For most businesses, accounting software is crucial for monitoring finances, handling invoices and payments, and generating reports. This is also true for nonprofit organizations, which frequently depend on donations from people and businesses to support their work. However, nonprofits face specific challenges when it comes to accounting.

For example, donations can be cash, items, or services. Nonprofit groups also have to monitor and report their expenses to follow government rules. Furthermore, many nonprofits depend on grants from foundations and other entities, which usually have certain requirements for how the funds should be used.

Fortunately, there are a number of accounting software programs designed specifically for nonprofits — but which one is the best for your organization? In this article, we’ll take a look at some of the most popular options and compare their features.

The Best Nonprofit Accounting Software For 2022: Top 10 List

To help you narrow down the options and find the best software for your nonprofit, we’ve created this list of the top 10 options for 2022:

- Sage Intacct– Best Overall Nonprofit Accounting Software

- Zoho Books– Best For Automating Your Workflow

- Accounts– Best For Small Organizations

- Oracle Netsuite– Best Software With ERP and Ecommerce Features

- Aplos– Best Nonprofit Features

- Xero– Best Cloud Solution For Collaboration

- Quickbooks– Best Accounting Software UI

- Blackbaud – Best For Peer-to-Peer Fundraising

- NonProfitPlus– Best For Scalability

- Araize – Best Software That Offers Online Learning

Best Nonprofit Accounting Software Compared

We’ve included the very best in accounting software for nonprofits on our list, but some will be more suited to your needs than others. Let’s take a look at each of the top contenders and see what sets them apart.

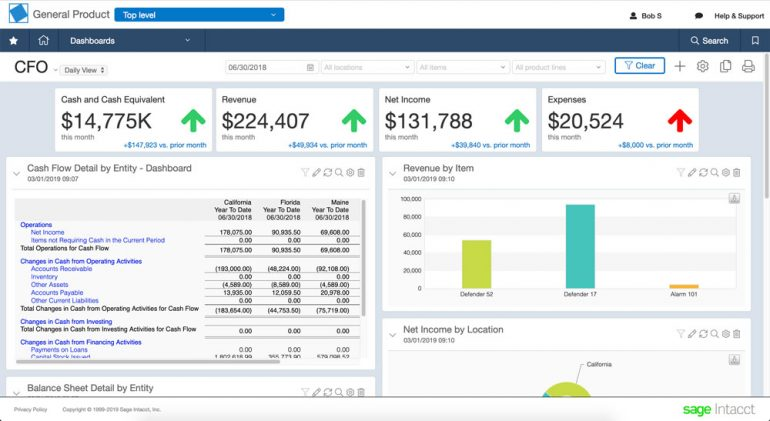

1. Sage Intacct – Best Overall Nonprofit Accounting Software

Sage Intacct sets a high bar for what NGOs may anticipate from their fund accounting software. The company gives free lectures to assist nonprofits to get off the ground, which is especially helpful for those struggling to make ends meet following COVID-19. On the TrustRadius website, Sage Intacct receives 8.7 out of 101 stars, with users praising Sage’s quick customer care response time.

This company has a complete set of features for nonprofits and is very user-friendly. The interface is clean and easy to navigate, which is important for busy nonprofit staffers who are not accountants.

Sage Intacct also offers a wide range of customization options so that you can tailor it to your specific organizational needs. This is important as each nonprofit is unique and will require different features from its accounting software.

Special Features

1. Donation Tracking – Sage Intacct offers robust donation tracking features, which is important for nonprofits who rely on donations to fund their work. This functionality allows you to track donations by source, amount, and date, as well as view donor information and contact details.

2. Fundraising and Membership Management – Sage Intacct’s fundraising and membership management features allow you to track and manage your membership base, as well as keep track of donations and payments from members.

3. Financial Reporting – Sage Intacct offers a wide range of financial reporting features, allowing you to create custom reports tailored to your specific needs, as well as track budgets and actual spending against budget.

