Data is the life blood of any SaaS company. Data will empower you to make better decisions and help you grow faster. However, few companies make the most of their existing data or get access to the data they need.

This guide is meant to help you go from zero to analytics proficient as quickly as possible. It doesn’t matter if you’re starting from scratch or if you’re simply trying to level up your existing data strategy. We’ll help you get access to the insights you need to grow your SaaS business.

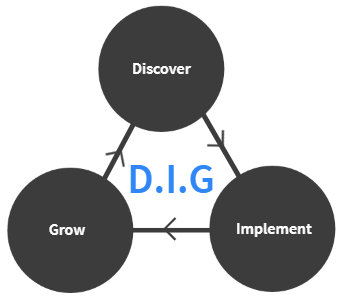

D.I.G.: Our process for data strategy

The process we use is called D.I.G. We have tested and refined this methodology over the past three years across more than 40 projects. After making every mistake imaginable, we now know what it takes to implement a data strategy successfully.

D.I.G. stands for:

- Discover: Which metrics and KPIs should you track?

- Implement: Which tools do you need to collect accurate data?

- Grow: Which reports or dashboards do you need to create?

D.I.G. is an iterative process that you can run over and over again. For this guide, we’ll focus on setting up a solid foundation. We’ll also give you some advanced ideas at the end of this post for those who are ready.

Let’s start with Discover: defining the list of metrics and KPIs that you should track.

Discover: Which metrics and KPIs should you track?

Before we start using tools or writing code, we need to know which metrics to track and why we want to track them. This is a business conversation and not a technical one.

One of the most common mistakes that we see companies make is skipping this step and assuming they already know what they want to track. For example, I was on a call recently with a company that was struggling to get basic insights from their web app. They knew high-level numbers like sign-ups but couldn’t dig deeper into their onboarding flow or retention.

On our call, the company told me about all the technical issues they had run into and how their development team didn’t seem to know how to do the most basic things. While that may have been true, I knew that the most pressing issue was that they didn’t know what they wanted to track—they couldn’t translate their business needs into concrete KPIs and metrics.

Instead, they asked for vague information like “track our onboarding performance” or “track user retention.” Most development teams struggle with vague requests, so—for that company and all others—we need to make the KPIs as clear as possible.

The first step is to define our KPIs across the customer journey.

KPIs for the customer journey

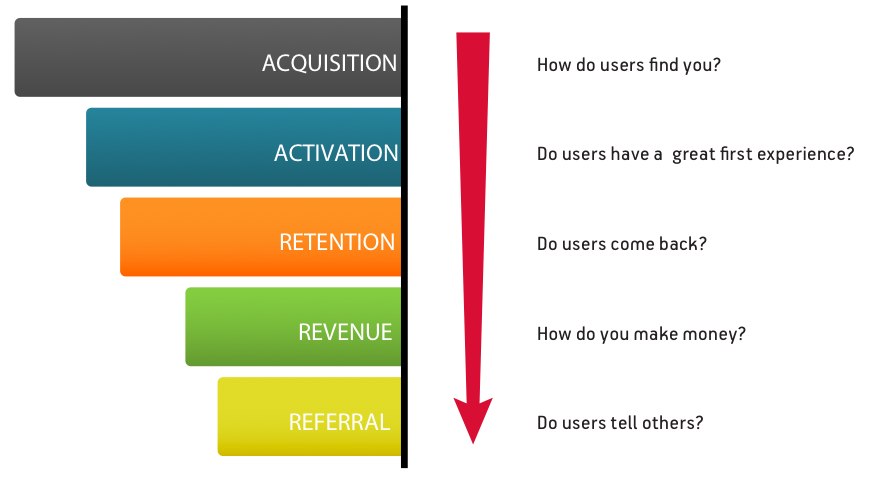

The customer journey is the series of steps that a user must take to become a customer. There are different frameworks out there, but we like Pirate Metrics since it aligns quite well with how SaaS products are built and marketed.

Our journey takes places across the following stages: Acquisition, Activation, Retention, Revenue, and Referral. For each stage, we want to list the most important metrics and KPIs, and a few other things.

We’ll organize our thoughts into a document called a Measurement Plan.

