Investment apps allow traders to buy and sell assets via their smartphones. This ensures that investors are never more than a click away from the financial markets.

In this guide, we compare the best investment apps in the market today for supported assets, low fees, accepted payment types, safety, and user-friendliness.

Best Investment Apps for Beginners in 2025

Those wishing to trade right now can consider the 15 best investment app providers listed below:

- eToro – Overall Best Investment App for 2025

- XTB – Access 2,100 Markets with this Forex Trading App

- Vantage – Access Low Spreads from 0 Pips with this Multi-Asset Trading app

- Kalshi – The First-Ever No Deposit Event Contract Trading Platform

- Trade Nation – Beginner-Friendly Investing App with a Low Fee Model

- Webull – Popular Investment App for Trading US Stocks

- Acorns – Automatically Invest Spare Change

- Fidelity -Trusted Investment App With $1 Minimum Stock Trade

- Public – Top Investment App for Long-Term Investors

- Robinhood – Best Investment App for Beginners

- Cash App – Combine Banking and Trading via a Single Investment App

- Investing.com – Great App for Investment News and Research Tools

- Ally Invest – Low-Cost Invest App With Robo Advisor

- E*TRADE – Huge Selection of Supported Markets and Account Types

- Stockpile – Buy and Sell Stocks at 0% Commission From $1

- Wealthfront – Managed Portfolios From Just 0.25% Annually

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Choosing the right investment app is an important task. Therefore, consider reading our provider reviews in the subsequent sections of this comparison guide.

Best Investing Apps Reviewed

Selecting the best investment app is no easy feat considering the sheer number of trading platforms active in this space.

Most investment apps are offered by traditional online brokers – so users should explore key metrics surrounding the types of markets on offer and what fees and commissions apply to both trading and funding.

Safety and regulation are also important, as real money will need to be deposited in order to invest.

In the sections below, we review and rank the very best investment apps in the market right now.

