With the best open-source accounting software by your side, you can automate time-consuming tasks such as invoicing and payments to save time and eliminate the risk of manual errors, plus with a centralized location for all your financial data; you’ll be able to make informed decisions on what’s best for your business. Need we say more?

To help you narrow down your options, we’ve sourced, ranked, and reviewed the market’s top 10 best open-source accounting software based on criteria like ease of use, functionality, pricing, and user reviews. Read on to learn more about leaders like FreshBooks and Zoho to find the one best suited to your needs.

The Best Open Source Accounting Software 2025

From the best free accounting software to the market leaders for startups and enterprises alike, here we’ve compiled the ultimate list of the best open-source accounting tools and ranked them accordingly. Here’s how each one fared when put to the test:

- Freshbooks – Best Overall Accounting Software

- Zoho – Great Open Source Small Business Accounting Software

- Sage Accounting – Amazing Cloud-based Accounting Software

- Xero – Easiest To Use Open Source Accounting Software

- Free Agent – Small Business-Friendly Accounting Software

- Tax Slayer – Most Affordable Tax Accounting Software

- Liberty Tax – High-Quality Audit Assistance

- Odoo – Great Open Source Double Entry Accounting Software

- ERPNext – Complete ERP and Open Source Accounting Software

- GnuCash – Customizable Open Source Accounting Software For Small Business

The Best Open Source Accounting Software Reviewed

To help you narrow in on the best one for your needs and budget, we’ve reviewed them in more depth below. Read on for all the nitty-gritty details.

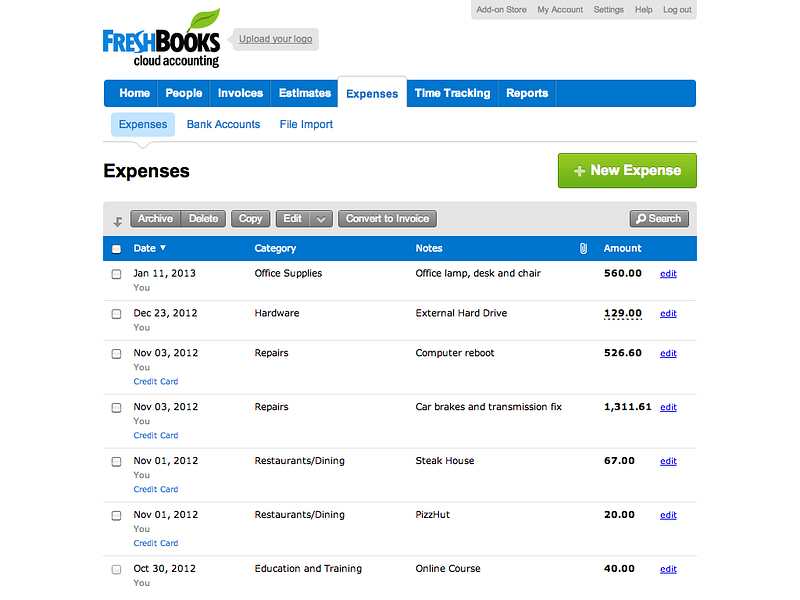

1. Freshbooks – Best Overall Open Source Accounting Software

Freshbooks is our top pick for the best open-source accounting software. It’s a cloud-based solution that’s perfect for small businesses and freelancers. Prices start at just $4.50 per month, making it one of the most affordable options on our list.

Freshbooks also offers a free trial, so you can try it out before you commit to a paid plan.

Using accounting software like Freshbooks is one of the quick ways to attract clients as a freelance accountant. If you decide to upgrade, there are three different pricing tiers to choose from, so you can find a plan that fits your budget.

One of the things we love about Freshbooks is its ease of use. The interface is clean and user-friendly, so you won’t need any training to get started. And if you do need help, there’s plenty of documentation and support available.

FreshBooks’ Best Features:

- In-App Estimates and Proposals: Success and clear expectations are mutually exclusive. The process of setting up and charging for new clients is made simpler by customized estimates and proposals. Additionally, you may quickly turn your estimates into ready-to-pay bills and invoices.

- One-Click Duplicate Invoicing: When you’ve found the perfect invoice template for your business, the last thing you want to do is start from scratch each time. FreshBooks allows you to quickly duplicate invoices so that all you have to do is update the client information and dates.

- Pre-populated Chart of Accounts: Depending on your business, you may need to track dozens of different expenses. FreshBooks comes with a pre-populated chart of accounts that makes it easy to see where your money is going — and identify any areas of potential savings.

- App Integrations: FreshBooks integrates with over 80 different applications, including PayPal, Stripe, and Gusto. This allows you to automate repetitive tasks and save time on data entry.

