Terra and its underlying digital token – LUNA, is perhaps behind the most sensational event in the crypto industry in recent times.

Put simply, LUNA went from being a top-10 digital currency for market capitalization before losing 99% of its value in the space of a week. This was largely due to its sister project – UST, losing its 1:1 peg with the US dollar.

If you are looking to add this token to your portfolio while it is super cheap, this guide will explain how to buy Terra LUNA in Australia with low fees.

How to Buy Terra LUNA in Australia – Quick Guide

The easiest and safest way to buy Terra LUNA in Australia is with an ASIC-regulated broker like eToro.

This popular broker allows you to invest in cryptocurrency from just $10 per trade with a debit/credit card – so you won’t need to risk large sums of capital.

Here’s how to buy Terra LUNA in Australia right now in four simple steps:

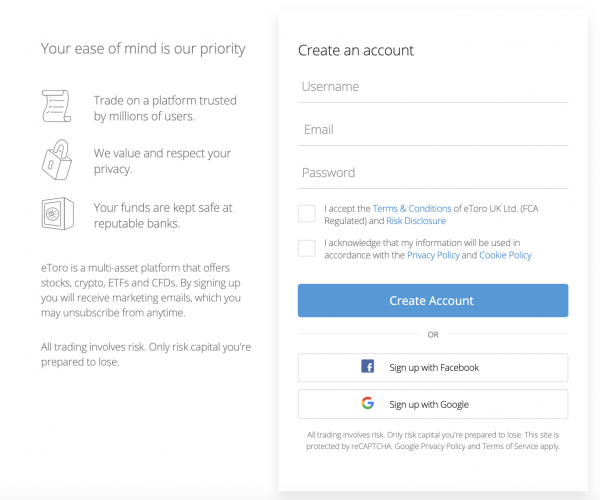

- ✅ Step 1: Open an eToro Account – You will first need to register a trading account. At eToro, this simply requires you to let the broker know who you are. Enter your personal information when prompted and choose a suitable username and password.

- Step 2: Deposit Funds – Australian traders are required to meet a minimum eToro deposit of just $50. You can fund your account instantly with a debit/credit card, POLI, or an e-wallet like Paypal.

- Step 3: Search for Terra LUNA – Start typing ‘Terra’ into the search box. When you see the crypto project load from the search box, click ‘Trade’.

- Step 4: Buy Terra LUNA in Australia – You will now need to fill out a simple order form. Enter the amount of money ($10 minimum) that you wish to invest in Terra LUNA and click on ‘Open Trade’ to confirm the investment.

Cryptoassets are a highly volatile unregulated investment product.

Your newly purchased LUNA tokens will be added to your eToro portfolio right away.

Read on for a more detailed walkthrough on how to invest in Terra LUNA in Australia.

Where to Buy Terra LUNA in Australia

Bearing in mind that Terra LUNA was a top-10 digital currency for market capitalization prior to its capitulation, it goes without saying that many crypto exchanges in Australia give you access to this asset.

You do, however, still need to do some research to determine where to buy Terra LUNA in Australia for your financial profile. For instance, be sure to explore what fees and commissions apply and what minimum trade size you will need to meet.

In the sections below, we discuss the best places to buy Terra LUNA in Australia right now.

1. eToro – Overall Best Place to Buy Terra LUNA in Australia

When it comes to security, low fees, and accepted payment types, eToro is the overall best place to buy Terra LUNA in Australia. This top-rated brokerage site is not only regulated by ASIC for your safety, but by the FCA (UK), SEC (US), and CySEC (Cyprus) too. As such, you can invest in Terra LUNA via a legitimate platform.

The minimum deposit to get started at eToro is just $50 and you can choose from a wide selection of convenient payment types. This is inclusive of Paypal, Neteller, Skrill, and even POLI. Other instant payment methods include debit and credit cards. All payment types come with a competitive deposit fee of just 0.5%.

Once you have registered an eToro account and deposited some funds, you can then buy Terra LUNA in Australia with a minimum of just $10. This is especially ideal for a volatile and speculative digital asset like LUNA, as you won’t need to risk too much money to gain exposure. Trading fees amount to just 1% – which again, is very competitive.

