Every morning when a marketer gets into work, just after he or she fires up their computer and grabs that first cup of coffee, they pull out their crystal ball and begin to scan the future skies for potential buyers.

A well-honed third eye is, after all, a crucial quality in a good marketer.

But what about those marketers who — gasp! — can’t see into the future?

Enter: intent data, the tried and trusted crystal ball of savvy B2B marketers.

The opportunity represented by intent data is obvious: find in-market buyers before they enter the funnel by tracking their online behavior and content consumption on different websites.

Get enough of a head start and you can land a deal before they even consider your competition, shorten your sales cycle, and cut your customer acquisition costs.

But the risk represented by bad intent data is even more obvious: tracking user behavior without consent does, after all, go against new GDPR and CCPA regulations and can carry heavy fines.

Misuse information without consent – intentionally or unintentionally – and your organization could be paying the price for years, like Google.

Let’s dive a little deeper into what you need to know before operationalizing intent at your organization and ensure the health of your business.

For those in the back – what is intent data?

Intent data is a valuable predictor of which target accounts are ready to have a conversation or make a purchase. It refers to the behavioral signals that indicate increased interest from your target accounts (or net new accounts) and is often broken down into first-party and third-party data.

First-party intent data, or engagement data, is nothing new. It’s the information captured on or through your own website and channels and is standard fare for most marketers.

Third-party intent data is a different story. Captured by an intent data provider, like our partners Bombora and G2, third-party intent data reflects the behavioral signals made by your targets on sites other than your own.

Because third-party data inherently relies upon a provider, it’s crucial to understand where your intent data comes from and how it was acquired. Let’s review a few of the ways intent data can be collected and distributed below.

Not all intent is created equal

Three of the most popular ways to collect intent data are:

- Independent Websites or Portals

- Publisher Co-Ops

- Bidstream

Independent websites or portals collect consumer information and deliver those insights to 3rd parties. While they lack the scale to collect huge amounts of data, they can also require opt-in and consent from their users in order to traffic their sites.

For example, G2 is an independent online review website that tracks what products consumers are researching and then can deliver that information to the companies in question. This data is hyper-focused on B2B products and is one of the strongest signals of purchase intent.

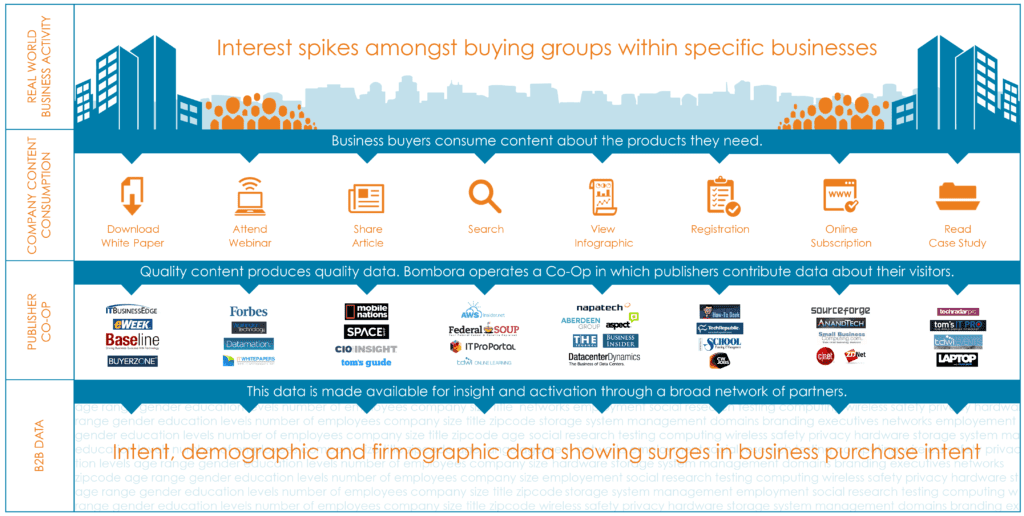

Publisher Co-ops is a collection of many publishers and websites which pool their data so that all participants can benefit from a larger data set. Each publisher or website also asks for consent from their visitors on their first touch.

