There is a misconception that is spread around the media that in order to win big, we need to risk big.

That the most successful entrepreneurs, business owners, and leaders of the world risked everything to get to where they are, is simply not true.

Sure, there are individuals who takes uncalculated risks and end up failing. But these aren’t the individuals we want to model.

The smartest entrepreneurs minimize the downsides in case they fail, and maximize the upsides if they succeed.

“Superficially, I think it looks like entrepreneurs have a high tolerance of risk. But one of the most important phrases in my life is “protect the downside.” — Richard Branson

Let’s go through the 5 different ways to validate your startup ideas.

1. Landing page

Mint.com is your typical overnight success story that is very well publicized in the media. However, the founders of Mint took a strategic, calculated approach to starting the business.

The common route that a lot of founders take is:

Create a prototype → Raise funding → Build the team → Validate the market

The problem with this approach is that you’re doing the activities that require the most time and risk upfront (building and bringing on early investors), without knowing if anyone even wants it in the first place!

Mint’s founder, Aaron Patzer took a different approach :

Validate the idea → Create a prototype → Build the right team → Raise funding

“Number one rule is to validate your startup idea. I actually didn’t write a line of code until I did about three or four months’ worth of thinking on Mint, which I think is counter to what a lot of people will suggest. A lot of people will say ‘Just get the product out there, just iterate very, very quickly, (and) just make a prototype.”

By having a landing page and bringing people on to the website to sign up, Mint was not only able to validate the demand of their product, but they were also able to test which marketing message appealed to their audience.

But they didn’t stop there.

In order to drive more demand, the team started building a loyal audience by starting a personal finance blog. They brought in the best personal finance experts online, and began to collect emails for those interested in getting notified for Mint’s launch.

The result?

They ended up collecting 30,000 email sign-ups before they even launched. Talk about a waiting list.

Mint was able to minimize the downside by putting up a simple landing page, then building an audience first before writing a single line of code.

They were able to get off the ground strong, and it’s why they were able to sell the business to Intuit for $170M in just two years.

2. Crowdfunding

Before Crowdfunding platforms such as Kickstarter and Indiegogo existed, one had to prototype, build, and then hope that the world wanted what you were selling. If not, you would end up with a warehouse full of unsellable inventory — in addition to wasting thousands of dollars upfront.

Now, with the power of crowdfunding, you can introduce, validate, and generate massive amounts of sales for a product you haven’t created yet.

This removes a huge amount of risk and upfront dollars, which means almost anyone can launch a product into the market without any risk and the potential to start a revenue-generating business from day 1.

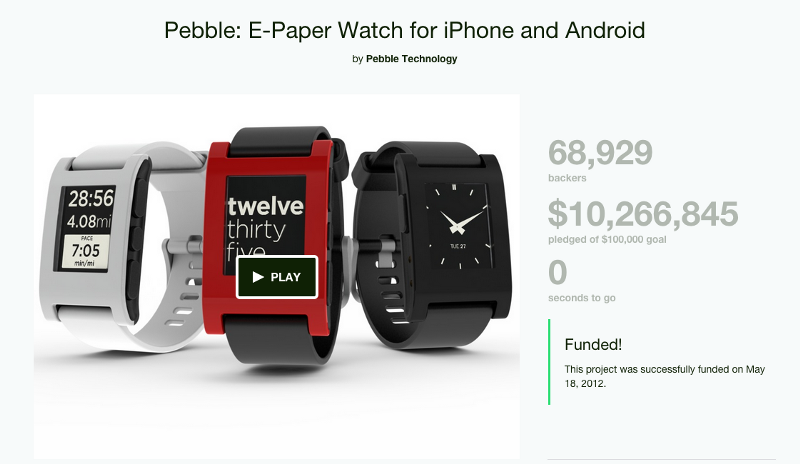

Successful startup ideas such as Pebble, Oculus, and Ouya started with a single video, and were able to raised millions of dollars and use that money to build their product and grow their team.

Although raising millions of dollars in less than a few weeks would be ideal, that’s not the main reason why you should consider crowdfunding.

The core benefit of creating a crowdfunding campaign is it allows you to:

- Get your idea out to thousands of supporters with little to zero capital

- Validate your idea with no downside and unlimited upside

- Earn upfront capital to build and grow your business

If you are interested in learning how to increase your chances of success, here’s how to hack your kickstarter campaign.

3. Webinars

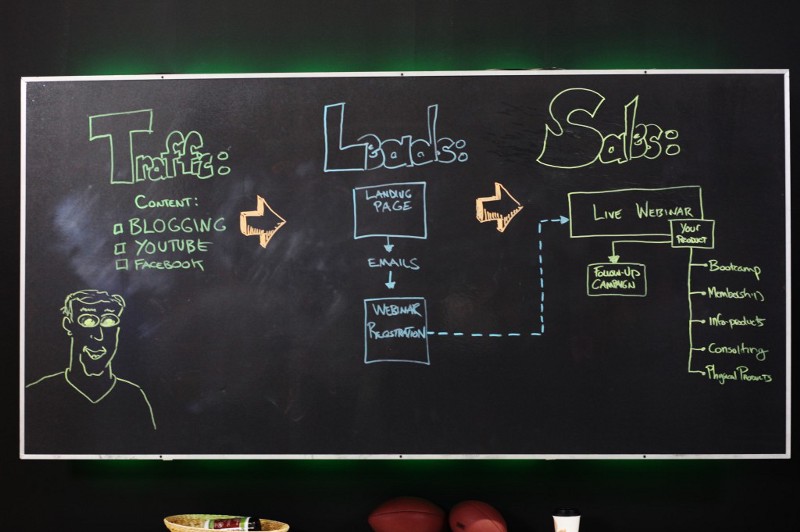

A powerful way to sell a digital product, course, or service before you create it is through live webinars.