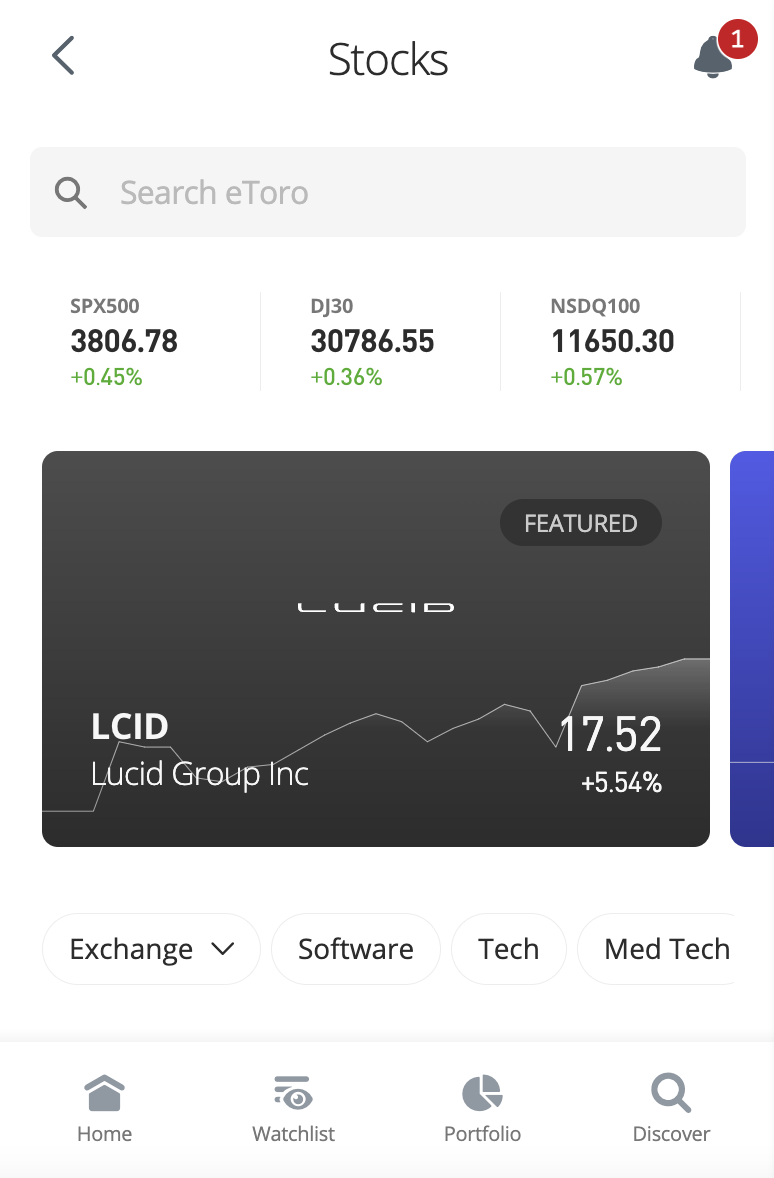

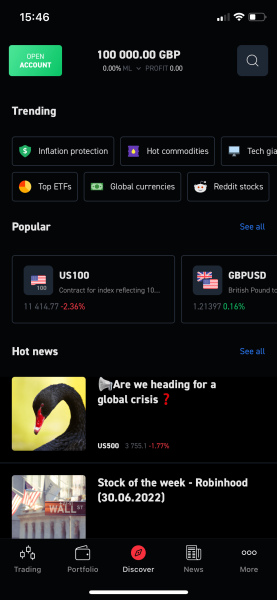

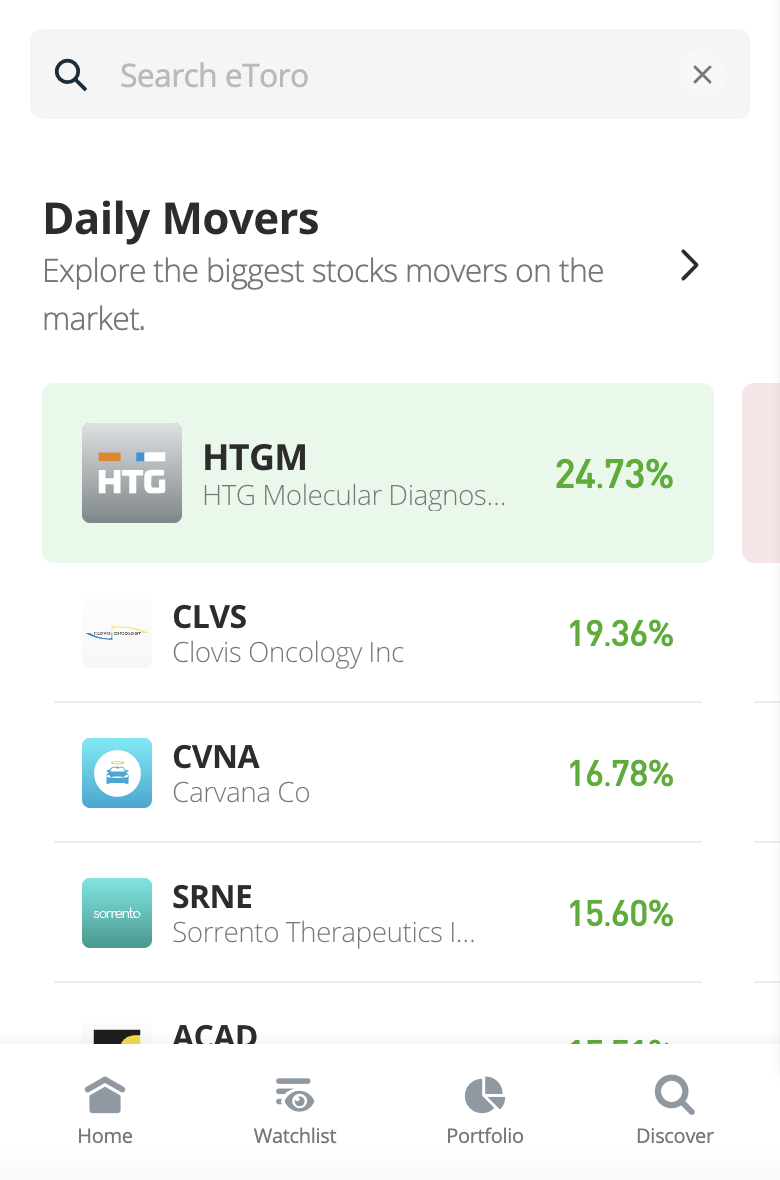

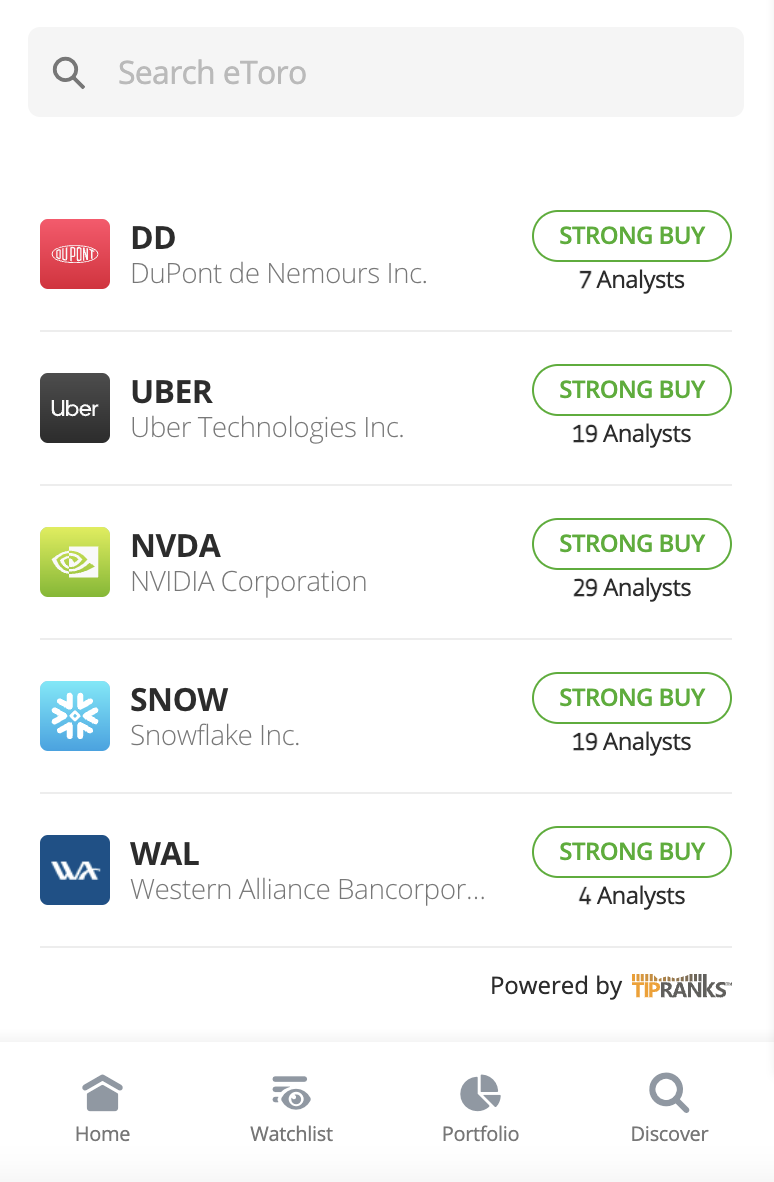

1. eToro – Overall Best Investment App for 2025

On top of the NYSE and NASDAQ, this covers markets in the UK, Europe, Asia, Canada, and more. eToro also offers ETFs – such as those managed by iShares and SPDR. Crucially, all stocks and ETFs at eToro can be traded at 0% commission and the minimum investment stake is just $10.

US clients can also use the eToro investment app to buy cryptocurrency. There are over 70+ supported tokens – which includes everything from Bitcoin, Solana, and Dash to Dogecoin, Shiba Inu, and Ethereum. Those looking to invest in cryptocurrency via the eToro app will pay a fee of just 1% plus the market spread to enter and exit the market.

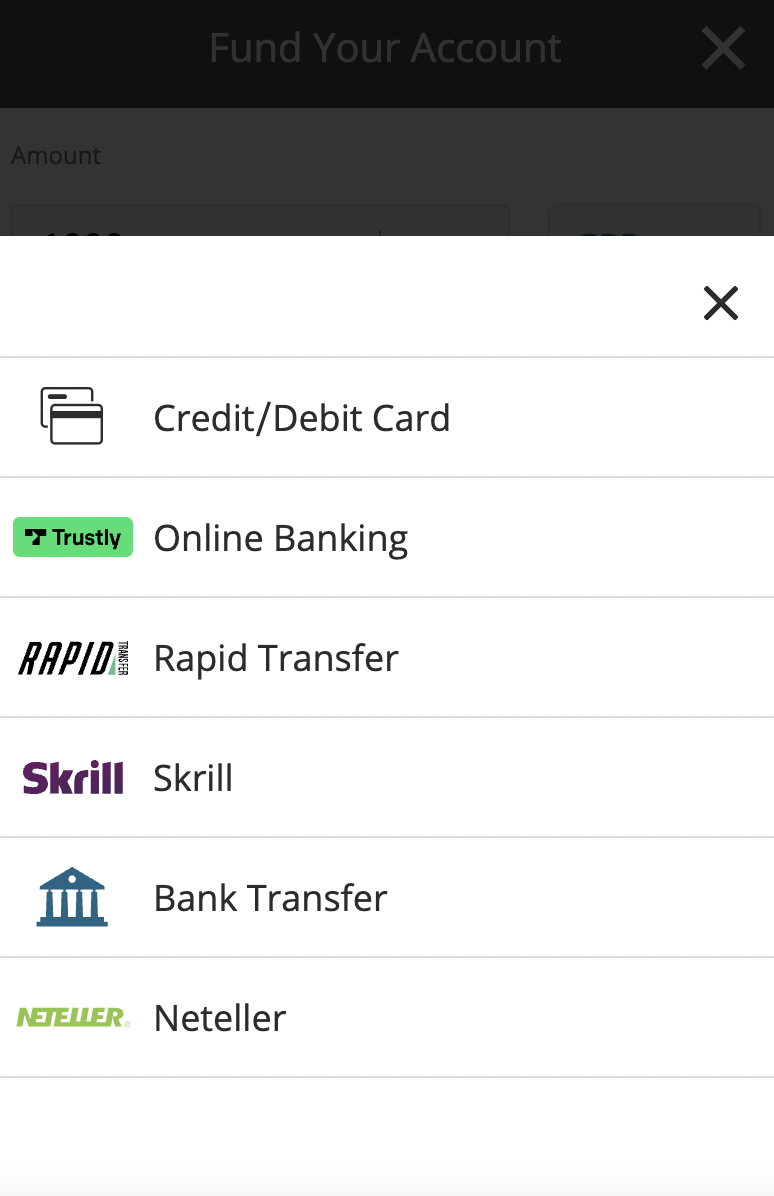

eToro investors can also deposit funds via the app with PayPal, Neteller, WebMoney, and Skrill. No deposit fees are charged on payments made in US dollars. This is also the case with withdrawals. In terms of regulation, the eToro investment app is licensed by the SEC and FINRA. Non-US users will appreciate regulation from ASIC, CySEC, and the FCA.

