1. Car buyers spend 59% of their time online researching. (Autotrader)

2. When researching online, 46% of car shoppers use multiple devices. (Autotrader)

3. Most car buyers are undecided at the start of the shopping process. When they first begin to shop, 6 out of 10 them are open to considering multiple vehicle options. (Autotrader)

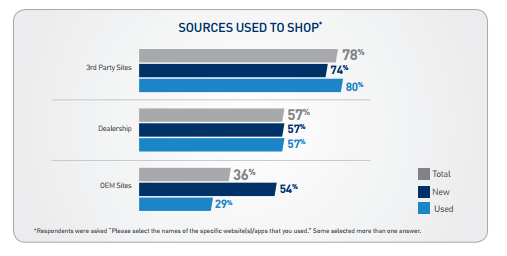

4. Third-party sites are the most used sites for car shopping, used by 78% of shoppers. (Autotrader)

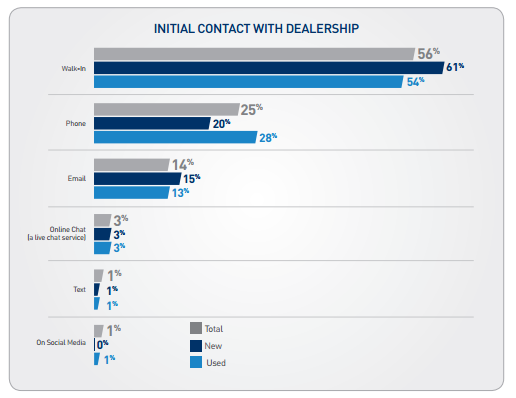

5. Walking in remains the common form of initial contact with a dealership by more than half of car shoppers. (Autotrader)

6. The top five activities conducted online by car shoppers include researching car prices (71%), finding actual cars listed for sale (68%), comparing different models (64%), finding out what current car is worth (63%), and locating a dealer or getting dealer info (46%). (Autotrader)

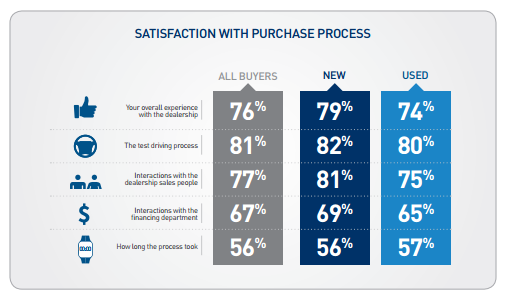

7. When asked to rate their satisfaction on a scale of 1-10, 81% of car buyers rated the test-driving experience an 8-10. However, satisfaction dropped to 67% when interactions with the F&I department were included. Out of the average 3 hours spent at the dealership during the buying process, over half of that time is spent negotiating or completing paperwork, leading to a satisfaction rate of 56% for the overall process. (Autotrader)

8. Among automotive internet shoppers, 22% use a social media site as a source while shopping for their new vehicle, up from 16% in 2015. The most popular social media sites used by auto internet shoppers during the shopping process are YouTube (13%), DealerRater (7%) and Facebook (5%). (D. Power 2016 New Autoshopper Study)

9. Among automotive internet shoppers who use social media, only 13% indicate that the information posted on social media sites influenced their purchase decision, and only 2% say a social site was the “most useful site” they visited. (D. Power 2016 New Autoshopper Study)

10. Slightly more than one-third (34%) of new-vehicle buyers using social media for automotive information post a picture of their new vehicle on a social site. Facebook is by far the most posted site at 88%, followed by Instagram at 21%. (D. Power 2016 New Autoshopper Study)

11. Smartphones Surpass Tablets for Automotive Research: More than half (53%) of automotive internet shoppers use a mobile device in their quest for automotive information. For 2016, smartphone usage surpasses tablet usage (37% vs. 33%, respectively). The use of desktop or laptop computers remains most common at 92%, but has been steadily decreasing from 99% in 2012. Consequently, the proportion of time spent shopping on mobile devices continues to increase, with 33% of the total shopping time now conducted on a mobile device. (D. Power 2016 New Autoshopper Study)

12. When looking to buy, Millennials consider slightly more vehicles on average than Baby Boomers. Millennials also usually take longer to decide what car to buy than Baby Boomers, an average of 16.9 vs 15.7 weeks. Millennials invest more time in the actual buying process as well, almost four and a half hours more on average. (D. Power)

13. 87% of Americans dislike something about car shopping at dealerships and 61% feel they’re taken advantage of while there. (2016 Beepi Consumer Automotive Index)

14. 52% of car shoppers feel anxious or uncomfortable at dealerships. Millennials lead the pack in their dislike, with 56% saying they’d rather clean their homes than negotiate with a car dealer. Gen X-ers aren’t fans either, and faced with alternatives 24% say they’d rather have a root canal than get into car negotiation. Among millennial women, 62% feel pressured to buy right away and 49% said they felt tricked into buying features they didn’t need. (2016 Beepi Consumer Automotive Index)

15. When asked about newer car buying alternatives, 54% said they would “love” being able to sell or buy a car from home and 42% were fine buying a car without a test drive, as long as there was some form of guarantee. (2016 Beepi Consumer Automotive Index)

16. According to research from Facebook, US vehicle shoppers not only use mobile devices as they research new cars, they even prefer them for some activities. A majority of vehicle shoppers, for example, said mobile was a better way to ask friends and family about auto options, and about two in five preferred to book a test drive from a mobile device.

