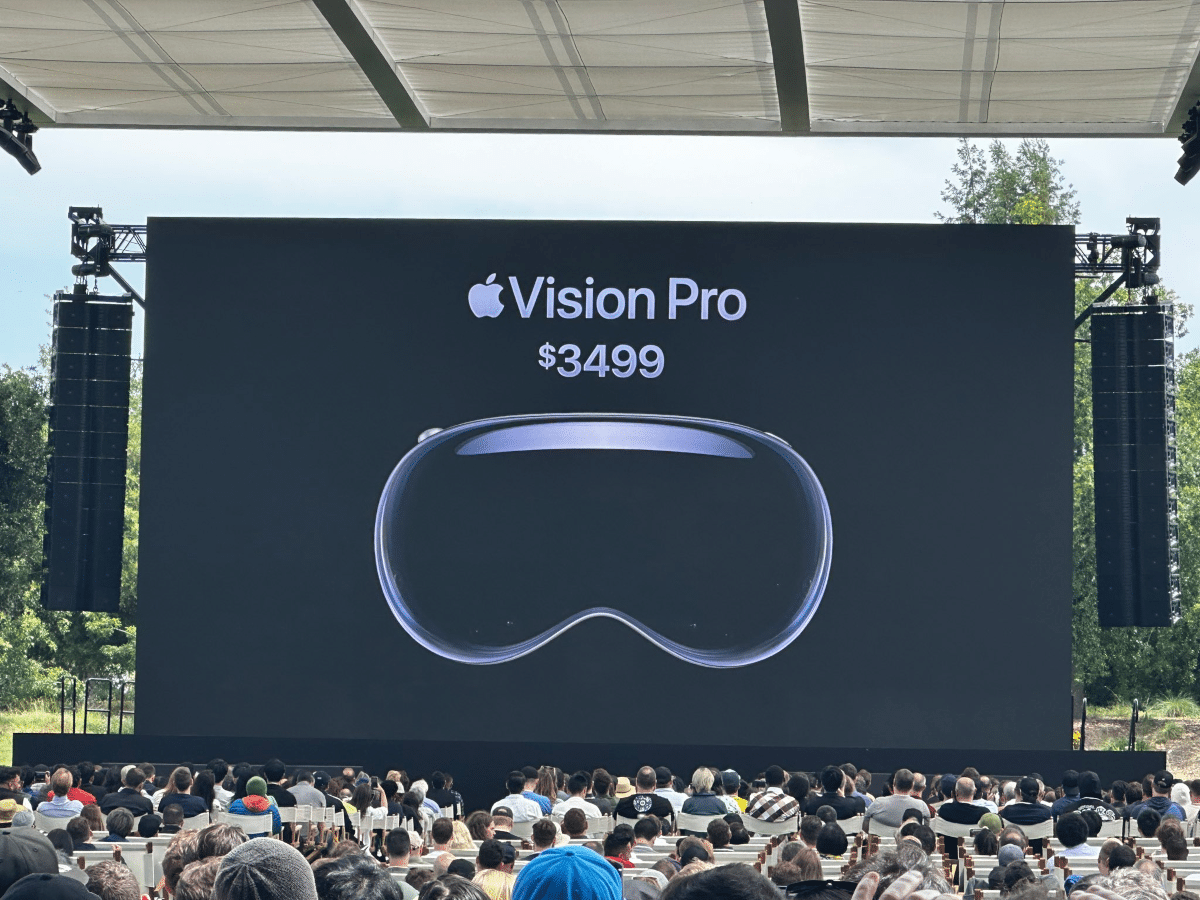

Apple has reportedly scaled back Vision Pro production and could stop making the model altogether by the end of the year. It seems like it will soon be one of a small handful of Apple products to fail, partially due to its exorbitant cost as well as a challenging virtual reality (VR) headset market.

Apple launched the Vision Pro headset only in February and it was the first new product from the Cupertino-based company in many years. Priced at $3,500, it wasn’t ever expected to be a mass product. However, if Apple is indeed suspending the production of Vision Pro it would come as a surprise as the company was expecting to increase its target market with the new product at a time when iPhone sales have at best sagged.

However, the Information reported that many suppliers for Vision Pro have “already halted manufacturing components since early summer” due to “weak demand.”

Apple has reportedly reduced production of the Vision Pro and could stop producing the headset by the end of 2024 😳

Source: @theinformation pic.twitter.com/xNApT2KW1j

— Apple Hub (@theapplehub) October 23, 2024

Apple Reportedly Looking to Suspend Production of Vision Pro

In a recent interview with the Wall Street Journal, commenting on the Vision Pro, Apple CEO Tim Cook said, “Right now, it’s an early-adopter product. People who want to have tomorrow’s technology today—that’s who it’s for. Fortunately, there’s enough people who are in that camp that it’s exciting.” While he admitted that it wasn’t a “mass-market product” given its premium pricing, he gave no hints about the company looking to suspend its production.

During the company’s fiscal Q3 earnings call in August, Cook said that the company will expand Vision Pro to more markets to give “customers the chance to discover the remarkable capabilities of this magical device.”

He was quite upbeat about the product’s demand and said, “we’ve seen great interest for Vision Pro in the enterprise, where it can empower companies large and small to pursue their best ideas like never before.”

While the company did not provide a breakdown of Vision Pro sales numbers, it seems its demand cooled off after the initial euphoria.

