Artificial intelligence (AI) has been the most prominent theme in the investing world over the past year and chip giant Nvidia has been its biggest benefactor. The company’s market cap surged over $2.5 trillion last week, making it the third biggest company globally after Microsoft and Apple.

Nvidia has indeed milked the AI opportunity like none other (at least in the short term). Analysts expect the company’s revenues in the current fiscal year to rise 98% YoY to over $120 billion, which is more than 11 times what the company posted in its fiscal year 2020. But Nvidia is already starting to seem extremely overextended and it is far from the only major company set to benefit from the rise of AI.

Here are some of the lesser-known ways to get exposure to the blossoming industry, looking beyond the obvious choices like Nvidia and Microsoft.

AI Is Permeating the Entire Economy

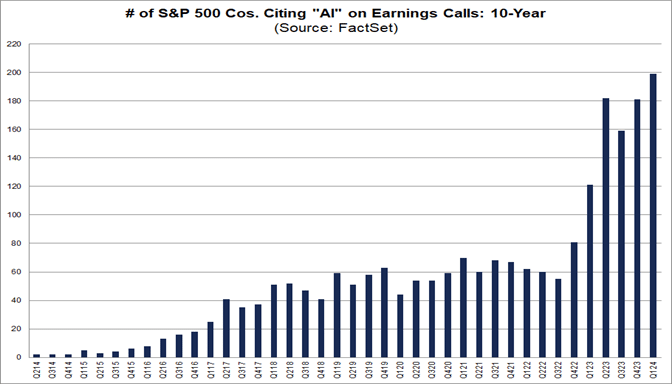

The world’s AI euphoria seems far from over and the term is increasingly featuring in the earnings calls of all kinds of companies. Data compiled by FactSet showed that 199 of the 500 S&P 500 companies used the term “AI” in their earnings calls between March 15, 2024 and May 23, 2024. It was a new record and surpassed the previous record high of 182 in Q2 2023.

The information technology sector topped the list among the companies talking about artificial intelligence in their earnings calls. 50 information technology companies used the term artificial intelligence during their Q1 earnings calls, constituting 91% of all companies in the sector. The second on the list was industrials and AI featured in earnings calls of 30 companies.

Next on the list were financials and healthcare with 25 and 20 companies, respectively, talking about artificial intelligence during their earnings calls. Clearly, AI is not only permeating the tech industry. It’s spreading across every nook and corner of the economy. This suggests that companies offering to help build or support new AI use cases will almost certainly benefit from this trend.

AI Spending Is Far from Over

AI spending was a common theme during the Q1 earnings calls. For instance, Tesla, whose CEO Elon Musk believes that the electric vehicle maker is more of an AI player than an automotive company, talked about its AI investments during the Q1 earnings call last month. Google-parent Alphabet reported a capex of $12 billion in the first quarter of 2024. The spending doubled that of the corresponding quarter last year.

Microsoft, which has invested billions of dollars in ChatGPT’s parent company, OpenAI, said that its capex in its third fiscal quarter of 2024 (that ended on March 31, 2024) rose a whopping 80% YoY to $14 billion. The company expects its capex to swell to $50 billion in the next fiscal year as it ramps up AI spending.

Meta Platforms also raised its capex guidance for 2024 to between $35 billion-$40 billion which was higher than the previous guidance of between $30 billion-$37 billion as it has scaled up its investments towards AI. The company expects to invest aggressively in AI over the coming years and said, “we expect capex will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.”

But Is AI a Bubble?

Many traders, analysts, and experts are starting to worry that the incredible growth of the AI industry is forming a bubble. If this is true and interest in AI slows in just one quarter, the entire industry could implode in a matter of days if not hours. Some point at similarities between Nvidia’s recent price action and Cisco’s right before the dot-com bubble popped, but the numbers simply don’t support the hypothesis (yet, at least).

Much of the current spending towards AI is going towards building LLMs (large language models) and companies – big and small – are lining up to buy Nvidia’s high-power chips. Nvidia’s CFO Colette Kress dispelled fears that AI investments were not transforming into realized revenues. During the fiscal Q1 2025 earnings call earlier this month, she said, “For every $1 spent on NVIDIA AI infrastructure, cloud providers have an opportunity to earn $5 in GPU instant hosting revenue over four years.”

