When it comes to crypto staking, choosing the right cryptocurrency is crucial. But the platform which you stake with matters more. So which is the best crypto staking platform Australia?

Below we list the top ten best crypto staking platforms that you can access from Australia. We break down staking rewards, extras and regulation. We also dive deep into how crypto staking works, so you can start earning crypto with confidence.

Best Crypto Staking Platforms in Australia List

The Australian Government has a positive attitude towards crypto. So investors are spoilt for choice when it comes to pinpointing the best crypto staking platform Australia:

- Sponge V2 – An evolved version of a 100x meme coin with a unique Stake-to-Bridge model and a Play-to-Earn game, improving token utility and community engagement.

- AQRU — Crypto Staking Platform Australia

- eToro — Platform for Automated and Regulated Staking

- Crypto.com — Great All-Round Staking Service

- Coinbase — Reputable US Exchange with Solid Staking Options

- Binance — Crypto Staking Rewards

- BlockFi — Good Platform for Staking Crypto Stablecoins

- Nexo — Good for Staking & Personal Finance Options

- Kraken — Australia-friendly Exchange with Good Staking Options

- Gemini — US-Based Exchange with Good Staking Reputation

- MyCointainer — Dedicated Staking-as-a-Service Provider

Best Crypto Staking Platforms Australia Reviewed

If you have been researching cryptocurrency staking, you have probably already have come across some of the best crypto exchanges Australia.

But did you know about ‘Staking-as-a-Service’ providers? These are specialist outfits that focus exclusively on crypto staking. This specialisation makes their service often very slick, with great staking rewards.

You may want great staking convenience as well as a choice of other financial assets. Perhaps check out then broker eToro, which offers crypto staking and trading as well as a massive range of 3000 stocks, 250+ ETFs, commodities, forex and indices.

For the widest selection of crypto and in-depth crypto staking options, try one of the three big exchanges we cover: Crypto.com, Coinbase and Binance.

1. Sponge V2 – Offers A Unique Stake-to-Bridge Model and a Play-to-Earn Game With A 40% APY

Sponge V2

Key Features:

- Stake-to-Bridge Model: This model allows users to stake Sponge V1 tokens to earn the new Sponge V2 tokens. It’s a new approach to token bridging, focusing on a seamless transition from V1 to V2.

- Play-to-Earn Game: Sponge V2 offers an exciting P2E game, offering free and paid versions. Players can earn $SPONGEV2 tokens, improving the token’s utility and appeal.

- Tokenomics: The total supply of $SPONGEV2 is set at 150 billion tokens. A significant portion (over 51%) is allocated for staking and P2E rewards, encouraging user participation and improving the token’s utility.

- Community and Marketing: Building on the success of Sponge V1, which reached a market cap of $100 million, the team plans to leverage its experience and community support to move Sponge V2 forward.

Staked V1 tokens are permanently locked, showing long-term commitment. The staking rewards are distributed over 4 years, starting at a minimum APY of 40%, incentivizing long-term engagement.

Users can bridge to V2 by either buying and staking V1 tokens through the Sponge website or by staking existing V1 tokens. This process reserves equal V2 tokens and allows users to earn additional V2 tokens.

Sponge V2’s innovative approach, combining the viral appeal of a meme coin with practical utility through staking and P2E gaming, positions it uniquely in the market.

Its focus on community engagement strategy could drive significant user adoption and potential market impact.

Users can enter the Sponge Telegram channel and follow it on X (Twitter) for all the latest updates about upcoming exchange listings and other updates.

| # of Cryptos to Stake | 1 |

| Staking Rewards | Variable APY (Min 40%) |

| Minimum Stake | NA |

| Maximum Stake | NA |

| Locked In? | Yes |

| Extras | Stake-to-Bridge; Exclusive Launch; P2E Game Participation |

| Payout Frequency | Over a 4-year period |

Cryptoassets are a highly volatile unregulated investment product.

