Nigerian residents are turning to cryptocurrency to fight double-digit inflation and circumvent capital constraints.

It’s never been easier to access the crypto market, but be careful with the exchange that you choose. By the end of this guide, you will be clear on the best crypto exchange in Nigeria for 2025.

We also offer a walkthrough of how to sign up with a trustworthy and low-fee exchange to buy cryptocurrencies today!

The Best Crypto Exchanges Nigeria for 2025

Below you will see a breakdown of the best Nigerian crypto exchanges:

- Capital.com – Overall Best Crypto Exchange Nigeria for 2025

- Crypto.com – Over 250 Cryptocurrencies With Low Fees

- Binance – Low Commission Crypto Exchange and P2P Marketplace for Trading

- Quidax – Africa-Based Crypto Exchange with 24/7 Customer Support

- Luno – Popular Crypto Exchange App for Mobile Traders

- Remitano – Top Crypto Exchange With Over 3 Million Clients

- NairaEX – Best Nigerian-Based Cryptocurrency Exchange for Advanced Traders

As you can see, whether you are a complete novice in cryptocurrency trading, or are a seasoned investor, there is an appropriate exchange for you that will allow you to buy Bitcoin in Nigeria with low fees.

You can read full reviews of the best Nigeria crypto exchanges next.

The Top Bitcoin Exchanges in Nigeria Reviewed

In this section, we go into more detail about the best crypto exchanges in Nigeria.

We cover fees, payment methods, regulations, supported markets, and more to ensure you find the right crypto exchange for your needs.