Pros

- Workflow automation

- User-friendly

- Customizable

- Robust financial reporting

Cons

- Pricey for small groups

Pricing: Contact Sage for a quote

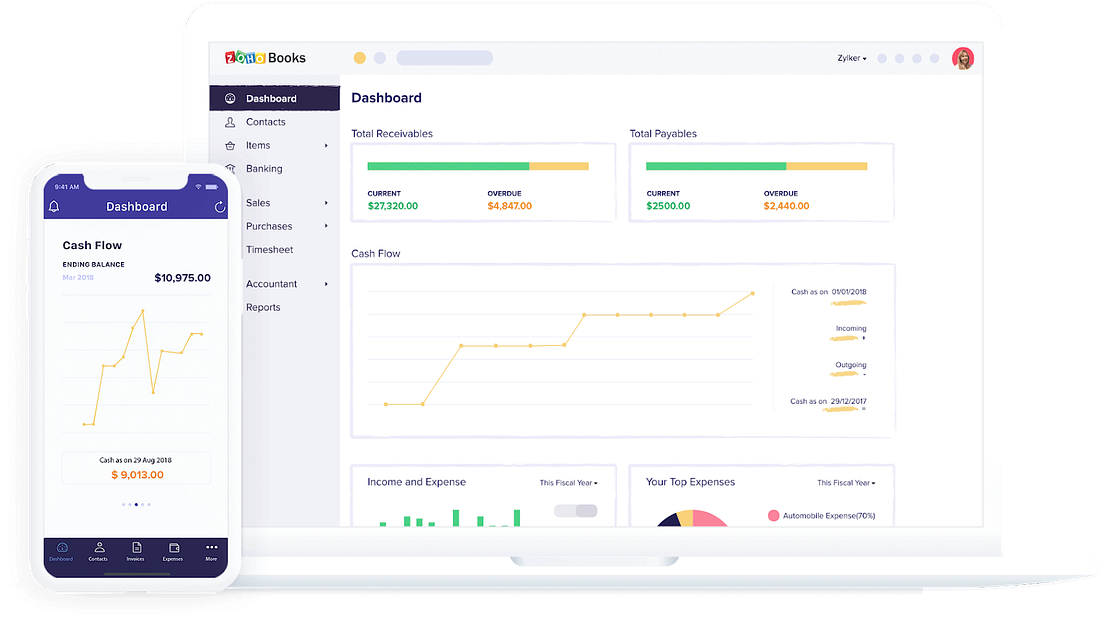

2. Zoho Books – Best For Automating Your Workflow

Expense reports, one of Zoho Books’ many reporting capabilities, make transparency and money management easier. You can assign as many jobs as necessary to other members of your business using Zoho Books. (While users are limited per plan, you can add extra users at $2.50 per month per user to any plan.)

Zoho Books, like Sage Intacct, leverages automated workflows to speed data input and condense repetitive processes. However, you cannot just simply register for Zoho Books if you want to collect donations (which you surely do).

Zoho Checkout, Zoho’s payment interface, is also required, but Zoho Checkout is free if you take no more than 50 donations each month. Clients that want limitless donations in different currencies must upgrade to a $9-per-month Zoho Checkout package in addition to their existing Zoho Books account.

Special Features

1. Invoicing – Zoho Books offers users the ability to send invoices, either as PDFs or directly through email. You can also customize invoices with your company’s logo and other information, such as payment terms and discounts.

2. Reporting – Zoho Books gives users a wealth of reporting options, including financial reports, job reports, and expense reports. Data can also be viewed in various charts and graphs to get a more visual understanding of your company’s performance.

3. Automated Workflows – Zoho Books’ automated workflows help you speed up data entry and reduce the chances of human error.

