The cryptocurrency space in Australia is growing day by day. When looking for the best exchange to buy crypto in Australia, the decision often comes down to Swyftx or CoinSpot.

In this guide, we make a thorough comparison of Swyftx vs CoinSpot. We analyze and review both these popular platforms based on supported cryptocurrencies, products and services, ease of use, deposit options, and more of the differences and similiarties between the two.

Swyftx vs CoinSpot at a Glance

Swyftx and CoinSpot are two of Australia’s most popular cryptocurrency platforms. Both offer a wide range of services that cater to crypto investors across all levels.

Here is a quick overview of our Swyftx vs Coinspot findings:

- Swyftx offers some of the lowest fees for trading digital assets – at just 0.6% per trade. The platform incorporates staking features for digital currencies and facilitates automated crypto investments using recurring deposits. Swyftx also accepts credit/debit card payments and makes it easy to diversify investments via crypto bundles.

- CoinSpot is a beginner-friendly exchange that lets users buy, sell, and trade cryptocurrencies in Australia. In terms of products, CoinSpot has a portfolio that is more or less similar to that of Swyftx. However, it also includes an NFT marketplace – a feature that is missing from its competitor. One notable drawback is that CoinSpot does not support deposits via credit/debit cards and additionally, trading fees here can go as high as 1%.

Throughout this guide, we have added in-depth comparisons to shine more light on how these platforms stack up against each other.

That being said, when searching for the best crypto exchange in Australia, it would also be smart to consider other leading providers in the market – such as eToro, an ASIC (Australian Securities and Investments Commission) regulated online broker with social trading and copy trading tools.

Cryptoassets are a highly volatile unregulated investment product.

Comparing Swyftx to CoinSpot

| Fees & Features | Swyftx | CoinSpot |

| Licensing | Registered with AUSTRAC | Registered with AUSTRAC, certified by Blockchain Australia and Sci Qual |

| Number of Cryptocurrencies | 320+ | 360+ |

| Pricing Structure | 0.6% trading commission + transaction fee; lower with higher trading volumes | 1% trading commission + transaction fee; 0.1% with OTC markets |

| Fee for Buying Bitcoin | 0.6% | 1% |

| Trading Tools and Features | Technical charts, advanced order types, crypto bundles, recurring buys, crypto interest accounts, portfolio tracking, OTC market | Price alerts, crypto bundles, recurring buys, crypto interest accounts, OTC market, NFT marketplace |

| Mobile App Rating | 4/5 | 4/5 |

| Payment Methods | PayID, OSKO, bank transfer, POLi, credit/debit cards | BPAY, Cash, PayID, POLi, direct deposit |

| Minimum Deposit | 75 AUD | 1 AUD for POLi, PayID, direct deposits; 5 AUD for BPAY; 50 AUD for cash deposits |

| Demo Account | Yes (10,000 AUD) | No |

What are Swyftx & CoinSpot?

Below is a quick introduction to both Swyftx and CoinSpot:

Swyftx Overview

Swyftx entered the Australian crypto market in 2018. The platform operates as a cryptocurrency exchange and facilitates the purchase of digital assets with multiple payment methods, including credit cards. Swyftx also comes with an advanced portfolio management tool that lets users track real-time profit and loss.