With such an array of stocks to choose from, investors wondering what is dividend investing in 2025 will find eToro to be a popular choice for those looking to invest in dividend stocks.

Another reason that this low margin rate broker came out as the best investment app today is that it also doubles as one of the best copy trading platforms out there. This allows users to select an experienced eToro trader and then copy their investments. In other words, if the trader invests in Apple stock and Bitcoin, the same position will be mirrored in the user’s portfolio.

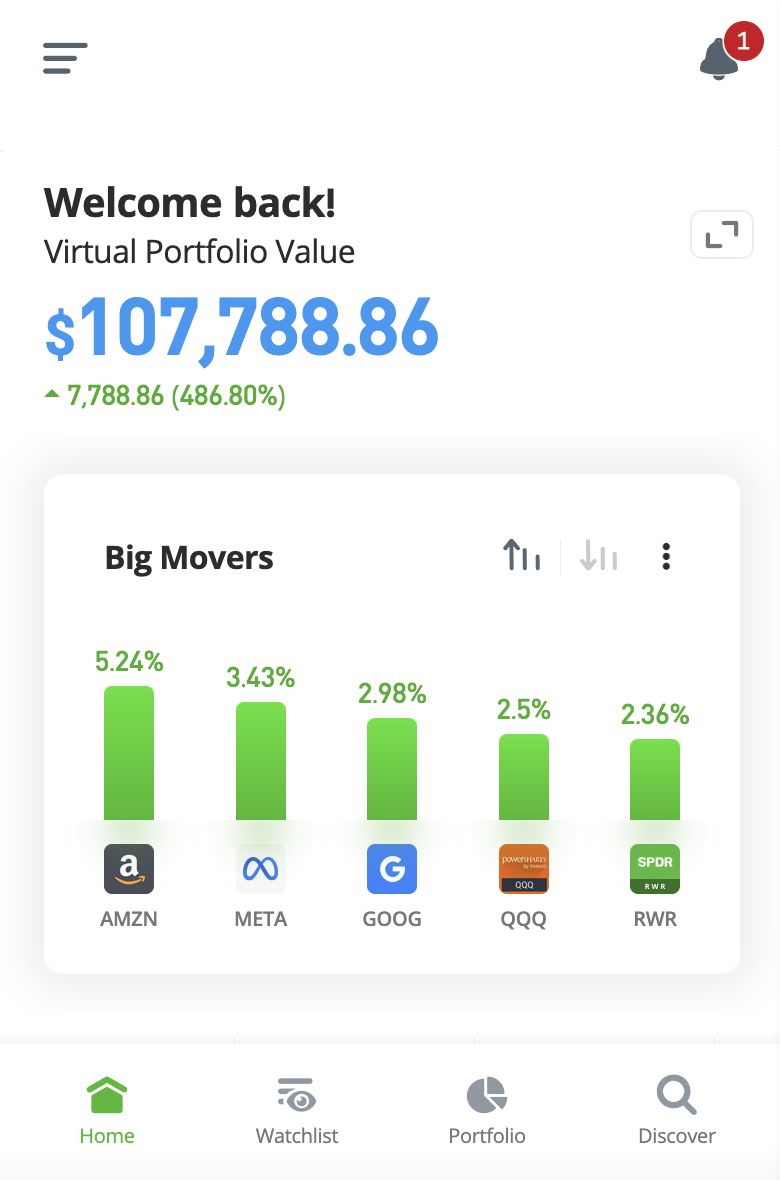

Users might also like the eToro investment app for its Smart Portfolios. These are pre-made, professionally managed investment portfolios that are both hand-picked and maintained by the eToro team. The eToro investment app also comes with a fully-fledged demo account that is pre-funded with $100k. Still wondering if eToro is the best investment app in 2025? Read our eToro review as we explore all the key metrics from fees to regulations.

| Minimum Deposit | $10 |

| Investment Markets | Stocks, ETFs, crypto, forex, indices, commodities |

| Pricing System | 0% commission on stocks/ETFs, 1% + market price on crypto |

| Core Features | Copy trading, smart portfolios, no fees on foreign stocks |

Pros

Cons

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

2. XTB – Access 2,100 Markets with this Forex Trading App

What’s really impressive about XTB is that retail traders can apply leverage up to 100:1 when trading major forex pairs and up to 10:1 when trading stocks. In addition, there are no commissions for any trades at XTB. The broker makes money through spreads, which start at 0.1 pips for forex trading and hover around 0.3% for stock trades. There’s also no minimum deposit at XTB.

XTB offers its own custom trading platform called xStation 5. It’s available for iOS and Android mobile devices in addition to the web. xStation 5 is a very user-friendly trading platform, especially for traders who are new to technical analysis. It comes with highly customizable charting templates, dozens of built-in technical studies, price alerts, and more. A discover feature also helps traders find hot assets that could present trading opportunities.

XTB has a free and unlimited demo account, allowing traders to test out the platform with no deposit.

| Minimum Deposit | None |

| Investment Markets | Stocks, ETFs, crypto, forex, indices, commodities |

| Pricing System | 0% commission |

| Core Features | Free demo account, xStation 5 platform, advanced technical charting |

Pros

Cons

Your capital is at risk. 75% of retail CFD accounts lose money.

3. Vantage – Access Low Spreads & High Leverage with this Multi-Asset Trading app

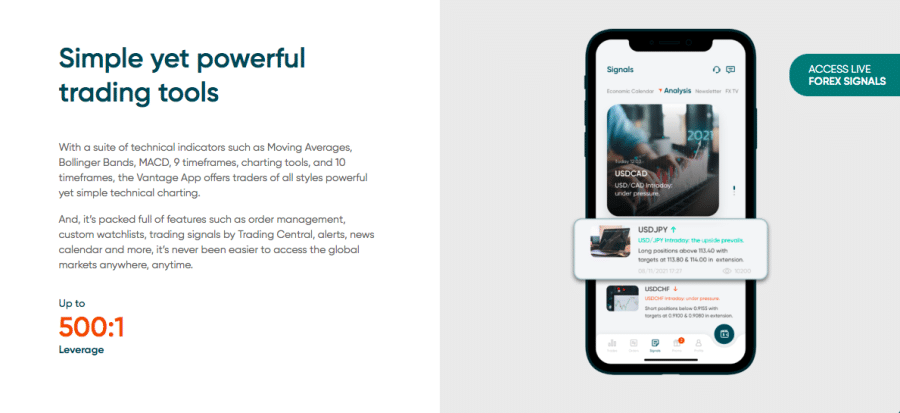

Through the Vantage app, users can trade on the go and access hundreds of forex pairs, commodities, share CFDs and indices. Notably, the app does not charge commissions when trading share CFDs from US-listed companies.

Over 40 forex pairs can be accessed through the app, including the popular EUR/USD pair. This particular pair charges low spreads starting from 0.0 – 0.2 pips. Users can access a suite of technical indicators on the app, such as moving averages, charting tools, multiple daily timeframes, bollinger bands, and more.

Members can also set up custom watchlists on the app to track their favorite assets and set up alerts. In total, 1,000+ instruments can be accessed through the app after users make a minimum deposit of only $50. Users can access payment methods such as VISA, Mastercard, Skrill, and Neteller to make this deposit.

The platform does not charge any deposit or withdrawal fees. A secure and established broker, Vantage is regulated by the FCA (Financial Conduct Authority) and ASIC (Australian Securities and Investments Commission). Through the mobile app, traders can also access copy trading features to copy the trades of more experienced traders.