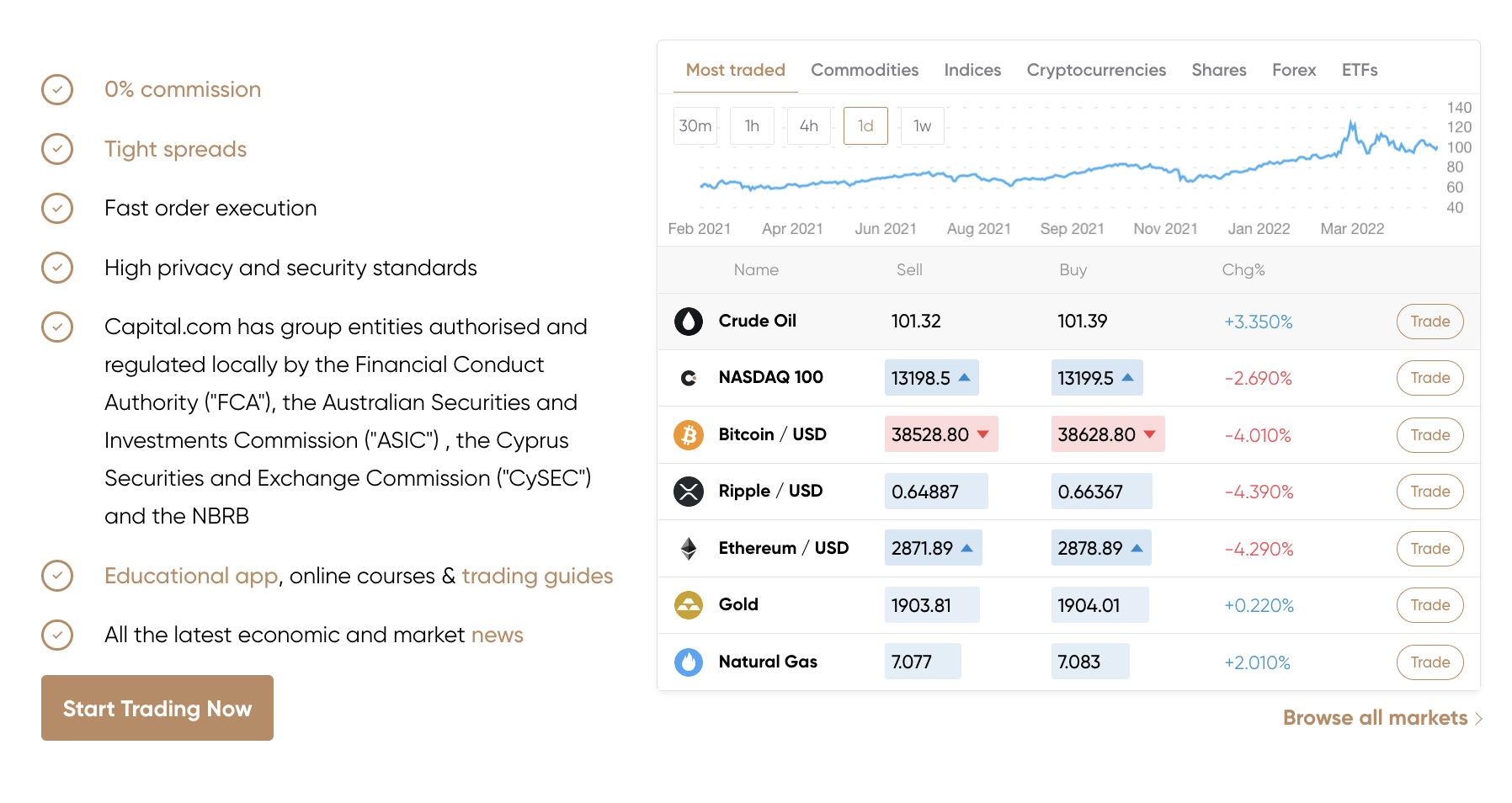

1. Capital.com – Overall Best Crypto Exchange in Nigeria for 2025

This is the overall best Nigeria crypto exchange for traders with varying levels of experience. Capital.com is regulated by the FCA, ASIC, CySEC, and the NBRB, so it is a safe place to trade crypto. Strictly speaking, this is a CFD trading platform, rather than an exchange.

