Beats Lifestyle Approach VS Bose Product-Focused in Reaching Target Audiences

Beats and Bose are two of the leading personal sound system brands globally. They target their customers in different ways: Beats goes for big endorsements, while Bose relies on its premium brand image. These strategies have built a loyal fan base for both brands. However, without quality products, they wouldn’t have the customer loyalty they enjoy. Using ForSight™’s BrightView™ algorithm, we examined how consumers reacted to Bose and Beats products on Twitter.

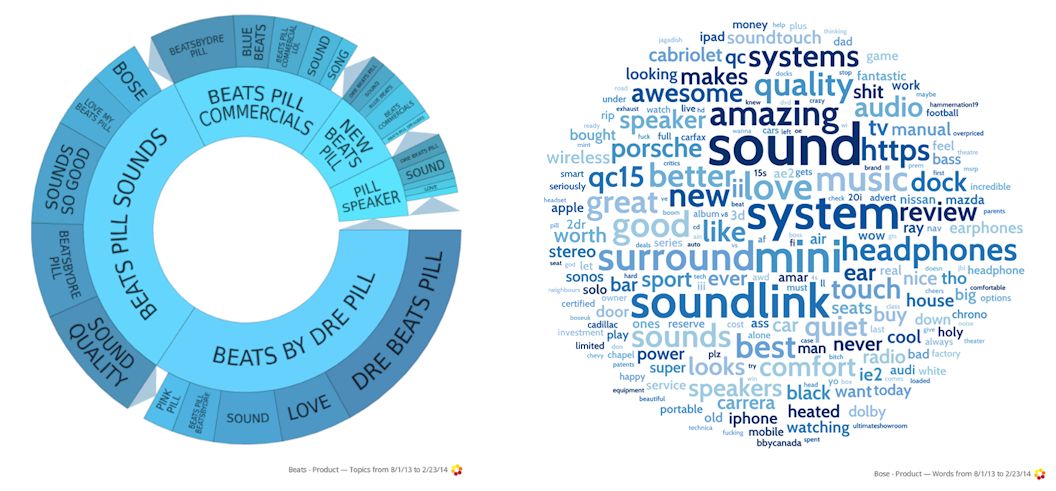

Talks about Beats by Dre’s products were partly influenced by discussions around the Beats Pill. The Pill is a portable speaker that connects via Bluetooth. Miley Cyrus and Nicki Minaj have promoted the product, and the ads have generated a lot of attention. Still, the sound quality and user-friendliness were key factors in the online chatter.

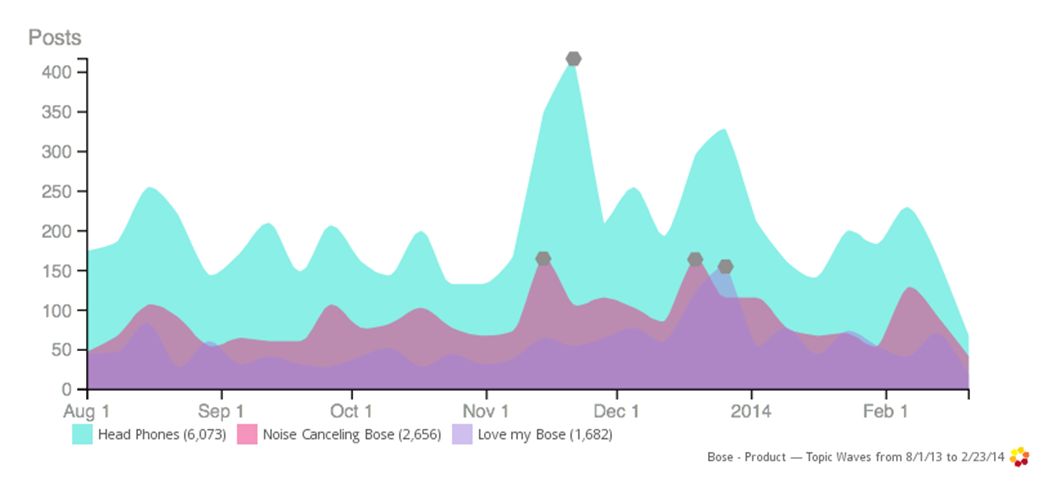

For years, Bose surround sound systems have been top contenders in the market for their sound quality and reliability. Much like Beats Pill, Bose sought to join the Bluetooth wave with the launch of Sound Link system. The Sound Link Bose Sound System drove a high volume of conversation surrounding Bose products

Another product driving Bose conversation is their Noise Cancelling headphones. Bose headphones are popular in their own right but the Noise Cancelling feature was a popular topic for users to discuss online. These products garnered a lot of positive sentiment from users. Many praised their ability to tune out the environment around them but also admired the look of the headphones themselves.