Meta Offers a Much Cheaper Headset

One of the reasons, Apple Vision Pro failed to strike a chord with users was its extremely high price tag of $3,500 in the US (and that doesn’t include accessories like prescription lenses). While Apple is known for its premium products and by extension premium pricing, the price differential between Vision Pro and competing headsets from other companies is massive.

Meta Platforms, for instance, offers its Quest 3 at $500 in the US. Moreover, at its Connect event last month, the Facebook parent unveiled Meta Quest 3S which it said has the “same mixed reality capabilities and fast performance as Meta Quest 3” but starts at a mere $300.

“Quest 3S is the best headset for those new to mixed reality and immersive experiences, or who might have been waiting for a low-cost upgrade from Quest and Quest 2,” said Meta Platforms in its release.

Notably, even Meta struggled to sell its higher-priced Quest Pro and eventually lowered its price by $500 to $999 in Q1 2023 within a few months of its launch. Meta has also reportedly suspended plans to produce a premium headset named La Jolla which would have directly competed with Apple Vision Pro.

While Vision Pro’s high price tag is certainly part of the problem, the overall AR/VR headset market has been struggling amid an uncertain global economy and the product has failed to move beyond early adopters.

Global AR/VR Market Has Been Quite Weak

According to the International Data Corporation (IDC), global augmented reality and virtual reality (AR/VR) headset shipments fell 28.1% YoY to 1.1 million units in the second quarter of 2024. Meta Platforms was the biggest player with over a 60% market share followed by Sony. Apple was a distant third as the company’s Vision Pro headset never really took off.

The overall AR/VR headset market itself has been quite challenged and after the YoY fall in 2023, the IDC predicts shipments to fall 1.5% in 2024 also. It however expects shipments to rise 41.4% in 2025 due to “new tech and more affordable devices.”

That said, the IDC’s optimistic forecast should be taken with a pinch of salt as last year it had predicted a 46.8% YoY rise in 2024 shipments. The research firm’s optimism was based on the launch of new models by Meta and ByteDance as well as the launch of Vision Pro from Apple.

IDC’s optimism about sales rising in 2025 is based on the assumption that cheaper models will drive sales. “The lack of affordable options has meant that few consumers have experienced this new technology, but that will change as Meta is expected to launch a more affordable version which will help the market return to growth in the coming year,” said Jitesh Ubrani, research manager, Worldwide Mobile Device Trackers at IDC.

Apple Intelligence To Be Released Next Week

While Apple started selling its AI-powered iPhone 16 last month, it hasn’t yet released “Apple Intelligence”, its upcoming suite of unique AI features. Given that this was the main selling point of the new model, it’s likely that early sales numbers aren’t great. The company claims that it will gradually start rolling out these features next week, though it hasn’t specified the exact date. The Tim Cook-led company will release its fiscal Q4 earnings on October 31 where it is expected to talk more about these features.

While a section of the market expects the iPhone 16 to trigger a massive replacement cycle like the 5G upgrade, not all experts are convinced. Bloomberg’s Apple expert and journalist Mark Gurmanm slammed the model, arguing that it is only incrementally better than its predecessor. He even accused the company of using “disingenuous’ marketing’ while advertising the model.

He also slammed the company for little innovation in hardware and said that even its AI efforts were a couple of years behind competitors. Notably, the Apple iPhone 16 has had mixed reviews and most observers believe that it at best offers incremental features and Apple Intelligence remains the only major change as compared to the iPhone 15.

In his review of the iPhone 16, famous YouTuber Marques Keith Brownlee (better known as MKBHD) also found it was not too different from the iPhone 15. Importantly, while at the iPhone launch event Apple said that the iPhone 16 Pro Max has the “best iPhone battery life ever,” Brownlee did not find any noticeable change. You can check his full review in the video above.

Other Apple Products That Failed

Meanwhile, if Apple indeed shelves production of Vision Pro it won’t be the first Apple product that failed to take off. For instance, in 1993 the company’s personal digital assistant (PDA) failed to generate the desired demand, in part due to its high price tag. Its original HomePod also failed due to high prices and low sound.

More recently, Apple has also reportedly shelved the electric car project that it had been working on for many years. The company spent billions of dollars towards that project and was also said to be in talks with several automakers to manufacture its car. However, the EV industry, like the VR headset industry, is troubled amid slowing demand and massive overcapacity. Legacy automakers are burning billions of dollars every year in their EV divisions so it’s not exactly surprising that Apple dropped its electric vehicle plans.

Headset Market Is Not Dead Yet

As for the Vision Pro, the product’s suspension – if it indeed happens – is yet another sign that there are not many takers for high-priced headsets even if it comes from a brand like Apple. It does not however signal an end to VR industry or VR headsets as there is still decent demand for the tech at lower price points.

IDC expects AI features and the introduction of smart designs to drive demand in the coming years. “Similar to the early days of this industry, we’re seeing a slew of new startups and next-generation products from established brands targeting the ‘smart glasses’ space. What’s different this time around is the inclusion of AI along with thinner and lighter designs catering to consumers,” it said in its report.

While its previous bullish forecast did not play out, IDC expects the industry to grow from 6.7 million units in 2024 to 22.9 million in 2028 – a CAGR of over 36%. However, it expects mixed reality (MR) headsets to account for 70% of the market by 2028.