Pros

- Pricing

- Integration

- Reporting

Cons

- Steep learning curve

Pricing: $29.00 per month (10 users)

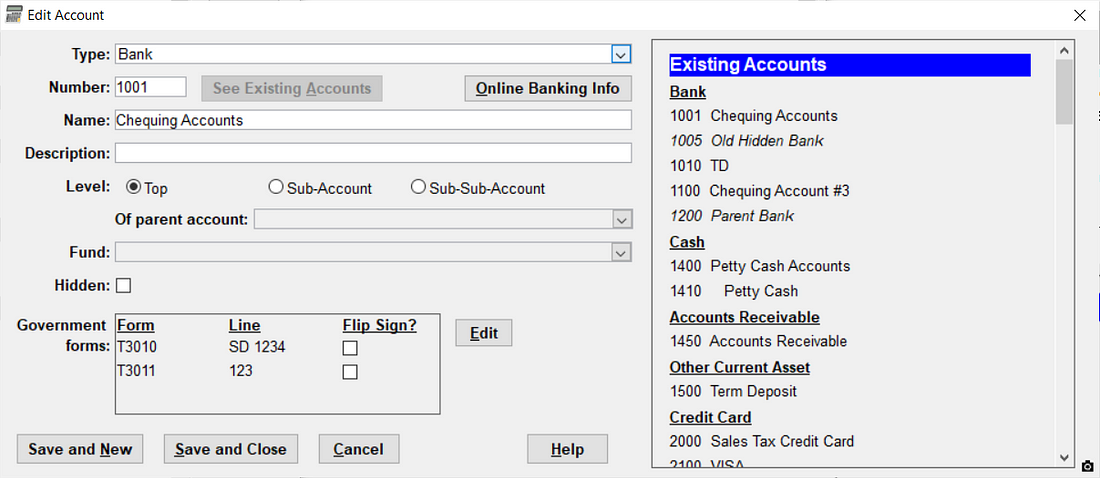

3. Accounts – Best For Small Organizations

Accounts is a Windows-based small nonprofit accounting software with a limited range of functionality tailored to small charitable organizations. It is arguably the best accounting software for small nonprofit organizations. The program provides basic bookkeeping and automatic fund accounting, which does not demand journal entries to maintain an accurate balance.

New organizations can make their custom chart of accounts or use one of the numerous examples available. Accounts’ single-user version may be installed on several computers, but the database must be duplicated between them. The network version allows up to five people to view the database simultaneously. The company recently released a cloud-based software compatible with several Mac computers.

Special Features

1. Income and Expense Tracking – Accounts offer a great way to track your income and expenses with its built-in reporting tools. You can see where your money is coming from and where it is going. This helps you stay on top of your budget and make better financial decisions for your nonprofit organization.

2. Automatic Fund Accounting – This feature is really helpful because it eliminates the need for manual journal entries, thus making your bookkeeping a lot easier and less time-consuming.

3. Accounts Payable – This feature allows you to keep track of bills and expenses that are owed to your nonprofit organization, which is helpful in keeping your finances organized and making sure that you are not missing any important payments.

Pros

- Customizable charts

- Ability to import/export reports

- Offers annual budgeting

Cons

- Not advisable for huge organizations

Pricing: $95.00 per year

4. Oracle Netsuite – Best Software With ERP and Ecommerce Features

NetSuite, which was recently acquired by Oracle, provides accounting, Marketing, and ERP solutions for a variety of businesses, including charities. Inventory and funds management and even e-commerce are all included in NetSuite’s cloud-based Social Impact software.

Unfortunately, NetSuite’s website is limited, and it’s on the more expensive side of accounting software (third-party estimates put the price at roughly $499 per month). Oracle NetSuite, on the other hand, is a better choice for moderate to large NGOs with a larger accounting budget because it concentrates on ERP and CRM software.

Special Features

1. ERP – Oracle NetSuite offers a comprehensive ERP solution for midsize to large nonprofits. This system can handle your NGO’s financials, HR, and supply chain needs.

2. CRM – Oracle NetSuite’s CRM software is also very comprehensive, tracking customer interactions and sales data.

3. e-Commerce – Oracle NetSuite’s e-commerce module allows you to sell products and services online. This can be a great way to raise additional funds for your NGO.

