the crisis, Boeing stock has a lot of value, and Jefferies maintained its buy rating and $270 target price for the company. Analyst Sheila Kahyaoglu pointed to the fact that Airbus and Boeing are the only two major aircraft manufacturers in the world. She also pointed out that air traffic is still at 2019 levels and there has been significant underproduction in the industry while the end demand is strong.

According to Kahyaoglu, Boeing makes around $10 million in free cash flows on every 737 that it delivers and said that the stock has tended to track the delivery growth of that model.

Boeing Benefits From the Aircraft Duopoly

The aircraft manufacturing industry is indeed a duopoly which is making some analysts see Boeing in a more poisitive light, despite its many troubles. For instance, Bank of America, which has a neutral rating and $200 target price on the stock, said, “Boeing remains uniquely positioned to the robust air traffic demand environment, with the moat that the duopoly creates. However, on the other hand turning around operations could take time and uncertainties remain in the near future.”

Notably, Chinese state-owned plane maker COMAC is also trying to expand internationally. While COMAC is arguably an untested player for global airlines, Boeing does not have any laurels to its name either when it comes to credibility – or at least that’s what the general perception has been about the brand over the last couple of years.

All said, Boeing has its task cut out and the company has to improve its image in terms of safety. The company also has to then start clearing the order backlog for 737 which is taking a toll on its cash flows. While managing quality/aircraft safety along with increasing production might seem like a contradiction, that’s what quality manufacturing companies are expected to do.