Pros:

- Offers free trial

- User-friendly

- Budget-friendly

Cons:

- Limited mobile app features

Pricing:

Starts at $4.50 per month

| Freshbooks | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $4.50 | Web, Mobile, Tablet | Yes | Yes |

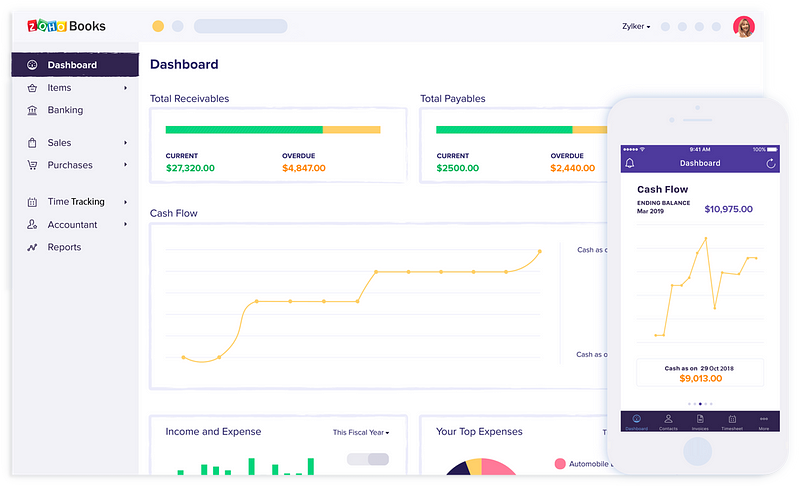

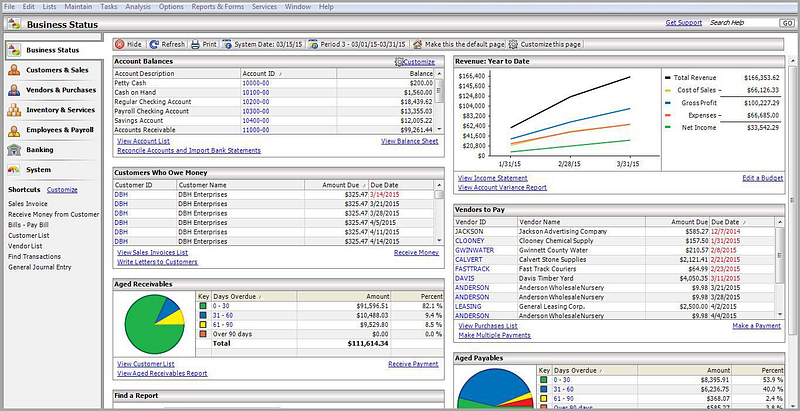

2. Zoho Books – Great Open Source Small Business Accounting Software

Zoho Books is a cloud-hosted accounting application made to function best for expanding companies. It enables cross-departmental cooperation while assisting you in managing your funds.

Because it contains capabilities that automate your company operations, you’ll save time and effort.

Zoho integrates with various third-party programs in addition to Zoho’s 40+ native applications and end-to-end accounting features.

This famous CRM for small businesses offers its own client portal for your customers to interact with, which gives them a better experience while also freeing up your time.

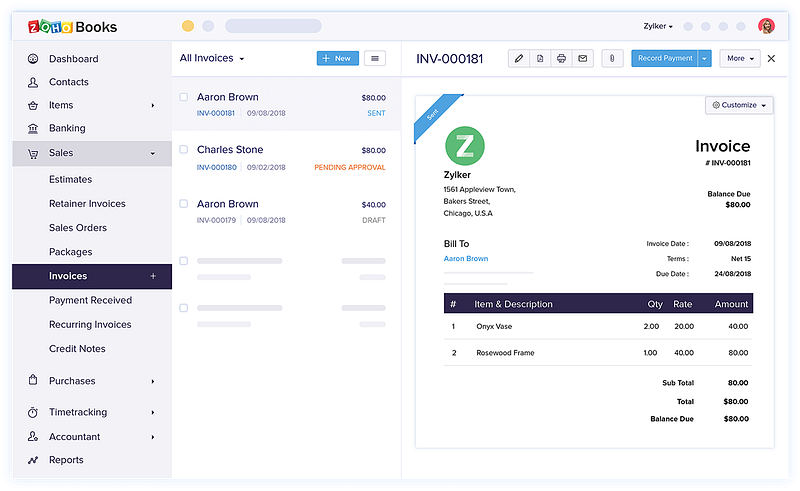

Invoicing is straightforward to understand, and you can customize invoices to match your brand. The recurring invoices feature is great for companies that have repeating charges.

Zoho Books supports multiple currencies and languages, so it’s a good choice if your company does international business. You can give different access levels to employees, and the software includes a role-based security model to protect your data.

The software is GDPR-compliant, and you can export your data anytime.

Zoho Books’ Best Features:

- Invoice Management – Invoicing and controlling receivables are made simple with Zoho Books. You can send your clients personalized statements and accept payments in different currencies. With a single click, professional invoices can be created. You may alter invoice templates to better represent your brand by altering the fonts and adding your company logo.