In terms of storage, eToro allows you to keep your Terra LUNA tokens in its secure web wallet. This way, when you eventually get around to cashing out, it’s just a case of logging into your account and placing an instant sell order. You might also consider downloading the eToro crypto wallet app for iOS or Android.

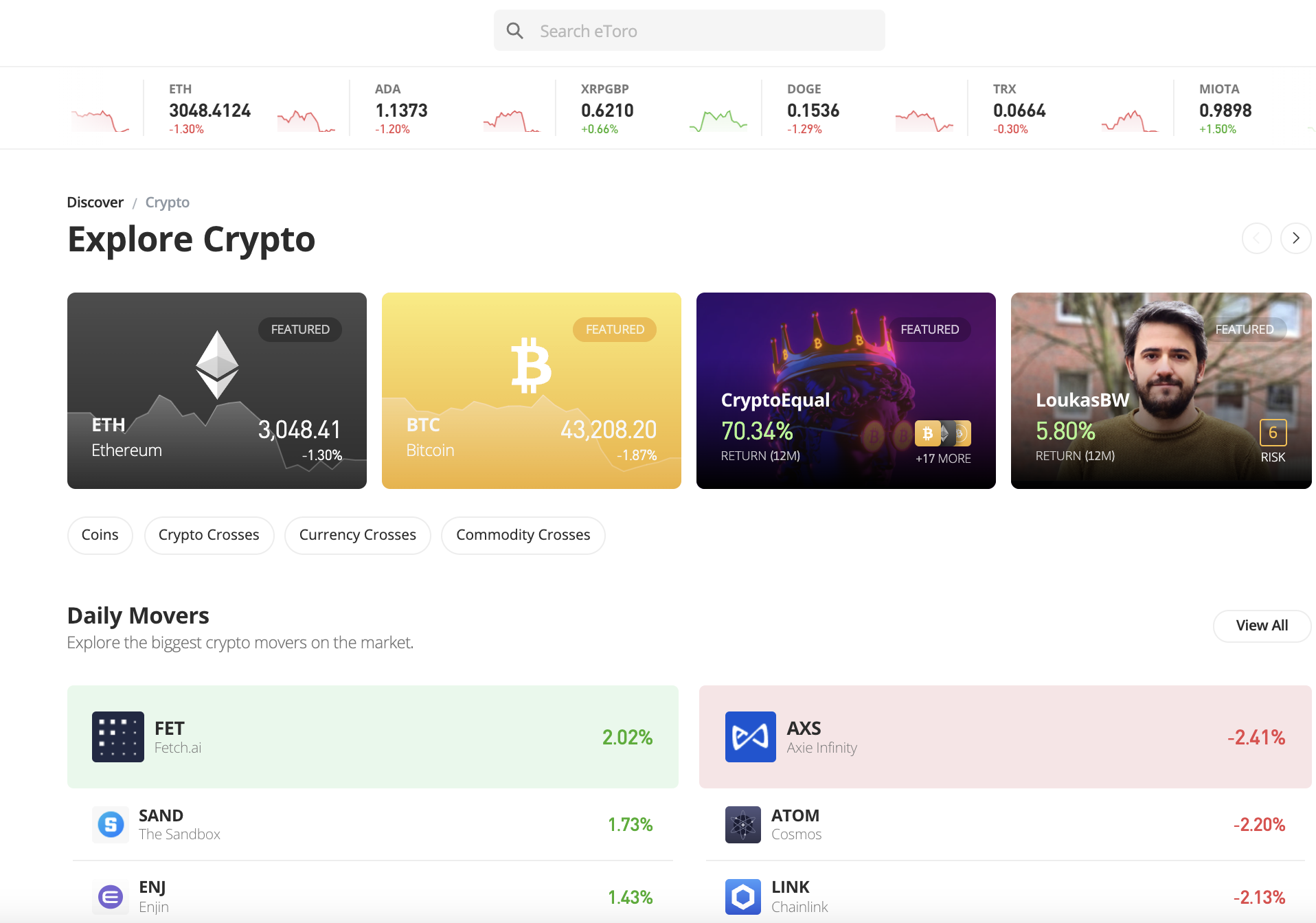

In addition to Terra LUNA, you can also invest in Bitcoin and 60 other digital currencies. This is inclusive of Ethereum, Shiba Inu, Dash, Cardano, Litecoin, Decentraland, and many others. You can also invest in thousands of commission-free stocks and ETFs, and trade leverage CFDs in the form of forex, hard metals, energies, indices, and agricultural products.