2. AQRU — Promising Staking Platform With High APYs

AQRU is a Staking-as-a-Service specialist which offers top rates of up to 12% on stablecoins and up to 7% on Bitcoin and Ethereum. AQRU aims for a no-frills approach suitable for all investors:

- First, you sign up with Aqru and get verified.

- Second, you deposit funds to buy crypto to use with staking — or you can simply deposit crypto you have bought elsewhere. You can deposit fiat currencies GBP, EUR or USD via bank transfer or credit card.

- Third, you buy whichever crypto you want to stake. Aqru offers staking with stablecoins USDC, USDT and DAI, as well as crypto market leaders BTC and ETH. Staking commences automatically.

- Fourth, you can withdraw any amount funds with 24hrs notice. ‘No catches, no lock-ins, no questions’ is the Aqru promise.

Effectively, AQRU acts as a hugely-convenient crypto savings account. This offers the key advantage that your crypto interest, which is calculated, daily goes straight into the pot. Unlike with other providers, it is not distributed to a separate wallet. This allows you develop compound interest, which you can explore using AQRU’s handy earnings calculator.

AQRU allows you to stake for much longer periods than other providers, and also (unusually) allows staking of fiat currencies EUR and GBP.

| # of Cryptos to Stake | 5 |

| Staking Rewards | Stablecoins (DAI, USDC, USDT): 12% Non-Stablecoins (BTC, ETH): 7% |

| Minimum Stake | €100 ($148 AUD) |

| Maximum Stake | NA |

| Locked In? | No lock-in period —flexible withdrawals only |

| Extras | NA |

| Payout Frequency | Daily |

Cryptoassets are a highly volatile unregulated investment product.

3. eToro — Platform for Automated and Regulated Staking

With 25m+ users, top broker eToro is a standout player in the staking sector:

With eToro, crypto staking happens automatically. When you hold Cardano (ADA) or Tron (TRX) with eToro, you will automatically earn a share of the monthly staking yield. Your yield will depend on which tier membership you have with eToro. This depends, in turn, on how much equity you have in your eToro account.

eToro is a full-service broker. That means as well as crypto staking and trading, you can manage your risk by trading in a massive range of other financial assets, including stocks, ETFs, commodities, forex and indices.

eToro is fully-regulated. eToro is regulated in Australia by ASIC, in the US by FinCEN, in Europe by CySEC and in the UK by the FCA. Try finding another crypto staking platform that offers this level of regulation overall!

eToro is a pioneer of Social Trading. Social Trading is not directly related to crypto staking. But it does reflect how focussed eToro is on making trading easy and successful for everybody. With eToro’s CopyTrader, you can copy other crypto traders for free. And, with 8 crypto Smart Portfolios to choose from, you can buy into expert strategic crypto positions for free too.

You can deposit AUD with eToro using bank transfer, credit card, Neteller or Skrill.

| # of Cryptos to Stake | 3 |

| Staking Rewards | Varies monthly for ADA, TRX, ETH % reward for each investor depends on equity held with eToro |

| Minimum Stake | Enough to earn $1 staking rewards per month |

| Maximum Stake | NA |

| Locked In? | No lock-in period |

| Extras | You get higher returns the more equity you have with eToro. |

| Payout Frequency | Monthly. |

Cryptoassets are a highly volatile unregulated investment product.

4. Crypto.com — Great All-Round Staking Service

Crypto.com is the tenth-biggest crypto exchange in the world. With over a $1bn worth of crypto business handled every day and 200 coins to trade, US-based Crypto.com is — unlike multi-asset eToro — deals in crypto only. You can deposit AUD with Crypto.com using bank transfer or credit card.

With Crypto.com, you can stake over 50 different coins for rewards of up to 10% on stablecoins (including TrueAUD, USD Coin and DAI) and up to 14.5% on other coins. You can stake on a flexible basis — which means you can withdraw your crypto whenever you like. Or you can commit for 1 or 3 months to get better rates.

