Traditional accounting software has long been replaced with a safer, more affordable solution — cloud-based tools. You get top-notch security, powerful automation, improved collaboration and productivity, and so much more, all at an affordable price point.

Read on to discover 11 of the best cloud-based accounting software options — we’ll explore each of them in detail to help you make an informed decision on the one best suited for your bookkeeping and accounting needs.

Best Accounting Cloud-Based Software: Our Top 11 List

The tools listed below are set up for accounting and bookkeeping — regardless of your needs and budget, you’re sure to find one from this list that ticks all the right boxes:

- FreshBooks — Overall, the best cloud-based accounting tool thanks to its affordable, scalable plans and all-in-one nature, which includes powerful automation, collaboration capabilities, and time tracking.

- Zoho Books — The best free solution with ample plans for various-sized businesses, plus it has built-in time tracking for easy billing, real-time collaboration capabilities, and recurring payments and reminders.

- Sage Accounting — The top choice for small businesses as the starting plan costs just $10/month and the other just $25/month for unlimited users, quotes, and invoices.

- Oracle NetSuite — Best for large businesses looking for ultimate flexibility and customization, plus it boasts CRM, accounting, ERP, and e-commerce services, all under one roof.

- Xero — Popular option for small businesses as it boasts unlimited users on all plans, and it lets you accept payments in 160 currencies and even set up a “Pay Now” button to invoices.

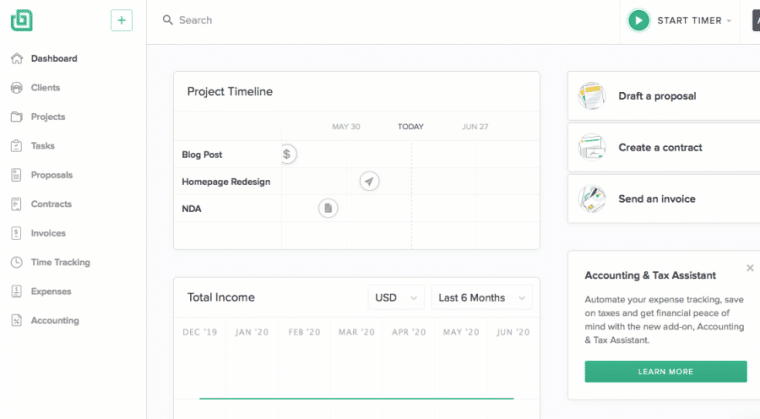

- Bonsai — Solid cloud-based accounting tool for freelancers needing an affordable solution to handle their expenses, time spent on projects, and tax — starting at $17/month for unlimited clients and projects.

- FreeAgent — The cheapest option that boasts unlimited users for just $10/month and offers support for multiple currencies and languages as well as built-in time tracking and accounting automation capabilities.

- Knowify — The best cloud-based construction accounting tool that comes with CRM and PM tools, lets you manage subcontractors, time spent on projects, dependencies, and project costs.

- Wave — A leading free solution for invoicing, banking, and accounting – plus, it lets you onboard an unlimited number of collaborators and accountants at no cost

- Kashoo — Offers a limited free invoicing solution for startups, and it boasts double-entry ledger management, auto invoice reminders, and project and payroll management for $20-$30/month.

- Reviso — Top choice for mid-sized businesses looking to manage VAT with ease, collaborate on projects, track inventory, and get budget and asset management tools alongside standard accounting capabilities.

Top Online Accounting Software Tools: Reviewed

We’ve carefully handpicked these cloud accounting solutions by taking customer reviews, the security, pricing, ease of use, pros (and cons), and more into consideration so that you’re presented with the best options.

Below, we’ll explore each tool in some more detail to help you find one that best suits your needs.

1. FreshBooks — Overall, the Best Online Accounting Software

This all-in-one accounting machine will have you desiring nothing more. From managing your accounts, expenses, and communications to running double-entry checks to ensure accuracy — FreshBooks has it all and more.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Small businesses | Starts at $4.50/month | Starts at $130.50 | 1 | Windows, Mac, iOS, Android | 30-day trial | 30-day guarantee |

What makes FreshBooks the best, though? Well, what we and the 30+ million FreshBooks users love most is the automation capabilities.

This includes things like expense and time tracking, client payment updates (including late fees and payment reminders), follow-ups, automatic receipts, setting up auto bank feeds, and more.