Pros

- Complete accounting software

- e-Commerce capabilities

- Very scalable

Cons

- Expensive

Pricing: $499 per month

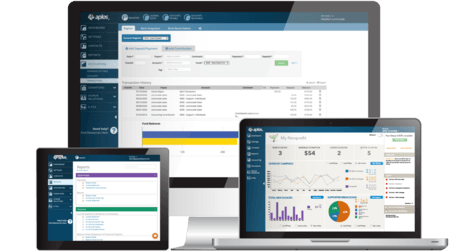

5. Aplos – Best Nonprofit Features

Aplos’ software has always been focused on nonprofits and churches. You won’t need to adjust your system’s built-in accounting records for nonprofit-specific financial needs because it’s based on fund-based accounting. Aplos Lite, which costs $59 a month, offers a comprehensive set of functions.

You can also subscribe to Aplos Core for $79 per month if you want text-to-donate functionality. Aplos’ bespoke services range at $179 a month for bigger nonprofits with multiple ongoing projects.

Keep in mind that, although Aplos’ charitable tools are impressive, its accounting capabilities are restricted. The customized plan is the only one that incorporates detailed revenue and spending monitoring, project or fund planning, asset management, and recurring transactions.

Special Features

1. Donor Management – Aplos has a great donor management system that allows you to track donors, donations, and pledges over time. You can also track information such as addresses, contact info, donation amounts, and more.

2. Fund Accounting – Aplos offers fund accounting which is specific to nonprofits and churches. This allows you to track your financials based on the funds that you have rather than lumping everything together.

3. Text-to-Donate – Aplos offers text-to-donate functionality which is a great way to increase donations from your supporters.

Pros

- Built for non-profits

- Offers CRM

- Provides automation

Cons

- Limited accounting features

Pricing: Starts at $59.00 per month

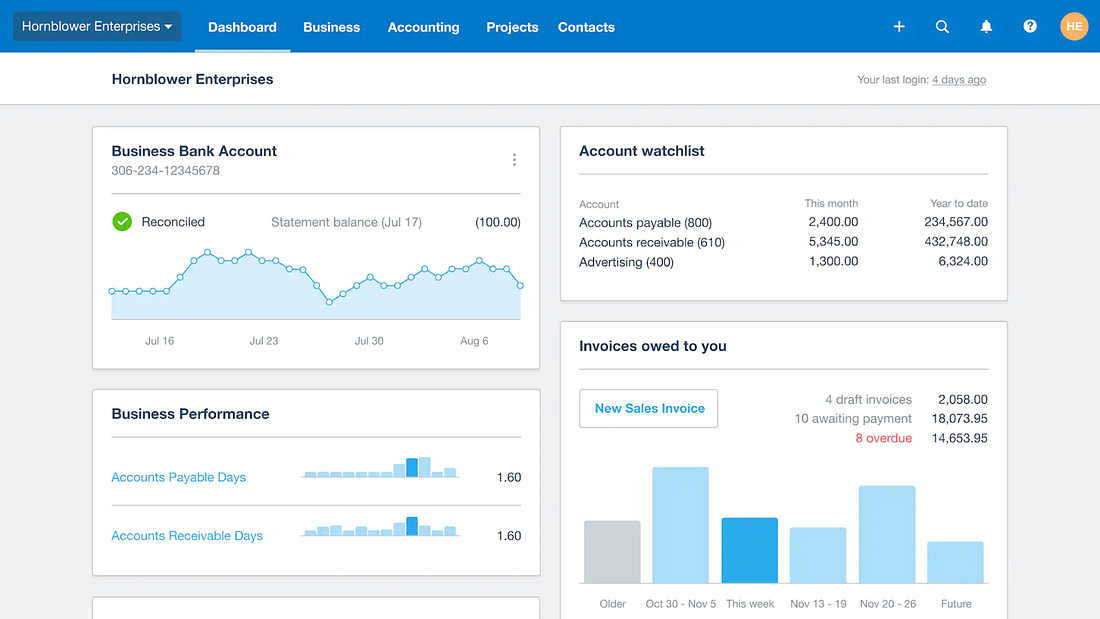

6. Xero – Best Cloud Solution For Collaboration

Xero outperforms practically every other cloud-based accounting software solution in one critical aspect: collaboration. Xero offers unlimited users, whereas QuickBooks restricts users per plan, and FreshBooks costs an additional $10 per user each month. NonProfitPlus does this as well; however, Xero’s beginning pricing of $12 per month far outweighs NonProfitPlus’s.

