As a small business owner, you have a lot of responsibility on your plate. Not only do you have to worry about running your day-to-day operations, but you also have to keep an eye on your finances. This is where accounting software comes in.

Desktop accounting software can help you track all of your financial information in one place, which can make it a lot easier to manage your business finances. But with so many options on the market, it can be hard to know which one is right for you.

To help you out, we’ve put together a list of the best desktop accounting software for small businesses. We’ll go over some of the key features of each option and explain why they made our list.

The Best Desktop Accounting Software 2024

We have evaluated and compared the best desktop accounting software for small businesses in order to help you make an informed decision about which is right for your business. From pricing to features, and customer support, here is the best desktop accounting software for 2024:

- ZohoBooks – The best overall desktop accounting software product with excellent automation tools and time-saving, customizable templates.

- Freshbooks – Popular product with top-notch features for income, inventory, and expense tracking, which makes it easy to get a quick overview of your ledgers.

- Patriot – Affordable option for small businesses with an easy-to-use dashboard. Makes it simple to manage contractors and staff.

- Oracle NetSuite – First-class software package with great automation tools and options for payroll and HR integration.

- Sage Accounting – Robust, scalable platform for accounting teams, which has features for accounts payable automation, cash flow management, and sales optimization.

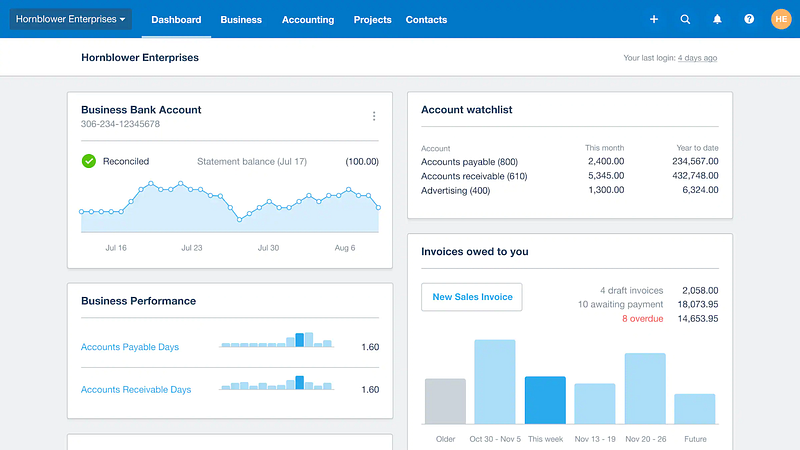

- Xero – Powerful accounting product for double-entry bookkeeping, with great invoice generation tools and inventory management capabilities.

- Free Agent – Outstanding accounting tools for small businesses with features for expense tracking, financial reporting, and generating estimates and invoices.

- Bonsai – Popular all-in-one accounting and tax tool for freelancers and small businesses. Also includes time management and CRM tools.

- TaxSlayer – Easy-to-use tax accounting software for self-employed workers that makes submitting a tax return simple.

- Liberty Tax – Simple desktop accounting software that makes tax preparation simple, and has tools for double-entry bookkeeping and income and expense tracking.

- Quickbooks – One of the best desktop accounting programs on the market from a leader in the field. Great for expense monitoring, income tracking, invoicing, and much more.

- Wave – Among the most affordable desktop accounting software options with free accounting and invoicing services.

- Accounting Edge – Premium desktop accounting software for accountants on Mac, which enables you to organize and process financial data.

Compare Quotes from the Best Accounting Services

Want a more tailored result for your business? Use the widget below to get a custom quote on accounting tools.

The Best Desktop Accounting Software in 2024 – In-Depth Reviews

1. ZohoBooks – Overall, Best Desktop Accounting Software

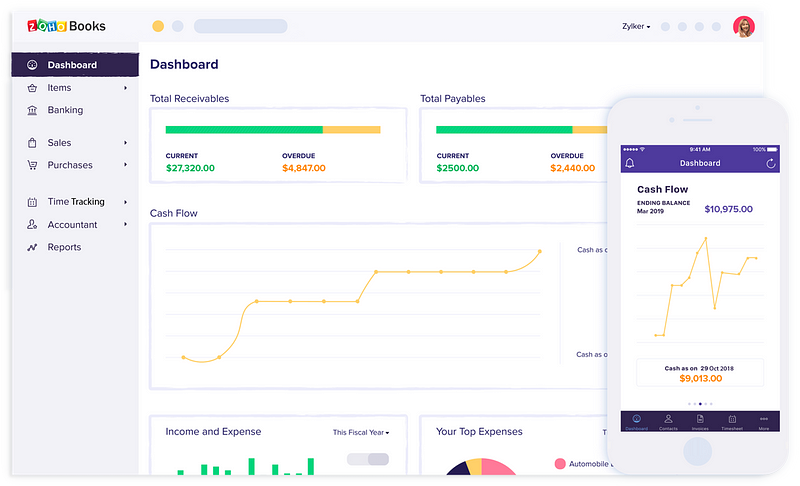

Zoho Books is a cloud-based accounting software that offers various financial management tools for businesses.

Zoho Books simplifies financial management for businesses by providing a single platform to consolidate bank transactions, financial records, and data from Paypal. It helps to prevent fraudulent payments by matching imported data with bank records. This allows you to view and track all of your company’s financial activity in a single, centralized location, without having to use multiple banking apps.

Yes, that’s correct! The automatic categorization feature in Zoho Books can save a lot of time and effort by automatically organizing transactions into relevant categories using bank rules and filters. This can be especially helpful for businesses with a large volume of transactions, as it allows you to easily locate and search for specific transaction data. It can also help to reduce the risk of errors by automating the process of categorizing transactions.

The client portal in Zoho Books is a useful feature that allows customers to view a complete history of their transactions with your business. This can be helpful in a number of ways. For example, it can provide transparency and accountability for customers, which can help to build trust and strengthen the relationship between the business and its clients.

