If you’re based in Australia and wish to invest in Bitcoin today – this beginner’s guide will walk you through the process every step of the way.

We’ll discuss the best exchanges that enable you to purchase crypto safely, what risks you need to consider before proceeding, and finally – how to invest in Bitcoin in Australia via an ASIC regulated platform.

How to Invest in Bitcoin Australia – Quick Guide

- ✅Step 1 – Open an Account with eToro: You will first need to open an account with eToro. This requires your first and last name, contact details, and desired username and password.

- Step 2 – Deposit: The minimum deposit at eToro is just $10. When you deposit Australian dollars – you only be charged a fee of 0.5% – even when opting for Visa or MasterCard.

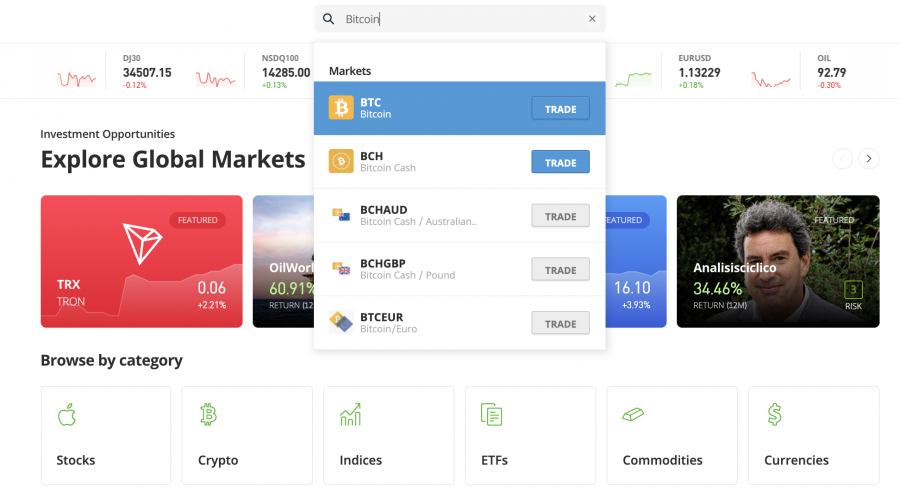

- Step 3 – Search for Bitcoin: You can easily find Bitcoin on the eToro website by typing the name of the cryptocurrency into the search bar. Then, click on the ‘Trade’ button.

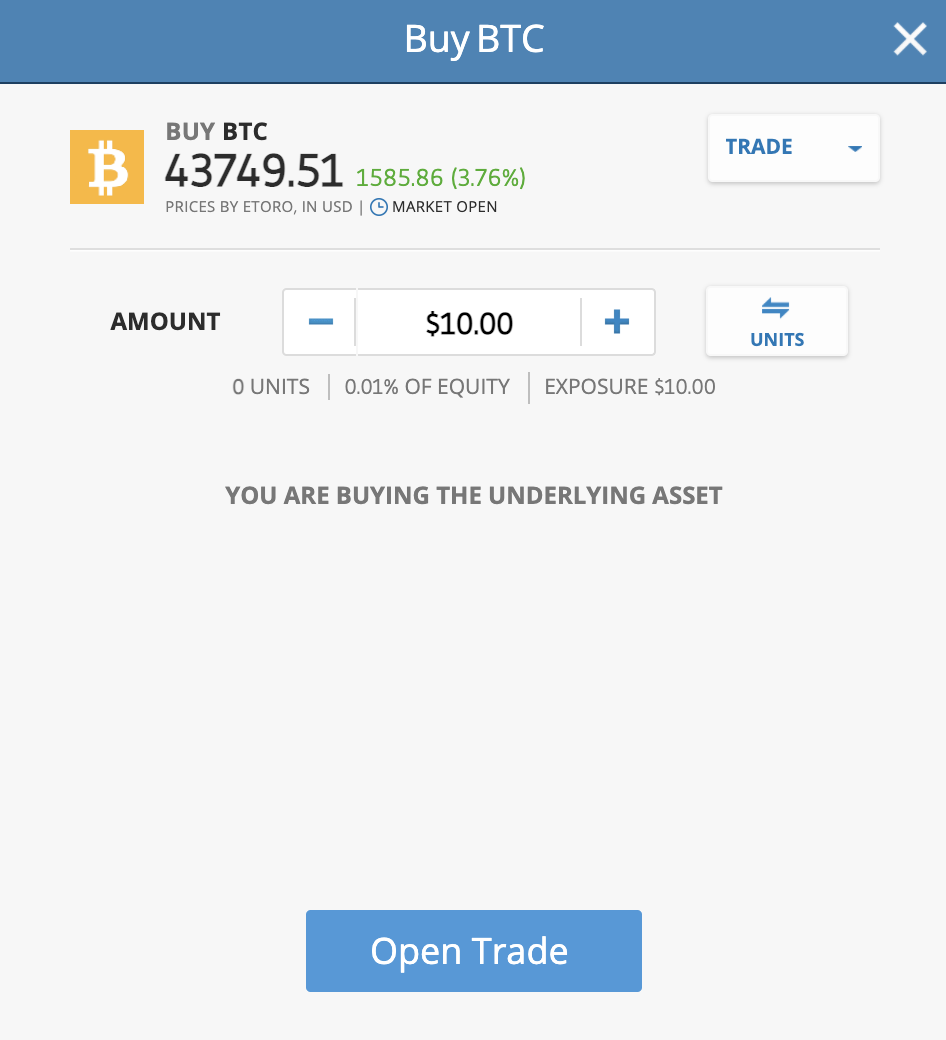

- Step 4 – Buy Bitcoin: An order box will now appear on your screen – which requires you to enter your total investment into Bitcoin. Just like the minimum deposit amount, you can invest in Bitcoin from just $10 at eToro.