If you wish to invest in Terra LUNA and other digital assets passively, there are a number of crypto-centric smart portfolios offered and managed by eToro. You can also invest in a popular and proven eToro trader by electing to copy their ongoing positions. The copy trading tool requires a minimum investment of just $200 per trader, while smart portfolios require $500.

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Buy Terra LUNA in Australia With Low Fees

And, Crypto.com offers additional ways for you to reduce your investment fees further. For instance, if you hit certain trading volume milestones within a 30-day period, your commission will be lowered. This is also the case if you decide to buy and stake the Crypto.com native token – Cronos (CRO).

In order to buy Terra LUNA via the Crypto.com platform, you will first need to register an account and deposit some funds. Fortunately, it takes just minutes to get set up and the platform accepts debit/credit card payments. With that said, this payment method does attract a deposit fee of 2.99%.

Nonetheless, this is somewhat offset by the platform’s industry-leading commission structure. Once you have invested in Terra LUNA, your tokens will automatically be added to your Crypto.com web wallet. You can leave the tokens there or elect to withdraw them to an external source. You can also download the DeFi mobile wallet for iOS and Android.

In addition to a full suite of decentralized services, the Crypto.com DeFi wallet allows you to store your Terra LUNA tokens without a centralized operator. This means that ultimately – you are the only person that will have access to your private keys. Another popular feature that Australians like at Crypto.com is its digital asset savings accounts.

Although Terra LUNA is not supported, dozens of other tokens are. And, in depositing your idle tokens into a Crypto.com savings account, you will be paid an attractive rate of interest. The best APY on offer right now is 14.5% on standard crypto tokens and 10% on stablecoins.

Cryptoassets are a highly volatile unregulated investment product.

3. Capital.com – Trade Terra LUNA in Australia With Leverage and 0% Commission

The third platform to consider when deciding on where to buy LUNA crypto in Australia is Capital.com. This provider specializes in contracts-for-difference or CFDs. This means that when you trade Terra LUNA here, you will not own the respective tokens nor will you need to worry about storage.

On the contrary, CFDs at Capital.com merely track the real-world price of Terra LUNA on a second-by-second basis. This gives you the option of trading LUNA tokens with leverage of up to 1:2. Meaning – that by staking $500 on a Terra LUNA position, you can amplify the value of your trade to $1,000.

Moreover, Capital.com allows you to trade Terra LUNA tokens without paying any commission. Another top-rated feature offered by Capital.com is that you can attempt to profit from both rising and falling crypto prices. This is because you can choose to enter a position with a buy or sell order.

We also like Capital.com for the sheer number of trading markets that it offers. For example, in addition to Terra Luna, you can trade over 470 other digital asset markets. Most pairs contain the US dollar, albeit, other fiat currencies are supported when trading large-cap tokens (e.g. BTC/AUD). A number of crypto-cross pairs are supported too.

Furthermore, Capital.com is home to thousands of international stocks and ETFs, alongside forex markets, indices, commodities, and more. If you like the sound of the CFD model offered by Capital.com, opening an account rarely takes more than a few minutes from start to finish.

You will only be required to meet a minimum deposit of $20 if you opt for a debit/credit card or an e-wallet payment. But, those wishing to deposit funds via a bank wire will need to fork out at least $250. Either way, we like that Capital.com charges nothing in deposit or withdrawal fees. And finally, when it comes to safety, Capital.com is regulated by NBRB, FCA, ASIC, and CySEC.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

What is Terra LUNA?