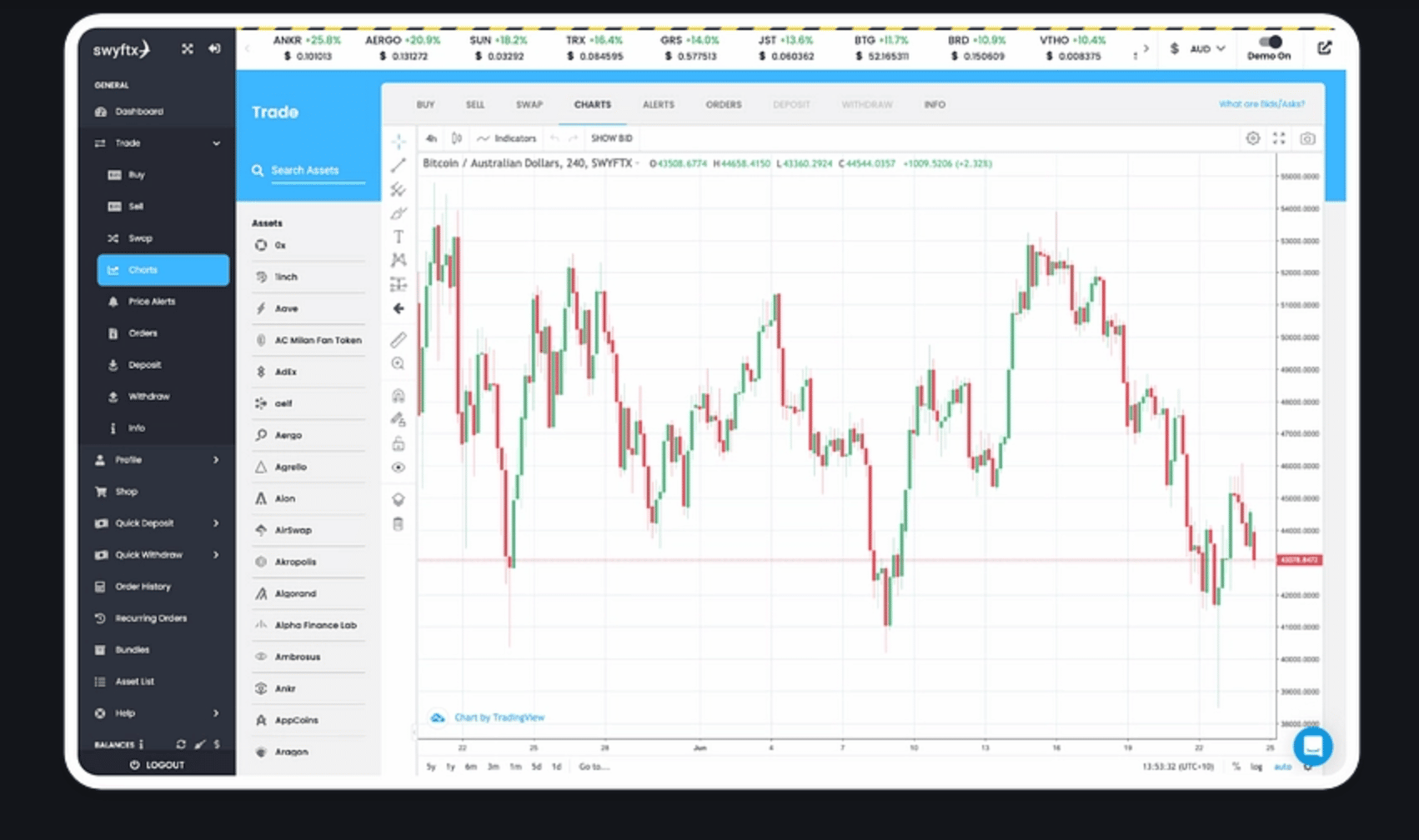

Swyftx has an extensive library of over 320 digital assets, making it easy for users to diversify their crypto investments. The platform also facilitates crypto trading with the help of advanced price charts, order types, and more. That being said, Swyftx is best known for its staking services.

Swyftx users can open a savings account for 20 cryptocurrencies and earn impressive interest rates. Moreover, the platform comes with an in-built free demo account, which is particularly useful for beginners. In terms of security, Swyftx is registered with AUSTRAC and has implemented all relevant industry-standard measures for the safety of its platform.

Finally, Swyftx is preferred by many traders due to its low trading fees. The highest trading fee charged by Swyftx is 0.6%. In 2021, Swyftx also expanded its services to cater to the New Zealand market.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

CoinSpot Overview

CoinSpot is also the first cryptocurrency platform in Australia to receive the internationally recognized ISO 27001 certification for information security. The provider offers Australia’s largest variety of digital assets, supporting over 360 cryptocurrencies. CoinSpot also integrates with a long list of payment methods – which includes BPAY, Direct, and PayID.

However, this platform does not accept credit/debit cards, which might turn away some users. Its OTC market is another top attraction, which allows users to purchase a large volume of cryptocurrencies. Fees when trading crypto via the OTC market are much lower when compared to the platform’s standard commission policy.

Moreover, CoinSpot also sets itself apart by offering an in-built NFT marketplace. CoinSpot is highly favored by Australian users due to the high standard of security offered. Like Swyftx, CoinSpot is also registered with AUSTRAC. In addition to this, the platform also possesses certification from Blockchain Australia.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Tradable Cryptocurrencies on Swyftx & CoinSpot