To get the best rates on Crypto.com you will need to buy some in-house crypto CRO. You can use the handy online calculator to see instantly what rates you will get, depending on how much CRO you have held for 6 months:

- $400 USD equivalent or less of CRO – normal rate

- $4,000 USD equivalent or more of CRO – better rate

- $40,000 USD equivalent or more of CRO – best rate

Crypto.com is unusual in offering staking on meme coins. For example, you could buy Shiba Inu Australia, stake it for 3 months and earn 2%. That’s if you have no CRO. If you had held $40,000 of CRO for 6 months, on the other hand, you would earn 5%.

If you were to buy Dogecoin Australia (fellow meme coin) you would earn the same rate.

Note that, with Crypto.com’s higher earning tiers, a proportion of your interest will be paid in CRO rather than the staked currency.

| # of Cryptos to Stake | 50+ |

| Staking Rewards | Stablecoins: up to 14% Non-Stablecoins: up to 14.5% |

| Minimum Stake | Varies by coin |

| Maximum Stake | Tier 1: up to USD 30,000 equivalent Tier 2: receive 0.5 reward for upwards of USD 30,000 equivalent |

| Locked In? | 30 days, 90 days or flexible |

| Extras | Buy in-house crypto CRO to increase your staking rewards |

| Payout Frequency | Weekly |

Cryptoassets are a highly volatile unregulated investment product.

5. Coinbase — Reputable US Exchange with Solid Staking Options

Like Crypto.com, Coinbase is a big US crypto exchange that handles over $1bn of crypto business every day. Coinbase is a big name in the crypto business, having been the first exchange to go public on the stock markets with a NASDAQ IPO in 2021. (You can buy Coinbase stock with eToro under the ticker name ‘COIN’).

When it comes to staking, Coinbase offers a streamlined suite of 6 crypto staking opportunities:

- Algorand: 0.45% APY max

- Cosmos: 5.00% APY max

- DAI: 0.15% APY max

- Ethereum: 3.675% APY max

- Tezos: 4.63% APY max

- USD Coin: 0.15% APY max

For investors wanting to manage the risk of their staked crypto, you can stake stablecoins DAI and USD Coin. Or you can stake Cosmos (ATOM) for the maximum return available of 5% APY. Staking periods vary by coin. A minimum stake of $1 is required.

Coinbase does not offer the high rates available with AQRU or the range of crypto available with Crypto.com. Thus it cannot be considered the best crypto staking platform Australia. However, Coinbase does offer key advantages. It has some regulation in the US via the SEC. And you can deposit AUD with Coinbase using debit card — or stake using crypto you have transferred in from another exchange/wallet.

| # of Crypto to Stake | 6+ |

| Staking Rewards | Stablecoins: up to 2% Non-stablecoins: up to 5% |

| Minimum Stake | Varies depending on coin No minimum for ETH |

| Maximum Stake | NA |

| Locked In? | Varies by coin. |

| Extras? | NA |

| Payout Frequency | Daily/weekly |

Cryptoassets are a highly volatile unregulated investment product.

6. Binance — Popular Platform For Crypto Staking Rewards

Binance is the biggest crypto exchange in the world. It offers 600 crypto and numerous trading

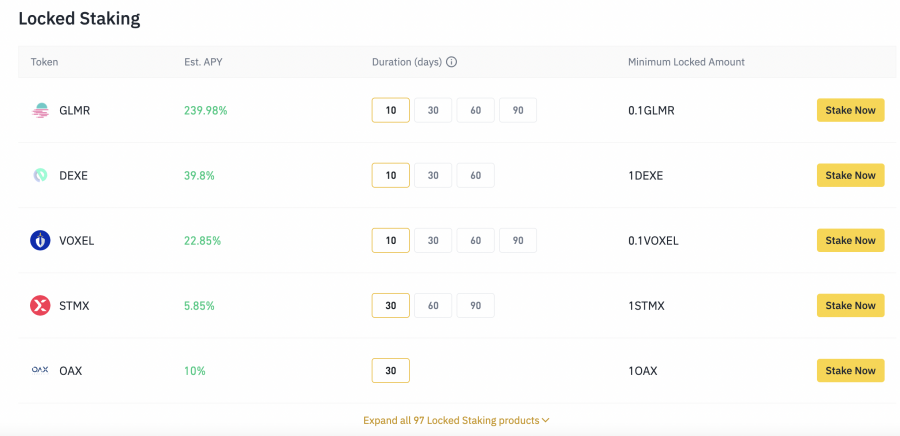

There are two main types of staking available: locked staking and DeFi staking.