Special Features:

- Create professional invoices

- Access your data on the go with the mobile app

- Integrate with 130+ external apps, including Zapier

- Create profit and loss and expense reports

- Get in-depth sales tax summaries and invoice histories

- Accept payment from leading gateways

- Centralize all your project collaboration

- Manage your balance sheet, accounts payable, etc.

Pricing:

With FreshBooks, you have these 4 pricing options:

- Lite — $4.50/month — 5 billable clients, automated customizable recurring invoices, unlimited time and expense tracking

- Plus — $7.50/month — 50 billable clients, automatic expense tracking, double-entry accounting

- Premium — $15/month — Unlimited billable clients, track bills and accounts payable, automatic late payment reminders and fees

- Select — Custom — Start with 2 users

If you need additional users, this will cost an extra $10/month. And lastly, besides the 30-day money-back guarantee, you also get 30 days free to test FreshBooks in all its glory, completely risk-free!

Pros:

- Quality features and security

- The platform is user-friendly and intuitive

- Offers powerful automation capabilities

- Customer support is top-notch

- Affordable pricing plans

Cons:

- Retainers can be difficult to use

- More users come at an additional cost

2. Zoho Books — Top Cloud-Based Accounting Software for Any-Sized Business

As a cloud-based tool that does a fantastic job at simplifying contact management, accounting, and bookkeeping, it’s unsurprising that Zoho Books is as popular as it is.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Any-sized business | Starts at $20/month | Starts at $15/month | 3 | Windows, Mac, iOS, Android | Free plan + 14-day trial | 30-day guarantee |

It has loads of nifty features, including a client portal for real-time collaboration, plus some project and time-tracking tools to improve your business’ efficiency and productivity.

Plus, you get powerful automation. For example, you can easily automate payment reminders and recurring payments and even set up reports scheduled to be emailed to you, your team, or your clients.

Special Features:

- Create quotes and invoices

- Monitor payments and your expenses

- Send purchase orders and upload your receipts

- Categorize and attach docs to your banking transactions

- Manage your customer and supplier contacts

- Customize your dashboard and reports

- Monitor the time spent on tasks and projects

Pricing:

Zoho Books has one of the best free plans, plus loads of paid options:

- Standard — $15/month — 3 users, 5,000 invoices, recurring expenses, custom views and fields, timesheet reporting, and billing

- Professional — $40/month — 5 users, retainer invoices, recurring bills, purchase orders and approvals, plus workflow rules

- Premium — $60/month — 10 users, vendor portal, custom reports, budgeting

- Elite — $120/month — 10 users

- Ultimate — $240/month — 15 users, advanced analytics

It’s worth noting that extra users will add just $3/user/month to your subscription — overall, it’s not hard to see why Zoho Books is adored. You can test it yourself for free today for a full 14 days.

Pros:

- Large ecosystem of Zoho app integrations

- Great free plan and pricing flexibility

- Affordable user add-ons

- The interface is user-friendly

Cons:

- Needs a mobile payment option

- Expensive high-tier plans

3. Sage Accounting — Best Cloud-Based Accounting Software for Small Business Needs

With Sage Accounting, you get the perfect mixture of simplicity and power for your small or growing business.

You can collaborate with your accountants and bookkeepers in real-time, have your transaction records updated automatically, create and send invoices, and track what you’re owed.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Small and growing businesses | Starts at $10/month | N/A | 1 | Android, iOS, Windows | 30-day trial | No |

Plus, you can save time by automating your payments, invoices, and payment reminders — but of course, the magic doesn’t end here. And you also get comprehensive reports and handy budget and project tracking tools to ensure that you, your teams, and your business is on the right track.

Special Features:

- Create profit-and-loss reports and balance sheets

- Print or share your reports through email

- Accept payments in multiple currencies in Sage

- Time tracking (a paid optional add-on)

- View your transactions and cash flow forecasts

- 20+ external app integrations

Pricing:

Sage only has 2 plans priced as follows:

- Sage Accounting Start — $10/month — 1 user, send invoices, bank reconciliation

- Sage Accounting — $25/month — Unlimited users, quotes and invoices, forecast cash flow

The starter plan is great for small businesses — and in fact for growing businesses too as you get unlimited users and loads of accounting tools for just $25/month.

It’s up to you to decide whether this is the tool for you, and you get a full, generous 30-day free trial to explore the platform before committing.