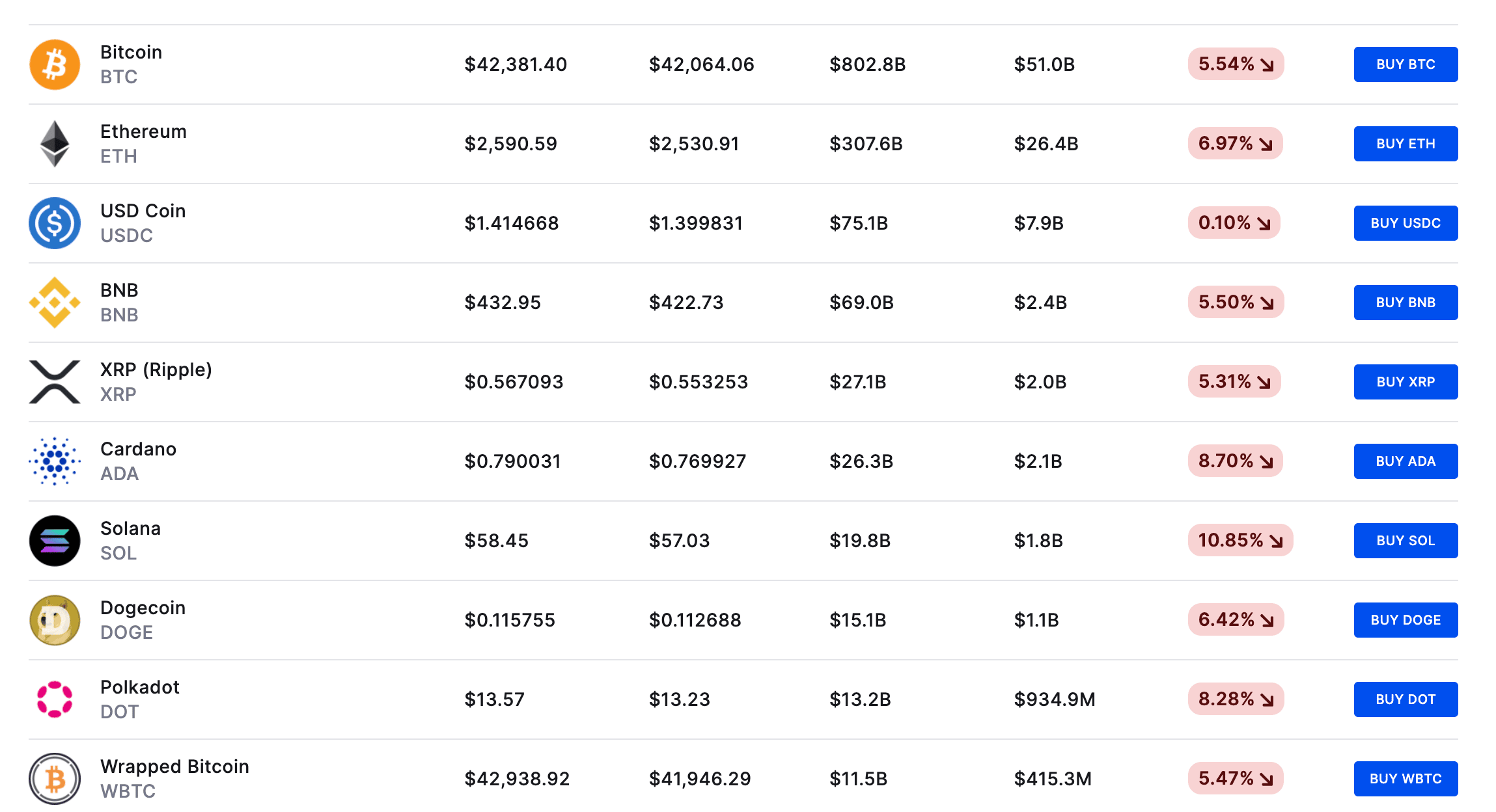

One of the most important considerations when choosing a crypto platform is the number of digital assets supported by the provider. As we noted earlier, both Swyftx and CoinSpot offer over 300 crypto coins, including many prominent stablecoins, altcoins, DeFi tokens, and more.

However, CoinSpot nudges in front, giving its users access to nearly 40 cryptocurrencies more than Swftyx. In addition to this, CoinSpot also comes up ahead as one of the best NFT marketplaces in Australia.

Since Swyftx and CoinSpot are native Australian exchanges, they both accept AUD deposits. Swyftx also allows its users to fund their accounts with NZD.

Account Types

Unlike some other prominent exchanges, neither Swyftx nor CoinSpot offers different account types. This means that users can access all features of the platforms with a single account.

However, bear in mind that both platforms have KYC requirements in place, and as such, users will need to verify their identity to proceed.

Moreover, as we noted earlier, Swyftx offers a demo trading facility, which can be accessed via the standard account. This will come in handy for users who are new to the crypto space.

Swyftx Fees vs CoinSpot Fees

When comparing CoinSpot vs Swyftx, one of the main differences is in the fees charged.

Fees on Swyftx are highly competitive, with the platform charging just 0.60% for trading. Moreover, users who trade high volumes can also get discounted fees.

On the other hand, CoinSpot charges 1% for buying and selling cryptocurrencies. However, the platform features an OTC market that offers a low fee of just 0.10% for those eligible.

Swyftx also offers some of the tightest spreads among crypto exchanges in Australia. The average spread charged by Swyftx is 1.70%, and this can go as low as 0.41%. In comparison, the spreads on CoinSpot are less competitive – typically between 3 to 4%.

Below, we have included detailed comparisons of the different fees charged by these platforms.

| Trading fees | Swyftx | CoinSpot |

| Instant buy, sell & swap | 0.60% | 1% |

| OTC markets | NA | 0.10% |

| Market and other trading orders | 0.60% per order; discounts are available for high volume traders | 1% |

| Recurring buy | 0.60% | 1% |

| Fees for buying 100 AUD worth of Bitcoin | 0.60 AUD | 1 AUD standard commission, 0.1 AUD via OTC market |

When choosing between Swyftx and CoinSpot, users should also consider deposit fees.

Swyftx does not directly charge fees for processing deposits or withdrawals. However, users might be liable to pay up to 4% via third-party payment processors when depositing funds through a credit/debit card.

On CoinSpot, the maximum fee charged is 2.5% – for cash deposits.

| Non-Trading Fees | Swyftx | CoinSpot |

| AUD deposits | Third-party fees apply for credit/debit card payments |

POLi, PayID, direct deposits –

free; BPAY – 0.9%; cash – 2.5% |

| AUD withdrawals | Free | Free |

| Crypto deposits | Blockchain network fees | Blockchain network fees |

| Crypto withdrawals | Blockchain network fees | Blockchain network fees |

Swyftx vs CoinSpot User Experience

When it comes to the user experience, CoinSpot and Swyftx have done an excellent job.