- Manage Recurring Expenses – Zoho facilitates the organization of your expenses and keeps track of them for you. This is a crucial feature for businesses, as it allows you to focus on more important tasks.

- Accounting Automation – Zoho automates various accounting tasks, such as bank reconciliation and issuing payments. The software also has a time-tracking feature that can be used to generate invoices based on hours worked.

Pros:

- Competitive price

- Rich features

- 24/7 Customer support

Cons:

- Limited invoices

Pricing:

Paid plan starts at $10 per month

| Zoho | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $10.00 | Web, Mobile, Tablet | Yes | Yes |

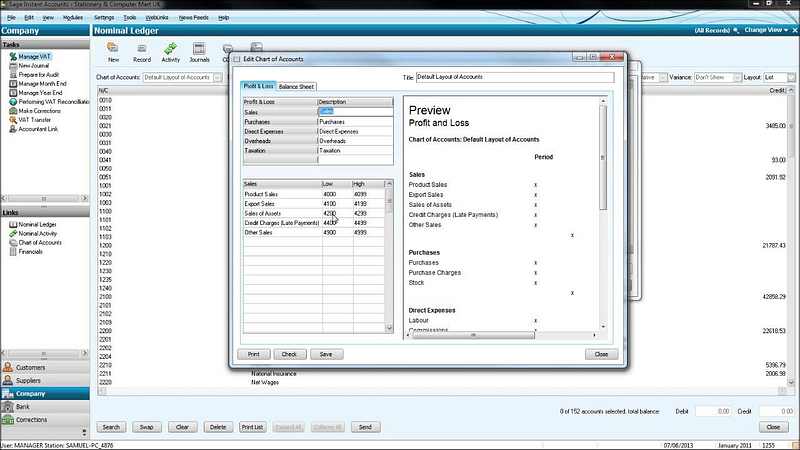

3. Sage Accounting – Amazing Cloud-based Accounting Software

The cloud-based accounting program Sage Business Cloud Accounting (formerly known as Sage One) is designed primarily with small- to medium-sized businesses in mind.

Sage promises to make it easier for organizations to get started with their cost management, accounting, compliance management, and project accounting processes by having many of the features fully configured and available for the user.

On the other side of things, it has also been said to be an unduly complicated and challenging system to use. Here are the benefits and drawbacks of Sage so you can decide if it will save you time or cause you more trouble than it’s worth.

Sage Accounting’s Best Features:

- Cash Flow Management: Dealing with the costs spent by their clients is a difficult chore for accountants. To keep track of the money coming in and going out for each of their clients, they spend a significant amount of time manually creating financial reports each month.

- Sales Optimization: This program also allows you to keep track of your sales so that you can optimize them. In other words, it provides the ability to see which products are selling well, at what price they’re selling, and how often customers are returning items. With this information, businesses can make better decisions about their inventory and pricing.

- Payroll Management: Sage also simplifies the process of managing payroll. The software can calculate employee paychecks, prepare direct deposit files, and even file state and federal payroll taxes. All you need to do is enter hours worked, and the software takes care of the rest.

Pros:

- Cloud-based

- Offers free trial

- Excellent reporting features

Cons:

- Steep learning curve

Pricing:

Paid plan starts at $340 per year

| Sage Accounting | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $340 per year | Web, Mobile, Tablet | Yes | Yes |