Cryptoassets are a highly volatile unregulated investment product.

You can invest in Bitcoin in Australia in less than five minutes when using eToro.com – which is an online exchange regulated by ASIC. Moreover, eToro supports Australian debit/credit cards, bank accounts, and even e-wallets.

To complete your Bitcoin investment in Australia – click on the ‘Open Trade’ button. For a more detailed walkthrough of how to invest in Bitcoin in Australia – read on for our complete beginner’s guide.

Where to Invest in Bitcoin in Australia

There are many online crypto exchanges that enable you to invest in Bitcoin in Australia. The best Bitcoin investing platforms in this space support convenient payment methods such as credit cards and local bank transfers.

You’ll also want to register with an exchange that is regulated and offers a competitive pricing structure. To make it easy to decide where to invest in Bitcoin in Australia – below you’ll find reviews of four top-rated exchanges.

1. eToro – Overall Best Place to Invest in Bitcoin in Australia (ASIC Regulated)

When deciding on where to invest in Bitcoin in Australia, the most important metric to consider is whether or not the exchange is regulated. And as such, this is why eToro is the overall best place to invest in cryptocurrency in Australia – not least because the platform is regulated by ASIC.

In addition to ASIC, eToro is also regulated by bodies in the US, UK, and Europe. Crucially, this ensures that you can deposit funds and buy cryptocurrency in a safe environment. In order to invest in Bitcoin at eToro, you will first need to open an account – which shouldn’t take you more than two minutes.

After that, you can deposit funds from just $50. Supported payment types at this exchange are inclusive of local bank transfers, Visa, MasterCard, Paypal, Skrill, and more. In terms of fees, all supported deposit methods are charged at just 0.5% of the transaction size. This is very competitive – especially if you are planning to use a debit or credit card.

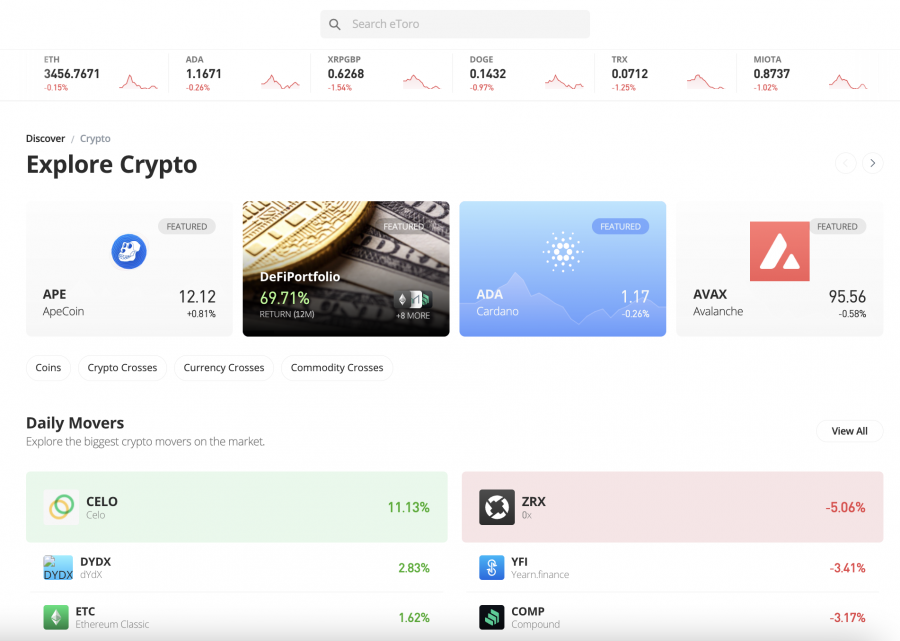

When it comes to commissions, you will only be charged 1% when buying and selling Bitcoin. If you are looking to invest in other cryptocurrencies, eToro has you covered. As of writing, the exchange offers over 60 leading digital tokens – with more being added on a regular basis. This means that you can buy Ethereum and other popular coins via a single platform.

And, as the minimum crypto stake at eToro is only $10 per trade – you don’t need to risk a lot of money to diversify. Another option you have when investing in cryptocurrency here is to consider a smart portfolio. For instance, there is a portfolio that tracks multiple cryptocurrencies – and your investment will be managed by the eToro team.