The client portal in Zoho Books includes a feedback feature that allows you to request and gather feedback from your customers. This can be a valuable source of information, as it can help you to better understand your customers’ experiences and identify areas where you can improve.

| Starting Price | Top Features | Free Trial | Customer Support |

| $0 | 1. Invoice creation tool

2. Time tracking 3. Automated follow-ups |

14 days | 24×5 – email or |

Pros

- Customizable templates to save time

- Offers both – an android and iOS app

- Automatically categorizes transactions

- Excellent automation features

- Information-oriented dashboards

- Allows a great degree of customization

Cons

- Limited 3rd party bookkeeping options

Pricing

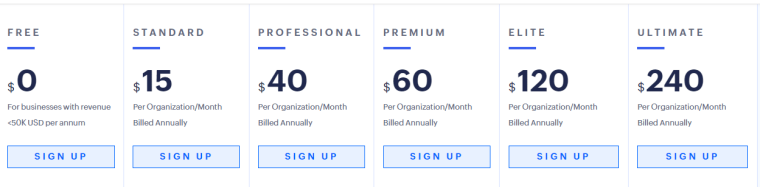

Zoho Books offers a free plan that includes a number of useful features, including invoicing, expenses, and financial reports.

The free plan of Zoho Books allows you to manage up to 1,000 invoices, as well as access a variety of other features such as multi-lingual invoicing, expense tracking, and email support.

If your business has more complex financial needs or you require additional functionality, there are five paid plans available that offer a range of options, such as increased integration and invoice capabilities, different levels of customer support, and more.

The Standard plan of Zoho Books includes integrations with several Zoho products, such as Zendesk, Zoho People, and Zoho Projects, as well as Avalara. However, it does not include integrations with Zoho Sign or Twilio, which are only available in the Premium plan.

All of the paid plans for Zoho Books offer a 14-day free trial. This can be a helpful way to determine which plan is the best fit for your business prior to any commitments.

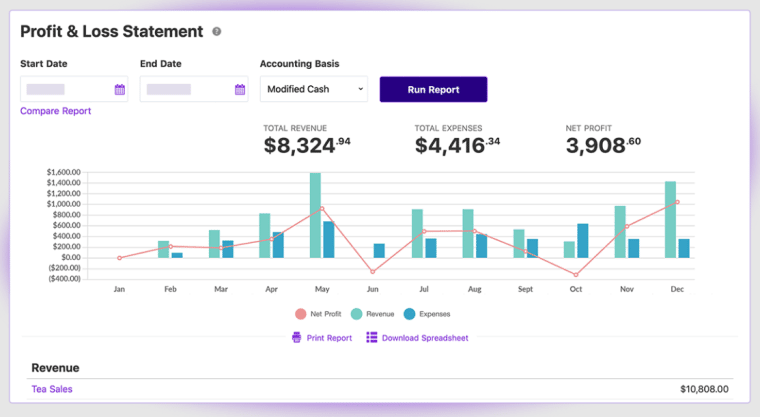

2. FreshBooks – Popular Product With Excellent Automation Features

FreshBooks is a popular accounting software used by many businesses around the world. It is known for its user-friendly invoicing tool and automated accounting features, which help to streamline financial management and make it easier for businesses to stay on top of their finances.

FreshBooks makes it easy to track expenses by automatically importing transaction data from your connected bank and credit card accounts. This can save you a lot of time, as you don’t need to manually enter expense information.

With FreshBooks, your expense sheet is updated daily, which can be very helpful in managing your budget and avoiding overspending. You can see your daily and weekly spending in real-time, which can be a useful tool for tracking your expenses and keeping your business finances in order.

FreshBooks offers a feature for tracking and storing digital versions of paper receipts, which helps prevent loss and allows for automatic categorization for tax purposes. Additionally, the platform allows users to easily turn estimates into proposals with a single click.

FreshBooks offers a selection of proposal templates that can be customized to fit your business needs. These proposals can be reviewed and accepted by potential clients directly through the FreshBooks platform.

FreshBooks makes it easy to create professional invoices from completed proposals. These invoices can include discounts and offer multiple payment options in your desired currency, streamlining the payment process and potentially speeding up the payment cycle.

| Starting Price | Top Features | Free Trial | Customer Support |

| $6/month | 1. Expense tracker

2. FreshBooks Payments 3. Compatible with major banks |

30 days | Call |

Pros

- Top-notch income and inventory tracking

- Provides a quick overview through the general ledger module

- Offers expense tracking through COGS feature

- Android and iOS apps are available

- Facilitates several third-party integrations

- Offers a 30-day free trial

Cons

- Can be expensive for some

Pricing

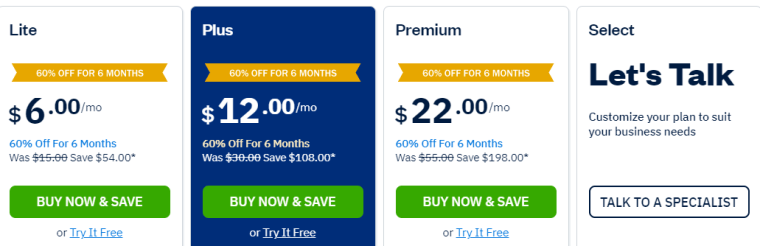

FreshBooks has multiple pricing options available, starting at $6 per month for the Lite plan. The Lite plan includes unlimited invoice, expense tracking, and estimate capabilities for up to 5 clients, but does not provide access to the dashboard for accountants.

Upgrading to a premium FreshBooks plan grants access to additional features such as automatic expense tracking, online payment checkout links, and the ability to remove FreshBooks branding from client emails. These plans also provide access to the dashboard for accountants.

FreshBooks provides a risk-free way to try out the software with a 30-day free trial that does not require credit card information. This allows you to test the platform and determine if it meets your needs before subscribing to a paid plan.

3. Patriot – Great Accounting Software for Small Businesses

Patriot is a comprehensive accounting software that allows you to manage both independent contractors and salaried employees.

It includes features specifically designed to handle forms 1096 and 1099, which are used to report income types other than salaries and tips and to summarize payments made to independent contractors, respectively. With Patriot, you can track an unlimited number of these forms without incurring any additional fees.

In addition to its other features, Patriot also offers the option to file the 1099 form online directly through the software for a small fee. This fee is well worth it, as Patriot will handle all of the necessary proceedings with the IRS on your behalf.

One feature that users appreciate is the ability to track expenses by department. This allows you to see how much you are spending on different areas of your business, such as the sales department, marketing team, and customer service department, separately. This can be useful for budgeting and identifying areas where you may need to cut costs or allocate more resources.

To determine the extent to which each department is contributing to the overall revenue, you can calculate their individual contributions. This will allow you to assess whether any departments may require additional investment or if their budgets should be reduced.