Pros:

- The interface is user-friendly

- Competitively priced for small and mid-sized businesses

- Comprehensive reporting capabilities

Cons:

- No built-in time tracking and payroll

- The UI isn’t as modern as others

4. Oracle NetSuite — All-in-One CRM, Accounting, ERP, and E-commerce Solution, Best Suited for Larger Businesses

Oracle NetSuite is a top choice for over 34,000 companies, and for good reason. It’s an all-in-one business management solution that allows business owners to get a custom quote on the services they need to ensure compliance, streamline operations, and everything in between.

|

Best For |

Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Larger Businesses | Custom | Custom | N/A | Android, iOS, Windows, Mac, Unix, Linux | Only a demo |

30-day guarantee |

Of course, as it’s cloud-based, this means that you and your employees will always have updated data and the freedom to access Netsuite from anywhere and on any device.

Beyond this, Netsuite’s popularity is also largely due to how flexible and customizable it is — whether it’s custom dashboards, processes, forms, or transactions, you can set it up in a way that best suits your business.

Special Features:

- Budgeting and cost estimation

- Built-in real-time analytics and reporting

- Manage cash flow and account receivables and payables

- Inventory/order management, distribution, and logistics

- Automate your payroll and easily manage contracts

- Manage your project resources, allocation, and cost

- Manage multiple legal entities, currencies, and languages

Pricing:

NetSuite doesn’t offer pricing on its website because every business is different. As such, you’ll need to request a custom quote. Some of the factors that make it custom include that the pricing will be based on the services needed, any add-ons, and the number of seats, amongst other things.

Pros:

- Effortless invoicing

- Lets you keep all your data organized

- Offers built-in payroll

- Custom, detailed reporting

Cons:

- There’s a learning curve

- Support is expensive

5. Xero — Reliable Online Accounting Software for Small and Established Businesses Alike

With unlimited users on all the plans and a boatload of advanced accounting features, it’s no wonder Xero is adored by many.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Unlimited users | Starts at $12/month | N/A | Unlimited | Windows, Mac, Android, iOS | 30-day trial | No |

You can view your accounts payable, your cash flow, and your entire transaction history at a glance, and you can even add a ‘Pay Now’ button to your online invoices.

Plus, you can also set up automatic bank feeds and organize your contacts and documents (including your files, bills, receipts, and everything else) — all in one place.

Special Features:

- Accept payments through PayPal and other leading gateways

- Project budget and time management tools

- Create and send customized invoices

- Manage your payroll (or integrate with Gusto)

- Accept payments in 160 currencies

- Integrate with over 1,000 external apps

- Manage your expenses and track your company’s financial health

Pricing:

Xero has the following 3 plans:

- Early — $12/month — Send quotes and 20 invoices, reconcile bank transactions

- Growing — $34/month — Bulk reconcile transactions

- Established — $65/month — Multiple currencies, track projects, in-depth reporting, claim expenses

These accommodate various needs and budgets, but it’s unfortunate that some of the key features, like reporting and the project tracking software tools, are only on the highest plan.

Nevertheless, Xero is certainly one of the best cloud-based accounting software tools on the market — and they offer a free 30-day trial for you to test it risk-free.

Pros:

- Unlimited users on all plans

- Superbly secure and reliable

- User-friendly interface

- Highly customizable

Cons:

- Limited to 20 invoices on the starter plan

- A month’s notice is needed to cancel

- The mobile app could use more functionality

6. Bonsai — Solid Cloud-Based Accounting Tool for Freelancers

Bonsai is a popular expense, time, and tax management solution for freelancers and small businesses or agencies, as it comes loaded with invaluable tools designed to help make managing your business a breeze.

|

Best For |

Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Freelancers | Starts at $24/month | Starts at $17/month | 1 | Android, iOS, Mac, Windows | 14-day trial |

14-day guarantee |

From automating your invoices and payment reminders to the automatic expense and timesheet updating — Bonsai handles it all for you so that you can focus on more pressing tasks that require human input.

On the whole, automatic expense tracking and tax deductions are an absolute must-have for small businesses and freelancers to streamline their processes, improve the accuracy of their books, and save time with their day-to-day tasks.