If you’re interested in actively trading the digital currencies markets but don’t have any experience in this space, you can also invest directly in verified eToro traders. This means that any buy and sell orders placed by your chosen trader will be replicated in your own eToro account. Finally, eToro also offers one of the best crypto wallets in Australia for beginners.

| Number of Cryptos | 60 |

| Trading Commission | 1% plus market spread |

| Debit Card Fee | 0.5% |

| Minimum Deposit | $50 |

Pros

- Regulated by ASIC

- Super low trading fees

- No deposit fees

- Offers one of the best crypto apps on the market

- Supports dozens of coins

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy trading tools

Cons

- Advanced traders might find the platform a bit basic

Cryptoassets are a highly volatile unregulated investment product.

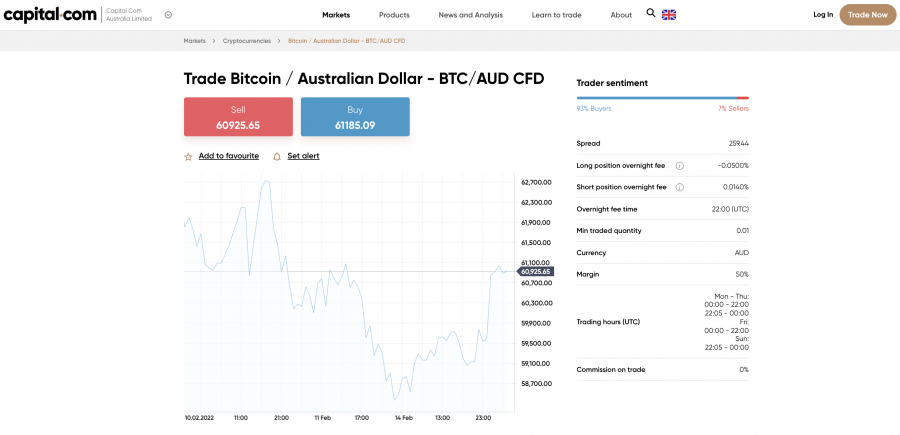

2. Capital.com – Trade Bitcoin at 0% Commission

If you’re looking to trade Bitcoin and other cryptocurrencies via a shorter-term strategy, then you might want to check out the Capital.com platform. Unlike eToro, Capital.com does not allow you to directly invest in Bitcoin. This is because the platform specializes in CFD products.

In a nutshell, CFDs at Catpial.com enable you to trade the future value of Bitcoin without actually purchasing or storing any tokens. For instance, if you stake $500 on a Bitcoin buy order and the value of the digital currency increases by 10% – you will make gains of $50. Although CFDs won’t be suitable for all investor profiles, they do come with a range of benefits.

For example, when you trade Bitcoin CFDs at Capital.com, retail clients can apply leverage of 2x. This turns a $500 stake into trading capital of $1,000. Moreover, you also have the option of choosing from a buy or sell order. The former can be used if you think the value of Bitcoin will rise and the latter if you believe the opposite.

We also like Capital.com for the number of cryptocurrency markets that it gives you access to. In total, Australians can trade the future value of more than 470 digital currency pairs. This includes dozens of Bitcoin-denominated markets – such as BTC/AUD and ETH/BTC. And, irrespective of which pairs you trade – Capital.com does not charge any commissions.

This CFD also offers tight spreads and does not charge any fees on deposits or withdrawals. In terms of payment methods, you can use a debit/credit card or e-wallet and the minimum deposit amounts to just $20. You can also deposit funds via a bank wire, but this will require a much larger minimum deposit of $250.

Once your account is set up, not only will you have access to live cryptocurrency markets, but on the same trading platform you can also trade thousands of stocks, ETFs, metals, energies, indices, and more. These markets are also offered on a commission-free basis. Should you wish to trade Bitcoin CFDs on your smartphone, consider downloading the Capital.com app for iOS and Android.

| Number of Cryptos | 470+ markets |

| Trading Commission | 0% commission plus market spread |

| Debit Card Fee | FREE |

| Minimum Deposit | $20 (debit/credit cards, e-wallets) $250 (bank wire) |

Pros

- Licensed CFD platform

- 0% commission and tight spreads

- Minimum debit card deposit is just $20

- Leverage of 1:2 offered on crypto CFDs

- More than 470 crypto markets

- No deposit or withdrawal fees

Cons

- CFDs are complex instruments – consider the enhanced risk of loss

Cryptoassets are a highly volatile unregulated investment product.

3. Binance – Low-Fee Bitcoin Trading Platform

This is because the Binance exchange offers a plethora of sophisticated trading features – such as technical indicators and chart drawing tools. Moreover, Binance is home to live order books and huge levels of liquidity around the clock. With that said, if you’re looking to invest in Bitcoin in Australia and you’re a complete beginner – Binance is still suitable.

This is because the platform – after opening an account and uploading some ID, enables you to invest in Bitcoin with a debit or credit card. There is no requirement to have prior experience to complete your Bitcoin purchase – as it’s just a case of following the on-screen steps. In addition to debit and credit cards, Binance also accepts deposits via BPAY and standard bank wires.

What we also like about Bitcoin is that the platform is ideal for creating a diversified portfolio of digital assets. This is because the platform is home to more than 600 cryptocurrencies of all shapes and sizes. This includes lots of small and up-and-coming cryptocurrency projects that offer attractive upside potential.