Patriot is a unique accounting software because it allows you to add an unlimited number of users at no additional cost. This means that you can hire an accountant or bring your entire accounting team onto the platform without having to pay any additional fees. This feature can be especially beneficial for businesses that have a large accounting team or that need to collaborate with multiple accountants.

It’s good to know that you have control over the level of access that you grant to the users you add to Patriot’s dashboard. With user-based permissions, you can customize the data and files that each team member can view, which is especially important for maintaining security and confidentiality within your business. This way, you can ensure that interns and new recruits don’t have the same level of access to sensitive company account records as senior executives.

| Starting Price | Top Features | Free Trial | Customer Support |

| $20/month |

1. Drill-down financial reporting 2. User-based permissions 3. Patriot Smart Suggestion |

30 days | Call, chat and email |

Pros

- Unlimited number of invoices and customers

- 24/7 customer support

- A popular software with good customer reviews

- More affordable than its contemporaries

- Easy-to-use dashboard

- Ideal for small businesses with limited needs

Cons

- Limited reporting

- No advanced features

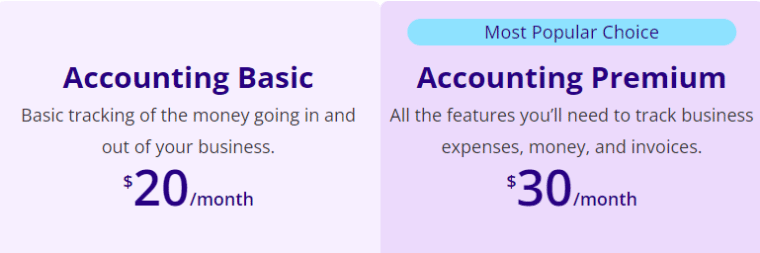

Pricing

You can start using Patriot for just $20 a month with the “Accounting Basic” plan.

This plan has everything a small, medium or even large business would need, like easy data imports, unlimited customers and invoices, and the ability to add unlimited users.

For extra features like custom invoice templates and account reconciliation, we recommend the “Accounting Premium” plan at $30 a month. You can also try Patriot for free for 30 days with no risk.

4. Oracle NetSuite – First-Class Software Package with Great Automation Tools

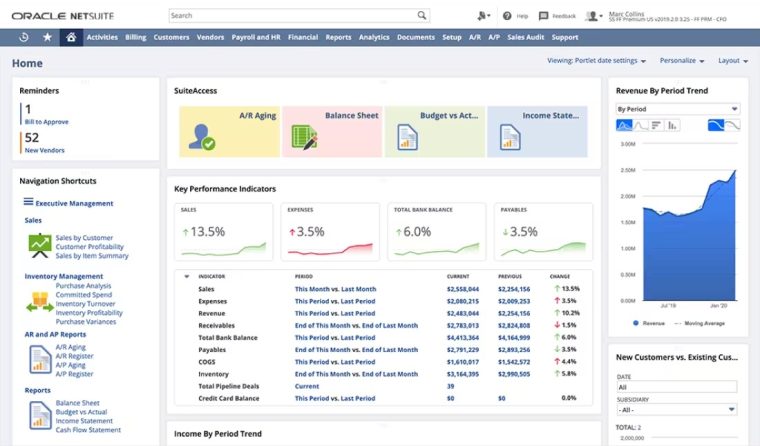

Oracle NetSuite provides one of the most comprehensive packages for managing accounting and finance for businesses available today.

The cloud-based product has an extensive accounting toolset to help you track financial information, manage vendors and payments, and reconcile statements. All this can be done from an intuitive dashboard, which makes it easy to call up information in real-time.

NetSuite also provides powerful automation tools, meaning there’s no need for manual data entry – transactions are simply entered automatically into the system, accelerating your processes and ensuring accuracy. Automation can also assist with bank reconciliations and managing transactions.

Tax management is equally straightforward, and the platform’s detailed reports mean it’s simple to double-check every detail and ensure you’re fully financially compliant.

The product also has a great mobile app, so you can look up details and enter information whenever you need to.

In addition to this, NetSuite is part of a larger business system, spanning ERP, CRM, eCommerce, and human capital management – and much more. These features can be acquired from Oracle as additional NetSuite modules, and, naturally, they integrate seamlessly.

Besides this, Oracle’s iPaaS and NetSuite Connectors tools make it easy to integrate the platform with other products. All this makes it an ideal tool for enterprise businesses, covering the entire enterprise technology stack.

| Starting Price | Top Features | Free Trial | Customer Support |

| Quote on request |

1. Tax Management 2. Invoicing 3. Reporting and Analytics |

Demo tour only | Email

Phone only available as a paid extra |

Pros

- Excellent payroll tools

- In-depth reporting and analytics features

- Enables automated data input

- Library of invoice templates

- Can unlock valuable financial insights

Cons

- Not for small businesses

- Steep learning curve

Pricing

Oracle doesn’t put pricing information on the internet but provides custom billing for every client. This number will be based on the number of users subscribed to the system and the amount of functionality added via NetSuite’s optional modules, as well as a one-off setup fee. Core costs reportedly start at $99 per month.

This puts the platform on the pricier side, but it’s a powerful product, and it comes with a huge range of opportunities to integrate with other business software tools.

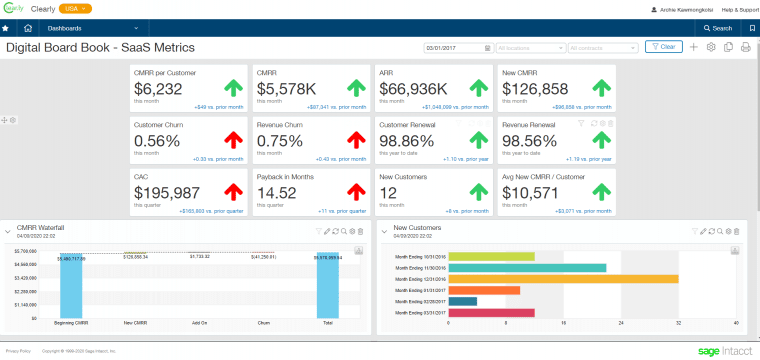

5. Sage Accounting – Robust, Scalable Platform for Accounting Teams

The robust basic accounting features of Sage Intacct include a general ledger, accounts payable, accounts receivable, cash and order management, bank feeds, and buying. With Sage Intacct, many everyday financial operations, particularly accounts payable and receivable, may be automated. The chart of accounts cannot be easily changed, which is a flaw in Sage’s accounting capabilities.