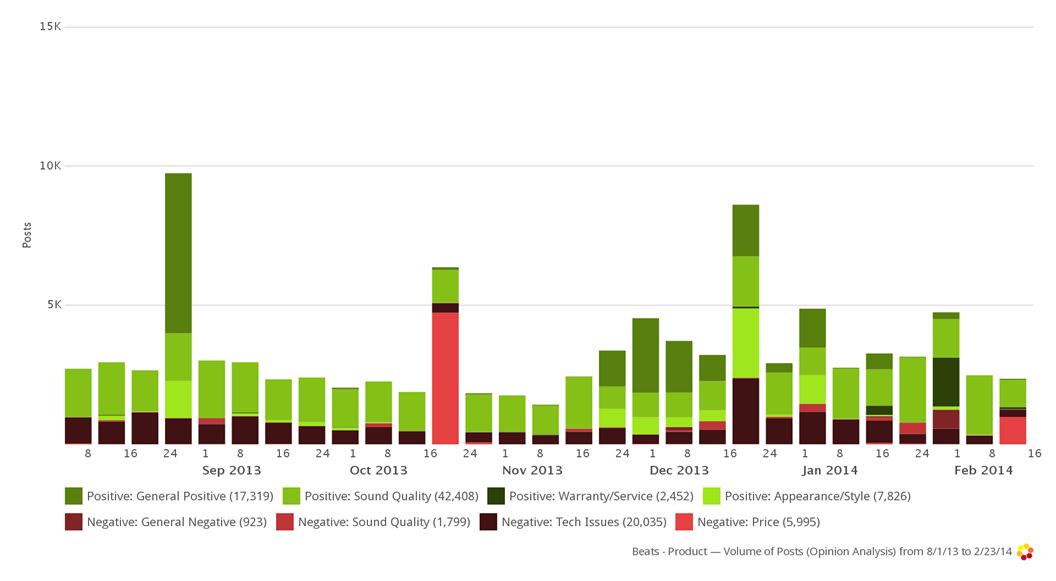

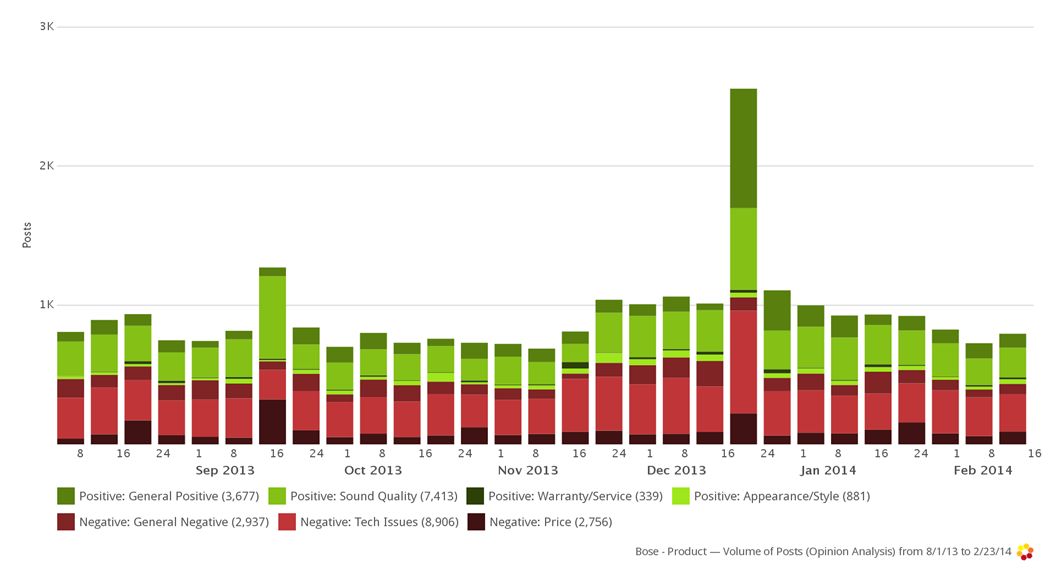

As much as these brands’ products are beloved by loyal customers not all of the conversation about their products is positive. Many users take to social media to air their grievances about product issues. Tech issues motivated most of the negative sentiment expressed on Twitter about both brands’ products. Bose tech issues made up 33% of the product conversation, while Beats tech issues only accounted for 21% of conversation. This is a surprising finding as Bose is branded as a premium or luxury brand. And Beats has lower negative conversation about price at 6%, versus Bose at 10%. Overall Beats negative product conversation is lower than that of Bose.

Whether users are discussing their love of the sound quality or complaining about high prices, both these brands drive strong conversation online. Using ForSight to analyze the product conversation, brands can find out shoppers’ opinions straight from consumers. Consumers’ organic insights are extremely useful for product and marketing planning, and have never been more accessible.

To learn more about consumer response to brand marketing strategy, we invite you to download the Beats VS Bose Case Study.