Special Features:

- In-depth financial reporting

- Create electronic proposal approvals

- Countless customizable time-saving templates

- Built-in CRM functionality to manage your clients

- Automatic expense tracking and tax deductions

- Send automatic payment reminders

- Built-in time tracking

Pricing:

Bonsai has 3 subscriptions on offer, with the option of monthly and annual plans. These are the prices for the annual subscriptions:

- Starter — $17/month — Includes all templates, unlimited clients and projects, invoicing and payments, proposals, and contracts, expense tracking, and up to 5 collaborators

- Professional — $32/month — The above, plus custom branding, forms, and questionnaires, workflow automations, client portal, integrations + up to 15 collaborators

- Business — $52/month — Subcontractor management + onboarding, accountant access, connect multiple bank accounts, unlimited subcontractors and collaborators

On top of the generous offerings, Bonsai has a solid 14-day free trial and a money-back guarantee so you can try the tool completely risk-free for a full 2 weeks to determine whether it’s best for you.

Pros:

- Superb for automation

- Fantastic invoice creation and tracking

- Intuitive, modern UI for easy navigating

- Incredible value for money

- Quality customer support

Cons:

- Can’t set up manual client reminders

- Pricing can be costly for some

- There’s a bit of a learning curve

7. FreeAgent — Cheapest Cloud-Based Small Business Accounting Software for Unlimited Users

FreeAgent is loved by its users for its simplicity and fantastic customer support — but besides this, it’s also incredibly intuitive and effective for both accounting and project management needs.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Small businesses | Starts at $10/month | N/A | Unlimited | Windows, Mac, Linux, Android, iOS | 30-day trial | No |

You can create and send invoices, proposals, and estimates and accurately track your expenses, tasks, and even the time spent on projects on both mobile and desktop — completely hassle-free.

It’s fair to say that although it’s not as popular as some of the bigger names, FreeAgent does a great job at offering small businesses a fantastic cloud-based accounting solution.

Special Features:

- Create timesheets and reports on logged time

- Link your bank account for auto-transaction importing

- Set up automated, recurring invoices

- Set your sales tax rates and create tax reports

- Supports multiple languages and currencies

- View all your financial data at a glance with the neat dashboard

- Create estimates from templates for client approval

Pricing:

FreeAgent doesn’t give you freedom of choice, but the one plan on offer does include all the features with no limitations and you’re not bound to a long-term contract.

And for just $10/month for the first 6 months and just $10 more thereafter — it’s a bargain that’s certainly hard to beat.

Plus, you have a free 30-day trial to explore whether this cloud-based accounting tool is for you.

Pros:

- Praised for its ease of use

- Superb customer support

- Fantastic task automation

- One of the best PM tools for small businesses

- Drag-and-drop dashboard customization

Cons:

- There’s only 1 plan

- The mobile app requires a lot of zooming in and out

8. Knowify — Best Cloud-Based Construction Accounting Software

Knowify is the best solution for mid-sized businesses because you get everything you need for your accounting needs, plus it’s one of the best construction project management tools that also has built-in CRM software.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Contractors | Starts at $124/month | Starts at $99/month | 1 | iOS, Android, Mac, Windows | 14-day trial | No |

Overall, you can easily manage your documents, contracts, your project bidding, budgeting, invoicing, and of course, payments with Knowify as your chosen cloud accounting software.

Special Features:

- Track the cost of materials, labour, equipment, etc.

- Manage subcontractor contracts, schedules, bills, and more

- Track time and expenses on the go

- Integrate with QuickBooks for your bookkeeping

- Create detailed cost estimates

- Track dependencies and project timelines with Gantt charts

- Collaborate with contractors on the client portal

Pricing:

Knowify has 4 plans on offer to meet varying needs and budgets, here are the annual billing prices:

- Launch — $99/month — 50 active jobs, contract and project management, time tracking, and scheduling

- Growth — $149/month — 150 active jobs, advanced scheduling, project and document management, CRM pipeline, subcontractor management

- Enterprise — $264/month — 250 active jobs, unlimited no-access users, advanced user permissions, enterprise reporting, customer portal

- Beyond Enterprise — Contact the sales team — 250+ active jobs

Monthly billing starts at a whopping $124 for 1 user, and additional users will cost between $1 and $15 depending on the access rights.