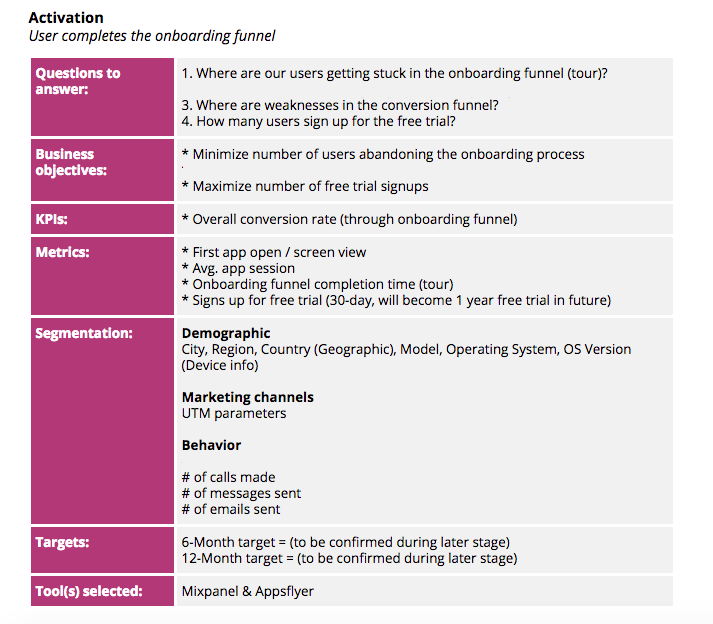

The document looks like this for each stage:

We start with the business questions that we want to answer. Then, we move on to business objectives, then to metrics and KPIs. We tend to use metrics and KPIs interchangeably, but in this document, KPIs are the one or two numbers that tell us how well we are doing at this stage; metrics provide more detail on the overall performance.

Consider the company I mentioned in the previous section: They wanted to “track our onboarding performance,” which is vague. They needed to break that down into the different categories in the Measurement Plan above.

The main KPI is the overall conversion rate through the funnel (e.g. 50% of users complete the funnel), but we also have other metrics that can help us understand the journey:

- First app open (first step of the funnel)

- Average app session

- Sign-ups into the free trial (happens at the end of the onboarding)

We can also list the ways in which we can segment our data, the targets we want to set, and the tools we’ll need. As you can see above, most KPIs are business focused—not technical.

A special note on segmentation: This is where the magic of data happens, so spend some time thinking about this component. We track three types of segmentation:

- Demographic: Information about the user, like their location, device information, etc.

- Marketing attribution: Which channel or campaign brought the user to us?

- Behavior: This is specific to your product. For example, if a user can create an account through Google or Facebook, this can become a segmentation option.

Some stages may not be relevant to your company right now. For example, you may not have a referral program in place, so you can skip that stage and come back to it another time.

Fleshing out this document can convert vague requirements into concrete next steps. Business stakeholders will understand the role of data, and technical stakeholders can start to think about what data to collect to deliver on these metrics and KPIs.

Once you complete the document, you’re ready to move on to the Implement stage.

Implement: Which tools do you need to collect accurate data?

Most companies tend to start at this stage. This is the “sexy” stage because we get to talk about tools and cool features. The goal of this step is to figure out which tools we need to track the data in our Measurement Plan.

Selecting the right tools for your company

There are hundreds of options when it comes to tools. Choosing among them can be exciting (if you like research) or overwhelming. Either way, you should think about the following three things before choosing any tool:

- Budget: Do you need enterprise support? How much are you willing to spend on tools on a monthly or annual basis?

- Internal capabilities: Does your team know languages like SQL? If not, then you need tools that can make it easy to create reports/dashboards without it.

- Role in the stack: You won’t find a tool that can do everything you need. Instead, you’ll need to create a stack of different tools. You’ll naturally have some overlap, but you want to minimize it as much as possible.

When thinking of your stack, there are a few categories that you need to fill to get a complete picture of your product. I’ll explain the categories and a few popular recommendations. You can start with these recommendations but also look for alternatives that might be better suited to your company.

- Data abstraction: Instead of implementing five different tools, how can you simplify your data implementation efforts—so it can be done once and then sent7 to all five tools? Options like Segment.com and mParticle fit here.

- Marketing attribution: Which marketing campaigns or channels drive the best users? Ideally, you want to track this data through the customer journey instead of stopping at the top of the funnel. Options like Google Analytics (web traffic) and Appsflyer or Branch (mobile attribution) fit here.

- User behavior: What are users doing within your product? Are they completing the onboarding process or using a specific feature? Think retention, engagement, and product usage. Options like Heap and Amplitude fit here.

- In-app messaging: What is the best way to send targeted messages to your users? These messages can be SMS, email, push notifications, or in-app messages. Options like Intercom and Braze fit here.

- Revenue metrics: What is the best way to track your SaaS revenue metrics like Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn, etc.? This gets a special category since these metrics tend to come from your payment processing provider. Options like Recurly and Chargify fit here.