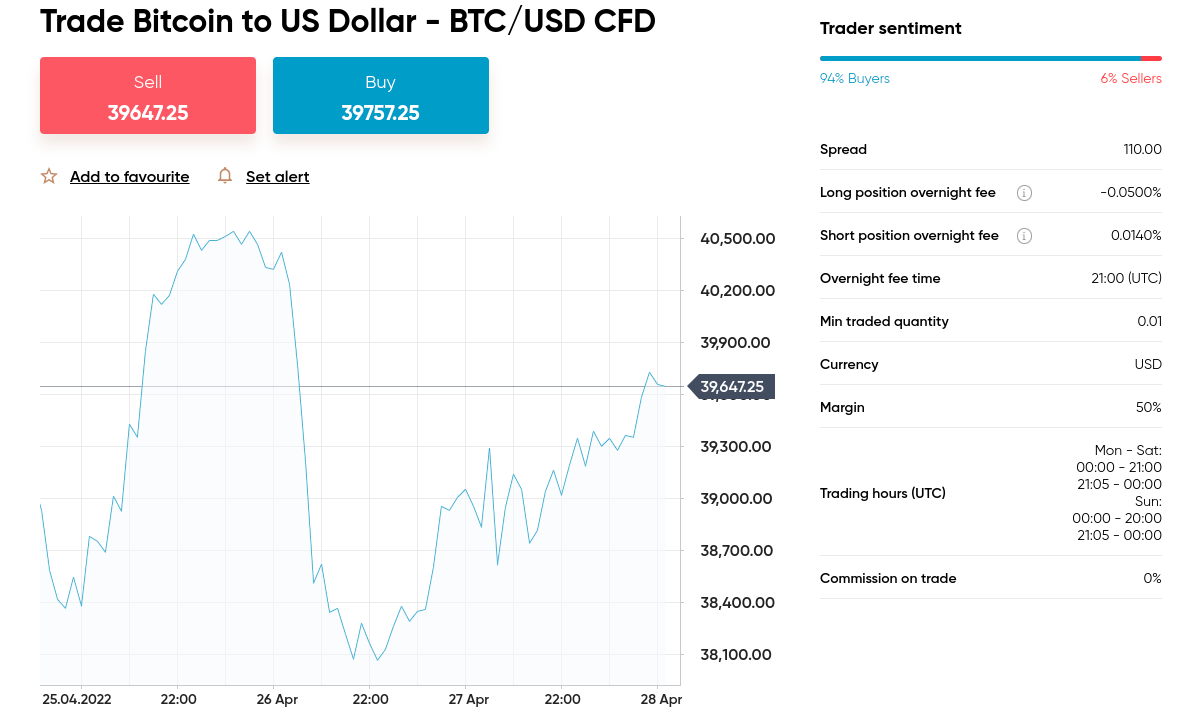

That said, Capital.com allows you to make gains by correctly predicting the direction of the crypto pair in question. Put simply, this saves you from taking on the responsibility of looking after the private keys usually needed to access crypto investments. Moreover, as you are simply speculating on a CFD that tracks a digital asset, you can enter the market with a buy or sell order.

If you believe the underlying asset will fall in value, you will opt to enter the market with a sell order. On the other hand, if you think it will rise, you will place a buy order on your chosen crypto pair. This offers Nigerian traders a great way to make short-term gains. There are more than 470 crypto markets to trade at Capital.com.

With hundreds of markets, you won’t be short of options. Plus, the platform is user-friendly so most traders will find it easy to find their chosen crypto assets. We found cryptocurrencies to include a wide range including Bitcoin, Dogecoin, Litecoin, Ethereum, and many more. You’ll also find the likes of Compound, Aave, Dash, Shiba Inu, and many others.

With hundreds of markets, you won’t be short of options. Plus, the platform is user-friendly so most traders will find it easy to find their chosen crypto assets. We found cryptocurrencies to include a wide range including Bitcoin, Dogecoin, Litecoin, Ethereum, and many more. You’ll also find the likes of Compound, Aave, Dash, Shiba Inu, and many others.

There is no commission to pay when you trade cryptocurrencies at Capital.com, so you will only be charged the spread. For those unfamiliar, this is an indirect trading fee that refers to the difference between the buy and sell price of the asset in question. This is super tight at Capital.com which means the global crypto exchange is also cost-effective.

You can finance your crypto trades with your debit/credit card or one of the various e-wallets. The minimum deposit is $20 on the aforementioned deposit methods. You can also fund your account using a bank wire however do note the minimum, in this case, is $250. This platform offers a free mobile app and is also regulated by multiple bodies globally.

| Number of Cryptos | 470+ markets |

| Debit Card Fee | No fee |

| Fee to Trade Bitcoin | Commission-free |

| Minimum Deposit | $20 on debit/credit cards and e-wallets and $250 on bank wires |

What we like

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

2. Crypto.com – Over 250 Cryptocurrencies With Low Fees

Moreover, if you trade in higher volumes, you will be eligible for a reduction in this fee. This is one of the best Nigerian crypto exchanges for multiple reasons, one of which is that you will find over 250 markets to choose from. This enables you to put together a diverse portfolio of crypto tokens.

One of the advantages of this is that diversification offers another way to mitigate some of the risk involved with trading volatile assets such as digital currencies. Investment options at Crypto.com include everything from long-existing tokens such as Ethereum, Litecoin, and Bitcoin, to meme coins like Dogecoin and Shiba Inu.

You will also find metaverse tokens such as The Graph and Decentraland, although there are lots more. Furthermore, you will have access to a DeFi wallet where you can keep all of your crypto investments. In this case, you will take care of your own private keys. The alternative is to opt to store your tokens in the Crypto.com custodial wallet.

In this case, your private keys are kept safe and Crypto.com provides backup and security for your assets. Crypto.com also allows Nigerians to buy and sell NFTs. We found this to include a wide selection of collectible digital items, covering categories such as music, gaming, art, and celebrities.