Pros:

- Fantastic for managing contractor work and billing

- It’s incredibly simple to use

- Great value for money for an all-in-one contractor solution

Cons:

- A bit costly for smaller businesses

- Submittals need some work

9. Wave — Popular Free Cloud-Based Accounting Software for Small Business Needs

Wave is great for small businesses looking to get a handle on their invoicing, banking, and accounting without needing to pay a cent. And it’s loaded with valuable features, which, of course, makes Wave a popular cloud-based accounting solution.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Startups and small businesses | Free | N/A | Unlimited | Web-based, iOS, Android | Free versions + 30-day trial | N/A |

In fact, you get what you need to manage your customer information, set up recurring invoices and automatic payments, and you can even organize overdue payment reminders to go out — all for free.

Plus, you can easily track the payment and communication history of each of your customers and get real-time notifications for all payments made and those that are currently due, etc.

Special Features:

- Monitor your cash flow and be ready for tax season

- Connect your bank accounts for automatic transaction syncing

- Automated accurate payroll (paid add-on option)

- Add unlimited collaborators and accountants for free

Pricing:

Besides the invoicing, accounting, and banking features that are all on offer for free — here are the prices related to payments:

- Credit cards — 2.9%-3.4% + $0.60/transaction

- Bank payments — 1% per transaction

Furthermore, payroll will cost an additional $45/month plus $6 per active employee or contractor, but you can try it for free with the 30-day trial.

Pros:

- Simple and easy to set up

- Great for setting reminders and recurring invoices

- Offers basic functionality and more for free

Cons:

- The payroll feature isn’t very flexible

- Lacks features and customer support

10. Kashoo — Great Cloud-Based Accounting Tool for Truly Small Businesses

As a platform that offers free invoicing and affordable accounting tools, Kashoo is a great option for small businesses.

But, this accounting software also has what you’d need to power a larger business too, making it not only a gem for startups and small companies but overall a great option for various needs and budgets.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Very small businesses | $20/month | N/A | Unlimited | Mac, Windows, iOS, Android | Free invoicing + 14-day trial | No |

As a popular double-entry accounting software, you can automate your workflow, capture receipts, prepare for tax season, manage your expenses, and more without the hassle.

Special Features:

- Create and send custom invoices

- Accept payments and sync your accounts

- Track income, expenses, and sales tax

- Manage specific project transactions and payroll

- Double-entry ledger management

- Set up auto invoice reminders

- Access advanced reports

Pricing:

Kashoo has a free invoicing solution that allows small businesses to send up to 5 invoices and create estimates, plus track their income. On the other hand, there are these 2 paid options:

- TrulySmall — $20/month — Track expenses and sales + sales tax, essential reporting

- Kashoo — $30/month — Advanced reporting, multiple users and currency support, project and inventory management, payroll

Both of these plans can be tested for free for a full 14 days.

Pros:

- Great free invoicing for tiny businesses

- Offers an incredibly simple accounting solution

- No charge for importing bank transactions

Cons:

- Lacks integration options

- Interface and support could be improved

- Reports lack customization

- Not as feature-rich as other options

11. Reviso — Advanced Online Accounting Software for Mid-Sized Businesses

Although not as popular and well-known as some of the other names on this list, Reviso lets you handle your documents, billing, customers and suppliers, and even your projects and inventory.

| Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| Mid-sized businesses | Starts at $20/month | N/A | 1 | Desktop, Android, iOS | 14-day trial | No |

In fact, it’s one of the best inventory management tools out there, and due to the add-on costs, we believe that Reviso is best for mid-sized businesses. Overall, this, plus the fact that it has advanced accounting tools, makes Reviso worthy of making our list.

For example, you get budget and asset management, you can set up commission rates for your employees, plus manage your customer, client, and supplier profiles, as well as your price list and stock levels!

Special Features:

- Create quotes, invoices, and orders

- Record all your expenses and invoices

- Collaborate on projects

- Automate your client billing and payment reminders

- Set up manual and automatic bank reconciliation

- Manage all your VAT data

Pricing:

Reviso has the following 2 plans billed on a quarterly basis:

- Small — $20+VAT/month — 4,000 entries per year

- Standard — $35+VAT/month — 10,000 entries per year

Both plans come with the same core features, and you have optional add-ons priced as follows:

- Extra users — $7.50/month

- Project and inventory management — $10 each/month

If you’d like to try Reviso, you can for free for a full 14 days.