Terra LUNA is perhaps one of the best and worst-performing digital currencies in recent years. Before we explain why this is, let’s first get a firm grasp of what this project actually offers. First and foremost, the company that created Terra LUNA is also behind a stablecoin known as TerraUSD – or UST. Both Terra LUNA and UST work in sync with each other.

As a stablecoin, the overarching objective of Terra USD is to remain pegged to the US dollar. Therefore, in theory, 1 UST should always be worth $1 in the open market. Unlike other stablecoins in this industry, Terra USD is not backed by actual reserves. On the contrary, the Terra project utilizes advanced algorithms to ensure that it remains pegged to the USD at all times.

It does this by increasing or decreasing the supply of Terra USD or LUNA based on broader market conditions. For example, if the project burns 1 Terra USD, this will increase the supply of LUNA by $1. And if $1 worth of LUNA is burned, this will create 1 Terra USD. However, unlike UST, Terra LUNA is not a stablecoin that is pegged to a fiat currency.

Instead, the price of LUNA fluctuates throughout based on market demand and supply. That is to say, as more and more people decide to invest in LUNA, this will have a positive impact on its price. Ultimately, as we explain in more detail shortly, LUNA went from being one of the world’s most valuable digital assets to losing 99.9% of its token price in the space of a week.

Is Terra LUNA a Good Investment?

Make no mistake about it – while all digital currencies carry an inherent level of risk, Terra LUNA is on another level.

After all, this crypto project has not only seen its stablecoin de-peg from the US dollar, but its LUNA token has lost over 99% of its value in a matter of days.

As such, if you are looking at how to buy Terra LUNA because you believe it represents a bargain entry price – you need to be prepared to lose some or even all of your investment capital if things don’t go as planned.

Here’s what you need to know when deciding on whether or not Terra LUNA is a good investment:

20% Yield on Terra UST via Anchor

It is crucial to understand that in order to determine the viability of Terra LUNA as an investment, you also need to consider its sister digital token – Terra USD. Now, prior to the capitulation of LUNA, holders of UST were able to deposit their tokens into Anchor – which is a third-party DeFi platform that offers decentralized yields and savings accounts.

This offered UST holders a huge yield of 20%. According to several reports, nearly 75% of UST tokens were deposited into Anchor for this purpose. However, as many market commentators argued for some time, this 20% was unsustainable in the long run. And as such, Anchor decided to implement a variable yield on Terra USD deposited held in its platform.

The result? Waves of investors decided to withdraw their UST tokens out of Anchor before cashing out at crypto exchanges. In turn, this then resulted in the unthinkable happening – UST lost its peg with the US dollar. In fact, at one point, Terra USD was trading at just $0.13 per token – as per CoinMarketCap.

Knock-on Effect of UST on Terra USD

Once again, both UST and LUNA are part of the same Terra project. As such, the reputation of one token will have a major impact on the other.

And, when you consider that traders were looking to offload their UST tokens for just 13 cents on the dollar, this resulted in a significant sell-off of Terra LUNA.

- In fact, in the one month prior to writing this guide, Terra Luna was trading at just under $100 per token.

- One year prior to this, LUNA was trading at just $15 per token.

- This means that in the space of a year, Terra increased in value by more than 550%.

- As a result, prior to its collapse, Terra LUNA was one of the best-performing tokens of the year.

- However, after the de-pegging of Terra USD, LUNA has since capitulated to lows of $0.00001 per token.

- This translates into a loss of over 99.9% of its value.

Crucially, this 99.9% decline in value happened in a matter of days in conjunction with the decline of the Terra USD stablecoin.

Huge Upside Potential

If you decide to buy Terra LUNA tokens in Australia, then you should be prepared to lose what you invest.

However, we should note that at current prices, LUNA does appear somewhat attractive. After all, if this digital currency is able to recover even a small fraction of its prior value, then the upside potential could be huge.

- For example, at the time of writing this guide, Terra LUNA is trading at just over $0.0002 per token.

- Now, even if it was able to hit $1 per token – which is just 0.8% of its prior all-time high of $119, this would result in an increase of nearly 500,000%.

- In other words, if you were to risk $10 on Terra LUNA at current prices and it hit $1 – your tokens would be worth $50,000.