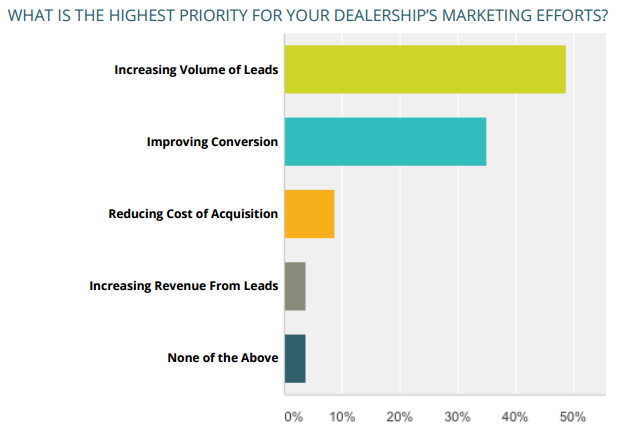

17. For automotive dealers, the biggest marketing priority by far is increasing lead volume and conversions. (9 Clouds, “The 2016 State of Automotive Marketing”)

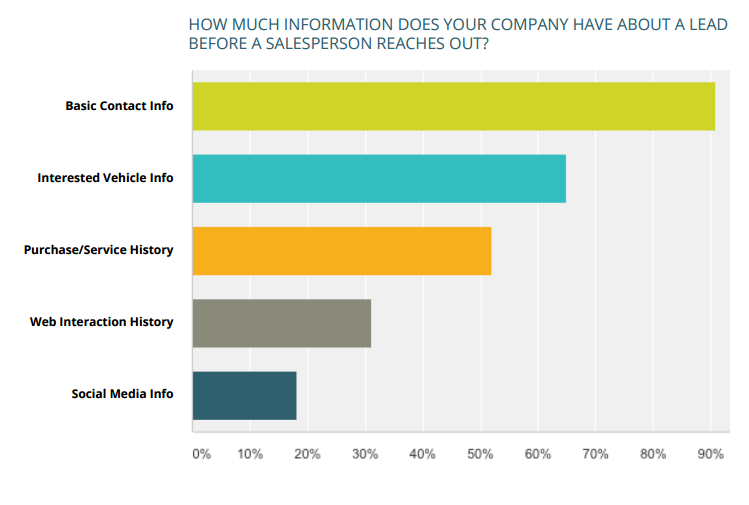

18. Dealerships are also utilizing the data they have on hand prior to contacting a prospect. The most common pieces of consumer data include basic contact details, vehicle interest, and purchase/service history. (9 Clouds, “The 2016 State of Automotive Marketing”)

19. A study by ACA Research maps out the automotive customer journey and the timing for key events from initial research to final purchase. According to the research, “Generally the automotive vehicle purchase journey for the vehicle and finance can take between 5 and 12 weeks and encompasses the following steps.”

- Develop a shopping list of vehicle brands: approx. 1-3 months prior to purchase.

- Cull the shortlist: 4-7 weeks before purchase.

- Test drive vehicles: 2-4 weeks before purchase.

- Finalize vehicle choice: on average 1-3 weeks before purchase.

20. 54% of consumers would buy from a dealership that offers their preferred experience, even if it didn’t have the lowest price. (Autotrader)

21. 72% would visit dealerships more often if the buying process was improved. (Autotrader)

22. Research that Google commissioned from Millward Brown Digital indicates that 70% of people who used YouTube as part of their car buying process were influenced by what they watched and views on YouTube of test drives, features and options, and walk-throughs have doubled in the past year.

23. A report by automotive research company, SBD provides evidence that these connected systems are important to younger, more digitally oriented consumers and will likely impact their next vehicle brand purchase decision. Cars play a key role in supporting Millennials’ need to stay connected, and in a study by Autotrader.com, 72% of younger millennials indicated that a car is important to their social life. Style and features, especially technology, are critically important to them. For example, more than 70% of younger millennials cite technology and infotainment features as “must-haves” when purchasing a car.

24. Integrated mobile apps and connected vehicle services deliver more value for the customer, enhancing customer loyalty after the initial car purchase. A study by DMEautomotive showed that vehicle buyers using a branded app were 73% more likely to make a purchase from the dealership, and after making a purchase, booked 25% more service appointments than shoppers without an app. They also spent more money than non-app users when purchasing a vehicle, 7% more according to a study commissioned by Cars.com.

25. According to a study by Arthur D. Little, dealers average response time is 9.2 hours and OEMs average time is around 24 hours. This is a huge opportunity for improving the overall customer experience.