The best part is you will not pay a commission to buy NFTs on this platform. After signing up, you can fund your account via a bank wire or a credit/debit card. The minimum deposit is $20, which is around ₦4,150 and debit cards come with a fee of 2.99% per transaction.

| Number of Cryptos | 250+ |

| Debit Card Fee | 2.99% |

| Fee to Buy Bitcoin | Up to 0.40% commission |

| Minimum Deposit | $20 |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

3. Binance – Low Commission Crypto Exchange and P2P Marketplace for Trading

Put simply, Binance P2P is the largest worldwide peer-to-peer marketplace, and it is now available in Nigeria. There are various benefits to using this platform, such as immediately being able to change your Naira to Bitcoin.

You can buy and sell cryptocurrencies on the P2P network whilst directly interacting with other Nigerian merchants and sellers with no transaction fees. Bank Transfers and more than 100 more payment options are available. To access the P2P marketplace, you just need to click ‘Buy Crypto’ on the main dashboard, followed by ‘P2P Trading’.

Keep in mind that this is still highly risky as there is no third party to ensure a smooth transaction. When you trade cryptocurrencies on the main Binance exchange, you will need to pay a standard commission fee of 0.1% on each transaction.

That said, if you elect to buy some BNB tokens to hold in your account, you can pay any fees owed using that instead of your trading funds. This also enables you to claim 25% off trading fees on all cryptocurrency transactions. This crypto exchange offers ongoing client benefits, such as referral commissions of up to 40%.

Binance also runs promotion campaigns and welcome bonuses. For instance, at the time of writing the ‘affiliate invitee’ promotion allows qualified depositors to benefit from a $100 bonus. You can fund your Binance account via bank wire by clicking ‘Deposit’ and selecting ‘NGN’ from the drop-down lists of currencies you see. Then, simply switch to ‘Fiat’ to make the payment.

| Number of Cryptos | 600+ |

| Debit Card Fee | Depends on the payment processor |

| Fee to Trade Bitcoin | 0.1% standard commission |

| Minimum Deposit | Varies depending on the payment type |

What we like

Cryptoassets are a highly volatile unregulated investment product.

4. Quidax – Africa-Based Crypto Exchange with 24/7 Customer Support

Quidax allows you to buy and sell a wide range of cryptocurrencies with either Naira or USDT, which as you likely know is a digital currency pegged to the US dollar. The minimum deposit at Quidax is $10, or the equivalent in Naira at the time of the transaction.

The exchange promises fast transaction speeds. According to the exchange, bank transfers are fee-free. On the other hand, debit cards will attract a 1.4% standard commission. This charge has a max cap of ₦2,000. A withdrawal fee is charged at this exchange, which is a flat rate of ₦100.

This exchange also supports Instant Buy, which allows you to trade crypto assets for a fee of around 1%. Quidax has a native cryptocurrency token called QDX which is built on the Binance Smart Chain. This can be used on the platform for staking, trading fees, financial products, and governance.

Education resources are included in the Quidax academy, which comprises lessons and video tutorials aimed at beginners. There is also an app available so that you can buy and sell cryptocurrencies on your mobile wherever you have an internet connection.

| Number of Cryptos | 20+ |

| Debit Card Fee | 1.4% standard commission with a max cap of N2,000 |

| Fee to Buy Bitcoin | 0.3% standard commission |

| Minimum Deposit | $10 is recommended by the exchange |

What we like

5. Luno – Popular Crypto Exchange App for Mobile Traders

The Luno app – which can be downloaded on your mobile for free is also simple to use so you can buy Bitcoin and other cryptocurrencies in seconds. That said, we should mention there are only eight cryptocurrencies available to trade on this platform, which will be disappointing to some people. If this is the case, consider Capital.com or Crypto.com.

Available cryptocurrencies include Chainlink, USDC, Uniswap, Ripple, and the usual large-cap tokens. The commission fee to trade cryptocurrencies at Luno is 2%, which isn’t very competitive. The minimum deposit is $10.

At the time of writing the platform says you must use vouchers in order to make deposits or withdrawals in Naira. To do this, you need to verify your Luno account to Level 2 or higher. This will allow you to buy a voucher and redeem it so the platform can add the funds to your NGN wallet.