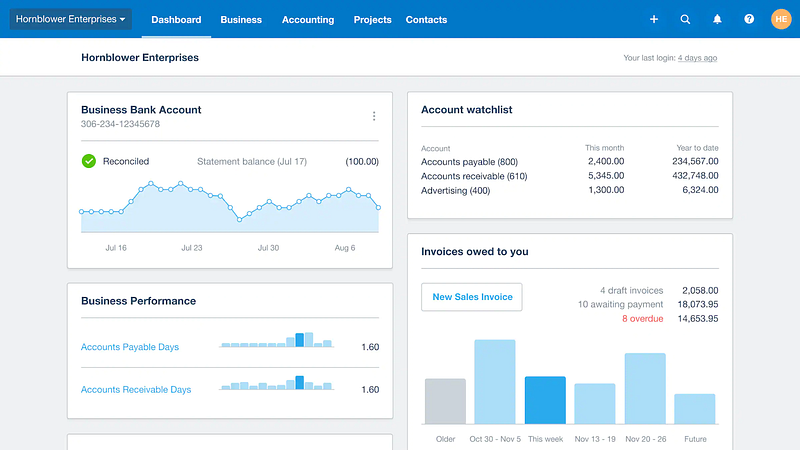

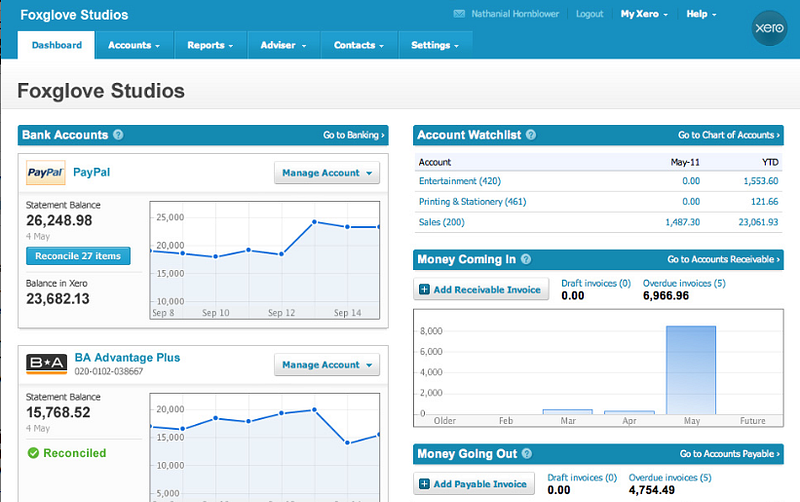

4. Xero – Easiest To Use Open Source Accounting Software

It should come as no surprise that this program has over 1,000,000 users and serves as the principal accounting solution for more than 16,000 accounting firms. Xero is said to be “cheap professional-level accounting software for small businesses” and “the best at what it does.”

Depending on your unique company requirements, Xero may wind up costing you far more in time, effort, and money than it is worth. To help you decide, we’ve listed the advantages and disadvantages below.

Xero’s Best Features:

- Bills Payment – Keep track of your expenses and pay them on time. Obtain a thorough picture of the cash flow and accounts payable as well. Additionally, you may see all of your invoices online from anywhere and make batch payments that you can arrange in advance.

- Accounts Receivable – Have a better overview of what your customers owe you. You can follow up on payments, see which invoices are overdue, and track credit limits. You can also automate customer reminders and set up payment plans for them.

- Inventory Management – Gain insights into what’s in stock, find the value of inventory, and reorder products efficiently with Xero’s inventory management features. This is particularly useful for businesses that sell products.

- Multi-Currency Support – With Xero, you can conduct business in multiple currencies simultaneously. This is a great feature for businesses that export or import products, as it simplifies the bookkeeping process. The program can also automatically convert currencies when needed.

Pros:

- Very affordable

- Ease-of-use

- Web-based

Cons:

- The inventory system is very basic

Pricing:

Starts at $22 per month

| Xero | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $22 per month | Web, Mobile, Tablet | Yes | Yes |

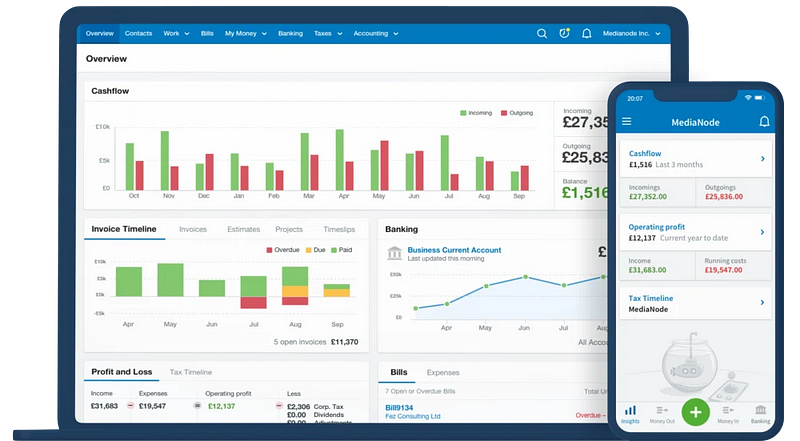

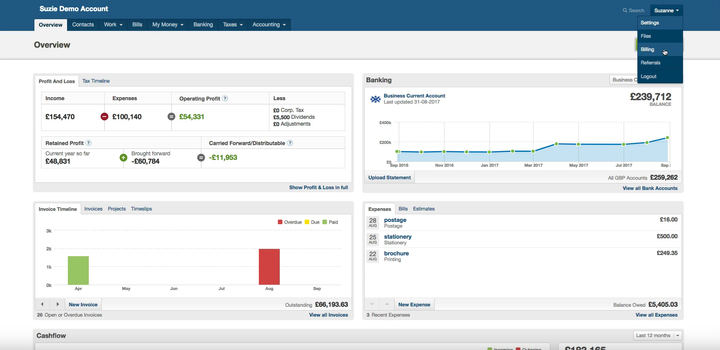

5. FreeAgent – Small Business-Friendly Accounting Software

Small enterprises and independent contractors are the target market for this powerful online accounting program. It has a ton of features that will undoubtedly provide small businesses with everything they need to organize their finances.

A collection of strong tools supports users in all facets of financial administration, from spending tracking to payroll runs.

Not only can the platform create bills, but it can also transmit and track them. Additionally, if you are having trouble keeping track of your costs, the program can help; all you need to do is submit a snapshot of your receipt.