Xero also excels in accounting essentials like financial reporting and cost management, which may help keep your nonprofit’s budget on track. Its mobile app allows you to collaborate and interface with hundreds of other apps while on the move.

Xero provides 24/7 customer support, which is crucial for any nonprofit that relies on its accounting software to keep operations running smoothly. In terms of online nonprofit accounting software, Xero is certainly one of the best.

Special Features

1. Unlimited Users – QuickBooks restricts users per plan, and FreshBooks costs an additional $10 per user each month.

2. Financial Reporting – Xero excels in accounting essentials like financial reporting and cost management, which may help keep your nonprofit’s budget on track.

3. Mobile App – The mobile app allows you to collaborate and interfaces with hundreds of other apps while on the move.

Pros

- Pricing

- Cloud-based

- Unlimited users

- 24/7 customer support

Cons

- Limited features for nonprofit

Pricing: $12.00 per month

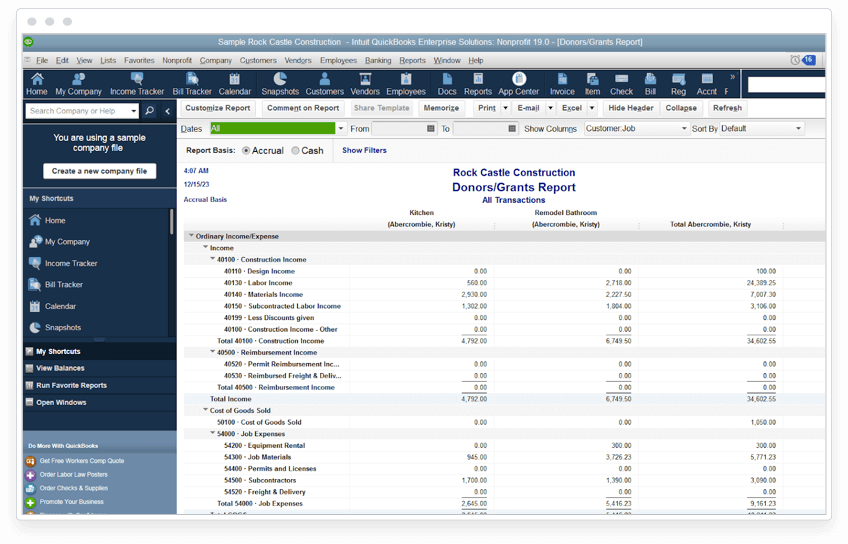

7. Quickbooks – Best Accounting Software UI

With capabilities including income and spending monitoring, tax deduction aid, receipt recording and organizing, payment services, and stock management, QuickBooks Online for Nonprofits provides more

comprehensive nonprofit accounting than many of the other solutions on our list.

It also contains financial tools tailored to nonprofits that several nonprofit-specific programs lack. (For example, QuickBooks’ cloud-based nonprofit plans, unlike Aplos’, allow you to break down expenditures by programs or funds.)

Because QuickBooks was created with non-accountants in mind, it’s simple for new nonprofit bookkeepers to gain a hold on their finances. Furthermore, QuickBooks’ mobile bookkeeping app is as user-friendly as its software counterpart, making it one of your best alternatives if you plan to perform a lot of on-the-go donation management or financial tracking.

Special Features

1. Fund and Donation Accounting – QuickBooks Online offers tools specifically tailored to nonprofit organizations, making it easy to manage donations and track where funds are going.

2. Multi-Currency – Nonprofits that work with or receive donations from people in other countries can easily keep track of all transactions with QuickBooks’ multi-currency feature.