Luno rewards referrals with Bitcoin, this is also under the condition that you have validated your account to a satisfactory level. Traders can also earn interest on certain idle cryptocurrencies. For instance, the interest offered on Bitcoin is up to 1.5%. Conditions apply.

| Number of Cryptos | 8 |

| Debit Card Fee | Not available in Nigeria |

| Fee to Buy Bitcoin | 2% |

| Minimum Deposit | Not stated |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

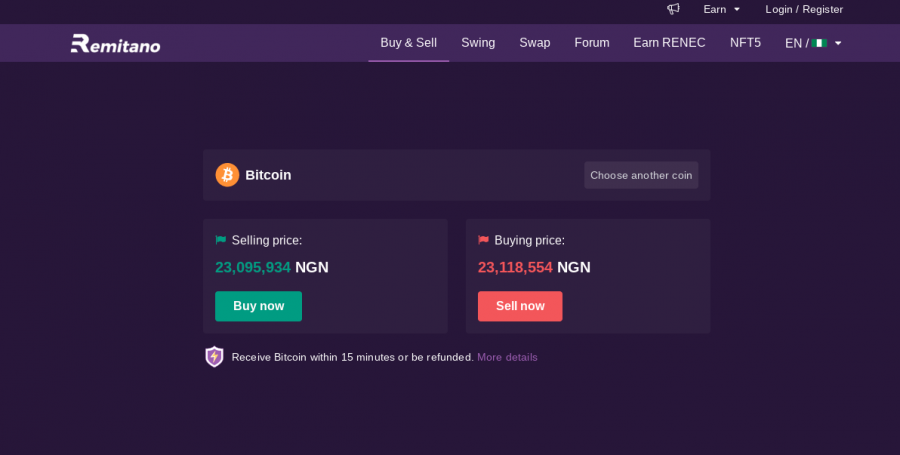

6. Remitano – Top Crypto Exchange With Over 3 Million Clients

However, the Remitano wallet can be used to hold your NGN. With this fiat wallet, you can deposit, withdraw, and trade using your native currency. Trading using a fiat wallet is completely automated, instantaneous, and secure. There are only 10 altcoins available to trade at the time of writing

However, the platform can facilitate purchases immediately. With this in mind, if you want to build a diverse portfolio of digital currencies you will be better off creating an account at Capital.com or Crypto.com. With regards to fees, these are clearly displayed each time you place an order. The commission is 1% of the position size.

As such, if you are allocating ₦1,000 to your chosen asset, the exchange will take ₦10 for completing the order for you. Qualifying investors can buy cryptocurrencies with a 2x margin. Although trading with more than you have should be left to crypto investors with experience.

Keep an eye out for perks such as the exchange’s referrals program which allows investors to earn up to 40% commission. Remitano does not charge a deposit or withdrawal fee on NGN to Nigerian crypto traders, but watch out for charges from processing banks though.

When it comes to the withdrawal of cryptocurrencies to a private wallet, fees are fixed based on the respective token. As such, you will need to check this information. For example, the Bitcoin withdrawal fee is 0.001 BTC, whereas Ripple is charged at 0.25 XRP. This escrowed P2P cryptocurrency exchange also offers a mobile app.

| Number of Cryptos | 10 |

| Debit Card Fee | Not available |

| Fee to Buy Bitcoin | 1% |

| Minimum Deposit | Not stated |

What We Like:

7. NairaEx – Best Bitcoin Exchange In Nigeria for Advanced Traders

NairaEx Pro offers investors a variety of different real-time order books and charting tools. There is also a NairaEx app that allows you to buy and sell cryptocurrencies and receive live price alerts.

Commission fees are included in the price you are quoted for your chosen currency, although there are only five to choose from. This Nigerian crypto exchange lists Bitcoin, Ethereum, Litecoin, Tether, and Bitcoin Cash.

Accepted deposit methods include bank transfer, Nigerian debit cards, and e-currency Perfect Money. You can transfer cryptocurrencies from any wallet or exchange to your NairaEx wallet.