Users of Sage Intacct may monitor cash flow from the dashboard and access the usual reports that the majority of businesses require. Reports are very customizable and adaptable. Sage Intacct’s data slicing capabilities are a major selling factor.

Here are some of its features:

1. Cash Flow Management: The software has a dedicated module to manage cash flow. This module can be used to track inflows and outflows of cash, as well as to forecast future cash needs.

2. Accounts Payable: Sage Intacct’s accounts payable feature allows businesses to automate many of the tasks associated with paying bills, such as creating invoices, issuing payments, and managing vendor relationships.

3. Sales Optimization: The software includes several features to help businesses optimize their sales efforts, including quote and order management, customer portals, and commissions management.

Pros:

- Robust reporting

- Easy integration

- Accounts automation

Cons:

- Difficult reconciliation

Pricing: $340.00 per year

| Sage Accounting desktop software | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $340.00 per year | 1 | Yes | Yes |

6. Xero – Powerful Accounting Product With Great Invoice Generation Tools

Double-entry accounting, a customisable chart of accounts, accounts payable and receivable, billing and invoicing, expenditure tracking, purchase orders, and project tracking are all features that come with Xero.

Reminders may be automated and invoice templates can be changed. It is simple to convert quotes and estimates into invoices, and Xero can be configured to automatically generate and send invoices as well as reminders. Additionally, invoices may be stored as editable templates.

Both time tracking and mileage tracking need interaction with Harvest and third-party software, although both are accessible for reasonable monthly costs. Like the majority of the top candidates for accounting software, Xero provides bank feeds and reconciliations. Inventory, fixed assets, and contact management are also included in Xero.

Here are some of its key features:

1. Double Entry: All accounting entries in Xero are double entry. This means that every time you make a transaction, two accounts are affected. For example, when you buy something on credit, your Accounts Receivable account goes up and your Cash account goes down.

2. Accounts Payable and Accounts Receivable: Xero automatically creates these two accounts for you when you set up your organization. You can use them to track money that you owe (accounts payable) and money that is owed to you (accounts receivable).

3. Billing and Invoicing: With Xero, you can create and send invoices to your customers. You can also set up recurring invoices so that they are automatically generated and sent on a schedule that you specify.

Pros:

- Unlimited users

- Double entry ability

- Inventory management

Cons:

- No phone support

Pricing: $22.00 per month

| Xero | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $22.00 per month | Unlimited | Yes | Yes |

7. Free Agent – Outstanding Accounting Tools For Small Businesses

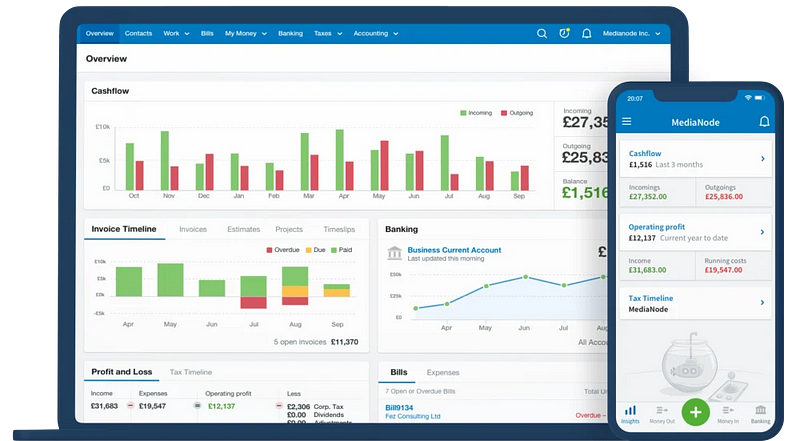

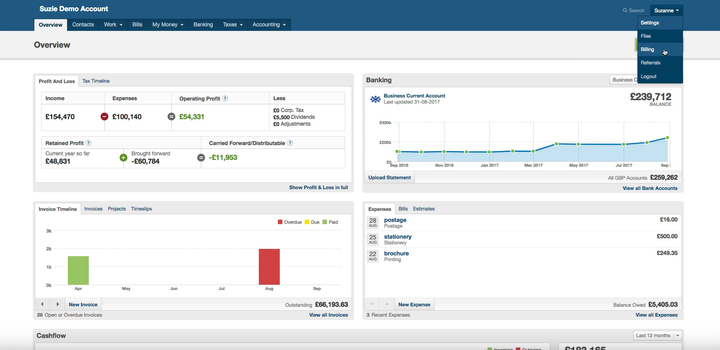

FreeAgent is an online accounting software program for small businesses and freelancers in the United Kingdom. FreeAgent’s accounting software is designed to be simple and easy to use, yet still provides all of the features that small businesses need to run their finances effectively.

It is exceptional accounting software for desktops that offers a wide range of features to its users. The software was developed with the requirements of both small businesses and accounting professionals in mind. It helps them save time by automating their accounting tasks. Moreover, it also reduces their chances of making mistakes while recording transactions or preparing financial reports. In short, it’s outstanding small business accounting software for desktop.

Here are some of its key features:

1. Estimates and Invoices: This feature helps businesses to quickly create and send estimates and invoices to their clients. It also allows them to track the status of their invoices and payments.

2. Expense Tracking: This feature allows businesses to track their expenses easily and effectively. It also allows them to set up spending limits and track employee expenses.

3. Financial Reporting: This feature provides businesses with real-time insights into their financial performance. It also allows them to generate various financial reports, such as Profit and Loss Statement, Balance Sheet, etc.