- Qualitative data: What is the best way to track qualitative data like session recordings, Net Promoter Score (NPS), or surveys? Ideally, you want a tool that lets you do multiple things (e.g. heatmaps, session recordings, surveys, etc.) Options like Hotjar (web) and Appsee (mobile) fit here.

Preparing a technical plan for implementation

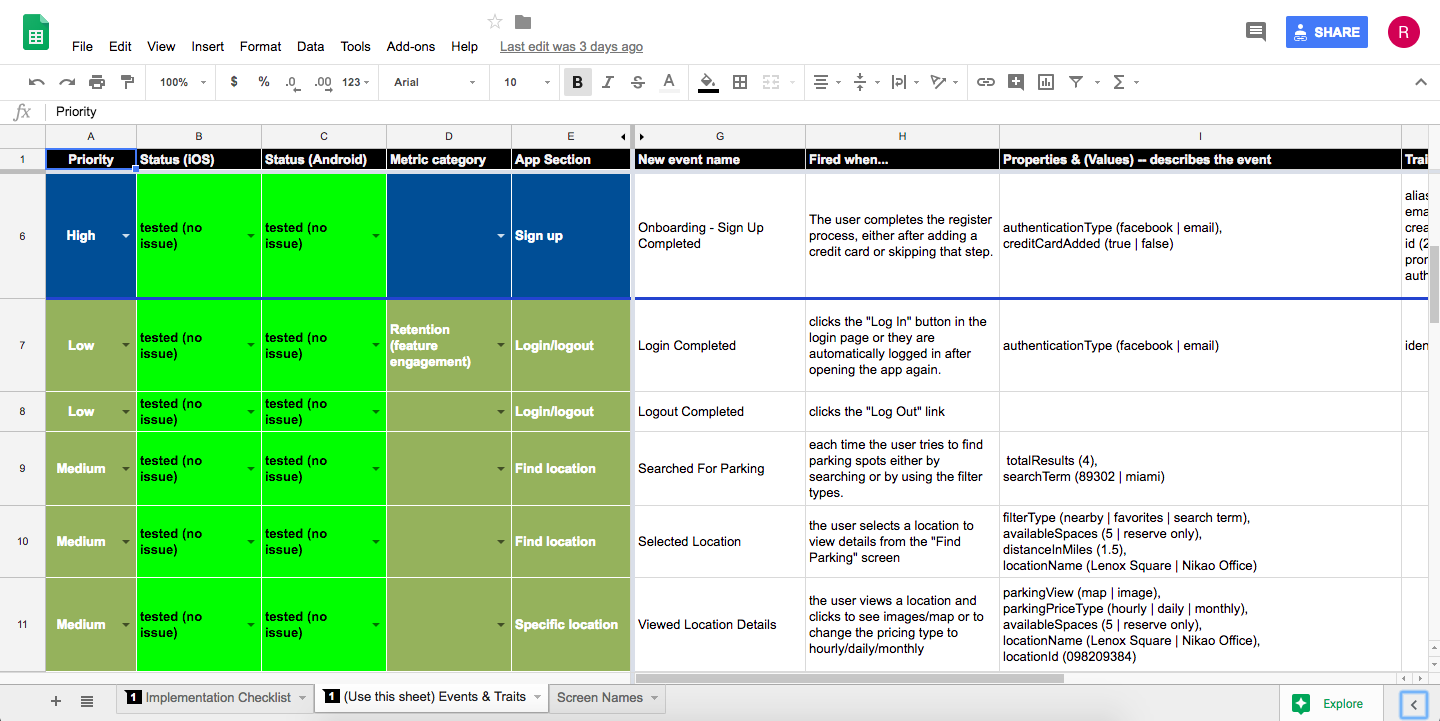

Once you know which tools you want to use, prepare a technical plan for your development team. This is typically called a “tracking plan” and outlines all the technical details that your development team needs to take care of. You can find templates for tracking plans directly from Mixpanel, Segment.com and Amplitude.

Here’s what the document looks like:

This document is critical because it determines what data actually gets implemented. (I could write a whole post on how to fill one out.) Also, most companies have scarce development time, so this document can either be a time saver or a time suck for your developers.

Here are some general guidelines to get it right:

- Think of events as actions within your product. Signing up is an action that can be translated into an event called “Sign Up.”

- Aim to implement 5–10 events in your first round. You can always implement more later on, but you want to get a visible win before asking for more development time.