When it comes to fees, deposit charges depend on your preferred payment method and whether a third-party processor is required – which it will be for debit and credit cards. Trading commissions are charged at a very competitive 0.10% per slide – so that’s $1 for every $1,000 traded.

Furthermore, if you pay your trading commissions in BNB, this fee is reduced further. You can also obtain more competitive commissions when you hit certain volume milestones. If you’re looking to invest in Bitcoin in Australia over a long-term period, you might also consider depositing your tokens into a Binance crypto savings account.

| Number of Cryptos | 600+ |

| Trading Commission | Up to 0.10% |

| Debit Card Fee | Depends on third-party processor |

| Minimum Deposit | Varies by payment method |

Pros

- Hundreds of coins across 1,000+ markets

- Low commissions of just 0.10% per slide

- Supports fiat money deposits and withdrawals

- Great tools for advanced traders

- One of the largest crypto exchanges for liquidity

Cons

- Not regulated by any licensing body

- Has previously been hacked

Cryptoassets are a highly volatile unregulated investment product.

4. Coinbase – Great Place for Beginners to Invest in Bitcoin

Coinbase is a US-based crypto exchange with nearly 90 million clients on its books. The exchange offers crypto trading services to customers in more than 100 countries – including that of Australia. While Coinbase does charge high feels across most of its products and services, the platform is extremely user-friendly.

In fact, even if you have never previously traded cryptocurrency, Coinbase enables you to invest in Bitcoin in Australia with absolute ease. After you have verified your Coinbase account by uploading some ID, you will have the option of buying Bitcoin instantly with a debit or credit card. This will set you back 3.99% of the transaction amount.

However, if you’re looking to invest less than $200, then additional fees will apply. The most cost-effective way of getting money into your Coinbase account is to execute a local bank transfer. However, although no fees are charged on bank transfers, you will need to pay a commission of 1.49% when you invest in Bitcoin.

Furthermore, bank transfers can take a few days to arrive. Nonetheless, Coinbase offers a super-secure way of investing and holding Bitcoin – as the exchange is home to two storage methods. First, beginners will likely be better suited to storing their Bitcoin in the Coinbase web wallet – which is protected by two-factor authentication.

98% of digital tokens held in the main Coinbase web wallet are kept offline at all times in cold storage. The other option is to download the Coinbase mobile wallet to your phone. Available on both iOS and Android, this wallet type is offered on a non-custodial basis. Put simply, this means that you are the only person to have access to the wallet’s private keys.

Another feature that we like at Coinbase is its staking tool. Although this doesn’t support Bitcoin investments, you can earn up to 5% interest per year on a number of altcoins. Finally, Coinbase offers more than 100 cryptocurrencies in addition to Bitcoin. Small minimum investments are supported – but just remember that purchases under $200 attract an unfavorable flat fee.

Note – withdrawals to Australian banks from Coinbase are not currently supported (or New Zealand banks) but you can buy Bitcoin, and then when you want to withdraw simply transfer it to yourself on another exchange to sell back into cash, for example eToro.

| Number of Cryptos | 50+ |

| Trading Commission | 1.49% per slide |

| Debit Card Fee | 3.99% |

| Minimum Deposit | $50 for bank verification |

Pros

- Regulated in the US and listed on the NASDAQ

- Supports 50+ coins

- Accepts debit/credit cards and bank transfers

- Great security features

- Perfect for beginners

Cons

- High payment and commission fees

- Limited trading tools and features

- Withdrawals to AU banks not currently supported

Cryptoassets are a highly volatile unregulated investment product.

Is Bitcoin a Good investment?

Bitcoin is a digital asset that was launched as recently as 2009. And as such, in comparison to traditional assets like stocks – many of which have a trading history of over a century, some market analysts argue that Bitcoin is still unproven.