Pros:

- Ease-of-use

- Robust features

- Accounting automation

Cons:

- Some of the features are only available on premium plans

Pricing: $10.00 per month

| FreeAgent | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $10.00 per month | 5 | Yes | Yes |

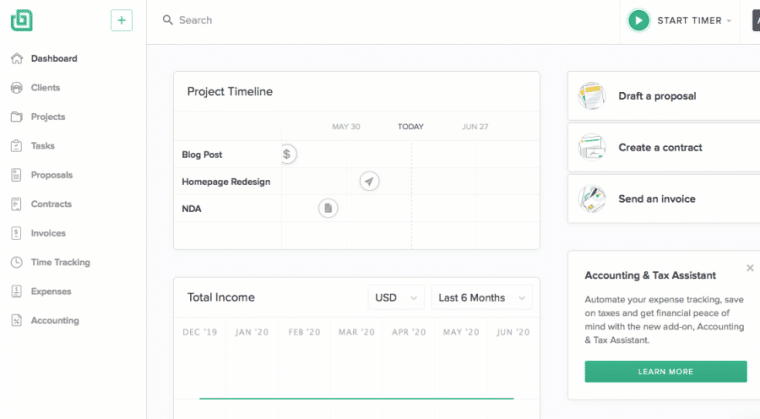

8. Bonsai – Popular All-in-One Accounting and Tax Tool for Freelancers

Bonsai is a popular accounting tool that doubles up as a solid tax solution for small businesses and freelancers. The software is designed to help you save time, organize your clients and projects, and keep your books accurate and up to date.

As far as this goes, Bonsai certainly provides businesses with ample value — the powerful automation means you get paid quicker with fewer late payments, and you save ample time as you don’t have to worry about a lot of tedious bookkeeping tasks.

This includes setting up payment reminders, automating your expense and income tracking, and having Bonsai handle your tax deduction calculations.

Without the need for manual entries, you’ll not only be saving time with keeping your books up to date, but you’ll be able to rest easy that your expenses, income, and tax preparation are accurate.

Here are some of its key features:

- Proposals: You can easily create, send, and track proposals with electronic approvals to speed up your proposal and approval process

- Management: You’ll have built-in task and time management tools to improve your project management — plus automated timesheets

- Unlimited collaborators: Even on the basic plan, Bonsai allows you to onboard an unlimited number of collaborators to improve your collaboration

- CRM: Bonsai offers built-in CRM capabilities that allow you to add leads, customers, and notes to track all your business contacts from within the app

Pros:

- All-in-one accounting solution

- Has valuable time-saving automations

- Provides ample free templates

- Great value for money for small businesses

Cons:

- Some users find there’s a learning curve

- Pricing might be high for some

Pricing: Starts at $17/month with an annual plan and $24/month with a monthly subscription

| Bonsai | Pricing | Accessibility | Mobile App | Number of Users in the Free Version |

| $17/month | 5 | Yes | 1 |

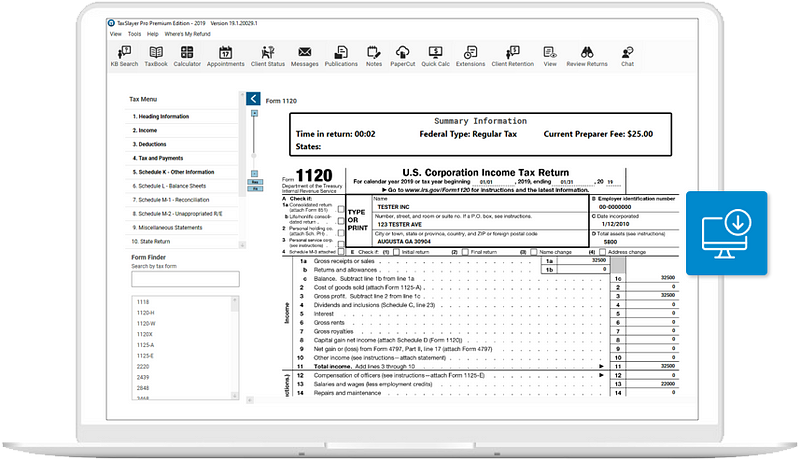

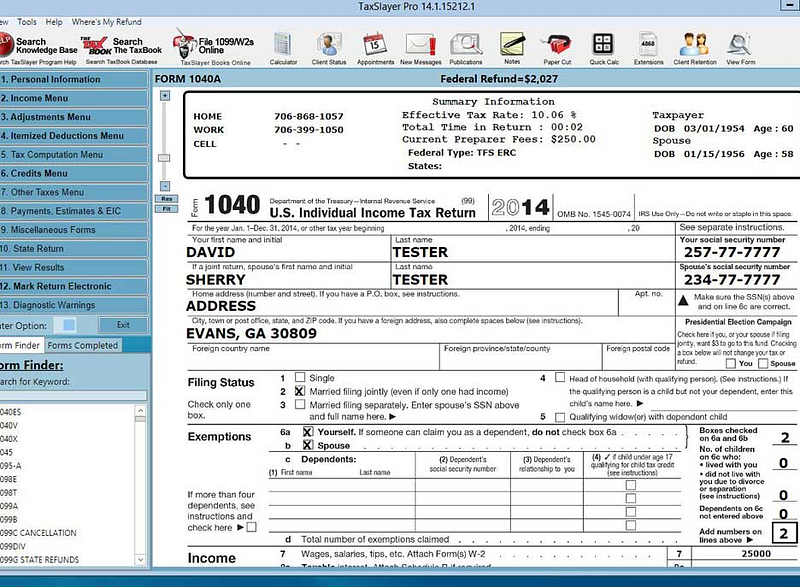

9. TaxSlayer – Tax Accounting Software For Self-Employed Workers

For those who don’t need a lot of assistance, TaxSlayer makes submitting a tax return simple. You can move forward to the portions you need if you are aware of the many forms of income you must declare as well as the various credits and deductions you are eligible for.

Users of TaxSlayer have the choice of answering questions to have the program take them to the appropriate forms, or going straight to the parts they need to fill out.

Due to its variety of choices, TaxSlayer is a suitable tax software solution for those who wish to attempt doing their taxes on their own but may also want assistance if they run into problems.

Here are some of its features:

1. Taxes ToGo Mobile: This feature allows you to work on your taxes on your mobile device. You can access and update your return, and calculate your refund — all from the convenience of your phone.

2. Refund Reveal: You can see how much money you’re getting back (or owe) as you go. Refund Reveal color-codes each section of the return as you complete it so that you know where you stand at all times.

3. Client Portal: The Client Portal is a secure online space where you and your tax preparer can share documents and communicate. This is especially helpful if you’re working with a TaxSlayer Pro to get your taxes done.