Over 100 coins are available to stake with Binance’s locked staking, including key stablecoins that you can stake without having to worry that their value will fall whilst they are locked in. Lock-in periods vary massively from 10-120 days.

If you browse through Binance’s locked staking options, you will notice that the best rates are available for coins that have high risk profiles. For example, you can get 120.69% APY by staking metaverse coin Axie Infinity (AXS) for 90 days. But the price of AXS was badly hit last month after its network was hacked by cyberthieves, and investor confidence has yet to return. The price of AXS could continue to drift whilst your AXS is locked up, offsetting any staking gains.

Binance’s alternative to locked staking is DeFi staking. This gives you direct access to 13 on-chain DeFi mining projects. But be clear: Binance does not accept liability for any losses incurred with these DeFi projects.

Binance offers alternatives to staking in the form of flexible savings accounts, liquidity pools, and more.

| # of Cryptos to Stake | 100+ |

| Staking Rewards | Stablecoins: up to 3.78% Non-stablecoins: up to 250% |

| Minimum Stake | Varies by coin |

| Maximum Stake | Varies by coin |

| Locked In? | Flexible, 10 days, 30 days, 60 days, 90 days, 120 days |

| Extras | Many earning alternatives to staking |

| Payout Frequency | Daily |

Cryptoassets are a highly volatile unregulated investment product.

What is Staking in Crypto?

Crypto staking, like several other areas of cryptocurrency trading, can be either a complex or straightforward idea, based on how much experience you have in the sector.

The main lesson for most crypto enthusiasts is that staking acts as a gateway to collecting rewards for owning particular crypto assets. Nevertheless for those only trying to earn staking rewards, it’s beneficial to know how crypto staking works in the first place.

Additionally, crypto staking gives investors the opportunity to make their crypto holdings grow while also minimizing crypto tax liabilities in Australia.

How Does Crypto Staking Work?

Staking crypto Australia is similar to investing fiat currency (like AUD) in a conventional bank account. You put in a certain sum with a staking provider, and you earn financial interest.

With crypto staking, the interest you earn is generally paid in the crypto that you invest with.

APY – Annual Percentage Yield

APY is a key term to understand. Staking rewards are usually shown as APYs. This percentage figure shows you the yield that would be returned if you staked for 12 months. You will need to do some simple maths to work out what rate you will therefore get for the much shorter staking periods that tend to be available.

On-Chain vs. Off-Chain Staking

A key distinction to understand is the difference between on-chain staking and off-chain staking.

On-Chain Staking

This means using a crypto wallet to stake crypto as part of the validation process of a blockchain that works on the Proof-of-Stake (PoS) protocol. This is a technical process, and not suitable for all investors.

Off-Chain Staking

This means staking crypto with a third-party. This third-party will then return rewards on your stake according to their terms of service. Off-chain staking is what is offered by the top 5 providers we review above.

Mining vs. Staking

So, what’s the difference between crypto mining and crypto staking?

Mining (Proof-of-Work)

Blockchain mining means using computing power to validate transactions on a crypto blockchain in order to earn rewards. Mining is the key mechanism in Proof-of-Work (PoW) authentication, and was pioneered by Bitcoin. The problem with PoW is that it is uses masses of electricity. It is thus going out of vogue across the crypto space.

Staking (Proof-of-Stake)

Proof-of-Stake (PoS) authentication is fast replacing Proof-of-Work (PoW). Ethereum, for example, is upgrading to Proof-of-Stake. Most new crypto use PoS.

Proof-of-Stake means that, rather than using computing power, blocks on the chain are authenticated by people staking large amounts of governance tokens. And this is why crypto staking generally has taken off — because for new blockchains to work at all, they need a constant supply of their own token.

