In complex B2B sales, there’s a common recognition that multiple stakeholders are almost always involved in the decision-making process. Research by the CEB (now part of Gartner) found that the average number was 6.8 and rising.

In some deals, that number is even higher, and it’s increasingly rare for a single decision-maker to be able to drive through a significant business purchase without the active involvement of their colleagues.

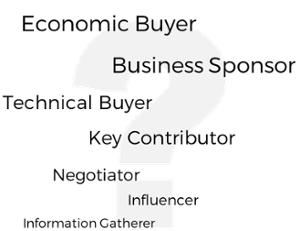

Few sales leaders would disagree with the importance of identifying, engaging and assessing these stakeholders. But many sales methodologies take an over-simplistic approach, attempting to categorize these stakeholders along a single dimension…

An over-simplistic approach

Some, for example, choose to emphasize the role the stakeholder plays in the buying process: are they the economic buyer, the business sponsor, the technical buyer, or merely an influencer?

Others attempt to assess the stakeholder’s degree of influence over the buying process, and yet others attempt to assess the stakeholder’s attitude to us.

Yet others attempt to characterize the primary contact as go-getters, skeptics, friends, teachers, guides, climbers or blockers.

And some mix up these internal and external-facing factors into a somewhat confusing one-dimensional mash-up.

In truth, all of these factors are important, and any attempt to channel our assessment of stakeholders along any single dimension is inevitably an over-simplification.

That’s why any effective assessment of the stakeholder group needs to take into account a number of different factors – their role in the decision, their influence over the decision, their attitude towards us, their top business priority as it relates to the current project, their single most important decision factor and our key value to them.

Identifying and engaging the stakeholder group

But, of course, we can’t start to assess these factors until and unless we manage to identify as many as possible of these stakeholders. Asking our current prime contact whether they are the ultimate decision maker won’t always return an accurate answer.

Sometimes, we’ll need to take a lateral approach, by asking – for example – which other roles and departments are affected by the issue, or by asking our contact to describe how other similar decisions have been made in the past.

If we haven’t identified a significant number of stakeholders, we’re probably missing some important people. If we remain stubbornly single-threaded through one individual, we inevitably will be.

We may need to persuade our prime contact that it is their interest to collaborate with us in opening up access to their fellow stakeholders. It’s easier to do this if they are genuinely serious about making change happen and see us as a credible option. If neither of these things are true, we’ve got to wonder whether the opportunity is real or worth pursuing.

We will probably need to earn the right to engage these stakeholders by sharing valuable experience and offering valuable stories and insights that they see as being relevant to their role. We’re far less likely to succeed if we come across as just another pushy sales person.

A multi-dimensional assessment

Once we have engaged these additional stakeholders, we need to consider the following:

Their role in the decision process

Is their primary role one of an economic buyer, business sponsor, technical buyer, one of the other key contributors, a negotiator (legal or procurement), an influencer or merely an information gatherer?

Their influence over the final decision

Are they the dominant influence – able to make or break the project or do they have a strong, average, weak or non-existent influence over the final decision?

Their attitude towards us

Are they a full-on champion for our cause, or are they positive, neutral, negative or a potential blocker?

Their top business priority

What is their single most important business priority when it comes to this specific project? How will they and their department benefit from our solution? How will they and their department suffer if the status quo were to prevail?

Their key decision factor

What is the single most important factor influencing their decision when it comes to this project? And how does each individual stakeholder’s key decision factor relate to that of their colleagues?

Our key value to them

What is the single most valuable thing that our proposed solution will deliver to them? How does this affect their personal and department performance?

The inevitability of imperfect knowledge

It’s hard to assess all of these factors accurately for every single stakeholder. It’s likely that some of the factors will be unknown. But knowing what we don’t yet know can help to establish what we need to know next. And having a partial understanding is a heck of a lot better than no understanding at all.

If we are to take this exercise seriously (and it’s of little value if we don’t) then we need to avoid wishful thinking or guesswork. It’s better to acknowledge that we don’t know than to make it up.

Imperfect knowledge is a lot better than none at all. When we look back on deals that we have lost, it won’t be unusual to conclude that part of the reason is that we failed to understand or navigate the prospect’s internal politics.

That’s why our stakeholder analysis always needs to have more than one dimension…