Pros:

- Great mobile app

- Loaded with features

- Has project and inventory management tools

Cons:

- No free version

- Isn’t worldwide and only caters to English users

- Minimal customer reviews

Accounting Software Cloud-Based: The Best Compared in a Table

With this table, you’ll be able to compare each cloud accounting tool’s pricing, trial and guarantee lengths, and more at a glance:

| Accounting Cloud-Based Software | Best For | Monthly Billing | Annual Billing | Users for Starting Price | Support | Free Trial/Plan | Guarantee/Refund |

| FreshBooks | Small businesses | Starts at $4.50/month | Starts at $130.50 | 1 | Windows, Mac, iOS, Android | 30-day trial | 30-day guarantee |

| Zoho Books | Any-sized business | Starts at $20/month | Starts at $15/month | 3 | Windows, Mac, iOS, Android | Free plan + 14-day trial | 30-day guarantee |

| Sage Accounting | Small and growing businesses | Starts at $10/month | N/A | 1 | Android, iOS, Windows | 30-day trial | No |

| Oracle Netsuite | Larger businesses | Custom Quote | N/A | N/A | Android, iOS, Windows, Mac, Unix, Linux | Only a demo | 30-day guarantee |

| Xero | Unlimited users | Starts at $12/month | N/A | Unlimited | Windows, Mac, Android, iOS | 30-day trial | No |

| Bonsai | Freelancers | Starts at $24/month | Starts at $17/month | N/A | Windows, Mac, Android, iOS | 14-day trial | 14-day guarantee |

| FreeAgent | Small businesses | Starts at $10/month | N/A | Unlimited | Windows, Mac, Linux, Android, iOS | 30-day trial | No |

| Knowify | Contractors | Starts at $124/month | Starts at $99/month | 1 | iOS, Android, Mac, Windows | 14-day trial | No |

| Wave | Startups and small businesses | Free | N/A | Unlimited | Web-based, iOS, Android | Free versions + 30-day trial | N/A |

| Kashoo | Very small businesses | $20/month | N/A | Unlimited | Mac, Windows, iOS, Android | Free invoicing + 14-day trial | No |

| Reviso | Mid-sized businesses | Starts at $20/month | N/A | 1 | Desktop, Android, iOS | 14-day trial | No |

As you can see, most are great for both mobile and desktop use — including Android, iOS, and Windows, and some of the best Mac accounting tools are included here too.

The Best Free Cloud-Based Accounting Software

Although free plans are limited, you may not be on the hunt for a full-fledged accounting solution. If this is the case, then a cloud-based tool like Zoho Books (by far one of the best free accounting solutions) might have what you need.

Wave and Kashoo are also great free options that you may want to look into, so here’s a comparison table outlining their key uses and features:

| Free Accounting Software | Best For | Special Features |

| Zoho Books | Small businesses | 2 users, 1,000 invoices/annum, recurring invoices, client portal |

| Wave | Unlimited accountants and collaborators | Loads of invoicing, accounting, and banking features |

| Kashoo | Invoicing | Send 5 invoices, track expenses, create estimates |

We certainly understand that pricing can be a big determining factor when choosing software for your business, but we’d highly recommend opting for free trials instead of free plans, as this lets you explore the full platform without limitation.

Plus, considering the competition, you get really affordable options like FreshBooks, which costs just $4.50 a month for 1 user, or $10 to $12/month with tools like FreeAgent and Xero.

Whether you’re a small or an established business, you’ll find that for the functionality and growth potential, you’re better off investing in a paid accounting solution.

What’s the Difference Between Cloud-Based Accounting Software and the Traditional Desktop Method?

The traditional means of managing accounts and financial data has thankfully evolved into a more flexible and affordable modern solution — so, gone are the days of needing to manually backup data or purchase and install individual software licenses onto each desktop in your office!

Plus, support for traditional desktop accounting software is gradually being withdrawn as the business world shifts to the cloud. To help you get a better idea of how this industry has evolved, we’ve discussed some of the key differences between cloud-based and traditional accounting software below:

Installation

Unlike traditional accounting software, cloud solutions don’t need to be installed as they’re accessible online through a web browser or a mobile app — all you need is your login credentials, and you’ll be able to access your data from anywhere and on any device!

Upgrades and Growth

Traditional software would require a complete re-do of your office software or additional software purchases and servers. With cloud solutions, you simply upgrade your subscription and boom, you’ve instantly got additional features such as user count, added storage, or functionality.

Automatic Backups

Besides being a real pain and incredibly time-consuming, manual backups risk having the drive containing your data get stolen, lost, or damaged. With cloud-based solutions, your data backups happen automatically!