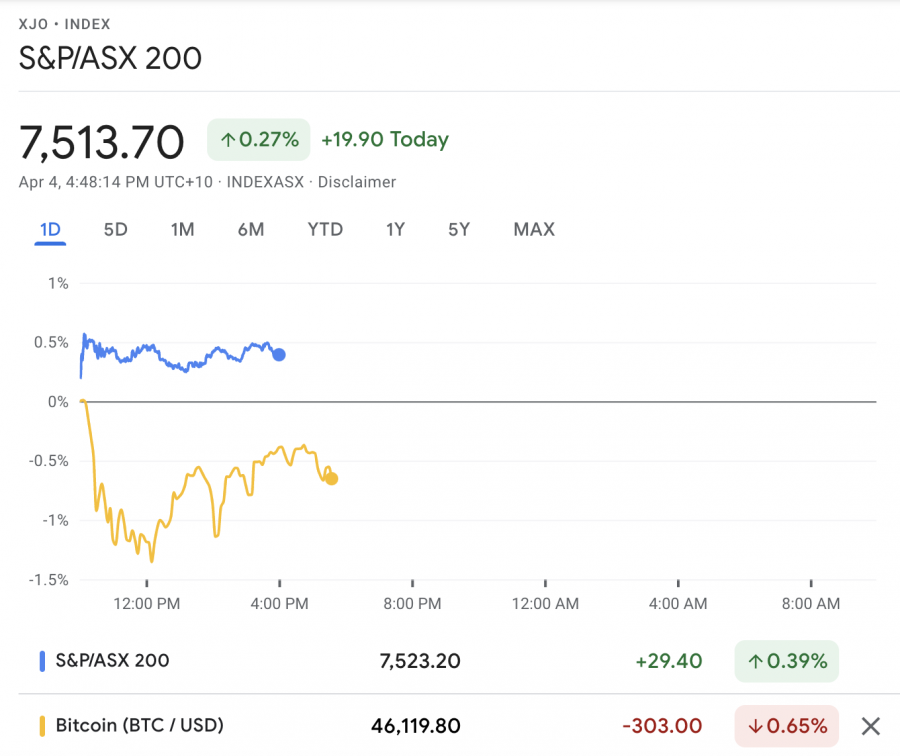

On the other hand, Bitcoin is by far the best-performing financial instrument of the prior decade – especially when compared to major index funds like the S&P/ASX 200.

Did you know that the ATO provides a 50% discount on crypto capital gains when cryptos are held for longer than a year? Learn more by reading our guide on crypto tax in Australia.

Taking all of this into account – it’s wise to do some independent research before you decide to invest in Bitcoin in Australia. In the sections below, we help clear the mist by discussing whether Bitcoin represents a good investment.

Decentralized Asset Class

One of the most innovative aspects of Bitcoin is that the underlying technology is decentralized. In its most basic form, this means that no single person or entity has control over the Bitcoin network.

As such, when you own Bitcoin and store the digital tokens in a private wallet, no centralized bodies – like a bank, can access your funds.

- And, most pertinently, the supply of Bitcoin cannot be manipulated by any central bank.

- This is especially important in the current economic climate, with many Western economies suffering from high inflation levels.

- This is a result of excessive quantitative easing – which is otherwise referred to as ‘money printing’.

But, in the case of Bitcoin, its supply is governed by a transparent code – which is immutable. In simple terms, 10 new Bitcoin tokens are minted every 10 minutes.

This cycle will continue until a total of 21 million Bitcoin tokens are in circulation – which is estimated to happen in 2140.

Bitcoin vs S&P/ASX 200

If you’ve previously invested in the Australian stock markets, then you will know that in recent years – returns have been somewhat unattractive.

For example, the S&P/ASX 200 – which is the primary stock market index in Australia and consists of the leading 200 domestic firms, has grown by just 28% over the prior five years.

This means that an original lump sum investment of $5,000 five years ago would now be worth just $6,400.

In comparison, had you instead decided to allocate your $5,000 investment into Bitcoin back in 2017, you would now be looking at gains of over 3,800%. This means that your $5,000 would now be worth more than $195,000.

Huge Upside Potential

It goes without saying that most people decide to invest in Bitcoin in Australia because they want to target above-average gains. On the one hand, Bitcoin already carries a huge market capitalization – which, at its peak, has exceeded $1 trillion.

However, when you consider that Bitcoin is a global digital currency that is not bound by jurisdictional borders, it still offers huge upside potential.

In terms of how much higher the value of Bitcoin can get, this is a subjective conundrum. With that said, various estimates put the total value of gold at more than $12 trillion.

And, as we cover in the next section – Bitcoin carries many of the same characteristics as gold, so an upside target of $12 trillion isn’t far-fetched at all.

Bitcoin is Digital Gold

Another benefit to consider when learning how to invest in Bitcoin in Australia is that this digital currency is often compared to gold.

- First and foremost, gold has a finite supply.

- This means that once the final ounce of gold is extracted, no additional supply will ever enter circulation.

- In comparison – and as noted earlier, the total supply of Bitcoin is capped at 21 million tokens.

Another characteristic that Bitcoin and gold share is that both are viewed as stores of value. In simple terms, this means that over the course of time – the value of both Bitcoin and gold will increase.

This is because there is a finite supply of both asset classes – so as demand increases, so does their market value. Furthermore, investors often turn to stores of value during times of economic uncertainty – so this can only benefit Bitcoin in the long run.

On the other hand, many market commentators argue that Bitcoin is actually more suited a store of value when compared to gold.

After all, Bitcoin is digital – so it can be transferred in a fast and low-cost manner. Gold, however, is a psychical asset – so when it comes to storage and logistics, this is both expensive and cumbersome.

Bitcoin is a Liquid Asset Class That Supports Small Investments

When it comes to the processor investing in Bitcoin, this digital asset class offers all of the same attributes as traditional stocks.

- For instance, when you invest in stocks that are listed on the Australian Securities Exchange, you can cash out your shares at any given time during standard market hours.

- And, in doing so, you never need to worry about finding a seller – there are always sufficient levels of liquidity available.

- In comparison, Bitcoin is also a highly liquid asset class – not least because it attracts billions of dollars in trading volume each and every day.

- Moreover, Bitcoin trades on a 24/7 basis, so when it comes to cashing out, you don’t need to wait for the traditional markets to open.

Another thing to note is that when you invest in stocks, many brokers support fractional shares. The same concept is available when you invest in Bitcoin – as exchanges like eToro support minimum purchases of just $10.

