Capital gains on crypto assets like Bitcoin and Ethereum are taxable in Australia. You might also need to consider the tax implications on other crypto-centric activities – such as token swaps, staking, or yield farming.

In this comprehensive guide, we cover everything there is to know about crypto tax in Australia so that you give yourself the best chance possible of minimizing your liabilities.

Key Points on How to Avoid Tax on Cryptocurrency in Australia Explained

Before reading this guide on crypto tax in Australia – consider the key points outlined below:

- The Australian Tax Office (ATO) views crypto assets as property – which means that they fall within the remit of capital gains tax.

- However, if you hold onto your crypto investment for more than 12 months – a 50% discount on your capital gains liability will apply.

- The specific tax rate that you pay will depend on your personal circumstances and overall investment proceeds for the respective period.

- In addition to capital gains, the ATO also notes that other crypto products – such as staking or yield farming, fall within the remit of income tax.

- As such, this will be added to your overall income tax for the respective year.

Understanding crypto tax in Australia can be complex – so we explain the above key points in great detail throughout this guide. However, it’s best to seek advice from a qualified tax specialist.

Cryptoassets are a highly volatile unregulated investment product.

How Crypto is Taxed in Australia

In a nutshell, there are two potential tax events that you need to consider when you invest in cryptocurrency in Australia.

First and foremost, just like when you buy and sell stocks, your profits will likely be liable for capital gains tax on cryptocurrency. This will take into account the gains element only – so the difference between the buy and sell price.

For instance, if you buy Bitcoin at a total investment of $1,000 and sell the same tokens for $4,000 – you’ve made a profit of $3,000. Therefore, the capital gains tax element here would be based on the $3,000 that you made. This will subsequently be added to your income for the respective year and taxed appropriately.

The second element of Australian crypto tax to take into account is with regards to gains made outside of conventional buy and sell positions. This would include the likes of crypto staking, yield farming, crypto-to-crypto token exchanges, and interest accounts. Any proceeds gained from these methods would be added to your annual income.

We explain the ins and outs of what you might be liable to pay on your crypto investments in the subsequent sections to ensure you have a firm grasp of what you might owe the ATO.

Crypto Capital Gains Tax

Capital gains tax in Australia on crypto investments is fairly simple to understand. As noted above, the profit element of your investment is what ATO will look to tax.

Let’s start with a simple example before elaborating on the 50% discount available on longer-term holdings:

- In January 2022, you invest in Bitcoin when the digital asset is worth $10,000

- You decide to buy 2 Bitcoin – so your total investment is $20,000

- In September 2022, Bitcoin is worth $40,000 per token – so you decide to sell

- You have 2 Bitcoin, so you cash out a total of $80,000

- Your original investment was $20,000 – so you made capital gains of $60,000

The $60,000 capital gains that you made in the above example will be added to your income for the year. Therefore, the amount of tax you pay will depend on a variety of factors – which we cover in more detail later in this guide.

50% Deduction on Crypto Capital Gains Tax

The ATO offers a 50% discount on your crypto capital gains liability when you hold your digital tokens for more than 12 months. This means that in the previous example, you would need to wait until at least January 2023 to benefit from this deduction.

This is something that you should seriously think about – even if you feel that Bitcoin is worth selling at a specific moment in time. After all, you might end up making more money with the 50% deduction – even if you are selling at a lower price.

Nonetheless, the capital gains tax element from the above example would be reduced from $60,000 down to $30,000.

Capital Losses on Crypto

Another positive element that you need to consider when learning about crypto tax in Australia is that the ATO recognizes losses. And most importantly, these losses can be offset against your capital gains liability in the current or future year.

For example:

- Let’s say that you buy 2 Ethereum tokens when the digital asset is trading for $3,000

- This takes your total investment to $6,000

- A few months later you decide to sell your 2 Ethereum tokens

- At the time of the sale, Ethereum is trading for $1,500

- This means that you cash out a total of $3,000 and thus – you have made a capital loss of $3,000

Let’s then say that in the same year, you made capital gains of $5,000 on a Shiba Inu investment. This means that you can subtract your capital losses of $3,000 from this figure. And in doing so, your total crypto capital gains for the year amount to $2,000.