Maintenance and Costs

With traditional software, you’d need to hire an IT team to assist with any issues or maintenance — with cloud solutions, the provider handles the maintenance, and you get phone, live chat, or email support to help you if you run into any technical issues.

Overall, it’s far more convenient, and it costs less — you don’t need to buy individual licenses, servers, additional software, or do any maintenance, updates, or backups yourself.

What are the Benefits of Using Cloud-Based Accounting Software?

Many of the key benefits are outlined when comparing traditional on-premises accounting software with cloud solutions, but below, we’ve outlined some additional factors that make online accounting software the best solution for any business:

Safety

Anything online raises concerns about security, but there’s no better way to secure your data than with the powerful encryption used by cloud solutions. In fact, it’s the same encryption method that’s used to protect the data being sent and stored with the best VPN services and even online banking apps.

Your data is also further protected with automatic regular backups on more than one server, so unlike traditional software that risks being destroyed in an event like an office fire, your data is 100% protected in the cloud.

Access and Collaboration

Unlike being tied down to one license for 1 device, cloud software allows you to onboard your accountants and other team members to boost collaboration and productivity.

With user permissions, this is also safe, plus because it’s all online, you and your teams can access the real-time data from anywhere in the world, unlike non-cloud-based accounting software where you’d need to be in the office at the precise desktop that has the software installed on it.

Automations and Integrations

The best cloud-based accounting software tools come with powerful automation capabilities to help you save time and improve your business’ productivity and efficiency.

For example, you can automatically send recurring invoices, do automatic data entries such as syncing transactions from your bank to your books, and more to save time, reduce human error, and ensure accuracy.

Plus, you also have the means to extend or connect with your current tech stack with external app integrations — so you’ll be able to seamlessly integrate your cloud accounting software with other business apps such as client management software, time trackers, or other tools that your company already uses.

Organization

Our list of benefits wouldn’t be complete without mentioning how cloud-based accounting software allows you to have a secure centralized hub for all your important documents — such as contracts, invoices, expenses, etc.

You and your teams will have instant access to the same software and the latest version of the documents at all times.

How to Choose the Best Accounting Cloud-Based Software

Deciding which of these would prove best for your needs can be challenging, so we’ve included some key factors that you should bear in mind when making your decision:

Pricing

Although there are free options, you get the most value with paid subscriptions, and thankfully there’s a tool for any budget — startups, large businesses, and everything in between.

Bear in mind, though, that if you need certain features, some platforms may only have them on the higher plans or as additional add-ons — and in some cases, you may even need to integrate with another tool for certain functionality.

On a final note, as most accounting tools are priced on a per-user basis, you’ll want to factor this in with your current and future needs in mind.

Integrations

As we mentioned in the last section, sometimes you may need to integrate with external apps for certain functionality if it isn’t provided built-in. This is important to consider as these generally come with their own subscription fees.

You’ll also want to check that certain tools can be integrated with your chosen cloud-based accounting solution if you already use CRM tools, project management software, or anything else.

Ease of Use

Accounting software can be as complex or as simple as you need it to be, and thankfully, most of the tools on this list don’t have hefty learning curves, so you don’t have to worry much about their user-friendliness.

At the end of the day, you want to factor in the user interface, the customer support and documentation on offer, and how long it will take to get you and your accountants or team accustomed to the software.

Regardless, it’s a far slicker solution for modern businesses than desktop accounting software or even the Excel spreadsheets used by some small businesses.

Features

The capabilities that are most important will depend largely on your particular needs. Nevertheless, here are the key features on offer with the best cloud-based accounting software tools:

- Mobile app support — To capture receipts, communicate with clients on the go, or track your financials on the move

- Automatic bank reconciliation — Linking your bank accounts to your books for instant transaction syncing

- Automations — Things like automatic billing or reminders for late payments to save time

- External integrations — The more, the better to ensure that you can connect with your current tech stack

At the end of the day, it’s best to consider the features you need now and how much additional functionality will cost you in the long run.

Conclusion: What is the Best Cloud-Based Accounting Software?

FreshBooks is our top pick for the best cloud-based accounting software, and at just $4.50 to $15 per month, you’ll have a tough time finding a better tool for your cloud bookkeeping and accounting needs.

But at the end of the day, the one you choose is up to you, but we have no doubt that you’ll find a winner that ticks all the right boxes for your business with one of our picks of the best online accounting tools.