A demo account can also be leveraged to practice trading strategies before using real funds.

| Minimum Deposit | $50 |

| Investment Markets | Share CFDs, forex pairs, commodities,indices |

| Pricing System | 0% commission on US share CFDs, low spreads |

| Core Features | demo account, multiple technical indicators |

Pros

Cons

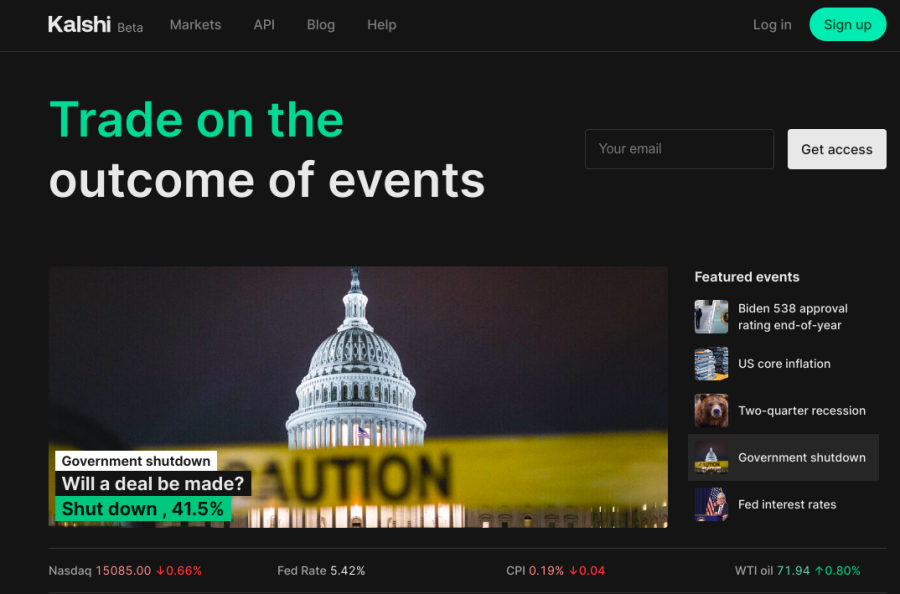

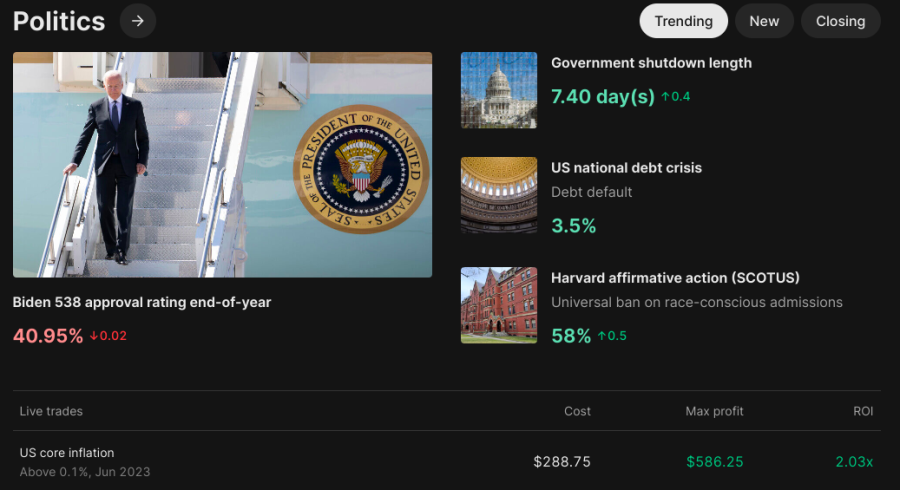

4. Kalshi – The First-Ever No Deposit Event Contract Trading Platform

The minimum investment to purchase a single contract is $0.01 on Kalshi. Contracts are taken on ‘Yes’ and ‘No’ outcomes, such as the likelihood of the EUR/USD to rise by the end of the day’s trading session. Members can also predict whether the temperatures in Chicago will rise by the end of the day or if the unemployment rates in the United States of America will decrease.

100 contracts can be purchased for only $1, resulting in a $0.07 fee on Kalshi. A safe platform to use, Kalshi is the first-ever regulated event contract exchange. In 2021, the Commodity Futures Trading Commission (CFTC) declared it as an Authorized Designated Contract Market.

This platform works with regulated clearing houses to promote market stability and store funds. Kalshi also uses various surveillance systems to monitor and detect any fraud within the exchange.

On the platform, users can sell their positions during trading hours when they have earned a profit. Furthermore, if the positions are profitable and have not been sold by the end of the trading session, you will earn $1 per contract.

Kalshi also lets traders use APIs to automate trades, access open-source resources, and analyze historical data before making new trading decisions. Through the Kalshi blog, members can also read articles on recent economic developments, access video tutorials, and study trading basics.

Kalshi is only available to use in the United States of America at this moment.

| Minimum Deposit | $0 |

| Investment Markets | Event contracts on global events |

| Pricing System | Fees taken per contract ($0.07 for 100 contracts worth $1) |

| Core Features | APIs, Event Contract Positions, Blog |

Pros

Cons

5. Trade Nation – Beginner-Friendly Investing App with a Low Fee Model

Another high-ranking investment app on our list is Trade Nation.

Instead of taking a commission route for most of its plans, it has resorted to a fixed spread model. It offers three types of accounts, including common, RAW, and TN, with TN Trader being the proprietary app for the platform.

In addition to no commission fee, there are no hidden fees involved with Trade Nation, allowing users to pay exactly what they get. Starting trading on Trade Nation can be done using a Meta trader account. With Meta Trader 4 – MT4 – users will get access to price charts and technical indicators.

And if the platform gets too complex, there is a customer support team available for assistance 24/5. And when it comes to deposits, users can deposit using any of the standard fiat methods such as VISA, Master cards, and e-Wallets.

| Minimum Deposit | $1 |

| Investment Markets | Indices, Forex, Commodities |

| Pricing System | Fixed costs spread |

| Core Features | Copy trading, market analysis, real-time news, signals center |

Pros

- Low fixed spreads

- Commission not asked for

- Multiple ways to pay

Cons

- No support for third-party platforms

75% of retail investor accounts lose money when trading CFDs with this provider.

6. Webull – Popular Investment App for Trading US Stocks

Otherwise, when opting for a domestic bank wire, Webull will charge an $8 transaction fee. There is no minimum deposit requirement stipulated by Webull on standard trading accounts. Webull is perhaps the best investment app for those looking to buy and sell US-listed stocks.

Across thousands of companies listed on the NYSE and NASDAQ, Webull users can trade stocks at 0% commission. The minimum stock trade requirement is just $5, so diversification is simple and cost-effective. Those looking to invest in stocks listed overseas will be disappointed, as Webull only supports a few hundred ADRs.

Webull, does, however, support stock trading options on its investment app. This allows users to gain exposure to US-listed stocks without needing to outlay the full capital requirement. Thus, this is an indirect way to obtain leverage. With that said, the Webull investment app also offers margin trading accounts to eligible users – which requires a minimum balance of $2,000.

There are also retirement accounts available at Webull, which include several IRAs. In addition to stocks and options, Webull users can also invest in ETFs. Moreover, the investment app supports dozens of cryptocurrencies – all of which can be purchased from just $1 per trade.

Those looking to invest in assets on the move via advanced trading tools will not be disappointed with the Webull app. It comes packed with custom pricing charts and access to technical indicators, not to mention a free demo account facility pre-loaded with $1 million in paper funds.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, crypto, options |

| Pricing System | 0% commission on all markets |

| Core Features | Retirement accounts, technical indicators, no minimum deposit |

Pros

Cons

7. Acorns – Automatically Invest Spare Change

Acorns is an investment app used by over 9 million clients. It offers a super innovative concept, whereby everyday transactions can be rounded up to the nearest dollar and subsequently invested into the financial markets. For instance, let’s suppose that an Acorns user buys a cup of coffee for $3.40.