Pros:

- Affordable

- User-friendly

- Offers free version

Cons:

- Lacks certain support features

Pricing: $29.95 per month

| TaxSlayer | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $29.95 per month | 1 | Yes | Yes |

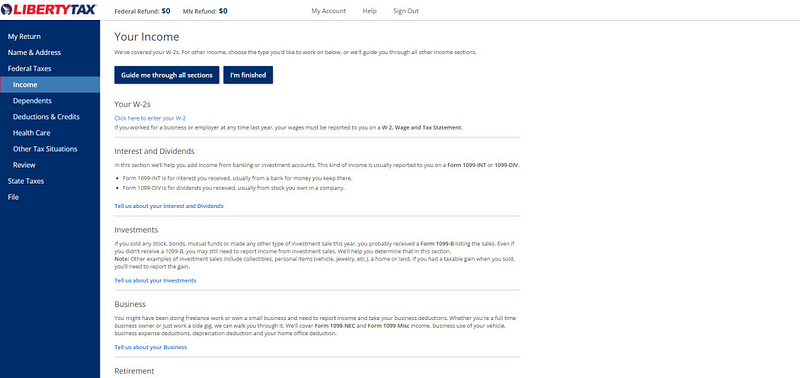

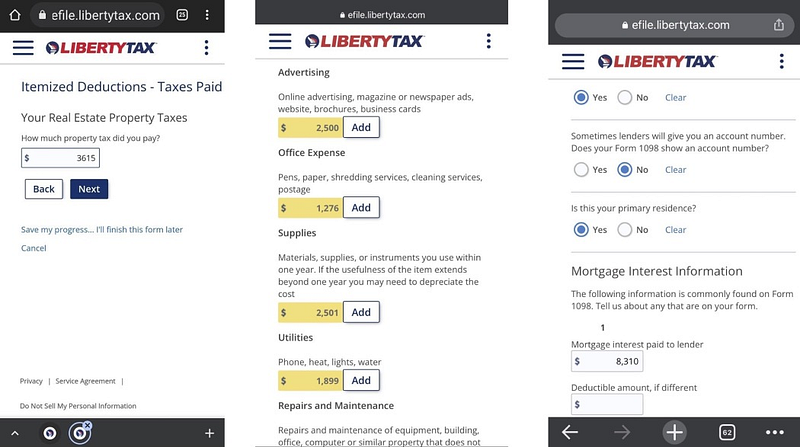

10. Liberty Tax – Easy-To-Use Desktop Accounting Software For Taxes

Since 1997, Liberty Tax has been in the tax preparation industry. Currently, the firm has more than 3,000 physical sites across the US and Canada. It provides online, do-it-yourself tax software like H&R Block and Jackson Hewitt, with the option to get extra help and advice from its financial specialists.

We looked at Liberty Tax Deluxe, which is made for people who wish to itemize their taxes and have a W-2, interest and investment income, and retirement income. In spite of using some unusual navigational practices, Liberty’s solution fared rather well in testing.

Here are some of its features:

1. Easy-to-Use Interface: The software is designed with a focus on simplicity and ease of use. Even individuals with no prior experience in accounting or tax preparation should be able to get the hang of it quickly.

2. Support for Multiple Users: The software can be installed on multiple computers and supports different levels of access for different users. This is useful for small businesses that want to give their employees limited access to financial data.

3. Comprehensive Set of Features: Liberty Tax Deluxe provides all the features you would expect from desktop accounting software, including income and expense tracking, double-entry bookkeeping, invoicing, bill payment, and tax preparation.

Pros:

- Quick and easy UI

- Excellent mobile version

- Good customer support

Cons:

- Occasional glitches

Pricing: $44.95 per month

| Liberty Tax | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $44.95 per month | Multiple | Yes | Yes |

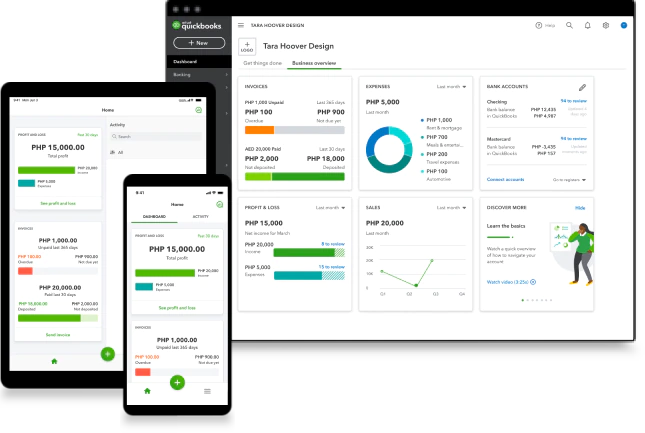

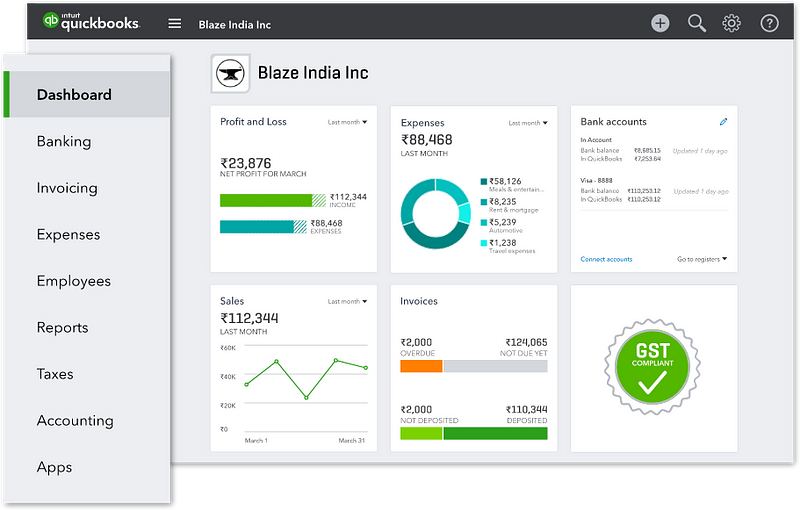

11. Quickbooks – Great Product From an Industry Leader

Accounting software from QuickBooks is available in both an online and a desktop edition, both of which are quite helpful. You will quickly learn as a business owner that QuickBooks is among the finest desktop accounting programs on the market.

You can manage all of your company’s finances with the help of QuickBooks, which streamlines everyday activities for you. It’s easy to use, read, and set up. You can quickly import data from a spreadsheet, so you don’t need any prior accounting skills.