There are some minor network transaction fees when withdrawing Bitcoin from the platform’s proprietary wallet to an external location. From our findings, the fee is 0.0005 BTC. This exchange also offers referral rewards in the form of commission. Nigerian clients are offered one free withdrawal a month.

| Number of Cryptos | 5 |

| Debit Card Fee | No fee |

| Fee to Buy Bitcoin | 0.0005 BTC |

| Minimum Deposit | Not stated |

What We Like:

The Best African Crypto Exchanges Compared

The table below provides a summarized overview of the Bitcoin exchanges reviewed above:

| Crypto Exchange | Number of Coins | Fee for Buying Bitcoin | Debit Card Fee | Supported Payments |

| Capital.com | 470+ | Commission-free | No fee |

Debit/credit card, bank wire, e-wallets

|

| Crypto.com | 250+ | Up to 0.40% | 2.99% |

Debit/credit card, bank wire

|

| Binance | 1,000+ markets | Up to 0.10% | Depends on the payment provider |

Debit/credit card (3rd party), bank wire

|

| Quidax | 20+ | Up to 0.30% | 1.4% standard commission with a cap of ₦2,000 | Bank wire, debit card |

| Luno | 8 | 2% | Not available in Nigeria | Luno vouchers |

| Remitano | 11 | 1% | Not available in Nigeria | Crypto |

| NairaEx | 5 | 0.0005 BTC | No fee |

Bank wire, debit card, Perfect Money

|

How to Choose the Best Cryptocurrency Exchange for You

Researching the best Nigerian crypto exchanges in the market is something you should think about carefully.

To give you an idea of what you can look out for when making your decision, see some considerations below.

Regulation

When you are researching the best Nigerian crypto exchanges, make sure you check out the regulatory status of the platform prior to signing up.

- Signing up with an exchange or online brokerage that holds licenses from regulators should give you a bit of peace of mind that you are trading at a platform that is capable of maintaining standards and sticking to rules.

- That said, you will likely not find one specifically regulated in Nigeria.

- A prime example of this is Crypto.com and Capital.com. Both hold licenses from various regulators.

- Capital.com is watched over by the NBRB, the FCA, CySEC, and ASIC.

In stark contrast, Binance P2P allows you to connect with Nigerian traders and cut out the middleman. But, as we said, this is high-risk with no regulation and there is no one ensuring your crypto trades are executed fairly.

Tradable Cryptos

Whilst this seems obvious, always make sure you check what markets are available. This should be done prior to deciding on the best Bitcoin exchange in Nigeria.

For instance:

- Bitcoin exchanges NairaEx and Quidax offer less than 10 cryptocurrencies

- In contrast, Binance offers 1,000+, and Capital.com has almost 400 markets

The more choice the better when it comes to crypto trading because it’s highly likely you will be looking to diversify and invest in more than one project.

Sign-Up Offers and Promotions

When you’re familiarizing yourself with how to find the best Nigerian crypto exchanges, make sure you check out what offers and promotions might be available to you.

That is to say, some offer a welcome bonus as well as other promotions for existing clients.

- A good example of this would be Binance’s affiliate invitee program whereby qualifying deposits earn up to $100

- Nigerian crypto exchange Remitano offers clients up to 40% on some referrals

- Our number one crypto exchange in Nigeria, Capital.com, offers up to $250 in its refer a friend promotion

Crypto.com offers a signup bonus of $10 or $50 in CRO tokens CRO is the platform’s native currency, which you can then swap for another coin if you wish.

Fees

Watch out for fees, as even the best platforms are going to charge you to access the crypto markets. Many of the platforms that made our list of the best crypto exchanges in Nigeria offer low fees.

For instance, at Capital.com, you have access to hundreds of cryptocurrency pairs, and will only have to pay the spread as the platform is commission-free.

In contrast, Luno will take 2% of your trade amount. Also, look out for deposit and withdrawal fees. For a recap, scroll up to the fee table underneath our reviews of the best Nigerian crypto exchanges.