As per the user’s account settings, Acorns will deduct $4 from the linked debit card, with the $0.60 balance being used to buy ETFs. This means that users can invest bits and pieces into the markets without a second thought. This is also a great strategy for dollar-cost averaging purposes.

The portfolios that Acorns offer are hand-picked by industry experts and are aimed at long-term investors. Rebalancing is done on behalf of account holders, so this offers a passive way to invest. There are five portfolio strategies in total, ranging from conservative to aggressive. When it comes to fees, Acorns charges $3 on personal accounts.

Family accounts – which include children, costs $5 per month. All account types offer additional perks, such as free educational material, the ability to receive a salary two days early, and fee-free access to over 55,000 ATMs. Retirement plans can also be accessed on the Acorns investment app.

| Minimum Deposit | $0 |

| Investment Markets | ETFs via pre-made portfolios |

| Pricing System | $3/month on personal accounts, $5/month on family accounts |

| Core Features | Automatically invest spare change, hand-picked portfolios, educational tools |

Pros

Cons

8. Fidelity – Trusted Investment App With $1 Minimum Stock Trade

Fidelity is one of the most trusted investment apps in the market. This provider can be accessed via a free iOS and Android app that connects to the user’s main account. The Fidelity investment app comes packed with useful tools and features.

This includes the ability to set custom pricing alerts on any asset. For instance, if the user wishes to be notified when Tesla stock hits $700, a notification will pop up on the respective smartphone. We also like the Fidelity investment app for its fractional stock trading tool. This enables users to trade stocks at a minimum stake of just $1.

This can come in handy for those on a budget that wish to invest in expensive stocks like Google or Berkshire Hathaway. The Fidelity app also offers access to a huge number of funds and ETFs. There is also the option of trading futures, as well as fixed-rate bonds. The Fidelity investment app is also great for performing technical analysis on the move.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, index funds, options, futures, bonds, and more |

| Pricing System | 0% commission on US-listed stocks and ETFs, fees on other assets |

| Core Features | Advanced trading tools, $1 minimum stock trade, access to IPOs |

Pros

Cons

9. Public – Top Investment App for Long-Term Investors

The Public investing app allows users to buy stocks and ETFs at 0% commission, albeit, this focuses on US-listed assets. There is also the option of investing in crypto via the app and this supports 25+ digital tokens. There is an extensive range of educational tools on the app – which is inclusive of videos and contributions from expert investors.

We also like the interactive side of the app, which allows users to follow like-minded traders. There is also the option to see when leading stocks are due to release their next earnings report and keep up-to-date with upcoming IPOs. Finding a stock or ETF to invest in is also made easier via the app’s trending and top-mover ranking tables.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, crypto |

| Pricing System | 0% commission on US-listed stocks and ETFs, 1-2% mark-up on crypto trades |

| Core Features | Very user-friendly, follow like-minded traders, earnings reports calendar |

Pros

Cons

10. Robinhood – Best Investment App for Beginners

Robinhood is one of the best investing apps for those with little to no trading experience. The interface itself is very user-friendly and the app has been fully optimized for both iOS and Android devices. We also like that those on a budget are catered for – as Robinhood has no minimum deposit.

It is also possible to buy and sell stocks with just a few dollars, as Robinhood supports fractional trading. In addition to US-listed stocks, Robinhood also offers ETFs and options. Robinhood is also perhaps the best app for crypto investing, as it requires a minimum trade of just $1.

When it comes to fees, Robinhood supports commission-free trading across all of its supported markets. There are no deposit or withdrawal fees on ACH transactions, but do note that debit/credit cards and e-wallets are not supported. Robinhood also offers a gold account at $5 per month. This offers access to margin trading accounts and more comprehensive research data.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, crypto, options |

| Pricing System | 0% commission on all supported markets |

| Core Features | App designed for newbies, no minimum deposit, margin accounts available |

Pros

Cons

11. Cash App – Combine Banking and Trading via a Single Investment App

Next up on our list of the best investment apps is Cash App. This provider offers an all-in-one financial hub – which subsequently allows users to combine banking and investment services. Regarding the latter, the Cash App offers conventional checking accounts.

This means that users can send and receive money at the tap of a button. It is also possible to receive a monthly salary two days early. There is also a debit card that comes with the account. In terms of its products, the Cash App investing platform enables its users to buy stocks from a minimum of just $1. This covers leading stocks on the NYSE and NASDAQ.

The cash app also supports Bitcoin investments. We also like the recurring buy feature, which allows users to invest in their preferred asset at a predefined amount and date. The Cash App also offers market insights, which is inclusive of earnings reports and key news developments.

| Minimum Deposit | $1 |

| Investment Markets | Stocks, Bitcoin |

| Pricing System | 0% commission on stocks, fees on Bitcoin built into the market spread |

| Core Features | Offers checking accounts and debit cards, buy stocks and Bitcoin from $1, easy to navigate |

Pros

Cons

12. Investing.com – Great App for Investment News and Research Tools

First and foremost, Investing.com is not an app that allows users to invest in the financial markets. On the contrary, it is an app for iOS and Android that offers invaluable investment tools and research materials. As such, Investing.com will need to be used in conjunction with a fully-fledged trading app.

Nonetheless, the app covers real-time financial news on a variety of asset classes – including stocks, forex, commodities, cryptocurrencies, and the broader economy. There are also market insights published by industry experts, which can be great for generating trading ideas.

We also like Investing.com for its watchlists and pricing alerts. These tools will ensure that users never miss a trading opportunity. This top-rated app is also ideal for performing technical analysis and high-level charting reading. Moreover, if advanced charting tools are what you’re looking for then you might want to check out our guide on the best MT5 brokers in 2025. Newbies might also appreciate the Investing.com app for its educational materials – which include webinars and trading guides.

| Minimum Deposit | N/A |

| Investment Markets | N/A |

| Pricing System | N/A |

| Core Features | Real-time market news, trading ideas, educational materials |

Pros

Cons

13. Ally Invest – Low-Cost Invest App With Robo Advisor

Ally Invest is a popular investment app that also offers traditional financial services. This includes checking accounts and even personal loans. By opening an account with this provider, users will have access to thousands of US-listed stocks.

All stocks on the Ally Invest app can be traded at 0% commission. This is also the case with ETFs and options, albeit, the latter does attract a contract fee of $0.50.Bonds and mutual funds are supported too, but these instruments come with additional fees. Another feature that we like on the Ally Invest app for iOS and Android is its robo advisor.

From just $100, this allows users to have a portfolio built on their behalf. Assets will be selected based on the user’s appetite for risk and broader financial goals. There are no advisory or rebalancing fees when opening a robo advisor portfolio and the entire investment process is passive. The main drawback with Ally Invest is that it does not support fractional trading.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, bonds, mutual funds |

| Pricing System | $0 commission on stocks and ETFs, fees on other assets |

| Core Features | Robo advisors, no account minimums, wealth management accounts |

Pros

Cons

14. E*TRADE – Huge Selection of Supported Markets and Account Types

E*TRADE offers a highly diverse range of supported markets and account types via its investment app for iOS and Android. Users can buy and sell US-listed stocks and ETFs at 0% commission. Options and futures can be traded at $0.65 and $1.50 per contract.

Other supported assets, such as bonds and mutual funds, come with various fees. We also like that E*TRADE allows its users to invest in upcoming IPOs. Another benefit of choosing E*TRADE is that it offers an account to suit most investor profiles. For instance, those looking to invest via a long-term retirement will appreciate the many IRAs on offer.