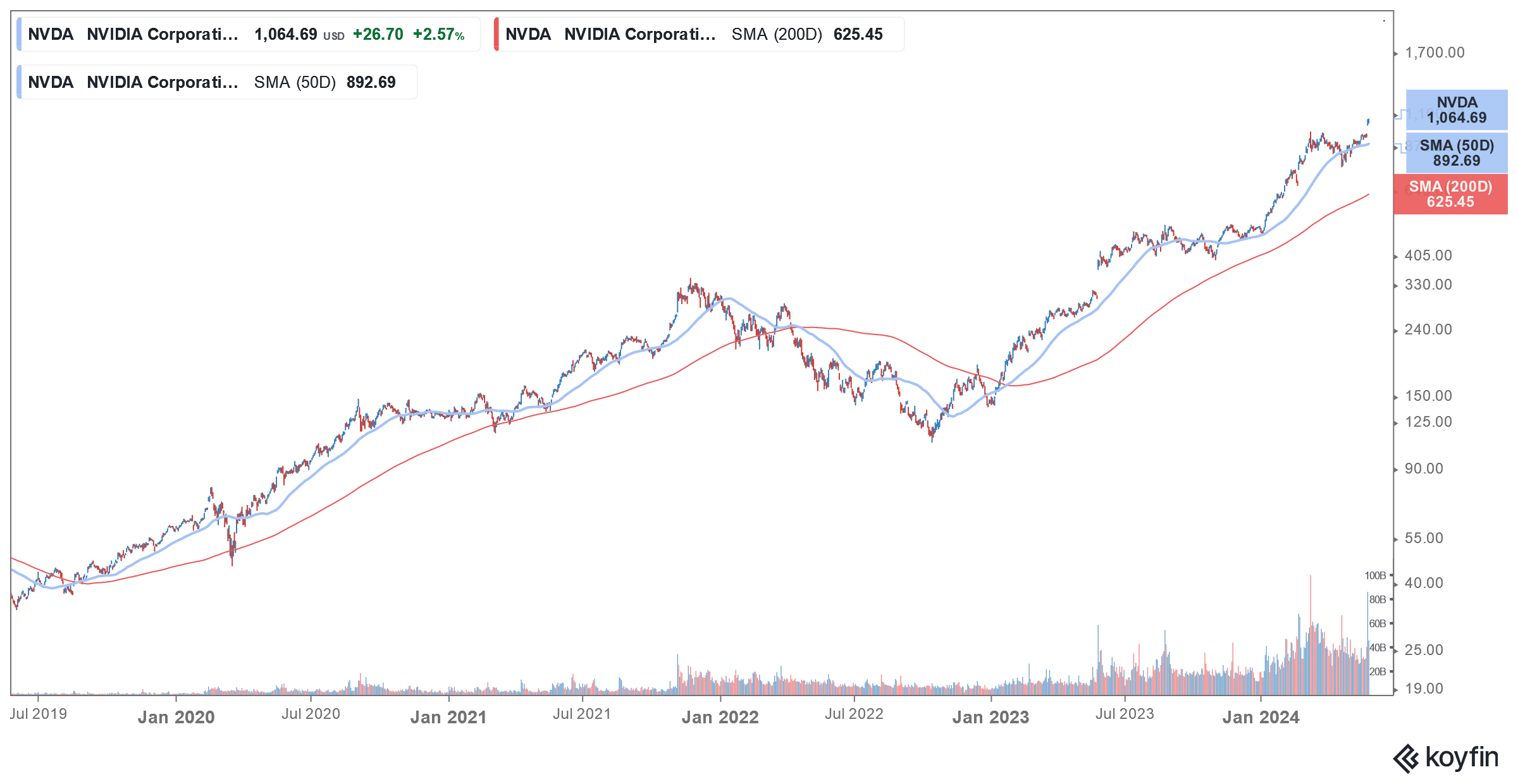

Nvidia stock has gained over 25-fold over the last five years, with the rally being largely driven by bullish sales of its AI chips.

While some still believe the AI industry is forming a bubble, drawing parallels to the dot-com days of the 1990s, the pivot toward AI looks real. AI is not only helping companies cut down on costs structurally and serve customers more efficiently but is also an opportunity to increase revenues. Here are some of the companies (apart from Nvidia) that stand to benefit from the AI pivot.

Which Companies Would Benefit from AI Pivot Besides Nvidia?