Here are some of its features:

1. Expense Monitoring: You can track all your expenses in one place and get an overview of where your money is going. This is helpful in creating budgets and reducing wasteful spending.

2. Income Tracking: QuickBooks can help you keep tabs on your income, so you know exactly how much money you’re bringing in and when payments are due. This information is critical for cash flow management.

3. Invoicing: The software makes it easy to create and send invoices, so you can get paid faster. It also allows you to track payments and see which invoices are outstanding.

Pros:

- Ease of use

- Robust features

- Payment gateways

- Great desktop accounting software for ecommerce

Cons:

- Not for large enterprises

Pricing: $10.00 per month

| Quickbooks | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $10.00 per month | 1 | Yes | Yes |

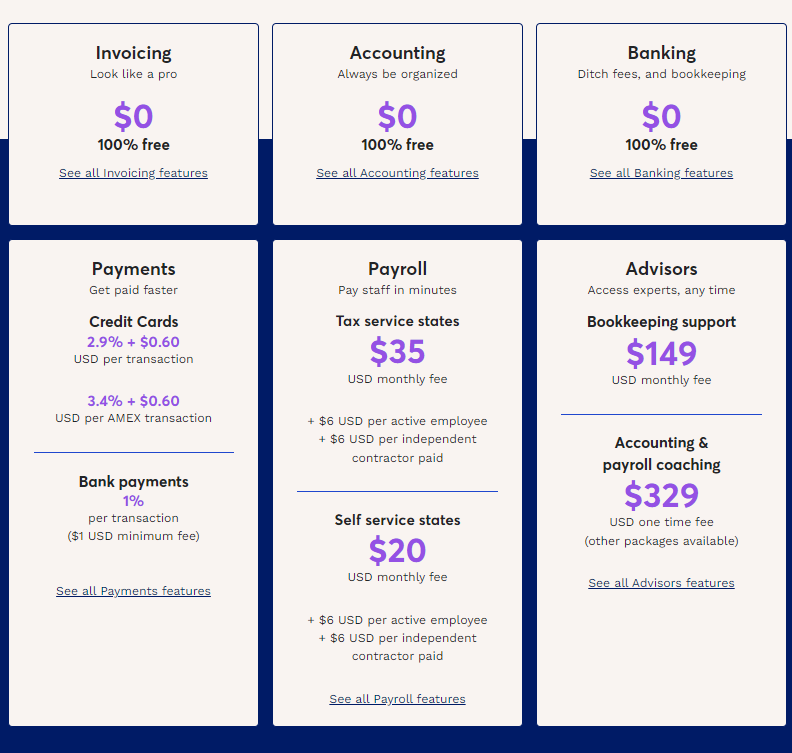

12. Wave – Free Desktop Accounting Software

Since Wave Accounting offers free accounting and invoicing services, we selected it as our best-value accounting software.

Keeping in mind that there are costs involved with payroll services and credit card processing, not all of the capabilities are free, and the free features aren’t as rich as those offered by some of the other software solutions. Nevertheless, it’s one of the best accounting software Canada has to offer.

Here are some of its features:

1. Double Entry: Wave Accounting uses the double entry accounting system, which is the standard for most businesses. This means that every transaction has two entries: a debit and a credit. The total of the debits must equal the total of the credits.

2. Accounts Payable: Wave Accounting can manage your accounts payable so you can keep track of what you owe to vendors and suppliers. When you create an invoice in Wave, you can link it to an existing vendor account or create a new one.

3. Bank and Credit Card Integration: Wave Accounting integrates with your bank and credit card accounts so you can automatically download transactions and reconcile your accounts. This saves you time by eliminating the need to manually enter transactions into Wave.

Pros:

- Free desktop accounting software

- Unlimited transactions on paid plans

- Unlimited users

Cons:

- Very limited integrations

Pricing: Service payments start at $25 (Payroll)

| Wave | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| Payments start at $25 | Unlimited | Yes | Yes |

13. AccountEdge – Great Desktop Accounting Software For Accountants

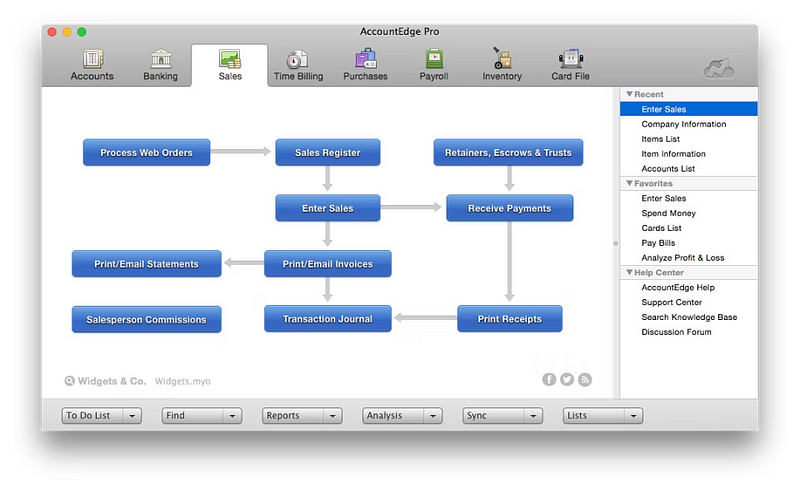

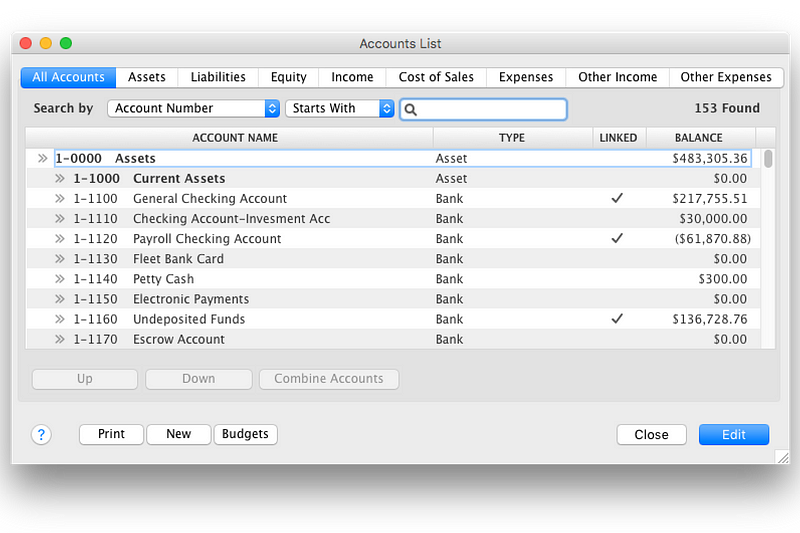

AccountEdge Pro is the next program on our list of top desktop accounting programs. The most complete and user-friendly accounting solution for small businesses worldwide is offered by AccountEdge, a premium accounting program for Mac. AccountEdge Pro is a productive and user-friendly desktop accounting tool for Mac and Windows. There is a 30-day trial period that is free.