There are also managed portfolios in addition to standard brokerage accounts. A great option for passive investors is the core portfolios on offer, which require a minimum capital outlay of $500 and an advisor fee of 0.30% annually. These portfolios are managed and maintained on behalf of the investor.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, bonds, mutual funds, options, futures |

| Pricing System | $0 commission on stocks and ETFs, fees on other assets |

| Core Features | Managed portfolios, IRAs, margin accounts with competitive fees |

Pros

Cons

15. Stockpile – Buy and Sell Stocks at 0% Commission From $1

Stockpile is a great option for complete beginners that wish to gain exposure to the US stock market with a small amount of capital. This app for iOS and Android devices allows investors to risk just $1 on each stock that they buy.

Moreover, Stockpile does not charge any commissions, so small investments are not penalized. Deposits via both ACH and domestic bank wires are fee-free. However, those making a withdrawal via a domestic bank wire will be charged $25. In addition to stocks, the provider also offers commission-free access to ETFs and ADRs.

The Stockpile app also allows parents to set up a separate investment account for their children. This is completely supervised, so orders will only be executed after approval from the parent. Another gimmick feature offered by Stockpile is the ability to gift a stock to someone.

| Minimum Deposit | $0 |

| Investment Markets | Stocks, ETFs, ADRs |

| Pricing System | $0 commission on all markets |

| Core Features | Parents can open a stock account for their children, no minimum deposits, free ACH transfers |

Pros

Cons

16. Wealthfront – Managed Portfolios From Just 0.25% Annually

The final provider to consider from our list of the best investment apps is Wealthfront. This option will be suitable for those that wish to invest in the financial markets – but don’t have the knowledge or required time to research individual assets.

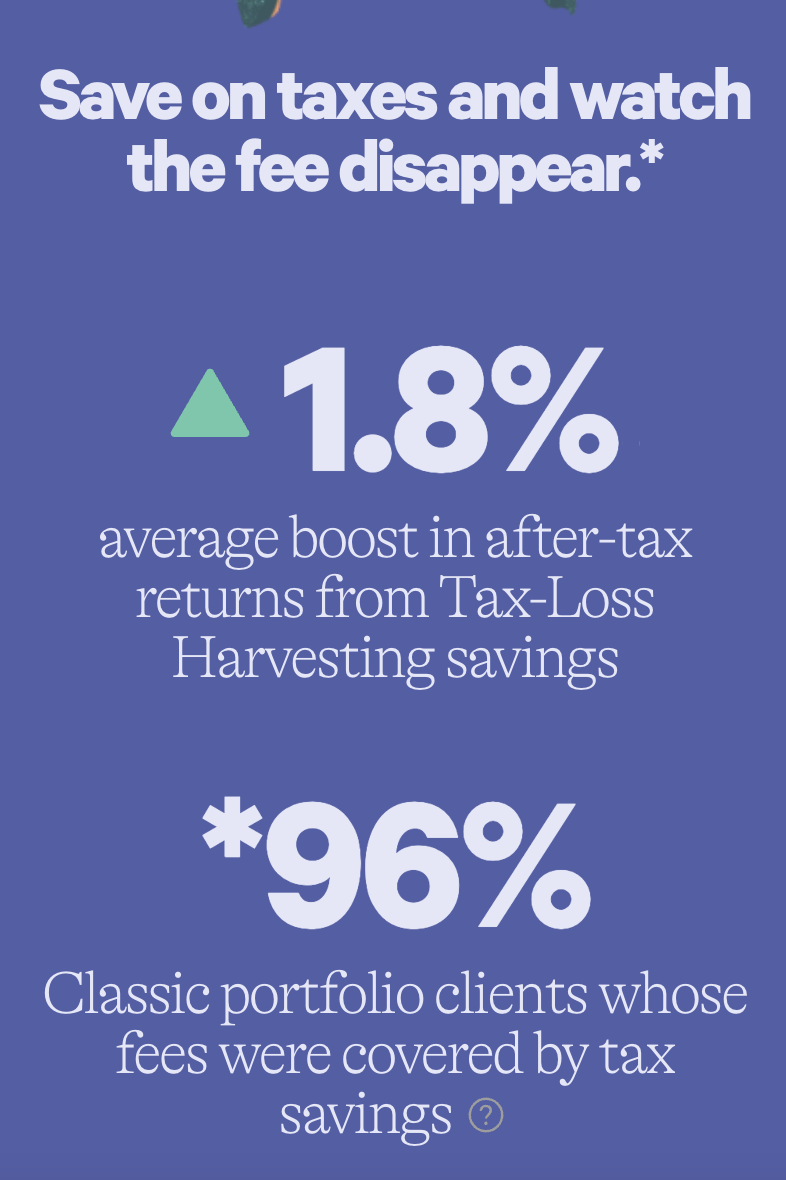

This is because Wealthfront offers managed portfolios – which are initially built based on the investor’s investment objectives and tolerance for risk. After the portfolio goes live, Wealthfront will automatically rebalance and reweight the basket of assets to ensure that it aligns with the investor’s goals.

In terms of fees, Wealthfront charges just 0.25% annually for its managed portfolio service. This works out at just $2.12 per month for every $10,000 invested. We also like the tax-loss harvesting feature at Wealthfront. This allows investors to find tax savings automatically when the broader market dips.

| Minimum Deposit | $500 |

| Investment Markets | Managed portfolios |

| Pricing System | 0.25% annual management fee |

| Core Features | Portfolios are built based on investor profile, very low fees, responsible investment plan |

Pros

Cons

Top Investment Apps Compared

A comparison table of the top investment apps in the market today can be found below:

Investment Apps

Commissions

Min Deposit

Core Features

eToro

0% commission on stocks/ETFs, 1% plus market spread on crypto

$10

Copy trading, smart portfolios, no fees on foreign stocks

XTB

0%

$0

Free demo account, xStation 5 platform, advanced technical charting

Vantage

0% commission on US share CFDs, low commission on other trades + spreads

$50

Demo account options, charting and trading indicators on the mobile app, no deposit and withdrawal fees

Kalshi

$0.07 commission on $1 contracts

$0

APIs, Event contract positions, Blog

Webull

0%

$0

Retirement accounts, technical indicators, no minimum deposit

Acorns

0% plus spread

$3/month

Automatically invest spare change, hand-picked portfolios, educational tools

Fidelity

0% on US-listed stocks

$0

Advanced trading tools, $1 minimum stock trade, access to IPOs

Public

0% commission on stocks and ETFs, 1-2% on crypto

$0

Very user-friendly, follow like-minded traders, earnings reports calendar

Robinhood

0% on all markets

$0

0% commission on all markets, beginner-friendly, $1 minimum trade

Cash App

0% on stocks, fees on Bitcoin built into the market spread

$1

Offers checking accounts and debit cards, buy stocks and Bitcoin from $1, easy to navigate

Investing.com

N/A

N/A

Real-time market news, trading ideas, educational materials

Ally Invest

0% on US-listed stocks and ETFs

$0

Banking and investment services, robo-advisors, low fees

E*TRADE

0% on US-listed stocks and ETFs

$0

Managed portfolios, IRAs, margin accounts with competitive fees

Stockpile

0% on all markets

$0

Parents can open a stock account for their children, no minimum deposits, free ACH transfers

Wealthfront

0.25% annually

$500

Portfolios are built based on investor profile, very low fees, responsible investment plan

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

How We Select the Best Investment Apps

The process of choosing the best investing app for an investor’s financial goals and requirements can be somewhat cumbersome.

After all, not only does the user need to explore fees, supported markets, and safety – but accepted payment types and minimum deposits. The user-friendliness of the investment app also needs to be taken into account.