Tools & Features

Many of the best crypto exchanges in Nigeria offer tools and features to traders. Whilst in many cases this is basic and will include price charts and beginners guides, others allow you to earn interest.

For example, at Crypto.com, you can deposit your idle cryptocurrencies available for loan and earn up to 14.5% yearly interest.

Payment Methods

Check what payment methods are supported when looking for the best crypto exchange in Nigeria.

This is especially the case if you have one in mind already. At Capital.com, you can fund your account with credit/debit cards, bank wire, and also e-wallets like Paypal.

Customer Service

The best Bitcoin exchange in Nigeria will offer great and varied customer service.

Things to look for are 24/7 assistance, live chat, active telephone numbers, and email. You can also research what other traders say about the customer service on the platform.

How to Use a Crypto Exchange in Nigeria

When you’re feeling confident enough to hit the markets and trade cryptocurrencies, you will need to sign up with an exchange or online brokerage.

Next, you will see a step-by-step of how to sign up and place an order at the best crypto exchange in Nigeria – Capital.com.

Here you also have the flexibility of trying to make gains from both the rise and fall of your chosen digital asset via leveraged crypto CFDs.

Step 1: Open Capital.com Account

When you arrive at Capital.com, look for the button marked ‘Trade Now’. Next, you can begin to enter your personal details. The platform will require your name, email address, and mobile phone number.

You can also think up a username and password that’s unique to you. This will give you, and only you, access to your trading account.

As well as being one of the best cryptocurrency exchanges, Capital.com is a well-respected platform that adheres to rules set out by numerous regulators. As such, you will need to upload some ID.

This is a quick process and simply entails uploading a photo of your Nigerian passport or e-ID card.

You can also attach a copy of a recent bank statement or bill, such as one from a utility company. The latter is to prove your address. Check Capital.com for more document options.

Step 2: Deposit Funds

You only need $20 (which is around ₦8,300) to get started at Capital.com. As you might expect from the best crypto exchange in Nigeria, Capital.com accepts multiple payment types.

To start trading cryptocurrencies, click ‘Deposit’ and enter an amount of $20 or more.

You can choose between payment methods such as bank wire and a debit/credit card. Other supported payment methods include Apple Pay, PayPal, Sofort, Ideal, and Giropay.

There are lots more so check the Capital.com website for more details.

Step 3: Find Crypto to Trade

The best crypto exchange in Nigeria should make finding your chosen asset simple. Here, we are using the search bar to locate the crypto pair BTC/USD.

Type your chosen cryptocurrency pair into the search bar and click to go to the relevant trading page.

Step 4: Trade Crypto

When you are taken to the screen specific to your chosen crypto pair, you can click buy or sell to place your order.

As we said, Capital.com is the best crypto exchange in Nigeria for many reasons, one of which is that it is a CFD platform.

This means you can place a buy order if you believe the crypto asset will increase in value, or a sell position if you think it will fall.

Enter your chosen stake and confirm your trading order.

Are Crypto Exchanges Legal in Nigeria?

When you are searching for the best crypto exchange in Nigeria, you may wonder whether they are legal.

- There has been a lot of news surrounding this subject, particularly throughout 2021

- This followed the Central Bank of Nigeria’s decision to ban financial institutions from enabling the payment of cryptocurrencies

- To offer some clarification on this subject, buying cryptocurrencies is not illegal in Nigeria

- However, paying for them with your local bank account might be problematic at some exchanges

As such, make sure you research what payment types will be available to your prior to signing up with the best crypto exchange in Nigeria.

Conclusion

There are so many cryptocurrency exchanges out there it can be hard to choose the best platform for your goals. We’ve saved you some legwork today and reviewed the very best crypto exchanges in Nigeria.

Nigerians can trade in safety at the CFD trading platform Capital.com, as it is regulated by four licensing bodies.

This includes the FCA in the UK, ASIC in Australia, NBRB in Belarus, and CySEC in Cyprus. The broker offers commission-free trading to Nigerians and there are nearly 400 crypto pairs to choose from.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.