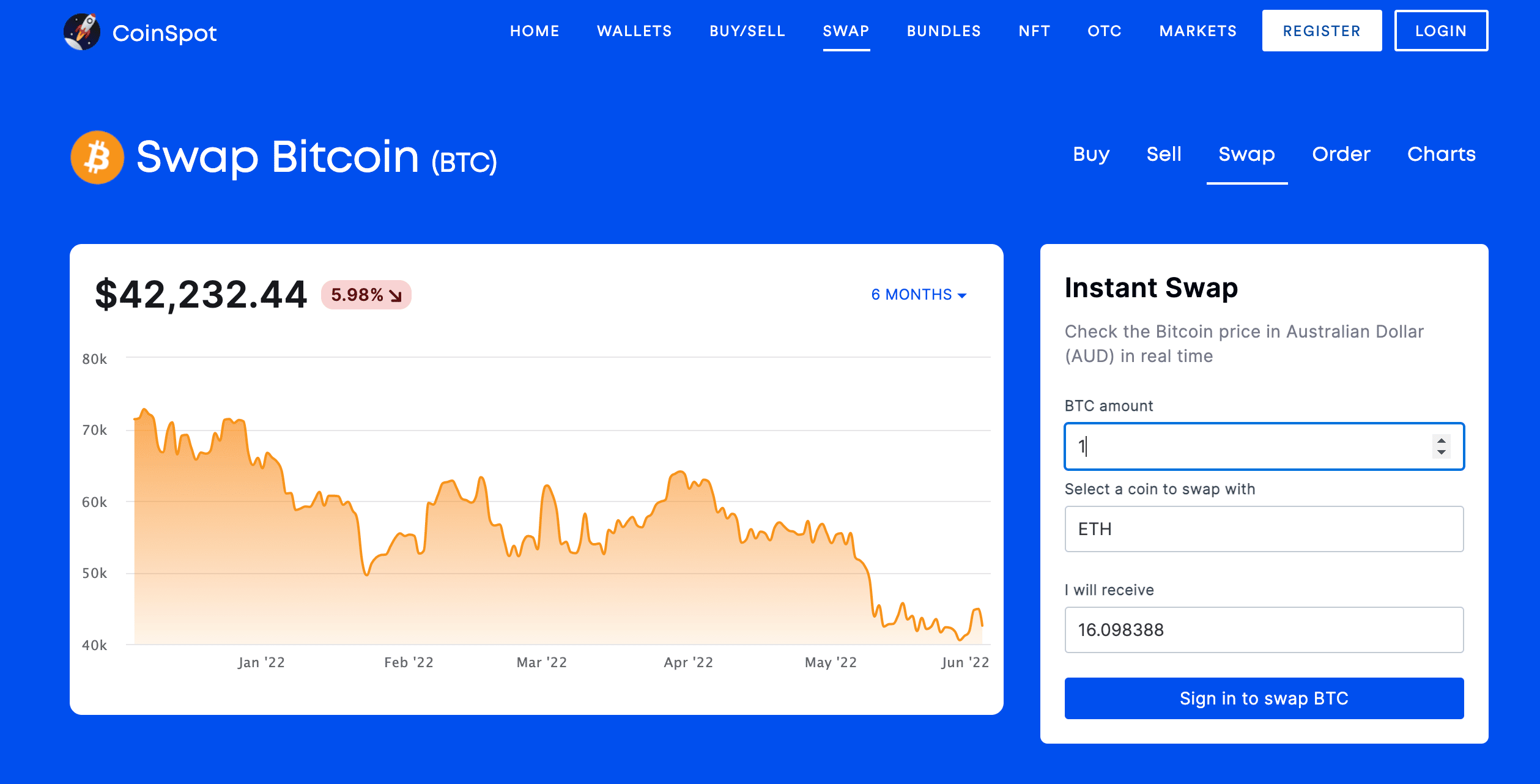

Both platforms feature a friendly interface catering to both novices and experienced traders. However, we found CoinSpot to be one of the best crypto exchanges in Australia for beginners – as it is more intuitive and adaptive to the needs of newbies.

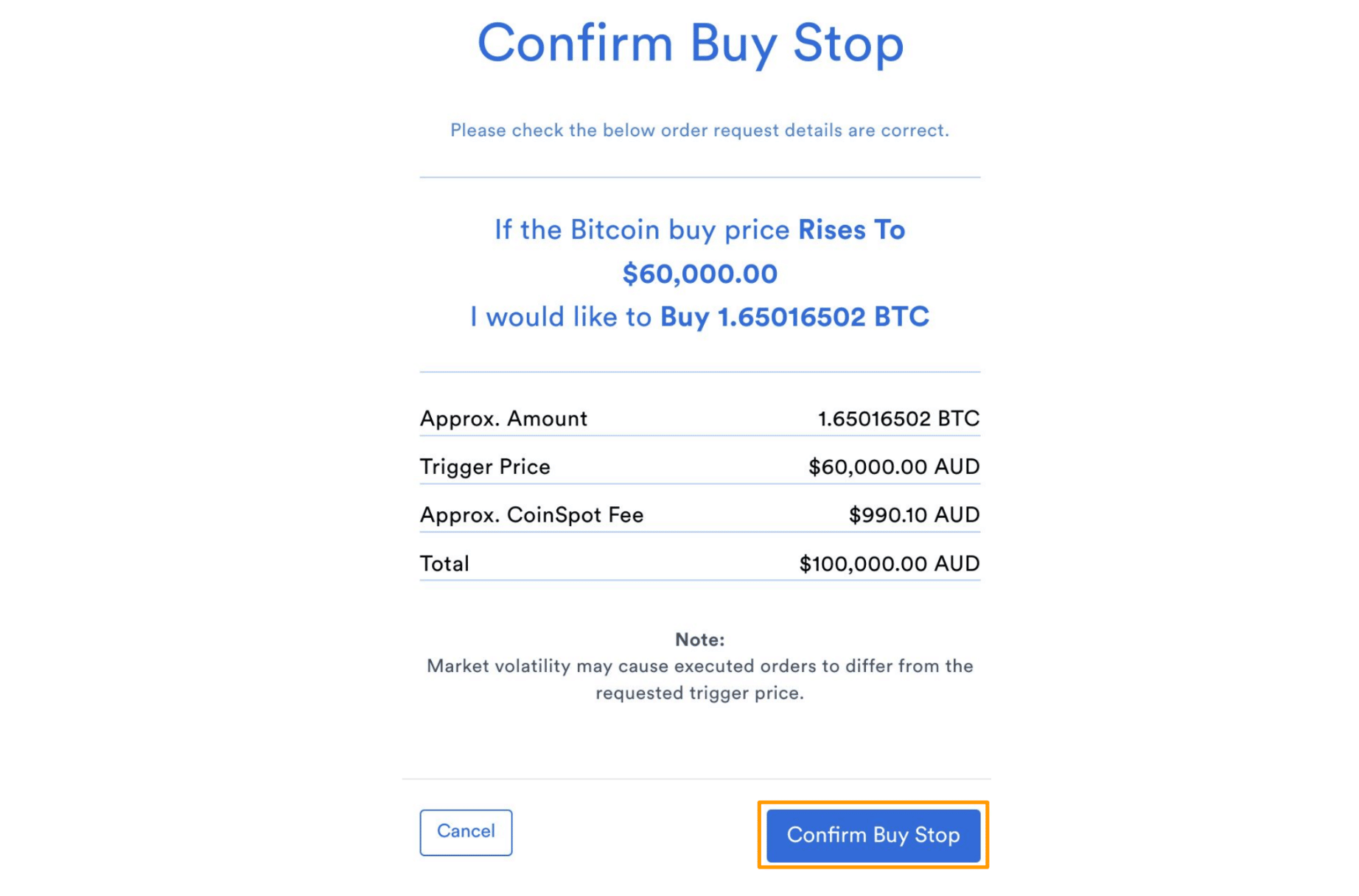

CoinSpot features pricing charts and flexible orders – such as take-profits and stop-losses. However, its trading interface is not that sophisticated – so it is simple to place advanced orders.