Therefore, although the risk of loss is very high, you don’t need to invest large sums to be in with a chance of making attractive gains.

Super-Cheap Token Price

Leading on from the above section, another reason why you might decide to buy Terra LUNA in Australia is that you can purchase a significantly large number of tokens with a small capital outlay.

For example, let’s suppose that you were to invest $100 into Terra LUNA via the eToro platform. We’ll say that you enter the market at $0.0002 per token. In doing so, your $100 investment would get you 500,000 LUNA tokens.

Exchange Risk

On the other hand, another risk that you need to consider before you buy Terra LUNA in Australia is with respect to third-party crypto exchanges.

This is because some of the biggest exchanges in this industry have since suspended their trading markets on LUNA. Some platforms have gone one step further by delisting LUNA from their exchange entirely.

This means that when it comes to cashing out your LUNA tokens, you might need to do a lot of digging around to find an exchange that can assist.

Terra LUNA Price

In this section of our guide, we will go into a lot more detail about the recent highs and lows of Terra LUNA in terms of its market price.

- First and foremost, according to CoinMarketCap, Terra LUNA first hit public exchanges back in July 2019 at $1.3 per token.

- Fast forward to early May 2022 and LUNA hit an all-time high of $119

- This means that those that bought LUNA in 2019 and held on until its peak value were looking at gains of over 9,000%

- However, in conjunction with the de-pegging of Terra USD, LUNA began its capitulation

- On May 4th, 2022 – Terra LUNA was trading at $86 per token

- On May 12th, 2022 – Terra LUNA was trading at $0.91 per token. This amounts to an initial decline of 98%

- LUNA has since hit lows of $0.00001 per token. This translates into a decline of over 99.9% since the de-pegging event

As you can see, people that were holding Terra LUNA before the crash – especially those that invested post-2022, have potentially lost a lot of money.

Terra LUNA Price

The key question that you are probably looking for answers to is whether or not Terra LUNA will ever recover to its prior highs. The simple answer is likely to be a resounding no. After all, investors have all but lost confidence in this project.

Moreover, based on prices as of writing, Terra LUNA would need to increase in value by unrepresented amounts were it to get anywhere near its previous all-time high of $119. In fact, this would require an upward swing of nearly 60 million percent.

For this to happen, there would need to be a capital injection from new investors worth multiple billions of dollars. On the other hand, perhaps not all is lost with this project.

- Crucially, even the slightest of recoveries could result in a major increase in value from where the Terra LUNA price is currently sitting.

- For example, let’s suppose that you invested at an entry price of $0.0002 per token.

- If Terra LUNA was able to hit $0.10 per token, this would translate into gains of nearly 50,000%.

- This means for every $1 invested, your LUNA would be worth $500.

And, if LUNA did hit $0.10 per token – this would only amount to 0.08% of its prior all-time high price of $119.

Ways of Buying Terra LUNA

If you are happy to take the risk and subsequently wish to buy Terra Luna in Australia today, there are many ways that you can achieve this goal.

The best ways of investing in this highly volatile digital asset are discussed below:

Buy Terra LUNA With Credit Card or Debit Card

When you buy goods and services via your web or mobile browser, there is every chance that you use a credit/debit card. And as such, this payment method is by far the easiest and most convenient to use when investing in Terra LUNA in Australia.

The process is as follows:

- Open an account with a suitable crypto exchange that lists LUNA

- Deposit funds with a credit/debit card

- Search for LUNA

- Enter your stake

- Buy LUNA

As simple as it is to buy LUNA in Australia with a credit or debit card, you need to consider fees. eToro is perhaps the best option here, as you will only pay 0.5% of the deposit amount.

Capital.com offers free credit/debit card deposits – sh0uld you wish to trade crypto CFDs.

Buy Terra LUNA With PayPal

Both eToro and Capital.com also allow you to buy Terra LUNA with PayPal. The fees mirror that of the aforementioned credit/debit card charges.

That is to say, at eToro, you will pay 0.5% to deposit funds with PayPal while at Capital.com, no fees are charged at all.