3. Customizable Reports – Generate detailed reports on your nonprofit’s financial activity to help you understand and improve your organization’s performance.

Pros

- Very user-friendly

- Great for small nonprofits

- Intuitive mobile app

Cons

- Not ideal for large groups

Pricing: $80.00 per month

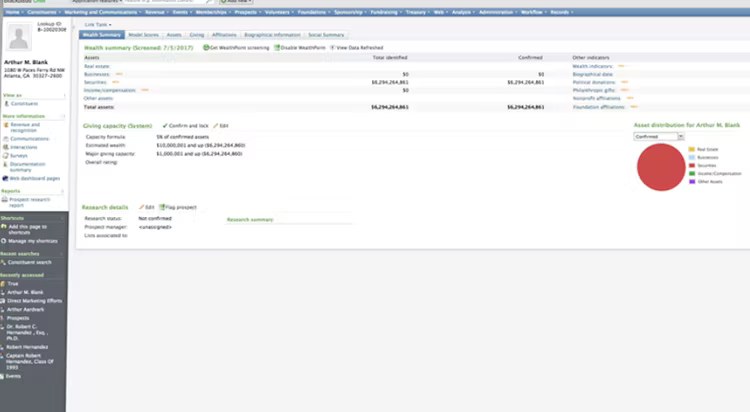

8. Blackbaud – Best For Peer-to-Peer Fundraising

Faith groups and churches, cultural organizations, academic institutions, and almost any other form of nonprofit you can think of are all served by Blackbaud. Peer-to-peer fundraisers, grant and award administration, charity marketing, and payment processing are all supported.

This software was specifically built for nonprofits, so it’s intuitive and easy to use. It offers comprehensive tracking of donations, pledges, and membership dues; online donation management, event registration and management; automated billing and payment processing; and even grant proposal writing tools.

Blackbaud also has a wide variety of add-on modules that can be tailored to your specific needs, including solutions for tracking and managing volunteers, donor relations, and even social media outreach.

Special Features

1. Peer-To-Peer Fundraising – Blackbaud allows for online peer-to-peer fundraising, which is great for nonprofits looking to increase donations from individuals.

2. Robust Tracking of Donations and Membership – Blackbaud offers in-depth tracking of donations, pledges, and membership dues. This makes administering a nonprofit much easier.

3. Event Registration and Management – Blackbaud offers event registration and management tools, which can be very helpful for charities and other nonprofits.