This is made possible because Bitcoin – and all cryptocurrencies for that matter, can be divided into small units. This makes the industry ideal for investors on a budget.

Risks to Consider Before you Invest in Bitcoin Australia

In the sections above, we discussed five core reasons why you might decide to invest in Bitcoin in Australia today.

However, as successful as this digital currency has been since it was launched in 2009 – a number of risks still need to be considered before you proceed.

Regulatory Issues

Bitcoin – and all cryptocurrencies for that matter, are unregulated financial products. This is because Bitcoin is decentralized – so the way in which its network is run cannot be controlled or governed by financial regulators.

With that being said, regulators can still dictate how the general public can access Bitcoin. For example, exchanges that seek to offer Bitcoin trading services to Australian residents must abide by a range of ASIC guidelines.

This includes a requirement to verify the identity of all customers that open an account with a crypto exchange. If in the future regulations become any more draconian, this could hinder the growth of Bitcoin.

Volatility Risk

Bitcoin is a volatile asset class that goes up and down in value at a faster rate when compared with traditional stocks.

For example:

- Throughout 2017, Bitcoin went from $1,000 to $20,000 over the course of 12 months – which translates into growth of 2,000%.

- However, by the end of 2018, Bitcoin was trading for less than $4,000 – which equates to a decline of 80% in just one year.

- Fast forward to late 2021 and the same digital currency surpassed a market value of over $68,000.

As you can see, the examples above highlight just how volatile Bitcoin is, and as such – this needs to be considered before you decide to invest.

Wallet Risk

Another important risk to consider before you invest in Bitcoin in Australia is with regards to storage. For instance, if you buy Bitcoin from an online exchange and the platform is hacked – then there is every chance that your personal tokens will be stolen.

This is why it is important to only invest in Bitcoin through a regulated exchange.

If you decide to withdraw your Bitcoin tokens to a private wallet, you will be responsible for safekeeping your private keys. And as such, if somebody is able to gain access to your private keys remotely – they can access your wallet and steal your Bitcoin tokens.

What is the Best Way to Invest in Bitcoin?

There are a number of different methods that you can take to gain exposure to Bitcoin.

The best ways to invest in Bitcoin in Australia as a beginner are discussed below.

Buying Bitcoin

The overall best way to invest in Bitcoin in Australia is to purchase tokens from an online exchange. In doing so – you will own the underlying Bitcoin tokens 100%. This is no different from buying shares from a stockbroker.

Moreover, the value of your investment will directly correlate to the market price of Bitcoin. For example, if you invest $500 into Bitcoin and the digital currency increases in value by 50% – your gains will amount to $250.

Trading Bitcoin CFDs

We mentioned Bitcoin CFDs earlier when we reviewed Capital.com. To quickly recap – if you decide to trade CFDs – you won’t actually own any Bitcoin tokens. Your trade will, however, directly correlate to the market price of Bitcoin.

For example, let’s suppose that you decide to risk $100 on a Bitcoin CFD position. A few days later, Bitcoin has increased by 10%. This means that should you close your Bitcoin CFD position – you will do so at a profit of $10.

Don’t forget, if you decide to buy or sell CFDs in Australia, this means that you can trade Bitcoin with leverage of 1:2.

Invest in Bitcoin Stock

If you’re wondering how to invest in Bitcoin stock – there is no such thing. Bitcoin is a digital currency, after all.

With that said, if you feel more comfortable gaining exposure to Bitcoin via the traditional stock markets, this is still somewhat possible. For example, you could buy shares in leading US-based exchange Coinbase – which trades on the NASDAQ.

In theory, when Bitcoin and other cryptocurrencies are performing well, so will the value of Coinbase stock. However, there isn’t a direct correlation to the market price of Bitcoin.

After all, the value of Coinbase will depend on a lot more than just Bitcoin – as factors like revenue, operating profit, and customer growth will all come into play.

You can buy Coinbase stock (ticker $COIN) from just $10 at eToro on a 0% commission basis.

Cryptoassets are a highly volatile unregulated investment product.

Choosing a Bitcoin Wallet for Investing

We briefly covered wallets earlier when we discussed the risks of investing in Bitcoin. In this section, we explain how to choose the best Bitcoin wallet for your investment needs.

- First and foremost, you need to think about the type of Bitcoin wallet that is suitable for you.

- For example, if you’re a complete newbie that has no knowledge of how private keys work – it might be best if you keep your Bitcoin tokens in the wallet offered by your chosen exchange.

- This is, however, on the proviso that your chosen exchange is reputable and secure.

- Good examples here include eToro, Crypto.com, and Coinbase – all of which are approved to offer Bitcoin trading services to Australians.

The other option you have is to download the eToro Money crypto wallet. This is a multi-currency wallet that comes in the form of a mobile app for iOS and Android devices.

Not only is the eToro Money crypto wallet secure and user-friendly, but it gives you access to your main exchange account. And as such, the wallet enables you to buy, sell, and trade Bitcoin at the click of a button.

Bitcoin Investment Strategies

If you’re looking to maximize your potential returns when you invest in Bitcoin in Australia – you will need to determine which strategy is best for your skillset.

The best Bitcoin investment strategies for 2022 are discussed in more detail below.