Capital Gains Tax Rates for Crypto

There is no specific capital gains tax rate in Australia. On the contrary, any gains that you make are added to your annual income. We discuss the income tax rates on crypto in Australia further down in this guide.

Cryptoassets are a highly volatile unregulated investment product.

Crypto Income Tax

Now that we have covered how capital gains and losses work on crypto in Australia, we can now discuss income.

There are many alternative products and services in the crypto space that can attract income tax – which we discuss in more detail in the sections below.

Tax on Crypto Interest Accounts

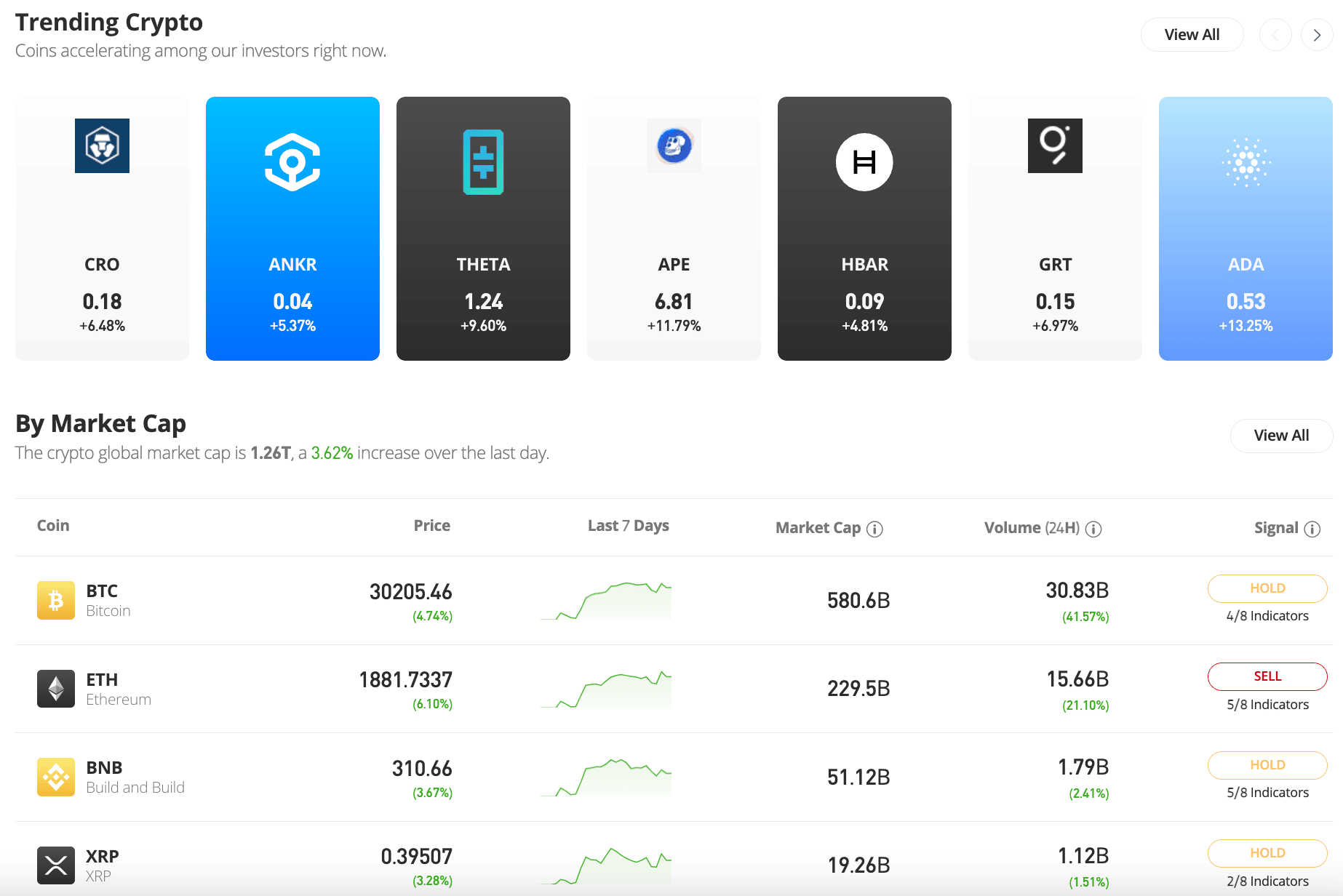

Crypto interest accounts are becoming more and more popular in Australia. Put simply, the main concept here is that you will deposit your tokens into a platform like Crypto.com and in return – generate a rate of interest.