Best Terra LUNA Wallet

Depending on what your trading strategy looks like, you might need to consider getting a Terra LUNA wallet.

With that said, if you buy Terra LUNA from a reputable exchange or broker, then you can perhaps consider leaving your tokens in your account.

For example, eToro is regulated by ASIC, so its web wallet is a great option in terms of both safety and convenience. After all, when you eventually get around to selling your LUNA tokens, you can log into your eToro account and place a sell order.

On the other hand, if you end up trading LUNA tokens via Capital.com – you won’t need to worry about wallet storage. This is because Capital.com offers CFDs, which merely track the real-world value of LUNA.

The other option is to download a wallet app to your phone. eToro offers a mobile wallet for iOS and Android that supports dozens of tokens in addition to Terra LUNA.

How to Buy LUNA in Australia – eToro Tutorial

If you have considered that you could lose your entire investment and wish to proceed – we will now walk you through the process of how to buy LUNA crypto in Australia.

We mentioned earlier that eToro is the best broker for this purpose in terms of fees, safety, and user experience – so our tutorial will show you the required steps with this platform.

Step 1: Open a Crypto Account

You can open a crypto trading account with eToro in minutes. First, hit the ‘Join Now’ button from the homepage and choose a username and password. After entering your email address, click ‘Create Account’.

As an ASIC-regulated broker, eToro will, of course, also need to collect some personal information from you. This is just a case of entering your name, residential status, home address, and date of birth.

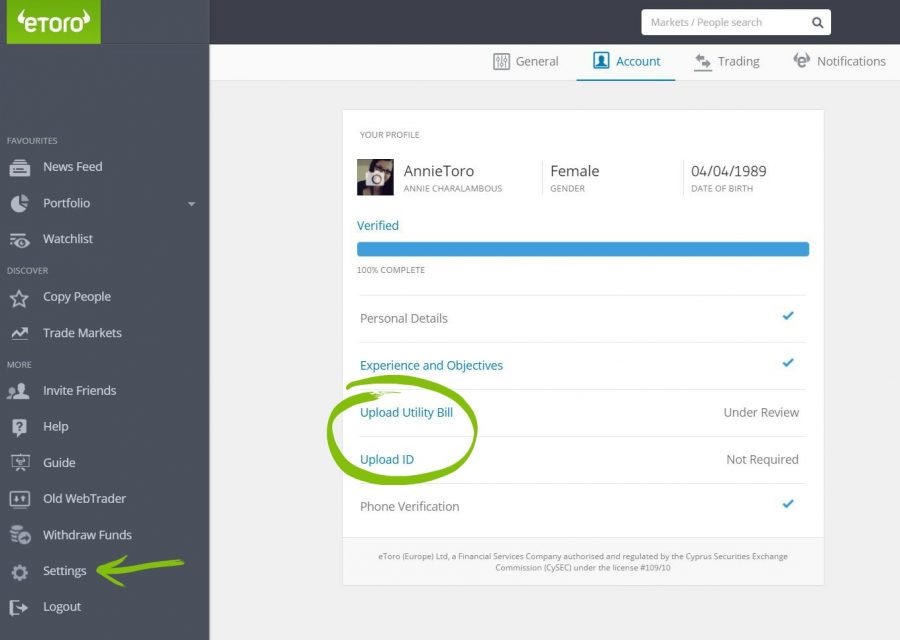

Step 2: KYC Process

You will also need to upload a copy of your government-issued ID and a proof of address. This is another legal requirement implemented by all ASIC brokers.

To verify your identity, upload a copy of your passport or driver’s license. To verify your residential status, upload a recently issued bank statement or utility bill.

Note: Other KYC documents are accepted, so check the eToro website for more information.