First of all, artificial intelligence is already making digital ads even more focused and effective. While increasingly better targeted ads may not be what users want, this trend certainly helps companies like Meta Platforms which get a bulk of their revenues from digital ads and are unsurprisingly investing billions in AI.

Gadget sales – which include PCs as well as smartphones – could receive a boost as companies make devices AI-enabled. PC sales have been tepid over the last couple of years, but IDC sees a ray of hope in AI-enabled PCs and expects them to account for 60% of all shipments by 2027. In a note earlier this year, Tom Mainelli, IDC’s group vice president of Devices and Consumer Research said, “In 2024, we’ll see AI PC shipments begin to ramp, and over the next few years, we expect the technology to move from niche to a majority.”

Apple could be another beneficiary as it is expected to add new AI features to its next iPhone which is set to be revealed later this year. JPMorgan analyst Samik Chatterjee sees the AI upgrade cycle mimicking the 5G upgrade cycle for Apple.

“The increasing appetite from investors has largely been driven by interest in participating in the cyclical upsides associated with the AI on-device led upgrade cycle, with investors taking the cue from the 5G-led upgrade cycle,” said Chatterjee in his note. If he is right, it could be a game-changer for Apple as it has struggled to keep iPhone sales up in recent months.

Consumer Companies Would Benefit from the AI Pivot

Consumer-focused companies like Netflix and Spotify would also be able to enhance consumer experience and make better recommendations for users.

Last month, Spotify launched its personalized AI playlist builder which is expected to come up with better recommendations for Spotify users which could help fuel its popularity. Spotify is offering the AI recommendation functionality to premium subscribers only and if it gains popularity among listeners, more users might pivot to the premium plan.

AI would also help companies monetize their data – which is the backbone of AI models. Reddit stock soared earlier this month after it announced a deal with OpenAI to train the latter’s AI models using Reddit content.

Data-as-a-service (DaaS) companies could gain traction amid the AI pivot. Palantir and Snowflake are among the companies that are capitalizing on the opportunity.

Earlier this month, Palantir even sponsored the AI Expo for National Competitiveness” which was hosted by the Special Competitive Studies Project, backed by former Alphabet CEO Eric Schmidt.

Cloud companies would also benefit from the AI pivot and Amazon expects artificial intelligence to be a multi-billion-dollar opportunity for its Amazon Web Services (AWS) segment. The company’s CEO, Andy Jassy, emphasized the revenue potential of artificial intelligence on its AWS multiple times during the Q1 2024 earnings call.

According to Jassy, “All of this generative AI set of workloads, which will transform every experience they’re going to be built from scratch on the cloud largely.”

Microsoft is another beneficiary as AI adoption fuels demand for cloud companies. It is a prominent AI play anyway given its massive investment in OpenAI which is ChatGPT’s parent company.

The world will be in need of so much electricity for AI. ⚡️💡#copper #uranium #natgas #energy #AI pic.twitter.com/3WBnQjKkBk

— Oliver Groß (@minenergybiz) May 24, 2024

Energy Companies Could Benefit from Artificial Intelligence Investments

Bank of America’s Investment and ETF strategist Jared Woodard believes that while chip, data center, and hyper scalers were the winners in “round one” of artificial intelligence, old economy industries like metals and energy would also join the list subsequently.

“Further investments in those beneficiaries should be made contingent on a realistic path to expand the power supply. In other words, the big new digital darlings can still win, but the ruddy old real world may have to win first,” said Woodard in his note.

He added, “Progress is not possible without real assets. Our strategists expect metals like copper to fall into massive deficits through 2026. Miners should retain pricing power given constrained capacity after a decade of underinvestment.”

He lists utility and commodity ETFs as a proxy play on higher energy demand due to the AI transition. Freeport-McMoRan, which is the world’s largest listed pure-play copper miner is another interesting AI play as more investments towards renewable energy generation would mean higher copper prices– and by its extension higher profits for the company.

While most AI companies are growth names and trade at elevated valuations, Morgan Stanley’s value equity expert Aaron Dunn has found some intriguing value AI stock picks. The list includes names like Micron, NextEra Energy, and Eaton Management which is a power management company.

To sum it up, while chip names like Nvidia and Super Micro Computers have emerged as the key winners in the initial days of AI, countless other companies stand to benefit from the technology which some see as the most consequential in years.