FreeAgent’s Best Features:

- Estimates and Invoices: Get paid faster with online invoicing. FreeAgent makes it easy to create and send professional-looking estimates and invoices, track their progress, and see when they’re due.

- Time Tracking: Track the time you spend on each project and generate billable hours to include on your invoices.

- Expenses: Take care of business expenses quickly and easily with its mobile app or by forwarding emails of your receipts. It will even suggest which of your expenses could be tax-deductible.

Pros:

- Easy to use

- Small-business friendly

- Excellent UI

Cons:

- Limited customization

Pricing:

Pricing starts at $10 per month.

| Free Agent | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $10 per month | Web, Mobile, Tablet | Yes | Yes |

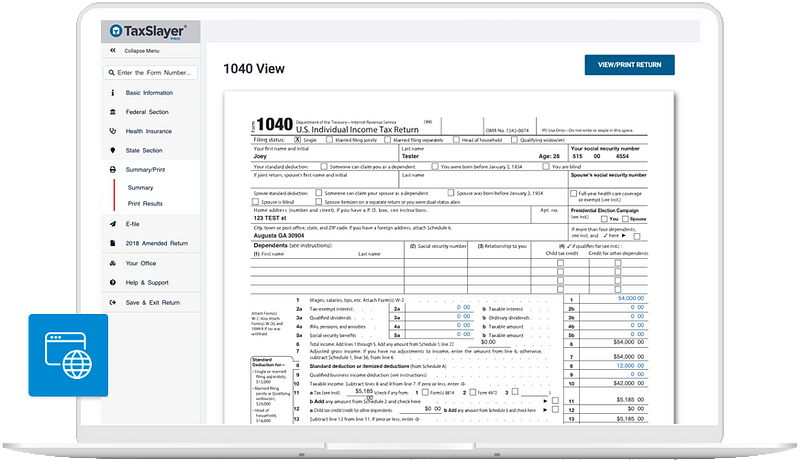

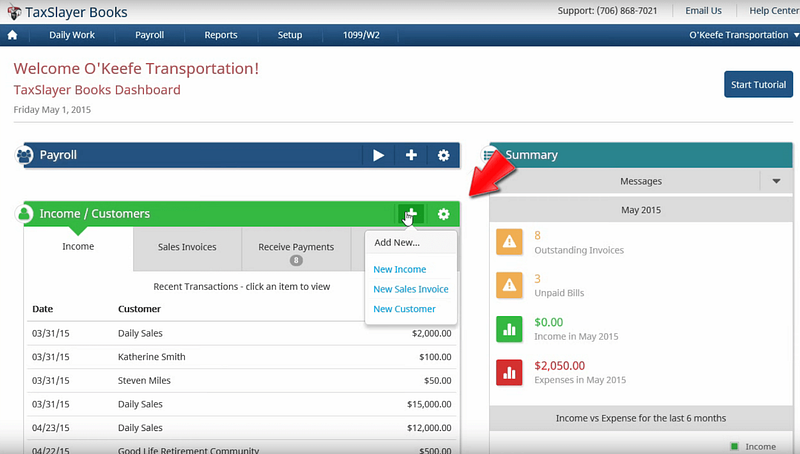

6. Tax Slayer – Most Affordable Tax Accounting Software

A division of Rhodes-Murphy & Co., one of the pioneers in computerized tax preparation services, is TaxSlayer.

It’s simple to register with TaxSlayer. You’ll be prompted with a series of questions about your financial situation for the tax year after creating an account using your email address and personal data.

W-2s, 1099s, 1098-Ts, and any other income or cost receipts that may be tax-deductible are things you’ll need.

Although TaxSlayer includes a document upload capability, it only works occasionally and only covers a few types of forms. TaxSlayer will determine your refund or amount of tax payable once you have provided all the necessary information.

TaxSlayers’ Best Features:

- Comprehensive Bank Product Solutions: All the features you would expect from a top-tier accounting software package are included in TaxSlayer.

- Advanced Integration: With TaxSlayer, your bank account, credit card, and investment data can be automatically downloaded and imported into the software regularly.

- Unlimited 1040 Program: The 1040 Program offered by TaxSlayer is one of the most comprehensive in the industry and can handle an unlimited number of taxpayers.

- Customized Reporting: Reports can be customized in TaxSlayer to better suit your needs.

- Fast Refunds with e-file: You can get your refund faster when you e-file with TaxSlayer.