Buy the Dip

The first investment strategy to consider is to make a purchase when the price of Bitcoin goes down. In the traditional stock market, this is known as buying the dip.

For example:

- Let’s suppose that over the past 24 hours, the price of Bitcoin was declined by 7%.

- In buying Bitcoin at this price point, you are entering the market at a discount.

- And, the theory is, if and when Bitcoin recovers this 7%, you will already be at a profit.

The other way to view buying the dip is that when the price goes down – you get more tokens for your stake.

For example:

- Let’s suppose that you invest $3,000 into Bitcoin when it is priced at $60,000.

- This means that you are buying 5% of one BTC token.

- Then, a few weeks later, we’ll say that Bitcoin is priced at $40,000.

- This time, when you invest $3,000 – you are actually getting 7.5% of one BTC token.

Ultimately, just because Bitcoin is going through a negative cycle, this isn’t something to be afraid of. On the contrary, this gives you a great opportunity to invest in Bitcoin at a much more favorable entry price.

Deposit Bitcoin Into a Crypto InterestAccount

This Bitcoin investment strategy is highly suited for long-term investors. In a nutshell, it is now possible to deposit your Bitcoin tokens into a crypto interest account.

And in doing so, you will be paid a rate of interest for as long as the tokens remain there. This is comparable to depositing Australian dollars into a conventional savings account.

Only in the case of Bitcoin, you will be offered a much higher rate of return. In addition to earning a yield on your idle Bitcoin, you will still retain full ownership of your tokens.

And therefore, if the value of Bitcoin increases, you will still benefit from this.

Try Copy Trading

More and more people in Australia are turning to passive investment tools. This means that you can invest in Bitcoin and other digital currencies without needing to have any prior trading knowledge.

One of the best ways to achieve this goal is via the copy trading tool offered by eToro. Put simply, eToro gives you direct access to experienced traders that successfully use the platform to buy and sell cryptocurrencies and stocks.

Once you have decided on which trader to copy, all future investments will be mirrored in your own portfolio. Each trade will be replicated at an amount proportionate to what you invest.

For example:

- You decide to invest $2,000 into an experienced crypto investor

- The trader allocates 30% of their portfolio into Bitcoin and 10% to XRP

- This means that automatically, $600 and $200 worth of Bitcoin and XRP respectively is added to your portfolio

Not only is copy trading a good idea if you are inexperienced in the world of Bitcoin – but also if you do not have the time to actively research the markets yourself.

How to Invest in Bitcoin & Make Money – Examples

If this is your first time learning how to invest in Bitcoin in Australia – you might be somewhat unsure of how the process actually works.

If so, check out the below – where we look at a real-world example of how to invest in Bitcoin and make money:

- Let’s say that in April 2020 – you decide to invest a lump sum of $10,000 into Bitcoin

- At the time of the investment, Bitcoin had a market value of $5,500

- You hold on to your investment until March 2022 – where Bitcoin has a market value of $47,000

- This means that compared to the $5,500 that Bitcoin was worth in April 2020 – your investment has increased by 754%

- As such, in cashing out your Bitcoin investment, you receive $85,400 back

Once you subtract your initial investment of $10,000, this means that your total profit from this Bitcoin trade amounts to $75,400.

Crucially, the figures given above are indicative of actual market prices – which illustrates just how lucrative a Bitcoin investment can be when you take a long-term approach.

Now let’s look at an example of how to make money trading Bitcoin via CFDs at Capital.com:

- Let’s say that on 14th March 2022 – you decide to place a buy order on Bitcoin at a total stake of $2,000

- You apply leverage of 1:2 – which doubles your stake to $4,000

- At the time of the trade, Bitcoin is priced at $37,200

- You keep your buy position open until 28th March 2022 – where Bitcoin is priced at $47,800

- This translates into gains of just over 28%

Ordinarily, on a stake of $2,000 – 28% gains would amount to a profit of $560. However, as you applied leverage of 1:2, these gains are doubled to $1,120.

When is the Best Time to Invest in Bitcoin?

We mentioned earlier that a great time to invest in Bitcoin is when the digital currency goes down in value.

In buying the dip, as we explained, this enables you to invest in Bitcoin at a discounted price. Then, if and when the price of Bitcoin recovers to previous levels, you are already looking at gains.

- With that said, buying the dip does require you to be overly active – as you need to regularly check the market performance of Bitcoin so that you know when to place an order.

- Perhaps a slight workaround to this is to place limit orders at your chosen exchange.

- But, this still requires you to be somewhat active.

- Moreover, buying the dip doesn’t come without its risk.

- After all, if you only invest when the price of Bitcoin goes down, you will miss out when the digital currency goes on a prolonged bull run.

Ultimately, unless you are an experienced trader that is happy to actively engage with market research – then it’s best to just invest in Bitcoin whenever you get the chance.

How Much Should I Invest in Bitcoin?

When it comes to deciding on how much to invest in Bitcoin – the simple answer here is to never risk more than you can realistically afford to lose.

This means that you should never dip into money that you need for daily living expenses. Moreover, you should never invest in Bitcoin on credit.