Now, if you decide to utilize a crypto interest account for this purpose, any gains that you make will need to be added to your total income for the year.

However, this is where things get a bit tricky – as you need to assess the market value of the interest that you receive each and every time. This is the figure that you will need to add to your annual income.

For example:

- Let’s say that you deposit 1 Bitcoin into a crypto savings account

- When you bought the Bitcoin it was worth $20,000

- The interest payable on this account amounts to 5% annually

- After one month, you receive an interest payment of 0.0058 BTC

- On the day that you receive the tokens, Bitcoin is worth $25,000

- This means that you would need to report the interest payment at a nominal value of $145 (0.0058 x $25,000 market value)

As you can imagine, evaluating crypto tax in Australia can be cumbersome – especially if you are receiving interest payments on a daily basis.

As such, you might want to consider purchasing some Australia crypto tax software if you are heavily involved in this space.

Tax on Crypto Staking

Staking is somewhat similar to the aforementioned crypto interest accounts, insofar that you will be looking to generate a yield on your tokens for locking them away for a certain period of time.

Furthermore, and perhaps most importantly, you will need to calculate the value of your tokens when you unlock them from the respective staking pool.

For example,

- Let’s say that you buy 3 BNB tokens at $300 each from a crypto exchange

- You then deposit the BNB tokens into a 12-month staking pool that pays 20% in interest

- At the end of the 12-month period, you receive your original 3 BNB plus the interest

- The 20% interest amounts to 0.6 BNB

- When you receive the staking rewards, BNB is trading for $500 per token

There are two events to consider from the above example. First, you receive 0.6 BNB in rewards – so this needs to be added to your total income for the year. This is no different from earning income in the form of a salary.

Second, if at some point in the future you decide to sell the 0.6 BNB tokens that you earned via staking, this could trigger capital gains tax. This will happen if you cash out for more than your cost price – which in the above example, was $500 per BNB token.

For instance, if you sell the 0.6 BNB when the digital asset is trading for $600 – this means that you will are making capital gains of $60 ($600 – $500 x 0.6 BNB). Again, this $60 will need to be added to your annual income.

Tax on Airdropped Crypto

Airdropped tokens are essentially free crypto that you receive for being part of a project. Oftentimes, it’s just a case of adding your wallet address to a newly launched crypto project’s airdropping list.

This allows a project to distribute tokens without collecting any funds. One of the most famous airdrops of all time happened in 2017 when Bitcoin Cash gave all Bitcoin holders free tokens on a 1:1 basis.

In terms of how this is taxed in Australia, check out the example below:

- Let’s say that you are airdropped 1,000 tokens from a new crypto project

- When you receive the tokens, they are worth $0.10 each

- This means that at the time of the airdrop, your tokens have a resale value of $100

- Irrespective of whether or not you sell, this $100 will need to be added to your total income for the year

- Then, when you eventually decide to sell the 1,000 tokens, capital gains tax will be triggered if you do so at a higher price

- Your cost price in this example is $0.10

Therefore, if you sold your 1,000 tokens at $0.15 each, your capital gains liability would amount to $50 ($0.15 – $0.10 x 1,000 tokens)

NFTs

Another area of cryptocurrency tax in Australia that you need to think about is with regards to non-fungible tokens – or simply NFTs.

- Let’s say that you buy a Lucky Block NFT at $1,500

- You hold onto your Lucky Block NFT for two years

- Then, you manage to sell it on an NFT marketplace for $10,000

- This amounts to capitals gains of $8,500

- However, as you held the NFT for more than 12 months, you get a 50% deduction on this amount

- As such, the total capital gains that need to be added to your annual income is $4,250

Don’t forget that some NFTs can be staked. And therefore, any proceeds you make from staking will be liable for tax.

Crypto Mining

If you are involved in crypto mining, there are two events that you need to consider when attempting to evaluate your tax liabilities.

First, you need to consider that any tokens earned from mining will likely be classed as income. The amount that needs to be added to your annual income should be based on the market value at the time the tokens are received.