Pros:

- An affordable option for tax computation

- One-on-one tax guidance

- Offers student loan filing

Cons:

- Need to get a Pro plan to enjoy its features

Pricing:

Paid plans start at $29.95 per month

| Tax Slayer | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| 29.95 per month | Web, Mobile, Tablet | Yes | Yes |

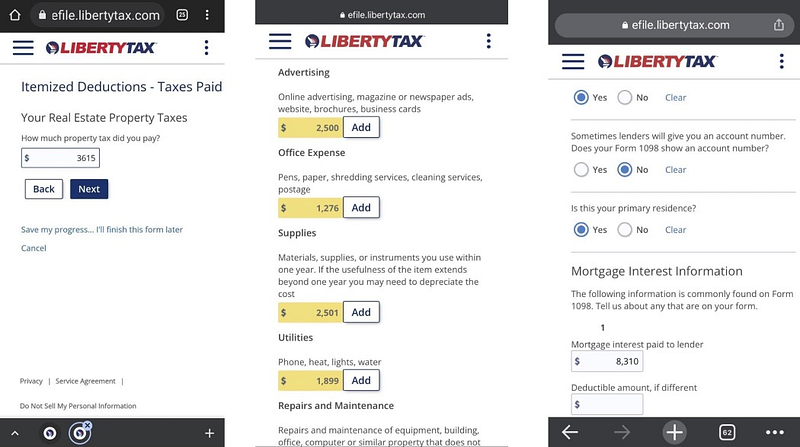

7. Liberty Tax – High-Quality Audit Assistance

Liberty Tax has been in business since 1998 and is one of the most popular online tax preparation and filing services. The company offers a free online tax filing service for federal and state taxes.

Liberty Tax also offers an online payroll service, which is a paid subscription. The Liberty Tax user interface has an interview-style format.

You will be asked questions about the property you own, your dependents, your residence during the year, and other topics. The program will next utilize your responses to ascertain your filing status and the schedules and paperwork you must import to finish your return.

Liberty Tax’s Best Features:

- Audit Support: If the IRS contacts you about your return, Liberty Tax will help you for free.

- Enhanced Audit Assistance: With this feature, you get unlimited access to a tax professional who will help you resolve your audit.

- Taxpayer Protection Promise: If you use Liberty Tax and are audited, the company promises to represent you for free.

Pros:

- Very straightforward UI

- Refund assistance

- High-quality audit assistance

Cons:

- No free filing

Pricing:

Federal Plan starts at $44.95

| Liberty Tax | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $44.95 per month | Web, Desktop, Mobile, Tablet | Yes | Yes |

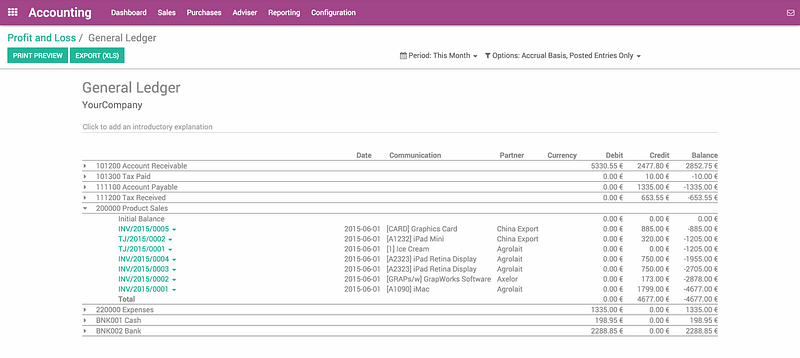

8. Odoo – Great Open Source Double Entry Accounting Software

Odoo accounting serves companies of all sizes across all industries, from agriculture and construction to real estate and telephony. It is offered as an app for Android and iOS smartphones and supports both on-premise and cloud deployment.

Users can easily manage their finances, invoicing, and inventory with its intuitive interface.

Odoo’s accounting software is based on double-entry bookkeeping principles. This means that for every financial transaction, there are two entries: a debit and a credit. The total of all debits must equal the total of all credits.

This system provides greater visibility into your financial affairs and can help prevent errors.

Odoo’s Best Features:

- Tax Planning: A variety of tax computations, including price included or excluded, percentage, grip, partial exemptions, and more, are available through the tax engine. According to a certain location, this module provides tax data in accrual or cash-based formats. Additionally, you may set up tax regulations that encrypt invoice values automatically.

- Accounting Entry: All accounting entries are made in real-time. This means that you can see the effects of your transactions immediately.

- Follow-up Tables: Odoo’s accounting software includes several follow-up tables that help you track your financial progress.

Pros:

- Web-based

- Offers credit management

- Excellent accounts receivable options

Cons:

- Does not have a payroll module

Pricing:

Starts at $6 per month

| Odoo | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $6 per month | Web, Mobile, Tablet | Yes | Yes |

