Public perception and trust in the financial industry has been hit hard in recent years.

Consumer belief that banks and other financial services providers have poor ethical and moral standards means that their reputational perceptions have dropped considerably, especially in the wake of the 2008 banking crisis.

For a more in-depth analysis on the challenges and opportunities that the financial sector faces in regard to the social media revolution, download our latest report here.

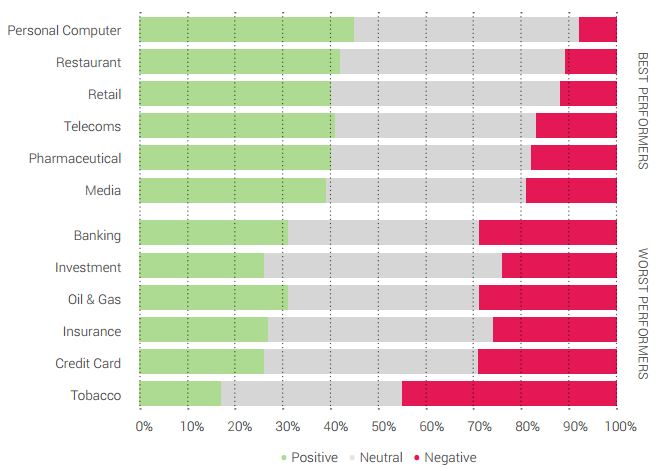

A recent IPSOS report identified banking, insurance, credit and investments as some of the worst performing industries when ordered by trust. These devastating findings demonstrate the uphill struggle that the finance sector is currently facing when changing public perception.

Combating this trend can be difficult, but ignoring this discontent is not an option. It would be detrimental to the brands and worsen their reputations further.

Instead, financial brands can confront crises and negative press, in order to avoid upsetting current customers and losing potential business.

Monitoring of this activity means that financial brands are alerted to issues as soon as they arise and reacting to them effectively can present an image of a caring and responsive organisation.

Beyond Social Media

When tracking negative conversations about a brand, sophisticated organisations will reach far beyond just the mainstream social networks such as Twitter and Facebook.

Although there’s an unmissable, large volume of conversation on these channels, forums are a cornerstone of digital peer-to-peer advice and reviews and thusly should not be overlooked.

With personal finance being a topic which concerns most and worries many, it is unsurprisingly a matter regularly discussed on consumer rights and advice forums.

Brands can develop strategies for engaging on platforms such as FatWallet and MoneySavingExpert. For example, some of our energy clients at Brandwatch even treat such consumer forums as owned media, in the same way they would with Twitter or Pinterest.

Empowering staff to monitor for – and respond to – brand mentions, or discussion around your company’s particular services, means that your customers and prospects receive direct feedback exactly where they want it.

Ensuring that negative mentions don’t remain ignored and preventing them from snowballing by responding promptly and helpfully is similarly important.

Having robust engagement strategies on all social platforms (even those that don’t seem like a social platform at first), although daunting, is fast becoming an must-do practice for all brands, especially those in the negativity, controversy-sensitive financial sector.

PR Controversy for RBS

In a recent blog on risk management we discussed a technological glitch which affected the UK-based Lloyds Banking Group’s customers.

These types of IT failures are not uncommon, thanks to the regular illegitimate activity of internet hackers and other digital criminals.

One of the most recent notorious stories occurred in late 2013, during the festive period.

In similar incident to the Lloyds glitch, RBS group’s online system (as did NatWest’s) crashed on the “ biggest shopping day of the year”, leading to the sensational headlines about the bank ruining Christmas for thousands.

RBS experienced a host of negative reaction from Twitter users who flocked to the web to complain.

Although traditional print media and blogs are damaging for organisations in terms of impact, the breathtaking speed of the spread of information is largely thanks to networks like Twitter.

According to a recent report, 55% of “opinion formers” referenced Twitter as a key source of news.

Deciding to handle potential crises exclusively via traditional media is no longer enough. Brands need to get out there on the front lines and tackle the problems as they spread – before they even reach the ear of publications.

Tesco Doing it Right

Tesco is a brand which handled a potentially devastating PR crisis well. Caught up in the 2013 horse meat scandal, the supermarket chain confronted the issue head on.

Reacting in a prompt manner, Tesco’s CEO Philip Clarke appeared in a video blog reassuring consumers that their current processes will be changed.

Instead of ignoring bad press Tesco was responsive, open and honest, realigning customer trust in the brand.

Solid Financial Advice

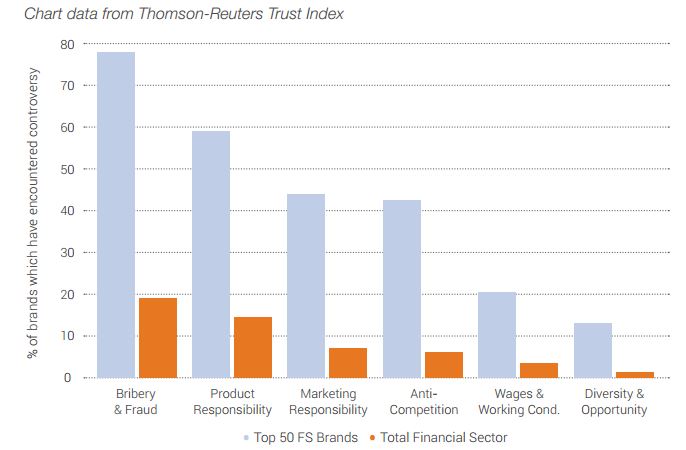

Controversial stories on financial brands circulate frequently and most of the top 50 financial brands providers have experienced PR controversies of some sort.

Bribery and fraud is the area where the financial sector has experienced the most damage.

However, by using SMM tools, brands can monitor suspicious activity and reassure consumers that their bank has effective online security defenses in place.

Having a solid internal infrastructure means that an organisation will be well prepared for any potential crises that present themselves.

Social media monitoring allows for the automation of this process, via (among other features) Alerts, so that the relevant teams can be alerted whenever negativity surfaces – either identified as a threshold change in volume of negative mentions, or by isolated incidents of high-impact negativity.

This is especially important for financial services brands, who must react almost instantaneously to mitigate the extent of such comments.

With a robust system for identifying crises before they escalate in place, brands can concentrate on creating processes for containing and preventing damage to brand reputation, rather than panickingly handling each issue on a case-by-case basis as each one unfolds.

For a more in-depth analysis on the challenges and opportunities that the financial sector faces in regard to the social media revolution, download our latest report here.