We explore the aforementioned factors and more in the following sections to ensure that our readers are able to select the best investing app for their needs.

Regulation

Online investment apps offering brokerage services to US clients must be in possession of the required regulatory approval from the SEC and FINRA. This ensures that investors are able to buy and sell assets in safety.

Our top-rated investment app – eToro, is not only regulated in the US, but the UK, Australia, and Cyprus.

Investment Options

The best investment apps in this space give access to a wide range of assets and markets.

At eToro, for instance, users can invest on a DIY basis in stocks – both from the US and 17 international exchanges. eToro users can also invest in ETFs and cryptocurrencies, and access Copy Trading and Smart Portfolio tools.

In comparison, the Stockpile app only offers access to US-listed stocks and ETFs, alongside a small selection of ADRs. Wealthfront is thin on the ground in terms of investment options too, as its users can only access managed portfolios.

Fees

Fees should play a very important role when researching the best investing app for the job.

Before opening an account, investors should check what deposit fees apply, and whether there will be any ongoing maintenance charges. At Acorns, for instance, users are required to pay $3 and $5 per month on personal and family accounts, respectively.

Next, check to see what trading commissions apply – which can vary depending on the specific asset.

We found eToro to be the best free investing app, not least because its users can trade stocks and ETFs on a commission-free basis.

Mobile Experience

Some of the investment apps discussed today offer a superb user experience. This means that even beginners can open an account and start trading assets without needing any prior experience.

Others, however, did come across as somewhat difficult to navigate, especially when it came to placing orders. If the investment app offers a demo account, be sure to use it before depositing any money.

Trading Tools

Trading tools are imperative to successfully outperform the market. Beginners will likely appreciate the Copy Trading tool offered by eToro, which allows users to mirror the investments of a seasoned pro.

Experienced traders will likely want access to advanced charting tools and technical indicators. Alerts are also handy when using an investment app, as the user will be notified when a specified asset hits a target price.

Minimum Deposit

It is also important to check what the minimum deposit requirement is when searching for the best app for investing. In most cases, the minimum will depend on the account being opened.

For example, when opening a standard trading account with Webull, there is no minimum deposit requirement. But, if opting for a margin trading account at the same provider, the minimum stands at $2,000.

DIY or Managed

Another metric to consider when researching the best investment apps in the market is whether the user will need to pick their own investments on a DIY basis, or if this will be professionally managed.

We like that the eToro investment app offers the best of both worlds. That is to say, eToro users can create their own basket of assets, or utilize the Copy Trading or Smart Portfolio tools for a passive experience.

Payment Methods

In most cases, US-based investment apps will support ACH and domestic bank wires only. This means that the user will not be able to make an instant deposit directly via the app.

In comparison, the eToro app supports a variety of instant payment methods – such as debit/credit cards and e-wallets like PayPal. Best of all, eToro charges no deposit fees on USD payments.

Customer Service

Users looking to obtain customer support should be able to do so via the respective investment app. In an ideal world, this should be offered via a live chat feature.

This will allow the user to speak with an agent in real-time. However, some investment apps only offer customer service via a support ticket. This can result in the user waiting hours or even days for a reply.

Micro Investing Apps

The age of digitization has opened up a whole new phenomenon in the trading sector – micro investing apps. Put simply, these are investment apps that support super-small trading minimums – which are oftentimes just a few dollars.

This is made possible through fractional trading, which means that users can buy just a very small percentage of a stock or cryptocurrency. For example, at eToro, clients can buy stocks, ETFs, and crypto from a minimum of just $10.

Therefore, if buying a stock that is trading at $1,000 and the user invests the minimum of $10, this would mean that 1% of the asset is owned. Not only are micro investing apps great for beginners – but also for those on a budget.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Are Investment Apps Safe?

We mentioned earlier that the best investment apps in this space are heavily regulated. This means that by using an app that is approved and licensed by the SEC and FINRA, investors can be sure that they are trading in a safe and secure environment.

Licensed investment apps are required to comply with a wide range of regulatory guidelines, especially when it comes to KYC (Know Your Customer).

This means that all new customers must have their identity verified before the investment app can offer brokerage services. This is often just a case of entering some personal information and taking a photo of a government-issued ID.

In order to stay safe, beginners are advised to consider that all investments carry an inherent level of risk. And therefore, investors should never risk more than they are comfortable losing.

How to use an investing app – eToro Tutorial

Those looking to start trading stocks, ETFs, crypto, and more via a top-rated investment app eToro can follow the step-by-step tutorial below.

US clients can open an eToro account in a matter of minutes and then deposit funds instantly from just $10, before having access to thousands of investment markets.

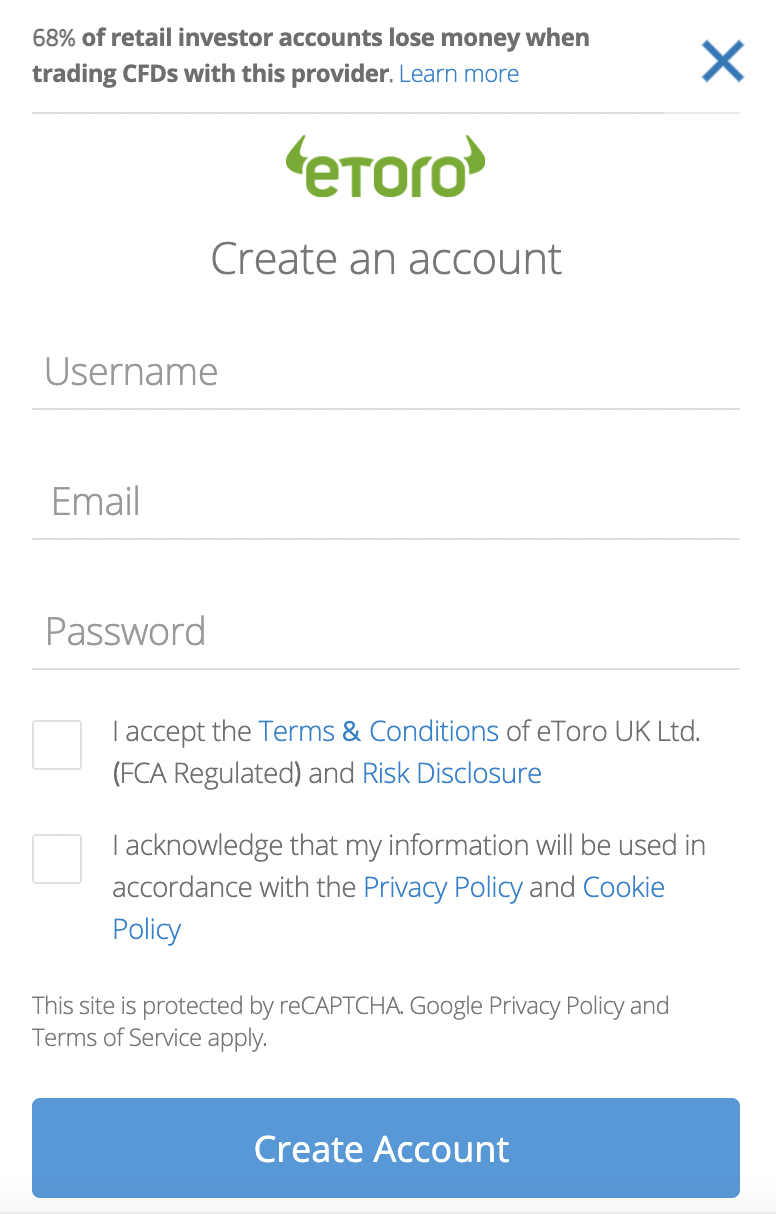

Step 1: Open an Account

Before downloading the app, head over to the eToro website and register an account by clicking on ‘Join Now’. Next, a registration form will appear – fill it out by entering an email address and a preferred username and password.