As seen in the image below, the CoinSpot platform breaks down complex orders – making it easily comprehensible to beginners.

Similarly, Swftyx also comes with the option to set price alerts and trigger trades using limit orders. This platform also comes with a well-built dashboard, offering users a summary of their crypto investments at a glance.

Such a tool makes it easier for users to track the performance of their portfolio easily.

That being said, beginners might find it a bit challenging to understand pricing charts on Swyftx.

However, as we noted earlier, this platform also comes with a demo account. As such, users can access this to familiarize themselves with the available tools before trading in the real market.

Mobile Apps

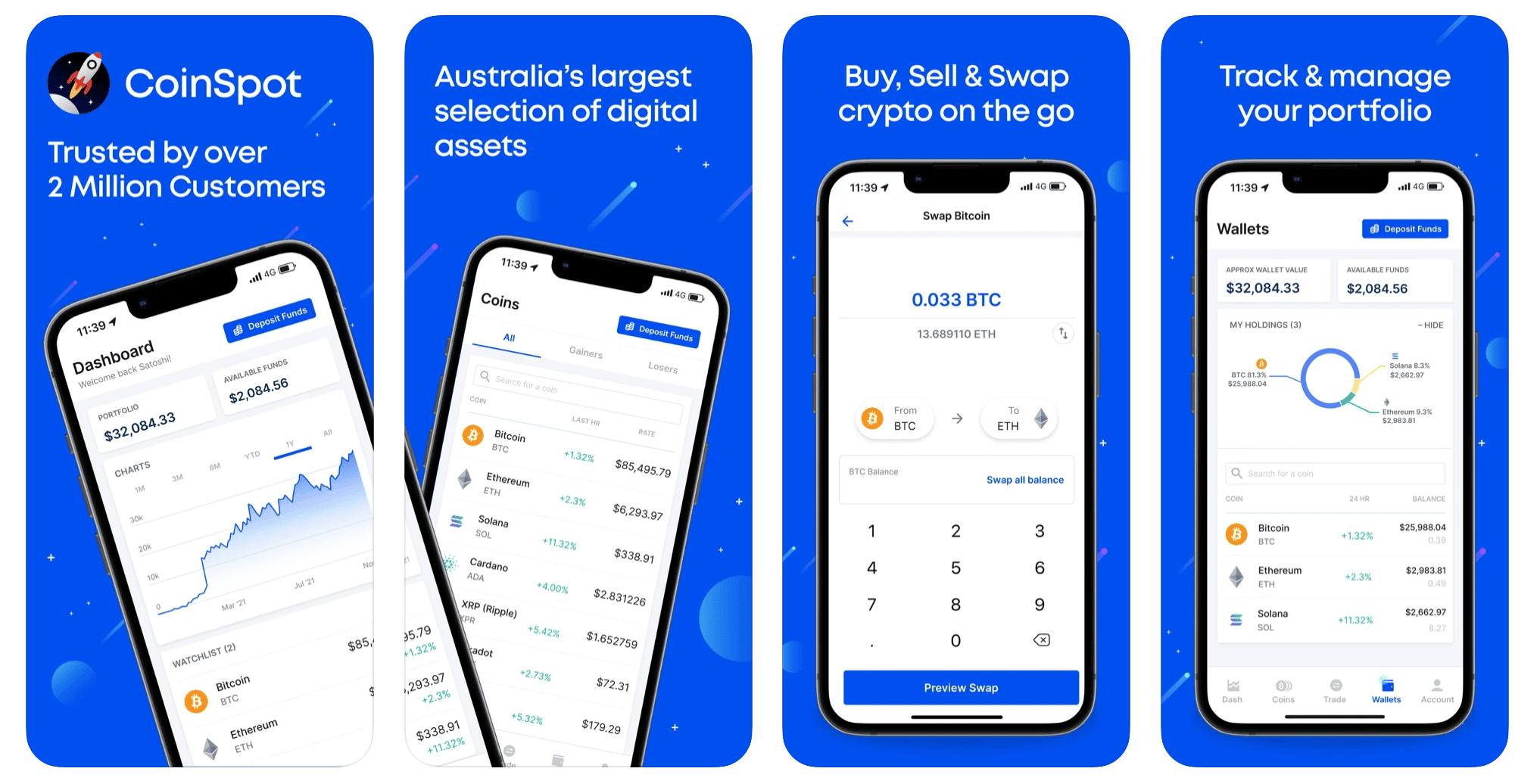

As with most other leading cryptocurrency exchanges, CoinSpot and Swyftz have also designed their own mobile apps.

Both apps are available on Android and iOS mobile devices.

Swyftx’s app features all the tools available on its web platform. Users will be able to buy, sell, and swap cryptocurrencies, place recurring orders, and manage their portfolios on the go.

Swyftx also makes it possible for users to move digital assets into an ‘Earn’ wallet to generate interest on their cryptocurrencies.

The mobile version of CoinSpot is on par with that of Swyftx- and is considered one of the best crypto apps for Australian users.

It comes with all the same features as found on the web version. However, at the moment, the CoinSpot app does not offer support for an NFT marketplace.