Benefits of Staking Crypto in Australia

Let’s take a look at some of the benefits of crypto staking in Australia right now.

Make Idle Crypto Work for You

Crypto staking makes your crypto investments work for you. Most people buy crypto as speculative investments rather than to use them to engage directly with the crypto ecosystem. For example, you can buy meme coin Shiba Inu Australia in the hope that it will repeat its incredible price performance of 2021. But, as you wait for that to happen, your SHIB is idle. With crypto staking, you can put it to work. You can stake SHIB with Crypto.com and earn up to 5% APY. With Binance, you can get rates of up to 12.09% APY.

Develop Compound Interest

Staking rewards are often calculated on a daily or weekly basis. If you re-stake your rewards, you can get some compound interest going. This means that the amount you are staking will grow as your staking rewards grow. This is the definition of a financial virtuous circle. Flexible savings account achieve this for your automatically, in general.

Use Stablecoins to Hedge Against Price Inflation

Price inflation in the real-world is the worst it has been for 40 years. And conventional savings accounts with banks are not offering great interest rates. That means that, if you have cash saved away in a bank, its spending power is being eroded.

One strategy to mitigate this erosion of your savings is to buy some stablecoins and stake them. Stablecoins (like DAI, USDC and USDT) come in four different types depending on how they are collateralised. But what really matters from the investor’s point of view is that the price of all stablecoins remains — as the name suggests — stable.

This price stability means that you can commit your stablecoins to a staking arrangement and be certain that the price of the asset will not drop whilst it is locked in. The crypto sector is, after all, very volatile. So this is a key consideration.

Stablecoins are available to buy at all the best crypto exchanges Australia. Another way that some users are making money with crypto is via the best crypto gambling sites in Australia.

The 6 Best Crypto Staking Coins

You can stake coins directly on blockchain networks yourself. But this requires technical know-how, as well as nerve. Most investors choose instead to stake with a staking provider.

One important rule-of-thumb: pick your provider first, then pick your staking coin second.

Staking providers offer different rates for different coins, so be sure to check where you can get the best deal. Then, and only then, buy the coin necessary to stake.

1. Ethereum (ETH)

Fortunately, many key providers allow you to stake manageable amounts of ETH with them rather than directly on-chain. Guaranteed lock-in periods are offered, as well as well as flexible withdrawals.

Crypto staking aside, ETH is a solid investment generally because the Ethereum blockchain is so central to DApps as well as NFTs.

2. Binance Coin (BNB)

With BNB, you can access all sorts of perks when using the Binance exchange, including great staking opportunities. You can get up to 12.99% APY if you lock in BNB for 120 days. A sliding scale of return is offered depending on lock-in duration. If you would rather have access to your staked BNB at all times, you can simply stash it in the BNB Vault and earn 0.35%. That’s a modest gain. But it is better than nothing!

Aside from staking, ownership of BNB allows you secure a 25% discount on Binance exchange trading fees. BNB also gives you generous discounts in Binance’s other financing products, including liquidity pools.

Binance is not the only exchange to offer BNB staking. Crypto.com, for example, offers up to 5% APY on BNB staking.

3. USD Coin (USDC)

USDC stands out amongst stablecoins because it is backed by big US exchange Coinbase. It also has a whopping market capitalisation of $49bn. You can earn up to 12% staking USDC with market-leader Aqru. Coinbase, on the other hand, only guarantees an APY of 0.15%, and Binance 1.2%. Crypto.com offers up to 10% APY. It just shows you — when it comes to crypto staking platforms, it is vital to shop around.

Other key stablecoins to consider for staking include:

- Tether (USDT): the biggest stablecoin by market capitalisation.

- Binance USD (BUSD): Binance’s own stablecoin.

- Dai (DAI): which, like Terra’s UST, is collateralised by other crypto rather than by fiat currency.

4. Terra (LUNA)

In February 2022, the price of LUNA jumped $14 on news that $1bn of funding had been secured for a new UST exchange. LUNA has high upside potential. It boasts an innovative approach to stablecoin management, as well as deflationary pressures built into the LUNA system.