For example:

- You are mining Bitcoin

- You successfully mine a Bitcoin block – so you receive 6.25 BTC

- At the time you receive the tokens, Bitcoin is worth $5,000

- This means that you will need to add $31,250 to your annual income

Then, let’s say that you decide to sell all of your tokens a few weeks later:

- When you sell the Bitcoin that you earned from mining, BTC is trading at $7,000

- You sell all 6.25 BTC tokens

- This means that you receive $43,750 from the sale

- Therefore, your capital gains amount to $12,500

- This would then need to be added to your annual income

Once again, if you held on for at least 12 months and then decided to sell the tokens you made from mining Bitcoin, your capital gains would be deducted by 50%.

Income Tax Rates for Crypto

We briefly mentioned earlier that when calculating your crypto tax in Australia – there is no specific rate for capital gains.

Instead, any capital gains that you make will subsequently be added to your annual income. This means that you are taxed on your total income in its entirety – which not only covers your investments but your salary too.

Nonetheless, below you will find the income tax rates in Australia for the 2021–22 year – as per the ATO website.

| Taxable income | Tax on this income |

| $0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

To ensure that you understand how much you will likely need to pay – let’s break the above table down with an example:

Crypto Tax in Australia Example

Let’s say that in the current tax year, you:

- Sold $10,000 worth of Dogecoin that you originally bought for $2,000 in the same year – so that’s capital gains of $8,000 with no 50% deduction

- Sold $5,000 worth of Bitcoin that you originally paid $10,000 for – so that’s a capital loss of $5,000

- Sold $30,000 worth of Shiba Inu that you originally paid $10,000 for 18 months ago – so that’s a capital gain of $20,000. But, you held for more than a year, so you get a 50% deduction. As such, your capital gains on this particular investment amount to $10,000

All in all, you need to add the following to your annual income:

- Dogecoin +$8,000

- Bitcoin -$5,000

- Shiba Inu +$10,000

As per the above, for this tax year, your total capital gains amount to $13,000. During the same tax year, you earned a salary of $70,000. This takes your total income to $83,000.

- Now, as an Australian resident for tax purposes, you get an allowance of $18,200.

- This leaves you with a total income of $64,800 ($83000-$18200)

- You will then pay 19 cents tax on every dollar you earn from $18,201 to $45,000. This amounts to $5,091.20.

- Then, everything between $45,001 – $120,000 – which is the balance, is charged at 32.5 cents for every $1

In addition to the above, you will likely need to pay a 2% Medicare levy tax.

Cryptoassets are a highly volatile unregulated investment product.

Do You Pay Tax for Buying and Selling Cryptocurrency in Australia?

In simple terms – yes, you will need to pay tax when you buy and sell cryptocurrency in Australia.

However, as we mentioned earlier, the tax is payable on the capital gains that you make.

And, moreover, if the specific investment in question was held for at least 12 months, then you will receive a 50% deduction on the amount of capital gains that need to be added to your total income.

However, if you swap open cryptocurrency for another, you might not be aware that this also triggers a taxable event. The reason for this is that you are essentially disposing of the first cryptocurrency to buy the next.

And as such, you need to take into account the difference in pricing from when you bought the original cryptocurrency to when you swapped it.

For example:

- Let’s say that you bought 1,000 XRP at $1 each

- 6 months later you decide to swap. your 1,000 XRP for BNB tokens

- When you do, XRP is trading at $1.50 per token

- Irrespective of how many BNB tokens you get for the swap, in the eyes of the ATO, you made capital gains of $0.50 per XRP

- As such, for the purpose of capital gains, you would need to add $500 to your annual income

To counter the above, if you swapped the XRP when it was worth less than $1 per token, you might be able to claim capital losses.

Crypto Tax Breaks Australia

The main crypto tax breaks that you have access to have loosely been discussed already. This includes the 50% capital gains deduction that you get when you hold onto a crypto investment for at least 12 months.

Moreover, you also have capital losses, which occur when you dispose of a cryptocurrency for less than what you originally paid. This can then be offset against capital gains in the current or following tax year.

It is also worth mentioning that if your total income – including capital gains, is under the $18,200 threshold – then no tax will be liable for the respective year.

What Crypto Transactions are Exempt From Tax in Australia?

The only exemption that the ATO considers on crypto transactions is associated with the personal use guideline.