Trading Tools & Features on Swyftx & CoinSpot

When comparing CoinSpot vs Swyftx, users will find that both platforms offer similar features. However, how these two platforms approach the same products is slightly different.

Take a look below to see the different trading tools and features available on Swyftx and CoinSpot.

Buy/Sell Crypto

Swyftx and CoinSpot make it simple for users to buy and sell cryptocurrencies. Both platforms offer a range of free and instant AUD deposit methods – which include bank transfers, PayID, Direct Deposit & POLi.

Swyftx also lets users fund their accounts with a credit/debit card, but when using this mode of payment, third-party charges might apply.

In addition to crypto-AUD pairs, users can also swap one digital asset for another. If engaging in trading, advanced features such as price charts and different order types are also accessible on both platforms.

However, as we noted above, CoinSpot is more user-friendly; whereas, advanced traders might prefer Swyftx for its customizable interface. Both platforms also let users set up automated investments into crypto using the recurring buy feature.

Users can set up this feature by automating deposits, and specifying what percentage of the funds should be allocated to cryptocurrencies of their choosing. Placing recurring orders incurs standard trading commissions on both platforms.

Crypto Bundles

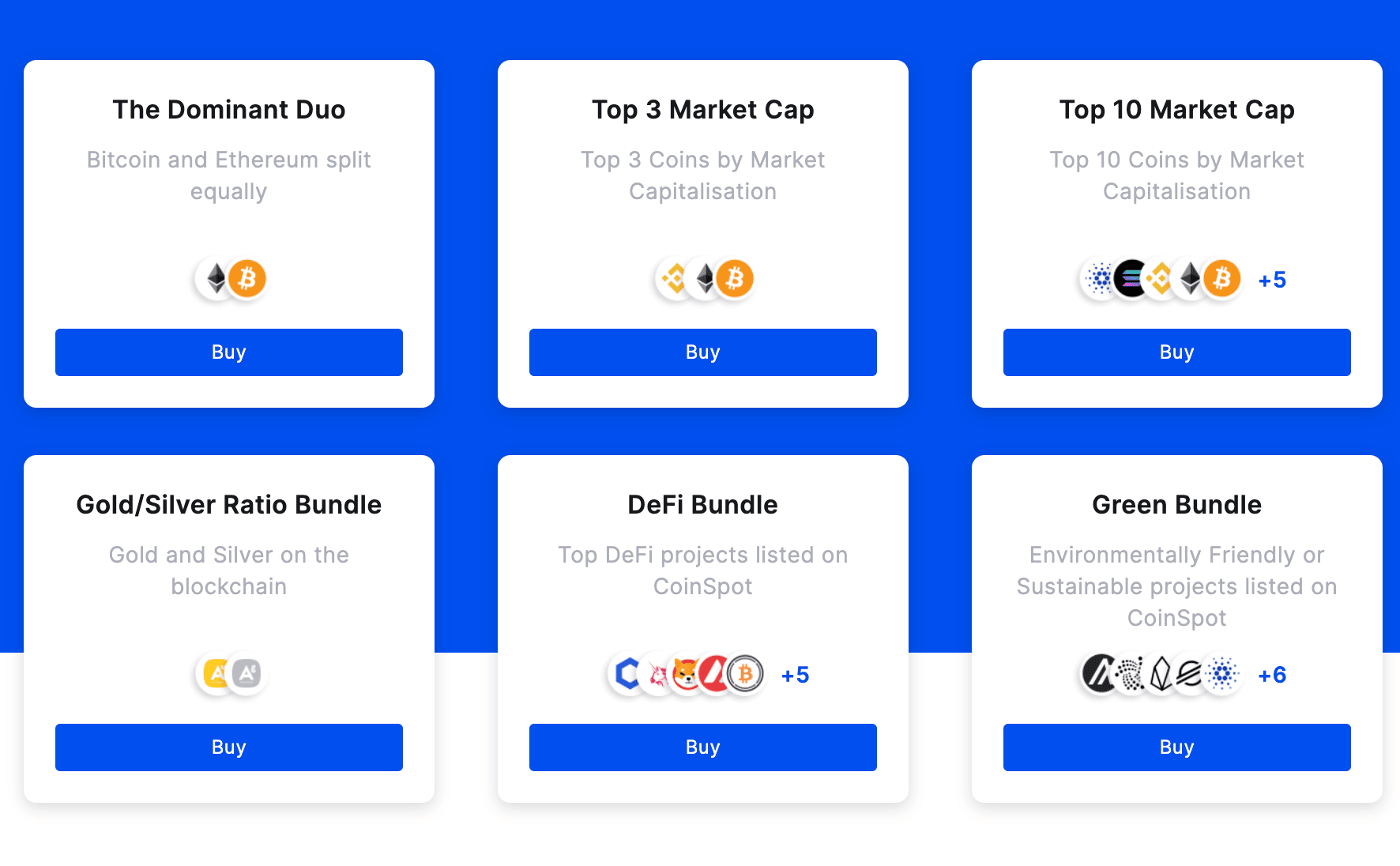

It is no news that cryptocurrencies can be extremely volatile. As such, when thinking of how to invest in cryptocurrency, one of the best ways to mitigate the risk is via diversification.

To make this step easier, Swyftx and CoinSpot have created bundles of cryptocurrencies.

In simple terms, crypto bundles are packages of digital assets that can be purchased in one single transaction.

Both platforms offer curated bundles that are created based on market trends. For instance, some bundles have the top ten cryptocurrencies based on market cap, whereas another might include the most popular DeFi tokens.

Staking

This is yet another feature that is common to both Swyftx and CoinSpot. Users can stake their digital coins to earn interest on their deposits via these two providers.