With that said, a more strategic approach when determining stakes is to invest on a dollar-cost average basis. This means that you will invest a certain amount at fixed intervals – and always stick with your plan.

For example, if you believe that you will have $100 worth of disposable income at the end of each month, you could invest $25 per week into Bitcoin. And, in doing so, you will average out your investment cost price.

This means that one week you might get a cost price of$47,000 per BTC token while the next, it could be $46,000. Either way, you will never be over-reliant on a single cost price like you will be when you invest a lump sum.

How to Invest in Bitcoin Australia – Tutorial?

This guide has covered everything from where to invest in Bitcoin in Australia and the benefits of doing so to the potential risks to consider and what trading strategies are suitable for your skillset.

In this section, we will explain how to invest in Bitcoin in Australia via the eToro.com website in less than five minutes. To reiterate, eToro is a leading ASIC-regulated Bitcoin broker that supports low-cost deposits and small investment minimums.

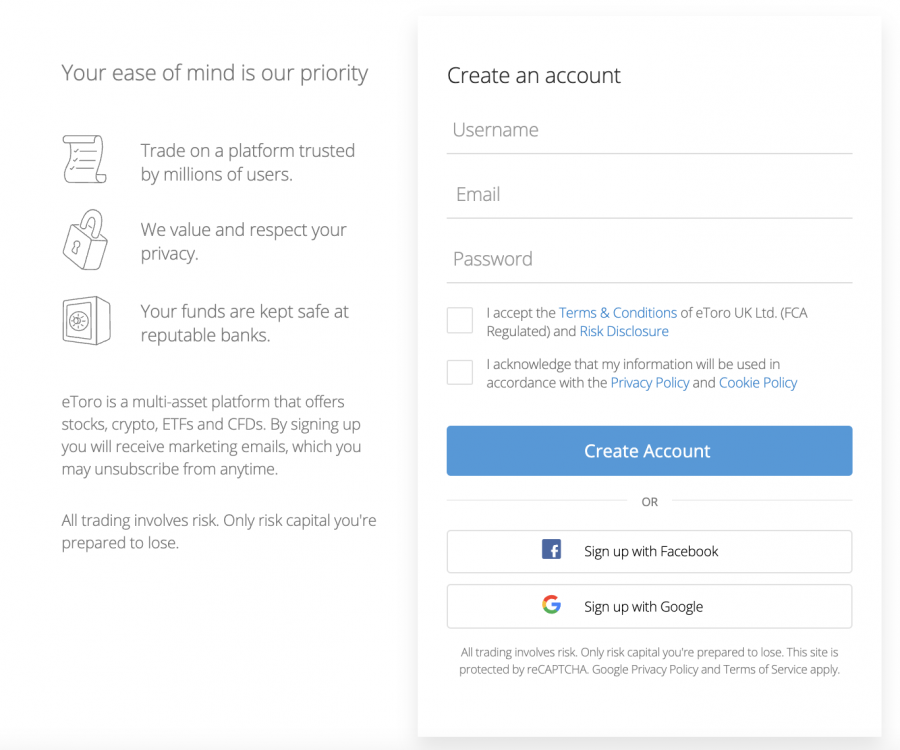

Step 1: Open an eToro Crypto Account

To open an account with eToro, you will need to fill out a registration form. This will collect some personal details from you so that eToro knows who you are.

You will also need to choose a username and a strong password.

eToro will also collect some contact information from you. This is inclusive of your email address and phone number – both of which need to be verified.

Step 2: Upload ID

We mentioned just a moment ago that eToro is licensed by ASIC. This means that the exchange must comply with anti-money laundering laws by asking you to upload some ID.

This can be any government-issued ID that is valid – such as a passport or driver’s license. Additionally, you also need to upload a proof of address document issued within the past three months – such as a bank statement.

Step 3: Deposit Funds

The minimum first-time deposit at eToro is $50 for Australian clients. You can fund your account instantly with Visa, MasterCard, Paypal, and a number of other supported e-wallets.

If you prefer to add funds via a local bank transfer, this will delay the deposit process by 1-3 working days. When you deposit AUD into the eToro platform, you will be charged just 0.5%.

Step 4: Search for Bitcoin

Now that you have added some money to your eToro account – you can invest in Bitcoin. The easiest way to find Bitcoin is to use the search box at the top of the screen.

Be sure to select the correct market – as we have highlighted in the image above. To load a buy order box, click on ‘Trade’ next to Bitcoin.

Step 5: Buy Bitcoin

In the ‘Amount’ box, you will need to let eToro know how much money you want to invest in Bitcoin. Don’t forget, the eToro platform is denominated in US dollars.

As such, when entering your stake, this needs to be in USD and from a minimum of $10.

When you are ready to invest in Bitcoin – click on the ‘Open Trade’ button.

Conclusion

Learning how to invest in Bitcoin in Australia is a simple process.

As this guide has explained, you simply need to register an account with an ASIC-regulated exchange such as eToro – before making a deposit with a credit/debit card, e-wallet, Paypal or bank transfer.

Then, after searching for Bitcoin, you can confirm your investment instantly. And, if you’re investing in Bitcoin for the first time – you will find the eToro platform very easy to use.

Cryptoassets are a highly volatile unregulated investment product.