- Try to capture as much data as possible within the event properties. Properties help you describe the actions that users take. In our “Sign Up” example, we might have properties like:

- Name: Ruben Ugarte

- Email: [email protected]

- Authentication Method: Google

- Plan: Free

- User attributes or properties help you describe the user. You can use them to capture things like location data (city, country, and region) or specific things about your product, like revenue or behavioral traits.

If you want to dive deeper into how to create these documents, here’s a 15-minute video in which I walk you through all the details:

Once you finalize your tracking plan, work with your development team to get into production. After a few weeks, you’ll be ready to move on to the Grow step.

Grow: Which reports or dashboards do you need to create?

The Grow step is the dessert of our meal. If you followed the previous steps properly, this should be pretty straightforward. The goal is to create the necessary reports or dashboards to visualize the metrics and KPIs from the Discover step using the tools from the Implement step.

How you create these reports or dashboards depends on the tools you selected, but here are a few universal guidelines.

- Audience: Consider who will use this report. Dashboards for a CMO versus your marketing team can be quite different. The CMO dashboard will focus on a handful of metrics like Customer Acquisition Cost, Lifetime Value, and ROI; it likely will show progress towards targets (quarterly, monthly, etc). The marketing team dashboard will show the performance of specific marketing campaigns, performance across specific segments, and other granular metrics.

- Prioritized metrics: In our Measurement Plan, we prioritized the most important KPIs and metrics. Our reports and dashboards should reflect those choices. Less is more.

- Comparisons: Remember that a number by itself doesn’t mean much. It gains meaning once we give it context, which we can do by comparing it to a previous time period (e.g. this month vs. last month) or by comparing it against a target (e.g. current progress vs. expected progress).

- Cohort users: To see changes over time properly, it’s helpful to cohort users. The simplest way to do this is to cohort users by sign-up date (e.g. all users who signed up during September). Grouping users is essential as you advance with data.

- Segmentation: As I mentioned during the Discover step, segmentation is where the magic happens. Ideally, you already took this into account in your tracking plan—this is when you reap the rewards. Make it easy to slice your data within your reports or dashboards.

Don’t forget training and deployment

Before you finish, take some time to think about training and deployment. This doesn’t have to be complex. The goal is for your team to use the data. To do that, they need training on how the data is structured and how to use the tools you implemented.

We recommend that, at a minimum, you do three things:

- Team sessions: These are general sessions for your entire team that cover the basics. Run 1–3 of these sessions over a few months.

- One-on-one sessions: These sessions should be geared toward specific individuals and the reports they care about. Run 3–5 of these sessions over a few months as well.

- Slack channel: If you use Slack (or something similar), create a channel dedicated to analytics. People can post their questions and get quick answers and explanations.

That’s it. This is how you put a foundation in place or improve existing data efforts. Once you master these first few steps, you can tackle more advanced ideas—like the ones in the next section.

Bonus round: Advanced ideas

The D.I.G. process is meant to be run over and over again. For our clients who have a solid foundation in place, we work on more advanced ideas and exercises. Here are a few to consider:

- Discover:

- Baseline and targets: What is a good conversion rate? What is “good” retention? Develop your baseline metrics, then create targets for any experiments you run. You need historical data before creating baselines, which will help you determine realistic targets.

- User personas/groups: Who are the different user groups within your product? Who qualifies as a “power user”? How can you convert normal users into power users? Just like above, you need data before you can group users. This is a more advanced version of the cohort idea mentioned earlier.

- Implement:

- Internal processes: To properly maintain data over time, establish internal roles for who will take ownership of the data implementation. Typically, this person is a developer who works closely with the marketing and product teams.

- Grow:

- In-app messaging: How can messages drive engagement and retention? What should be the logic for setting up and testing these messages?

- A/B testing: Now that you have data, deploy A/B tests across key sections like onboarding, retention, and engagement.

- Baseline/Target reporting: Once you create your baselines and targets, add them to your key reports. This is a great way to add context to reports and track progress.

One final point: Consider these advanced ideas only after you get the basics right. Walk before you can run.

Conclusion

Let’s finish by going back to the company I mentioned in the first example. After going through these steps, they finally got access to the insights they needed to understand their product.

They started with broad requests (e.g. “track our user retention”), then converted those needs into specific KPIs and metrics using the Measurement Plan document. They translated that into a technical tracking plan, which their development team implemented. As it turned out, their developers were quite capable—they just needed better instructions.

Finally, they created the right reports and dashboards for their company. Getting the first two steps right made the final one a breeze. Now they spend their time thinking of more advanced ideas to get even more value from their data.