As you go about your daily business it’s unlikely that you’ll come into contact with many people who think that a pair of jeans and a nuclear power plant have a lot in common. And with good reason. Both can keep you warm, but there are some blindingly obvious differences such the physical features and the level of danger (although some of those skinny jeans can be quite hazardous if one lunges unexpectedly).

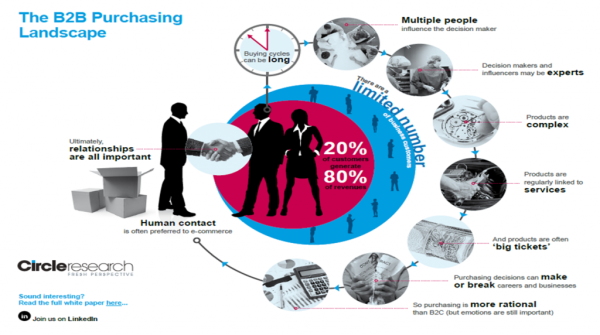

The example is tongue-in-cheek, but the point is quite serious. There are fundamental differences between B2C and B2B markets. In fact, as illustrated in the infographic below, there are 12 key features which make B2B markets unique.

These unique features of B2B markets have important implications when conducting B2B market research. B2B research differs from B2C research in 10 key respects:

- Mixed methodology studies are more common in B2B. Consumer researchers often label themselves as ‘qualitative’ or ‘quantitative’. Some even go so far as to label themselves with a particular methodology, e.g. an ‘ethnographic’ researcher. The complexity of B2B markets though means that multiple research methods often need to be used in conjunction. The findings garnered from desk research can help to frame a good qualitative interview and a thorough focus group can help provide relevant answer options for a quantitative survey. That’s why most B2B researchers are ‘methodology neutral’ and skilled in many approaches

- The tele-depth methodology is more common in qualitative B2B. Business decision makers conduct a lot of their transactions by phone. Furthermore, meeting with people takes up limited meeting rooms and consumes time beyond the meeting itself (e.g. organising a venue, meeting and greeting). This means that tele-depth interviews are often the preference of B2B respondents and can gain a better quality of information than face-to-face interviews (the opposite is true in consumer research)

- Focus groups are rarer in qualitative B2B studies. The target audience of interest in B2B studies often comprises senior, time poor decision makers. Furthermore, these individuals are often geographically dispersed and operate in competition to each other. This means that focus groups are often simply not a realistic option in B2B studies

- Sample sizes are smaller in quantitative B2B studies. The limited number of buyers in B2B markets means that fewer interviews are practical and indeed necessary. For example, as a rule of thumb a minimum of 50 quantitative interviews are needed to provide a reasonable degree of reliability in B2B research, but in consumer research this would be far too low (several hundred would be more appropriate given the population size)

- In B2B research the entire decision making unit rather than just the individual is represented. Multiple people are usually involved in B2B purchase decisions. This means that any research should explore all views and do so in a way which allows different ‘types’ to be analysed in isolation, e.g. users of the product, financial decision makers

- B2B respondents are harder to reach. B2B decision makers are busy – they’re at work and they’re inundated with requests for their time from colleagues, suppliers, clients and…market researchers. This means that they need to be carefully persuaded to support any research exercise. And before you even have the opportunity to persuade them you need to get past any ‘gatekeeper’ such as a secretary or PA

- Relationships are leveraged and respected in B2B research. B2B buyers often have an individual within the supplier organisation that they regularly deal with, e.g. an Account Manager. The support of this individual is invaluable in getting past gatekeepers and persuading respondents to support the research. It’s also critical to keep them informed as they ‘own’ the relationship and will need to act on the research findings

- Expert interviewers are needed. In B2B markets products tend to be complex and respondents are often expert in their field. This means that the research team needs to have a good working knowledge of the product area and industry. This allows them to design smart surveys which look beyond the superficial, hold intelligent conversations and interpret the results in a meaningful way

- B2B analysis reflects the 80/20 rule. As B2B markets tend to have a small number of disproportionately important customers in them, B2B research should reflect this. For example, quantitative studies might over-weight the views of large customers over smaller ones

- Respondent anonymity is often waived in B2B. In consumer studies it’s rare for survey responses to be attributed back to a named individual. In B2B research though it can be a valuable relationship building tool . Confidentiality is promised to those sharing their opinion, but they’re asked if they would like a direct follow up because that’s often what they want, e.g. for an issue to be reported to and actioned by their Account Manager

All of the above mean that consumer research techniques can’t simply be overlaid onto B2B markets. Rather, a unique approach is required for what is a different and potentially more challenging market environment.