At the time of writing, CoinSpot supports staking for over 25 cryptocurrencies, and Swyftx provides interest-earning accounts for 20 digital assets.

Notably, there is no need to lock in assets on either platform to earn rewards. In other words, withdrawals are possible at any time. Moreover, there are no additional fees to benefit from staking services.

On CoinSpot, users can earn as much as 23.5% on cryptocurrencies. On the other hand, Swyftx has a tier system that determines the APYs proposed for different digital coins.

However, bear in mind that the interest rates offered are dynamic and can change depending on marketing conditions.

There are three tiers on Swyftx based on the amount of crypto that is being staked. Typically, the higher the amount, the lower the APY. That said, Swyftx offers interest rates as high as 101% for DeFi tokens such as AXS.

OTC Markets

As we pointed out earlier, CoinSpot’s OTC service is popular in the Australian crypto market due to the low fees it offers. In fact, users can buy crypto via this market at just 0.1%. However, the minimum investment size needs to be at least 50,000 AUD.

Users can make an order inquiry between 9 am and 5 pm and get a response within five minutes. It is also possible to avoid having to place an inquiry and have the order processed within a minute. The latter option is available 24/7.

Swyftx also features an OTC market, which supports over 280 digital assets. However, users have to submit a request and receive a consultation.

Moreover, although the platform claims low fees, it isn’t clear how much the service costs.

NFT Marketplace

The one feature that is unique to CoinSpot is its NFT marketplace. The platform features several popular NFT projects, allowing users to buy non-fungible tokens easily.

For each NFT, CoinSpot lists core metrics such as attributes, collection name, rarity, and more. The platform charges a flat fee of 0.9% for facilitating NFT purchases.

In addition to this, users will also have to cover the network fees and pay any royalties set by the creator of the token. Users can also sell NFTs via CoinSpot, however, one cannot create an NFT through this platform.

Here is an overview of all the features offered by Swyftx and CoinSpot.

| Features | Swyftx | CoinSpot |

| Buy/Sell Cryptocurrencies | Yes | Yes |

| Trade Cryptocurrencies | Yes, advanced trading orders are available | Yes, advanced trading orders are available |

| Recurring orders | Yes | Yes |

| Crypto Bundles | Yes | Yes |

| Crypto Interest Accounts | Yes | Yes |

| NFT Marketplace | No | Yes |

Demo Accounts

For beginners looking to learn how to buy Bitcoin or other cryptocurrencies, Swyftx might be the better choice. This is because the platform comes with a demo mode, credited with 10,000 AUD of paper money.

The demo version can be accessed from within a Swyftx account and can be used to experiment with the different features of the platform without taking any risks.

- The demo mode also integrates features of the platform and facilitates practice trading over 320 cryptocurrencies.

- Users will also be able to follow live market trends and devise strategies based on real-world news.

- The Swyftx demo mode is accessible via both mobile and desktop applications.

Unfortunately, CoinSpot does not feature a demo account. In fact, this functionality is accessible only on a handful of crypto platforms in Australia. Apart from Swyftx, eToro is another broker that can be used to learn trading with a demo account.

Swyftx vs CoinSpot Payments & Minimum Deposit

As we discussed earlier, Swyftx and CoinSpot accept payments in Australian dollars.

Both platforms accept popular payment methods – such as PayID and POLi.

Perhaps the one advantage Swyftx has is that it facilitates deposits via credit/debit cards. While the platform does not directly take any fees for this, users might be charged by the third-party provider that facilitates the transaction.

Moreover, users have to deposit at least 75 AUD when making a payment via a credit/debit card.

Take a look at the table below to understand more about the payment methods accepted and the required minimum deposits.

| Swyftx | CoinSpot | |

| Payment methods | PayID, OSKO, bank transfer, POLi, credit/debit cards | BPAY, Cash, PayID, POLi |

| Minimum deposits | 75 AUD with credit/debit cards | 1 AUD for POLi, PayID, direct deposits; 5 AUD for BPAY; 50 AUD for cash deposits |

| Processing Time | Instant; 3-5 days for bank transfers | Instant, 1-2 days for BPAY |

Customer Service

To contact the customer service team of Swyftx, users can access a live chat feature on the platform. Swyftx also offers phone support. However, instead of phoning in directly, users will have to request a call-back by sending a message.

The customer support team is available 24/7 and the typical wait time is between five to 10 minutes. We also found that Swyftx has set up a separate platform named ‘Tapping into Crypto’ that features podcasts related to the digital asset market.

Users can also access podcasts via Spotify and Google. In addition to this. Swyftx also has the standard support center with FAQs and guides.

CoinSpot also features 24/7 live chat support. It also has a help center that includes comprehensive guides. And if needed, users can also reach out to the team via email.

Swyftx vs CoinSpot Regulation & Security

Both Swyftx and CoinSpot are registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) – the authority in Australia that deals with money laundering, terrorism financing, and other related financial matters.

In addition to this, CoinSpot also holds certification from Blockchain Australia and ISO 27001 from Sci Qual, ensuring that the platform follows high standards for security.

CoinSpot also lets its users customize their account security with features such as 2FA, custom withdrawal restrictions, and session timeout limit.

In comparison, on Swyftx, the security options are limited to 2FA. In terms of fund storage, it isn’t clear whether Swyftx or CoinSpot uses hot or cold wallets or a combination of both.

Most importantly, neither Swyftx nor CoinSpot is licensed by ASIC – the Australian governing body that regulates brokerage firms offering financial services. See our full article on whether Coinspot is safe.

Needless to say, to benefit from the highest level of safety possible, it is always best to choose a platform that is regulated by ASIC – such as eToro.

Is CoinSpot or Swyftx the Best Crypto Exchange?

