Not everyone is happy with the current bull market, despite the fact that the S&P 500 and the Dow are headed for their fourth straight year of gains and seemingly more records to break.

Not everyone is happy with the current bull market, despite the fact that the S&P 500 and the Dow are headed for their fourth straight year of gains and seemingly more records to break.

As the old saying goes, “the trend is your friend,” and so far, this has played out.

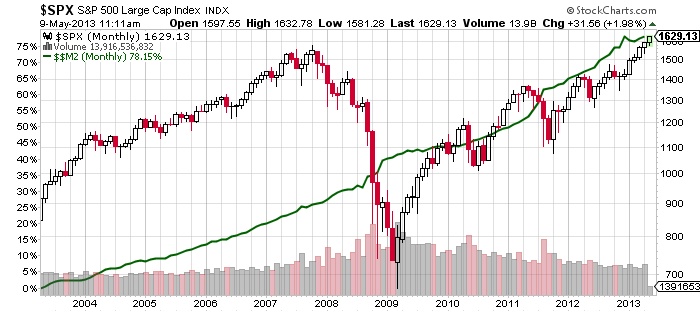

Just take a look at the chart below of the S&P 500 and its rally from the March 2009 bottom. Also note the rising flow of money into the system by the Federal Reserve, as indicated by the green upward-trending line. (Read “Thank the Fed for Your New Car, Home, Investments.”) Cheap and ample money combined with extremely low interest rates and yields on bonds has helped to fuel the stock market rally.

Chart courtesy of www.StockCharts.com

The stock market advance could continue, as long as the Fed and other central banks around the world are willing to continue to print money.

Now, let me explain why not everyone is happy.

With the burden of home foreclosures, job losses, declining wages, and continued uncertainties, many Americans do not have the resources to play the stock market. These lower- and middle-income Americans are just trying to pay for the necessities to survive daily, never mind thinking about their 401(k)s and retirement funds.

So you have the people making tons of money from the stock market. These are the consumers buying new cars, homes, traveling, and playing the stock market.

Then you have the people who are still struggling and haven’t yet recovered fully from the Great Recession. It could take a few more years for these people to rally out of their sinkhole, but in the meantime, they are missing out on the gains in the stock market.

By the time those who have not partaken in the current bull market are ready to once again invest in something other than the necessities, the stock market may be turning down, due to the aftermath of higher interest rates—and yes, they are coming down the road.

The reality is that it has been all about the timing over the past four years. If you invested, you made money. You can still ride the current gains, which still show no signs of stopping.

We will likely see a stock market correction—I’m just not sure when it will happen. But since we have yet to see a significant correction, aside from in mid-April, you know one is on the horizon. I would view a correction as a buying opportunity.