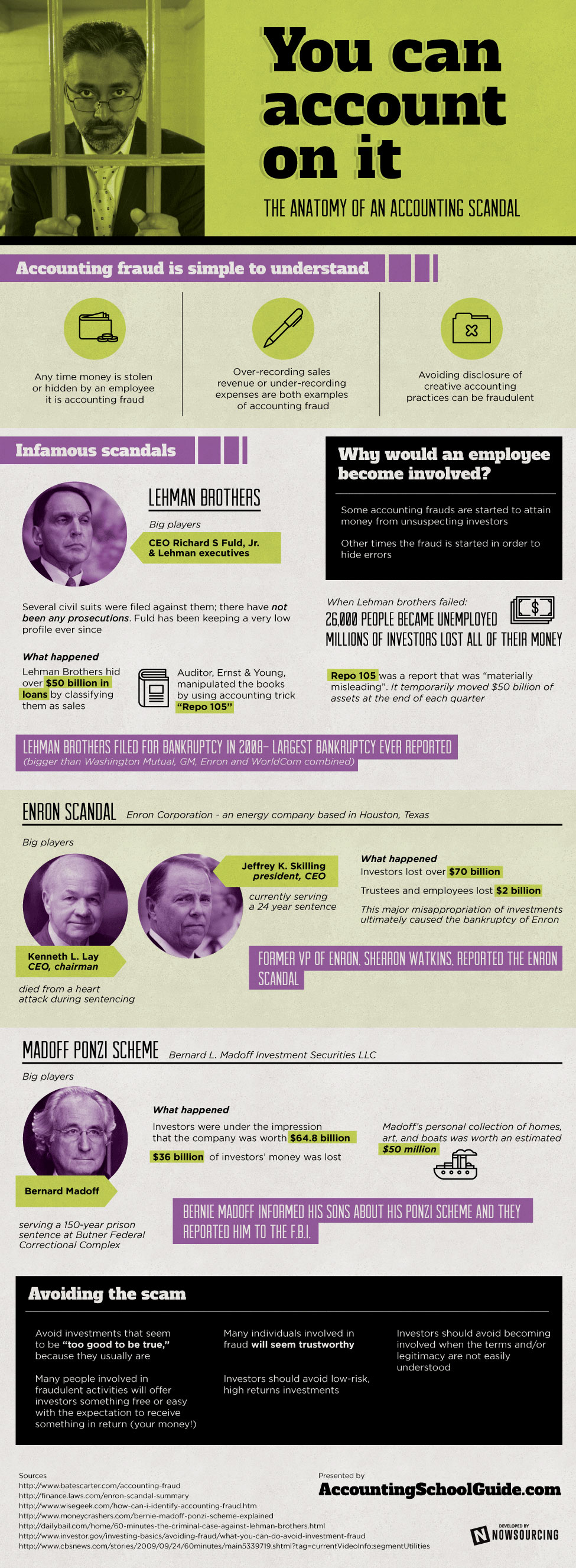

You might be surprised to find out that accounting fraud is usually easy to grasp. When employees take or conceal money, that counts as accounting fraud. Examples include recording sales revenue too high or expenses too low. Not revealing creative accounting methods can also be considered fraudulent.

A well-known example of an accounting scandal is the Enron scandal, which came to light in October 2001. Due to unethical actions by the Houston, Texas-based energy company, investors lost over $70 billion, while trustees and employees lost about $2 billion. Another significant scandal is the Madoff Ponzi scheme, the largest ever. In this scheme, investors believed that Bernard L. Madoff Investment Securities LLC was valued at $64.8 billion. In the end, $36 billion of investors’ money was gone. Madoff told his sons about the scheme, and they courageously reported him to the FBI. He is now serving a 150-year sentence at Butner Federal Correctional Complex. Madoff’s collection of homes, art, and boats was estimated to be worth $50 million.

To avoid scams, pass on investments that seem “too good to be true”—because they usually are. Also, many individuals involved in scams will appear friendly and trustworthy, but be on high alert! For more useful tips on how to avoid scams, check out the infographic below presented by AccountingSchoolGuide.com.

Source: Accounting School Guide