You can stake LUNA on-chain without becoming an official Validator by using a LUNA staking pool. Or you can choose the easy way. You can deposit some LUNA with Crypto.com to earn up to 7% APY, provided you have some CRO too. Or, even better, opt for Binance, where you can earn 18.79% APY if you are prepared to lock some LUNA in for 90 days.

5. Bitcoin (BTC)

Bitcoin is the world’s

But the Bitcoin blockchain is not Proof-of-Stake — it works via mining and Proof-of-Work. So how can you stake Bitcoin? The answer is that many exchanges and Staking-as-a-Service providers offer Bitcoin staking because they recognise how popular Bitcoin is generally. Instead of using your BTC to stake ‘on-chain’, they will use other DeFi applications to earn you (and them) rewards.

With Binance, you can stash Bitcoin in a flexible savings account and earn 5% APY. With both providers, you can withdraw your Bitcoin whenever you like and then return it to staking.

How to Buy And Stake Sponge V2 In Australia

You can buy or stake $SPONGE tokens using the following steps;

Step 1 – Connecting Wallet for $SPONGE Purchase

To buy $SPONGE tokens, first connect your MetaMask or Trust Wallet using the provided widget. The $SPONGE token is available on Uniswap, with the contract address 0x25722Cd432d02895d9BE45f5dEB60fc479c8781E.

Step 2 – Staking V1 Tokens for V2

If you already have $SPONGE tokens, you can ‘Stake Now’ via the Staking Dashboard. Here, you can deposit your V1 $SPONGE tokens and receive V2 tokens in exchange. Note that this process locks your V1 tokens permanently.

Step 3 – Purchasing $SPONGE

If you don’t have $SPONGE tokens, you can buy them using ETH, USDT, or a card. Purchasing through the widget automatically stakes your V1 tokens permanently and gives you a bonus in V2 tokens based on the purchase amount.

Step 4 – Earning Sponge V2 through Staking

Staking V1 tokens is the only method to get V2 tokens before their official launch. Essentially, more V1 tokens staked and a longer staking period result in a greater reward for V2 tokens.

Cryptoassets are a highly volatile unregulated investment product.

Is Crypto Staking Taxed in Australia?

The Australia Tax Office (ATO) is – like tax offices around the world – trying to keep up with crypto. But it is not quite there yet. As a result, there are no regulations concerning crypto staking specifically.

Australian crypto accountants, though, are generally agreed that:

- You will be charged income tax on all crypto interest that you earn on staking.

- You will be charged Capital Gains tax when you come to sell your staked crypto.

Potential Risks of Crypto Staking in Australia

Provider Risk

Risk: your staking provider could get hacked, go bust or turn out to be a fraudulent enterprise.

Solution: use a regulated provider with good security.

Crypto Value Risk

Risk: the value of your crypto could plummet whilst it is locked into a staking account. You will still earn interest. But you may end up withdrawing less crypto than you put in.

Solution: Stake with stablecoins (like USDC, USDT and DAI) only. The value of stablecoins does not change. So you will be guaranteed the same amount when you withdraw as when you deposited.

Opportunity Risk

Risk: You commit your funds to a particular staking deal and then discover you could have got a better deal elsewhere.

Solution: Do your research. Use our guide above as a starting point to explore the best deals. And only buy crypto for staking when you have a deal with a particular provider in mind.

Conclusion

Above we have reviewed 6 of the best crypto staking platforms. We have also given an overview of 6 of the best crypto staking coins. There’s a start for you. But be sure to do your own research. The crypto staking sector is growing fast, as it becomes clear that so much better rewards are on offer than those provided by conventional savings accounts in the banking sector.

Sponge V2 is our top pick for Best Crypto Staking Platform Australia. It is an evolved meme coin featuring a unique Stake-to-Bridge model and a Play-to-Earn game, focusing on seamless V1 to V2 transition and improving token utility and community engagement.

Cryptoassets are a highly volatile unregulated investment product.