This approach is seldomly talked about, and Lewis Howes is well known for teaching this topic.

The goal here is to validate your product/service’s demand by having people pay for the offer upfront before you spend months creating it.

Here’s how it works:

- Create a 1-hour presentation, where you will teach valuable and insightful information around your product & service.

- Drive people to a webinar registration page by:

- Creating content through blogging, social media, youtube, etc.

- Using your current email list

- Targeted Facebook Ads (Aim for $2–3 per registration)

- Partnering up with someone else and using their email list

3. Rock the webinar, and offer your product at the end of the webinar with a link to a checkout page (Paypal, Stripe, etc.).

Note: Don’t bother creating a fancy sales page. Your webinar presentation is your sales, and it’s only going to distract people from buying. Go straight to the checkout.”

From here, you can make several decisions.

If webinar attendees bought your offer:

- Ask buyers what their specific problems are and what they would like to see in the product/course. This is a sure way to deliver exactly what your customers are looking for and meet their needs.

- You can now create your product/course for customers who have already bought your offer.

*Note: If you are delivering an online course, you can:

-Let people know that the course will start in two weeks, which will give you enough time to create the first Module (release one module every week)

-Have live workshops, where people can listen live and ask questions at the workshop. You can record the workshop and use it in your course.

If no one bought:

- Follow up with attendees and ask why they didn’t buy.

Re-evaluate your webinar presentation & offer and try again.

or

- Move on to the next offer. Congratulate yourself that you just saved months of time and potentially thousands of dollars by validating the demand before you created anything. No harm, no foul.

By leveraging the sell before create strategy, Alicia Dunams was able to earn over $21K in one hour.

Talk about minimizing the downside, and winning on the upside!

4. Licensing

Stephen Key is an inventor, entrepreneur, and thought leader.

He makes millions of dollars licensing his ideas to larger corporations, including Disney, Nestle, and Coca-Cola.

What’s even more fascinating about Stephen is that unlike the thousands of other inventors who take years to license their products, it seldomly takes Stephen more than three weeks to go from idea to a signed deal.

How does he do it?

He does it by risking nothing and capitalizing on the upside.

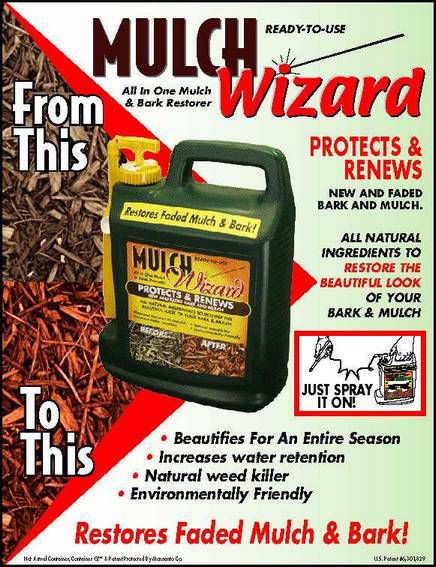

While most other inventors spend $3K to $20K patenting their idea and a few thousand more on the prototype, Stephen takes a lean, no-risk approach.

Here are the steps that Stephen suggests:

- File a Provisional Patent Application ($100) vs. an expensive patent involving lawyers ($3k — $20k)

- Create a sell sheet (an ad for your product on a sheet of paper) vs. creating a prototype

- Make a list of companies that will benefit from your product, and call them to pitch your idea. Click here to get a PDF of the script Stephen uses to call sales managers.

5. Always have an exit plan

The last factor required to minimize the downside is having an exit plan.

When Richard Branson was starting Virgin Atlantic, everyone at Virgin thought he was nuts.

But Richard was initially more concerned about hedging the downside than hitting a home run. He bought his first five planes and managed to negotiate the deal of a lifetime: to give back the planes if things didn’t work out.

In other words: a money-back guarantee.

If he failed, he didn’t lose. But if he won — he won big.

Without minimizing the downside of the venture, Richard would have never gained approval from his partners nor would he himself have taken the risk of jeopardizing Virgin Group without hedging the risk.

In other words, the billion dollar brand that we all know and love may not have existed today. Hedging the downside is not just about playing it safe, it provides you the opportunity to go all-in without having to second guess yourself.

“I said to them that if Virgin Atlantic wasn’t successful, then I wanted to be able to hand the plane back at the end of the first year — therefore protecting the downside.”

All of these examples are entrepreneurs who have figured out a smarter, different way to approach their business launches.

With the tools, strategies, and technologies available today, venturing out on our own does not have to be the risky bet that most of us depict it as.

By strategically validating our idea quickly with little investment, building up pre-demand, and hedging the downside, it’s possible for anyone of us to validate our startup ideas — often without risking anything.

Can you think of a way you can minimize the downside of your business, without capping the upside?

If so, what are you waiting for?