Pros

- No setup fees

- Custom reports

- Great when using on-the-go

Cons

- Not user-friendly

Pricing: Contact Blackbaud for Pricing

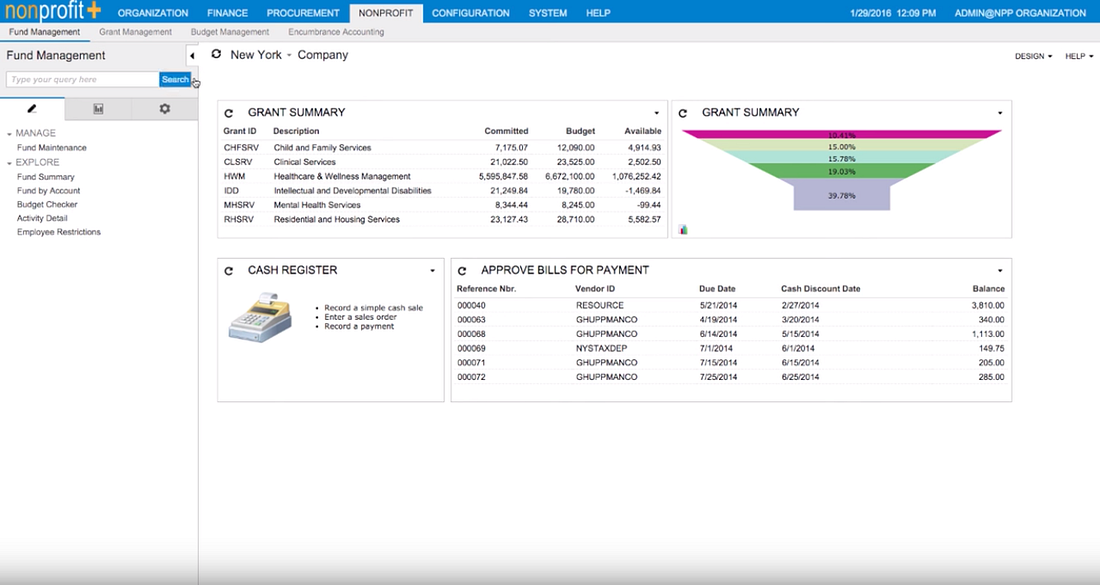

9. NonProfitPlus – Best Nonprofit Accounting Software For Scalability

Sponsor management, membership management, and limitless users are all included in NonProfitPlus’ accounting package for easy delegating. It also supports both fund-based and liability accounting, making budgeting easier. NonProfitPlus is extremely scalable, with so many capabilities: as your organization expands, more NonProfitPlus functions (such as assignment and time tracking) are becoming relevant.

NonProfitPlus, unlike other nonprofit software, provides supply management, which is essential if you sell products (such as shirts and tumblers) to generate money or thank sponsors. NonProfitPlus, on the other hand, does not provide pricing on their website — as with Sage Intacct, you must contact a representative for an estimate.

Special Features

1. Donor Management – Keep track of donor information, donation history, and pledge reminders.

2. Inventory Management – Track inventory levels, create purchase orders and manage supplier information.

3. Expense Management – Create and track expenses, assign budgets to projects, and manage bills and payments.

Pros

- Grant management module

- A true nonprofit software

- Offers several integrations

Cons

- Steep learning curve

Pricing: Starts at $675 per month

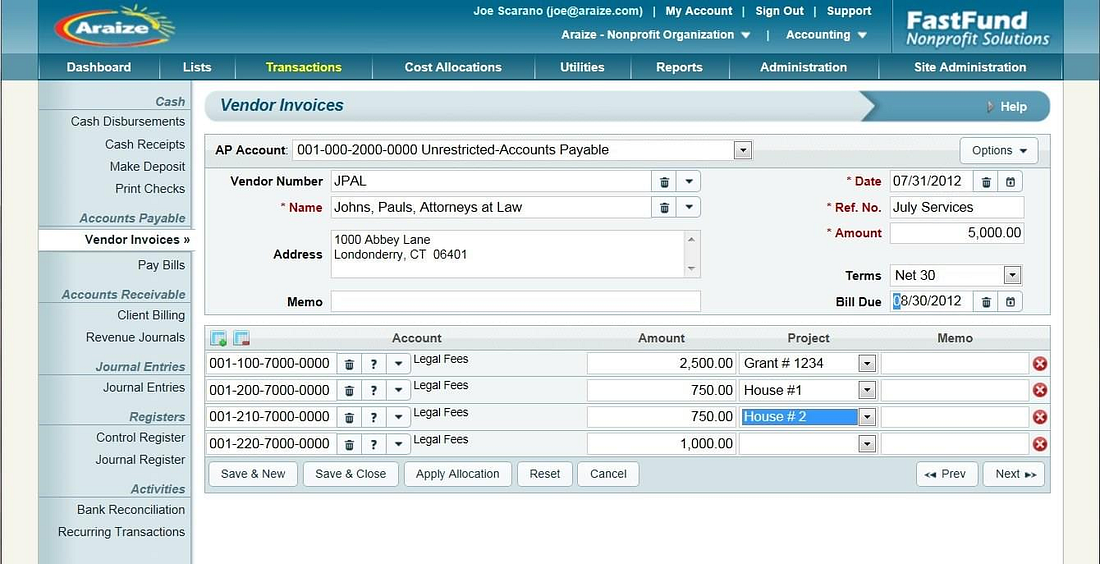

10. Araize – Best Software That Offers Online Training

CPAs that specialize in auditing organizations created Araize Accounting software exclusively for nonprofits. For registered customers, the company provides free and paid online training modules, as well as free weekly training webinars and individual instruction for $100 per hour.