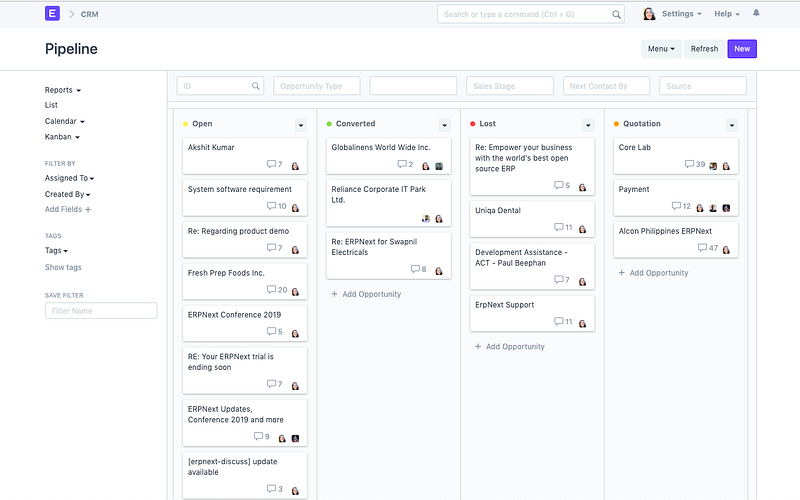

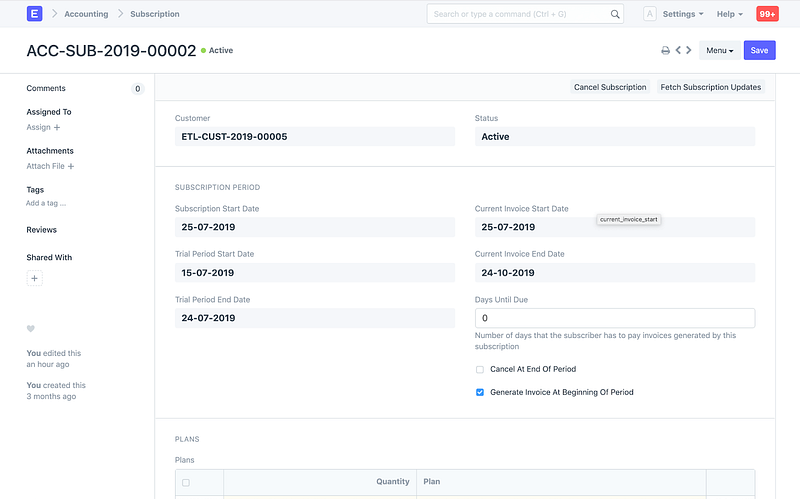

9. ERPNext – Complete ERP and Open Source Accounting Software

ERPNext is an expandable ERP that includes several modules, including asset management, manufacturing, sales and purchases, accounting, manufacturing, and payroll. It uses cloud and on-premise deployment and is intended for companies of all sizes.

Both iOS and Android smartphones may download the software.

ERPNext’s Best Features:

- Journal Entry Template: This is useful if you want to automate your journal entries. For example, you can create a template for all your sales invoices and have it automatically populate the ledger accounts.

- Asset Management: You can track your company’s assets and get depreciation reports. This helps maintain compliance with government regulations.

- Payment Terms Template: You can customize payment terms for your customers and vendors. This helps manage cash flow.

Pros:

- Reasonable price structure

- POS Integration

- Multi-currency

Cons:

- Doesn’t allow multi-session

Pricing:

Starts at $150 per site per month

| ERPNext | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $150 per month | Web, Desktop, Mobile, Tablet | Yes | Yes |

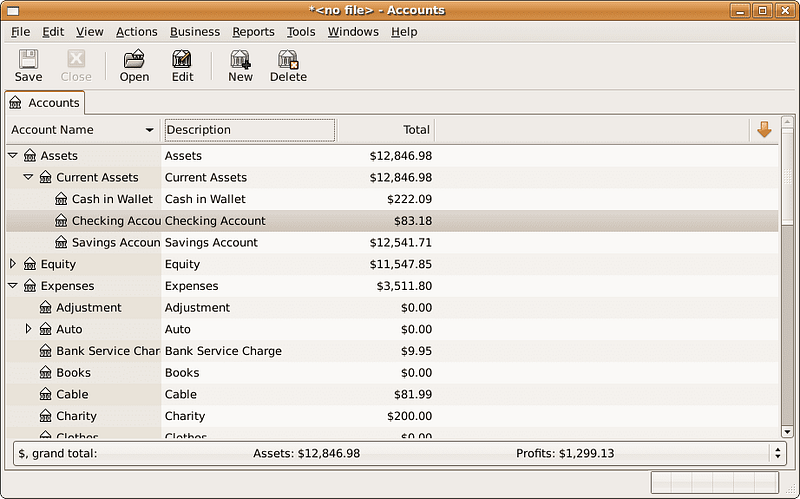

10. GNUCash – Customizable Open Source Accounting Software For Small Business

GnuCash is an open-source accounting program designed for on-premise implementation in small enterprises. It is tailored for the software and banking sectors. Additionally, there is an Android app for it.

Comparable to other software in this category, GnuCash offers features such as invoicing, tracking bank account balances, and generating reports. It is one of the most popular accounting software programs available.

GnuCash’s Best Features:

- Full Customization: Given that GnuCash is an open source, users can make full changes to the software’s code. This allows businesses to make GnuCash work exactly how they want it to.