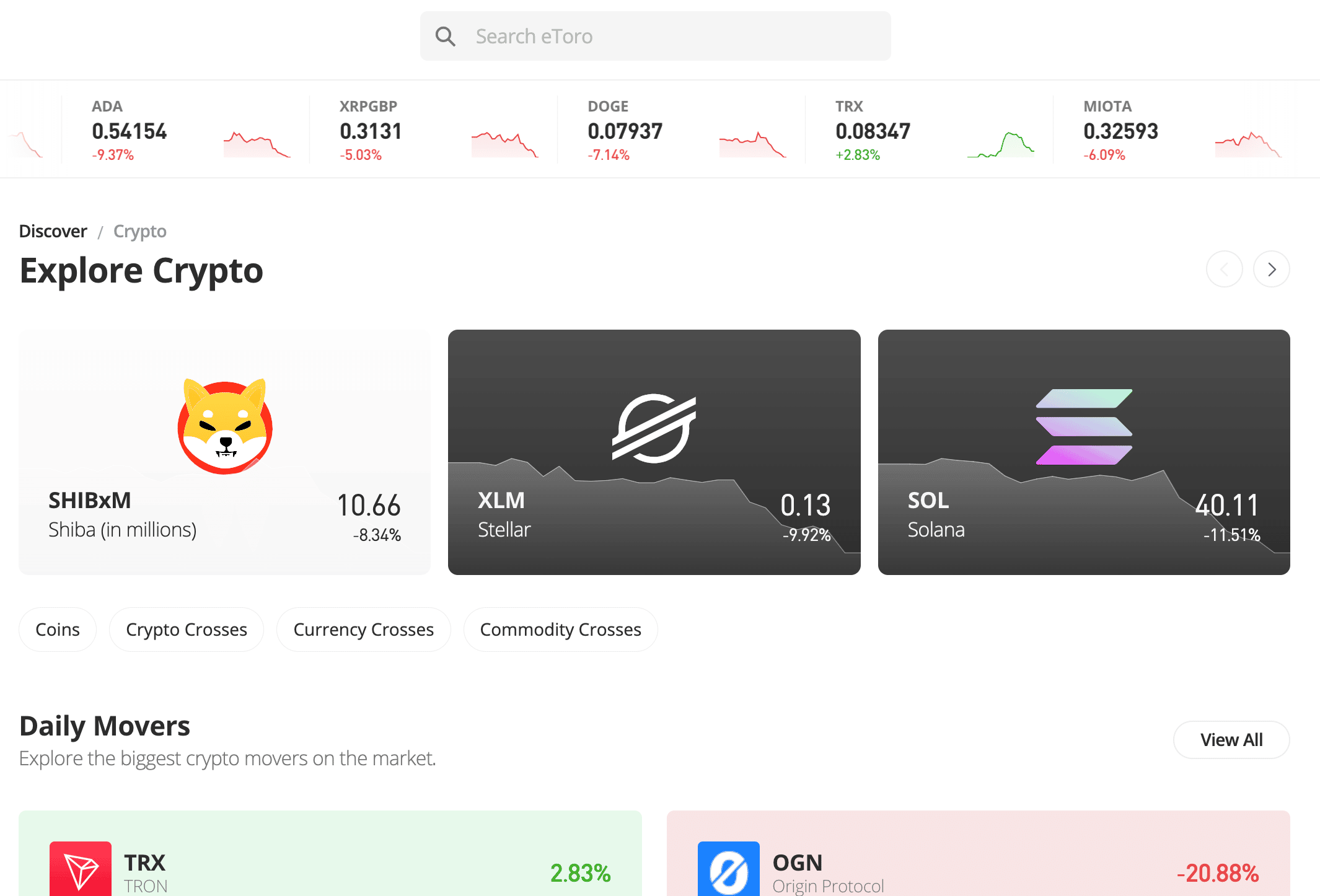

If searching for the best crypto exchange in Australia, we would encourage users to widen their search. While both CoinSpot and Swyftx are perhaps good candidates for this purpose, neither of these platforms are regulated by ASIC – the financial governing body of Australia.

The broker lists over 60+ popular digital assets and charges a flat commission of 1% for buying and selling cryptocurrencies. Notably, the minimum crypto trade size at eToro is just $10. eToro also accepts AUD deposits – via bank transfers, credit/debit cards, and e-wallets such as PayPal.

The fee for processing AUD deposits is only 0.5%, and that is for covering the cost of conversion to USD. This is because eToro has set USD as its benchmark currency. Apart from buying digital assets, eToro also facilitates crypto-to-crypto trading alongside access to advanced order types.

The standout feature of eToro is that it offers Copy Trading for all supported markets. In simple terms, the platform allows users to copy other traders. This passive strategy can be beneficial for beginners to benefit from the expertise of experienced investors.

In addition to this, eToro also features Smart Portfolios – which are similar to the crypto bundles offered by Swyftx and CoinSpot. Finally, users can also access eToro’s demo account, which comes with $100,000 in paper money, to practice trading. Other than cryptocurrencies, eToro also lists stocks, ETFs, commodities, and forex.

Cryptoassets are a highly volatile unregulated investment product.

Swyftx vs CoinSpot – The Verdict

As our Swyftx vs CoinSpot comparison discussed extensively, both of these platforms have their own merits and shortcomings. Swyftx might be preferred by those who seek lower trading fees and higher interest rates on their crypto deposits.

On the other hand, CoinSpot might be the better choice for investors who wants access to OTC or NFT markets. That being said, we found that there are other platforms that offer a better quality service in the Australian crypto market.

In terms of Australin regulation, the eToro.com platform is regulated by ASIC and other prominent financial authorities. Moreover, eToro lets users buy crypto for a fee of just 1% and the platform even offers a Copy Trading tool.

Cryptoassets are a highly volatile unregulated investment product.