Accounts receivable, payable, and cost allocations are all available in the premium edition. For a fee, the firm also provides fundraising and payroll software. Araize provides nonprofits with the ability to customize the software for their unique needs without having to hire a programmer.

Special Features

1. Cash Disbursements – This allows users to track who they paid when they paid them, and how much was paid.

2. Audit Trails – Tracks all changes made to the data, who made the change, and when it was made.

3. Financial Statements – Users have the ability to produce financial statements in a variety of formats, including balance sheets, income statements, and cash flow statements.

Pros

- Great cloud-based charity accounting software

- Customizable

- Affordable

Cons

- Limited integrations

Pricing: $42.00 per month

What is a nonprofit accounting software?

Accounting software is an essential business tool that helps nonprofit organizations manage their finances. Nonprofit accounting software is specifically designed to meet the unique needs of nonprofits, including tracking donations and grants, managing budgets and expenses, and creating reports.

Alongside the usual features of accounting software, nonprofit online accounting software often includes modules for tracking volunteer hours, creating donation letters and receipts, and managing membership databases. Some software also offers fundraising tools that help nonprofits manage their online donations and track their progress towards fundraising goals.

There is such thing as free nonprofit accounting software; however, the paid tools are often significantly more powerful and reliable and have a wider range of features. There are plenty of budget-friendly options included in our list.

While some programs are suited to both nonprofits and profitable organizations alike, there are some — such as Peachtree church accounting software — that have been designed specifically for nonprofits. However, you don’t necessarily need a program like this; simply find a program that includes all the features you need.

How does a nonprofit accounting software work?

Like regular accounting software, nonprofit accounting software works by automating many of the bookkeeping and accounting tasks that need to be completed for a nonprofit organization. This can include tracking income and expenses, creating invoices and bills, managing payroll, and more.

Generally, accounting software for nonprofit organizations works by storing and tracking all of your financial data in one place, then providing reports and other tools to help you understand your organization’s financial health. This can be invaluable for nonprofits, as it can help them make more informed decisions about where to allocate their resources.

There are tools for everyone in the accounting software space; for instance, you can find nonprofit treasurer accounting software, which caters to those in the treasury leadership position. There are also more general programs to suit all organization members.

What are the advantages of using a nonprofit accounting software?

If you are considering using nonprofit accounting software for your nonprofit organization, you are making a wise decision. Nonprofit accounting software can provide many advantages for your organization.

Perhaps the most important advantage of using nonprofit accounting software is that it can help you to better manage your finances. Financial management is critical for any nonprofit organization, and good financial management can help your organization to be more successful.

Accounting software for nonprofit organizations can make it easier for you to track your expenses and income, as well as to forecast future financial needs. This can help you to make better decisions about how to allocate your resources and manage your budget.

Another advantage of using accounting software nonprofit is that it can help you to comply with financial regulations. Financial regulations can be complex and difficult to understand, but nonprofit accounting software can make it easier for you to ensure that your organization is in compliance with all applicable rules and regulations.

Nonprofit accounting software can also help you to better manage your donors and fundraising efforts. Good donor management can help you to cultivate relationships with donors and to raise more money for your organization.

Overall, using nonprofit accounting software can provide a number of advantages for your nonprofit organization. It can help you to better manage your finances, comply with financial regulations, and manage your donors and fundraising efforts.

Conclusion: What is the best nonprofit accounting software?

Nonprofit organizations have plenty to gain from making use of the best accounting software. This is especially true as they face new challenges in the coming years.

Topping our list of the best nonprofit accounting software for 2022 is Sage Intacct, as it offers a comprehensive and easy-to-use platform for managing finances. It has more capabilities than the other software options we considered and is relatively affordable.

So, if you’re looking for a great way to manage your nonprofit’s finances, Sage Intacct is the solution to go for.