Next, provide some basic personal information – such as a name, home address, and social security number. Finally, upload a copy of a government-issued ID for the KYC process.

Step 2: Download eToro App

The next step is to download the eToro investment app. The app is free to download and compatible with both Android and iOS devices.

Step 3: Deposit Funds

After logging into the eToro app, it is then time to deposit some investment funds. Once again, US clients are required to meet an account minimum of just $10 and no fees are applied.

Those wishing to deposit funds instantly should choose from a debit/credit card or a supported e-wallet like PayPal.

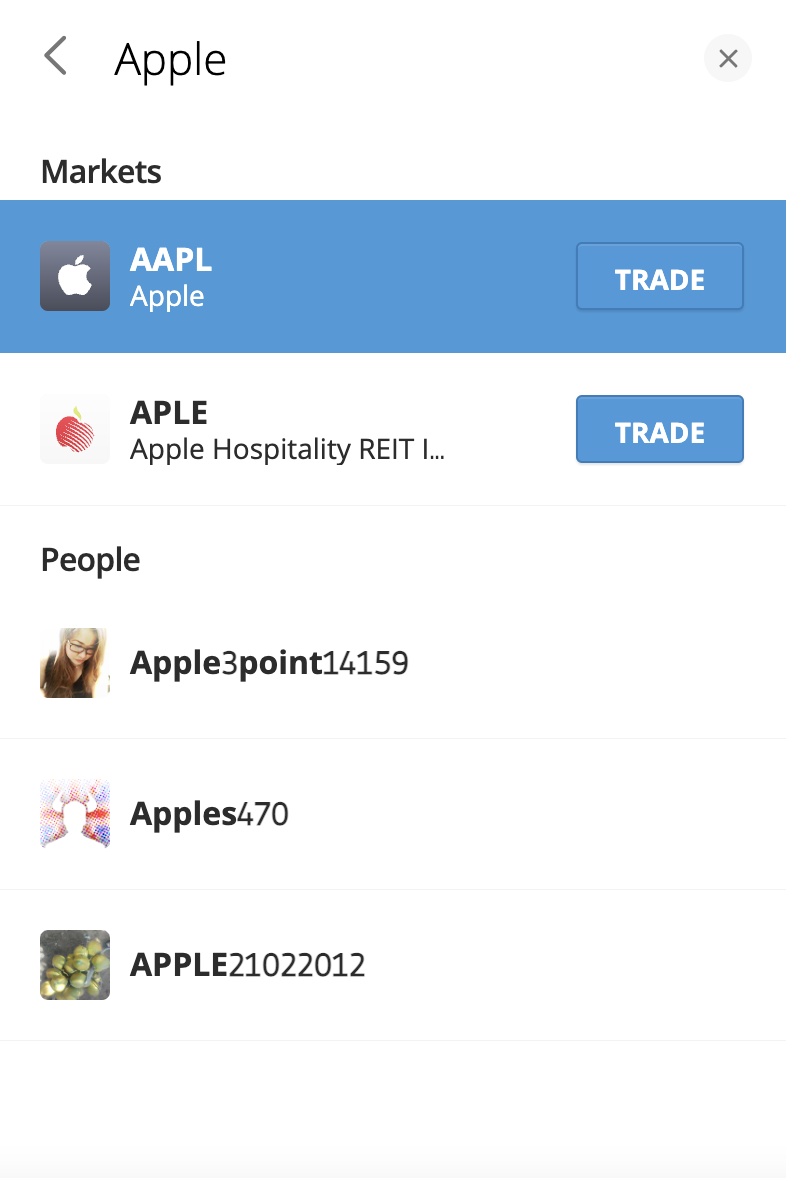

Step 4: Search for Asset

The next step is for the investor to search for the asset that they wish to trade. There are two ways to do this. Those that already know the respective asset can type it into the search bar and click on ‘Trade’ to populate an order box.

The other option is to click on ‘Discover’. The eToro app will then display the many markets and assets that it supports. In our example above, we are searching for Apple stock.

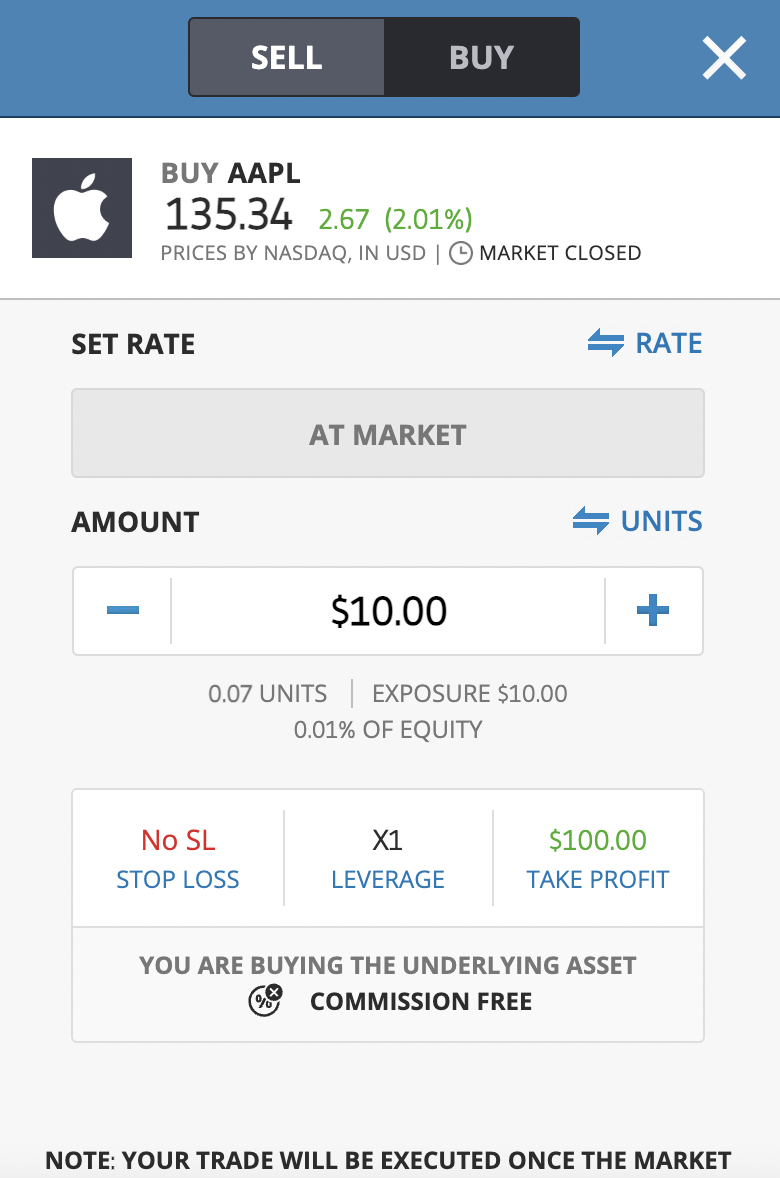

Step 5: Invest

The final stage is to set up an order. As per the image below, we are looking to invest $10 into Apple stock. Users simply need to specify their desired investment stake – from $10 upwards.

To confirm the order, click on the ‘Open Trade’ button.

Conclusion

The best investing apps in the market today have been reviewed and ranked. While there are many options to consider, we found that the overall best investment app is offered by eToro.

It takes just minutes to get set up with an account and USD payments are fee-free – even when depositing with an e-wallet or debit/credit card.

We also like that the eToro supports fractional trading from just $10 and no commissions are charged on stocks or ETFs.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.