In a nutshell, if you are buying crypto for the purpose of buying a product for personal use, then it might be exempt from tax.

For example:

- Let’s say that you are looking to buy flight tickets

- The website that you are using is offering a 15% discount when payment is made in crypto

- This brings the cost down to $800

- You, therefore, decide to buy $800 worth of crypto to cover the transaction

- Both the crypto purchase and flight ticket transaction are conducted on the same day

Although you bought crypto and use the funds to buy a product, this likely wouldn’t attract capital gains tax. The reason for this is that you bought the tokens specifically for the purpose of buying the product.

How Does ATO Know About Your Crypto Assets?

Since 2019, the ATO has been collecting data from crypto exchanges and other relevant service providers. Those operating in this space and serving Australian residents for tax purposes must provide relevant data to the ATO.

Crucially, it is not just transactions that occur at crypto exchanges that the ATO is aware of. On the contrary, transactions that take place to and from linked wallets can also be tracked.

- For example, let’s say that you use a crypto exchange to buy $5,000 worth of Bitcoin.

- You then withdraw the Bitcoin tokens out of the exchange and into a private wallet.

- A few months later, you transfer the Bitcoin tokens to another exchange with the view of cashing out.

- When you do, the Bitcoin is worth $20,000 – which results in capital gains of $15,000.

Now, while you might think that because you used a different exchange to complete the sale, the ATO is unaware of the transaction.

However, your private wallet is linked to your identity because you used it to withdraw the $5,000 worth of Bitcoin from the first exchange – which would have required your personal information and KYC documents.

Reporting Crypto Gains & Losses on Tax Returns

Make no mistake about – as this guide has explained extensively with real-world examples, the process of understanding your crypto gains and losses for tax reporting purposes can be extremely difficult.

This is why we briefly mentioned earlier that you might consider using a third-party tax computation provider.

In doing so, the provider will securely connect to your crypto exchange accounts and wallets and be able to perform all calculations in real-time as soon as the transaction is executed. This will make paying tax on crypto in Australia a lot easier.

How to Avoid Paying Crypto Tax in Australia

If you’re looking for some tips on how to avoid paying crypto in Australia – consider some of the legal strategies outlined below:

Make Sure You Report All Losses and Fees

The first step to take in your quest to avoid paying crypto tax in Australia is to ensure that you are fully aware of any potential losses that you have made.

After all, if you are performing lots of transactions throughout the year, you might have missed out on a potential capital loss. The good news is that you should be able to include relevant fees for this purpose.

For example, let’s say that you deposited $1,000 into a crypto exchange with your debit card – which attracts a fee of 5%. Straightaway, that’s $50 in fees that you should be able to deduct from any potential gains.

Then, when you buy your chosen crypto at the respective exchange, you pay a commission of 1%. Again, you should be able to use this to your advantage when calculating your gains and losses for the year.

Donate to Charity

You might also be eligible for a deduction from your crypto taxes in Australia if you donate to a registered charity. This will be based on the value of the respective tokens at the time of the donation.

Personal Use Asset

We already mentioned this one earlier. But to recap – if you buy crypto and then specifically use the tokens to buy a product within a short time span, then you might be able to claim the personal use asset rule.

Hold Tokens for At least 12 Months

One of the best ways that you can reduce crypto tax in Australia is to take full advantage of the 12-month rule.

As we mentioned earlier, if you hold your crypto tokens for at least 12 months from the time you invested – any subsequent capital gains will come with a 50% deduction.

Is Crypto Interest Taxed?

Yes, crypto interest is taxed. As we noted earlier, you will need to report the interest amount received. This is based on the market value of the tokens on the day that the interest is paid into your wallet or account.

However, the good news is that for as long as you have your crypto held in a savings account – you won’t need to worry about capital gains. And, as long as you avoid selling the tokens for 12 months, any capital gains owed will be deducted by 50%.

Conclusion

This comprehensive guide has covered everything you need to know about crypto taxes in Australia. As you now know – not only do you need to consider tax liabilities on capital gains – but also income surrounding staking, interest accounts, airdrops, and more.

If you’re looking to reduce your crypto taxes in Australia, one of the best ways to do this is to deposit your tokens into an interest-paying account like Crypto.com.

Cryptoassets are a highly volatile unregulated investment product.