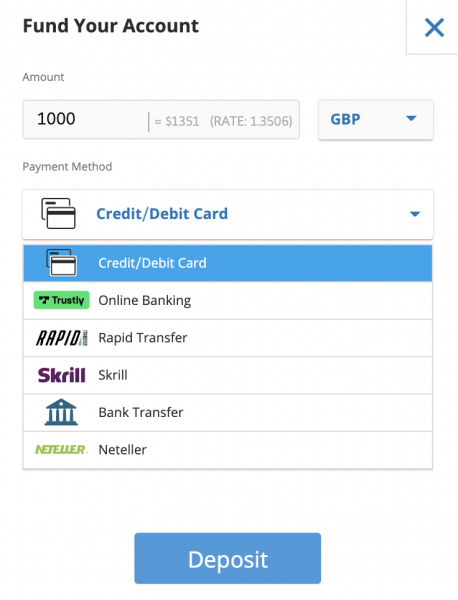

Step 3: Deposit Funds

You can now make a deposit into your account. You only need to meet a minimum deposit of $50 to get started with a LUNA investment. If you wish to enter the market instantly, opt for a debit/credit card, POLI, or an e-wallet.

Once you have selected your preferred payment method from the list of options presented to you, enter your funding amount and click on ‘Deposit’.

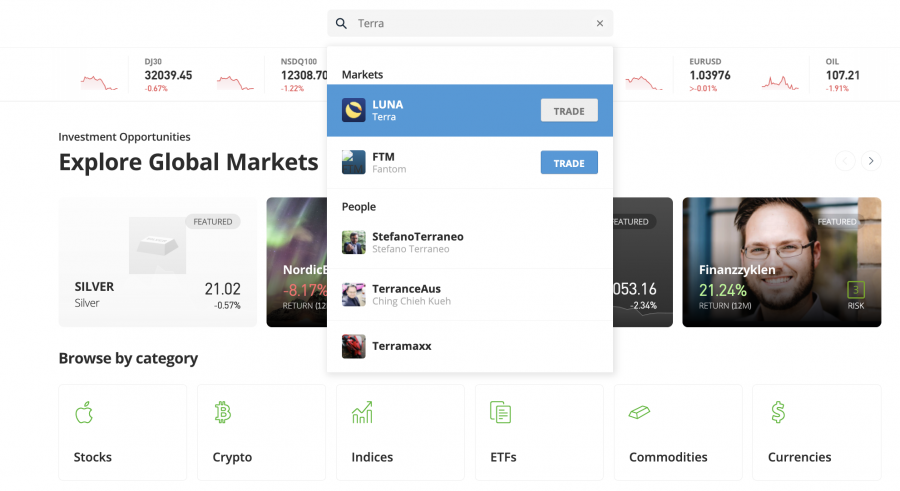

Step 4: Search for Terra LUNA

You can now find the relevant marketplace for LUNA by typing in ‘Terra’ via the search bar.

Then, click on the ‘Trade’ button.

Step 5: Buy Terra LUNA

You will now need to create a buy order. In the ‘Amount’ box, type in the size of your investment stake. The minimum crypto investment at eToro is just $10. Even by meeting the minimum, you can get yourself tens of thousands of LUNA tokens.

Finally, once you hit the ‘Open Trade’ button, the LUNA tokens will be added to your eToro investment portfolio.

How to Sell Terra LUNA

Once you have invested in LUNA tokens, you can leave them in your eToro account for safekeeping. When you decide to sell, go to your portfolio and click on the ‘Close’ button. eToro will execute your order at the next best available price.

Due to extremely volatile conditions, you need to be prepared for unprecedented spreads – which is the gap between the bid and ask price as per market forces.

This means that the price you are able to sell your LUNA tokens might be much lower than what you see displayed on your chosen exchange.

Either way, if you use eToro to sell your Terra LUNA tokens, the funds will be added to your cash balance as soon as you confirm the sale.

Conclusion

This guide has explained everything you need to know when learning how to buy Terra LUNA. As we have explained in great detail, LUNA tokens have capitulated in value – losing as much as 99.9% in less than a week of trading.

However, if you believe that this represents an excellent time to buy, you can complete the process right now at eToro. When using this ASIC-regulated broker, you can deposit funds instantly via POLI, PayPal, or a debit/credit card.

The minimum deposit stands at just $50 and you only need to meet a trade requirement of $10 when buying Terra LUNA.

Cryptoassets are a highly volatile unregulated investment product.