For example, Bombora relies upon a curated collection of content-rich publishers and partners to collect a massive pool of detailed business firmographics and buyer intent. In exchange for access to this data, co-op participants contribute privacy compliant, brand-anonymous visitor consumption data. Publishers include influential sites like Forbes, G2, BusinessEdge and more.

To make their co-op data even more valuable, however, Bombora also uses deep-learning and natural language models that actually read content and create groupings of related pieces, called topics. With the use of advanced machine learning, Bombora is able to scan billions — with a “b” — of monthly content consumptions and consider lots of keywords within content pieces, while also considering its context, relevancy, and density.

This approach paints a richer, more holistic, and more reliable picture of intent data than the exact match, utilized in keyword-based intent data. With access to timestamping, URLs, IPs, scroll velocity, and dwell time, Bombora can also determine the level of engagement with each content piece – not just a site visit.

Beyond the quality and authenticity of Bombora’s intent data, it’s also GDPR and CCPA compliant. Every participating content publisher and Bombora partner requires opt-in through a standard Terms of Service agreement for site visitors, which reflects the site’s intention to cookie and track behavior.

Bidstream data is user behavior captured by an ad pixel and shared through ad exchanges (there are growing concerns over bidstream’s incompatibility with GDPR).

With bidstream, an ads platform will display an ad on a certain public site and then scrape the keywords present on that site without the web visitor’s consent. This means that if your prospect is searching and viewing sites containing the phrase “social media,” and your social media-related ads are bidding or running on ad placements on that site, your intent provider will collect data.

But, if you’re prospect searches “Facebook, Instagram, or Snapchat,” terms directly relevant to social media, and views a site that does not include your specific keyword, the intent data won’t reflect that prospect’s interest.

Conversely, if you’re a company named “Terminus” and use a bidstream service, you’ll receive intent signals every time an account visits a website about the 2015 movie Terminus, a bus terminus in a random city, a historical article about Atlanta, etc.

Additionally, the additional data that bidstream providers collect, like dwell time, is actually specific to the ad itself – not the content. And further, it’s unclear whether users ever actually opt-in or agree to have their information tracked and shared by you – the person who will take action based on the intent data – because they only consented to share this info with the original site.

Bidstream intent data providers often argue that their intent data collection networks are much larger, and that might be true.

But is high volume, low-quality data really useful to marketers? ABM practitioners know that lower volume, higher quality isn’t a tradeoff — it’s just a better way to do business.

The difference between site visits and surges

While bidstream can collect a large amount of data via keyword scraping, it does so only at the site visit level. This means that the data will be aggregated over time without any sense of baseline, resulting in frequent false positives and demonstrated intent for most accounts.

When a salesperson follows up on an account showing a false positive or false spike in interest and their contact is unqualified – their trust and utilization of this important tool will fall flat.

That’s why it’s important for intent data providers to determine a benchmark for intent, so that only those demonstrating true purchase behavior are surfaced to your sales and marketing teams.

In order to provide quality data to their users, Bombora establishes a target’s baseline of activity around a specific topic. This baseline is crucial because it works under the assumption that a target is likely already searching for and reading content about a topic that relates to your business on a consistent basis. Built on an understanding that if all accounts are showing increased interest, none of them are, Bombora’s baseline helps to identify authentic surges in interest more reliably.

Similar to the Terminus engagement spike, a Surge is when a company exhibits an increased level of research activity or content consumption compared to its historical baseline. Companies ‘surging’ on certain topics are strong indicators of purchase intent or interest in certain products or services.

***

Intent data is an increasingly important piece of the puzzle for B2B marketers and ABM practitioners. That’s why we’ve partnered with G2 and Bombora to include access to these invaluable insights to all of our customers — sorry, psychics.