- Financial Statements Import: CSV and OFX files can be imported into GnuCash. This makes it easier to switch from another accounting software program.

- Mortgage and Loan Repayment Assistant: GnuCash includes a repayment assistant for loans and mortgages. This is a great feature for small businesses that are just getting started and need help with organization and repayments.

Pros:

- Transaction scheduling

- Ease of use

- Customizable

Cons:

- No accounts receivable features

Pricing:

Starts at $15 per month

| GnuCash | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $15 per month | Desktop Only | No | Yes |

Best Open Source Accounting Software

Often, seeing a head-to-head comparison like the one below can help you narrow down your options and pinpoint the ones most suitable to your needs:

| Software | Pricing for Higher Plans | Accessibility | Mobile App | Trial Version |

| Freshbooks | $4.50 per month | Web, Desktop, Mobile, Tablet | Yes | Yes |

| Zoho | $10 per month | Web, Desktop, Mobile, Tablet | Yes | Yes |

| Sage Accounting | $340 per year | Web, Mobile, Tablet | Yes | Yes |

| Xero | $22 per month | Web, Mobile, Tablet | Yes | Yes |

| Free Agent | $10 per month | Web, Mobile, Tablet | Yes | Yes |

| Tax Slayer | 29.95 per month | Web, Mobile, Tablet | Yes | Yes |

| Liberty Tax | $44.95 per month | Web, Desktop, Mobile, Tablet | Yes | Yes |

| Odoo | $6 per month | Web, Mobile, Tablet | Yes | Yes |

| ERPNext | $150 per month | Web, Desktop, Mobile, Tablet | Yes | Yes |

| GnuCash | $15 per month | Desktop Only | No | Yes |

Best Free Open Source Accounting Software

Freshbooks is an all-in-one accounting software for small businesses and freelancers that includes features such as invoicing, time tracking, expense management, and more. The software is available in both a free and paid version, with the paid version starting at $4.50 per month.

We chose this as the best free accounting software because it offers the most features and is the most user-friendly option.

Best Open Source Accounting Software For Mac

While most accounting software is designed for Windows, there are several high-quality options available for Mac users.

Odoo is our pick for the best open source accounting software for Mac because it is simple to use and maintain, supports a wide range of business types, and offers an excellent mobile app.

What Are The Benefits Of Using Accounting Software As An Open Source?

There are many benefits of using accounting software as an open source. One benefit is that it can help you save time and money.

With accounting software, you can automate tasks such as invoicing, payments, and bookkeeping, which is also one of the fastest ways to reduce your accounting department expenses.

Additionally, by automating these tasks, you can reduce the chance of human error, which could save you money in the long run. It also frees up your time so that you can focus on other aspects of your business.

Another benefit of using accounting software as an open source is that it can help you manage your finances more effectively. With all your financial information in one place, you can easily see where your money is going and make informed decisions about allocating your resources.

This can help you save money and run your business more efficiently. And lastly, using accounting software as an open source can give you peace of mind. When everything is organized and automated, you can relax knowing that your finances are in good hands.

This can help you focus on other aspects of your life and business and enjoy the fruits of your labor.

How We Evaluated The Best Open Source Accounting Software

To come up with our list of the best open-source accounting solutions, we took several factors into consideration. Besides genuine customer reviews, we also factored in the following:

Ease of use

The software should be easy to use and understand. This is especially important for small businesses that may not have the resources to hire an accountant.

Features

The software should offer a wide range of features, such as invoicing, time tracking, expense management, and more.

Pricing

We considered both free and paid options when choosing the best accounting software. While free options are often limited in terms of features, they can be a good option for small businesses that are just starting out.

Customer support

The software should offer excellent customer support in case you have any questions or run into any problems.

Scalability

The software should be able to grow with your business. This is important because as your business grows, your accounting needs will likely change.

Accessibility

The software should be accessible from anywhere, whether you’re at your desk or on the go. This is important for business owners who need to be able to access their accounting information from anywhere.

Conclusion: What’s the Best Open Source Accounting Software?

Here’s a quick look at the market’s best open-source accounting tools:

- Freshbooks – Best Overall Accounting Software

- Zoho – Great Open Source Small Business Accounting Software

- Sage Accounting – Amazing Cloud-based Accounting Software

- Xero – Easiest To Use Open Source Accounting Software

- Free Agent – Small Business-Friendly Accounting Software

- Tax Slayer – Most Affordable Tax Accounting Software

- Liberty Tax – High-Quality Audit Assistance

- Odoo – Great Open Source Double Entry Accounting Software

- ERPNext – Complete ERP and Open Source Accounting Software

- GnuCash – Customizable Open Source Accounting Software For Small Business

The best open source accounting software depends on your needs as a business owner. If you’re looking for something that is easy to use and offers a wide range of features, Freshbooks is a great option.

With Freshbooks, you can automate invoicing, payments, and bookkeeping tasks. We highly recommend Freshbooks for small businesses that are just starting out.