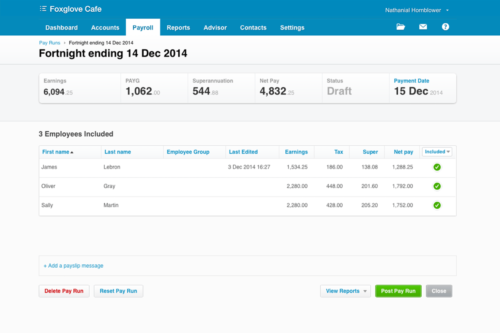

With AccountEdge Pro, businesspeople can organize, process, and document their financial data, freeing them up to focus on their core competencies. Its feature set includes accounting, automatic payroll, sales and transactions, contact management, inventory tracking, online ordering, time billing, and more.

Here are some of its features:

1. Sales and Transactions: This feature allows businesspeople to manage their sales, invoicing, and transactions all in one place.

2. Automatic Payroll: With this feature, businesses can automatically calculate payroll for their employees.

3. Contact Management: This feature helps businesses keep track of their contacts and customers in one place.

Pros:

- Automation

- No currency lock

- User-friendly

Cons:

- The price is a bit high

Pricing: $399 Perpetual

| Accounting Edge | Pricing for Higher Plans | Accessibility | Mobile App | Number of Users in the

Free Version |

| $399 Perpetual | Unlimited | No | Yes |

Best Desktop Accounting Software | Compared

The table shows our 13 picks for the best desktop accounting software for small businesses. We categorized each software application by pricing, number of users allowed, and mobile compatibility.

| Software | Pricing for Higher Plans | No. Of Users | Mobile App | Trial Version |

| Zoho | $10.00 per month | 2 | Yes | Yes |

| Freshbooks | $4.50 per month | 5 | Yes | Yes |

| Patriot | $20.00 per month | Unlimited | No | Yes |

| Oracle NetSuite | Quote on request | 100 to 4,000 | Yes | No |

| Sage Accounting | $340.00 per year | 1 | Yes | Yes |

| Xero | $22.00 per month | Unlimited | Yes | Yes |

| Free Agent | $10.00 per month | 5 | Yes | Yes |

| Bonsai | $17 per month | 5 | Yes | Yes |

| TaxSlayer | $29.95 per month | 1 | Yes | Yes |

| Liberty Tax | $44.95 per month | Multiple | Yes | Yes |

| Quickbooks | $10.00 per month | 1 | Yes | Yes |

| Wave | Start at $25 | Unlimited | Yes | Yes |

| Accounting Edge | $399 Perpetual | Unlimited | No | Yes |

Best Free Desktop Accounting Software

Wave is the best free accounting software for small businesses and freelancers. With Wave, you can send invoices, track expenses, and more. Payment starts when you make use of different services, such as payroll, at $20/month. Take note that it is free forever and unlimited users can use the software.

Best Desktop Accounting Software for Small Business

FreeAgent Accounting software offers a 30-day free trial and has no monthly fees. It is good for small businesses as it is easy to use. The software can track expenses and invoices, and manage your bank accounts in one place.

The reason that this is great for small businesses is that it takes the hassle out of bookkeeping and accounting. In addition, the pricing is very affordable.

And it’s definitely better than the Excel spreadsheets and even pen and paper used by some small businesses.

Best Desktop Accounting Software For Mac

Accounting Edge Pro has been in the business for a long time and is one of the best accounting software for Mac. It offers a 30-day free trial and has no monthly fees. The software can track expenses and invoices, manage your bank accounts, and prepare tax returns.

What are the Benefits of Using Accounting Software for Your Desktop?

There are many benefits of using accounting software for your desktop. The most obvious benefit is that it can save you a lot of time and energy. With accounting software, you no longer have to manually keep track of your finances. This can be a huge relief, especially if you are running a small business.

Another great benefit is that accounting software can help you become more organized. When all of your financial information is stored in one place, it is much easier to keep track of. This can help you avoid late fees and penalties, and it can also make it easier to spot areas where you may be overspending.

Lastly, using accounting software can help you save money. Many accounting software programs offer features that can help you save money on your taxes. These programs can also help you keep track of your spending so that you can cut down on unnecessary expenses.

And, while some desktop accounting software is being withdrawn, many business owners still value the security and familiarity of desktop accounting software.

How We Evaluated the Best Desktop Accounting Software

To evaluate the best desktop accounting software, we looked at a variety of factors. Here are some of the key factors that we considered:

1. Ease of Use

The best accounting software should be easy to use. After all, if you can’t figure out how to use the software, then it won’t do you any good. We looked for programs that were designed with the user in mind. We also considered how intuitive each program was.

2. Cost

Cost is always an important factor to consider when choosing any type of software. We looked for programs that were affordable, especially for small businesses. We also considered whether or not the program offered a free trial period.

3. Features

When it comes to accounting software, there are certain features that are essential. These features include the ability to track expenses, invoices, and bank accounts. We also looked for programs that offered extra features, such as the ability to prepare tax returns.

4. Customer Support

When you are dealing with money, it is important to have a good customer support system in place. We looked for programs that offered 24/7 customer support. We also considered how easy it was to get in touch with customer support and whether or not they were responsive to our inquiries.

Conclusion: What Is the Best Desktop Accounting Software?

There are ample desktop accounting software solutions on the market, but of course, some may stand out more to you than others.

Our top pick is the popular FreshBooks for obvious reasons. It holds a solid reputation, provides a neat, intuitive UI, and it offers all the important features businesses of all sizes would be after — including time tracking and invoicing.

However, you have ample great options to choose from, and the one best suited to your business will depend on your specific needs. All in all, you certainly can’t go wrong with any of the tools we’ve reviewed today.