As the cryptocurrency industry continues to expand rapidly, US tax authorities face a significant challenge – widespread tax evasion related to digital assets.

The Internal Revenue Service (IRS) and other government agencies are ramping up efforts to combat this issue, which threatens to deprive the federal government of substantial tax revenue.

According to recent studies and IRS investigations, cryptocurrency tax non-compliance appears to be a regular practice among investors.

While exact figures for the United States are not available, research from Norway provides insights into the potential scale of the problem. A study published by the National Bureau for Economic Research from this European country found that approximately 88% of Norwegian crypto holders failed to declare their digital assets to tax authorities.

If similar patterns hold true in the United States, the implications could be significant. With the cryptocurrency market’s explosive growth – from 5,000 types of virtual currency in April 2020 to over 26,000 as of July 2023 – the potential for tax evasion has increased dramatically.

The IRS Criminal Investigation Division has been actively pursuing cases involving virtual currency. During fiscal years 2018 to 2023, the agency investigated 390 cases related to digital assets. Out of that total, 224 of the cases resulted in recommendations for prosecution.

Financial Impact of Crypto Tax Evasion is Unclear but May Be Significant

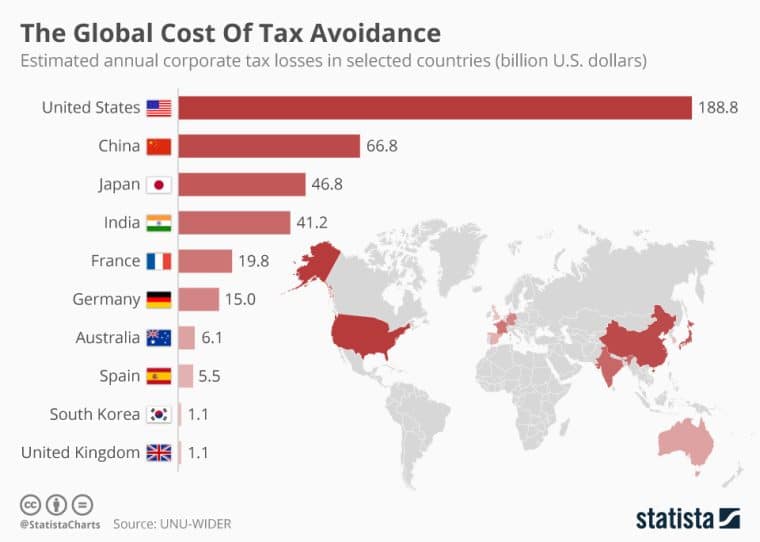

While the total amount of uncollected taxes due to cryptocurrency evasion is difficult to estimate with precision, most of the paperwork and research on the matter suggests that it could be substantial. Tax evasion is already a colossal problem in the US, especially with large corporations and the rich.

Extrapolating from the Norwegian study, which found average tax evasion ranging from $200 to $1,087 per non-compliant crypto investor, the aggregate impact on a country the size of the United States could be significant.

The Treasury Inspector General for Tax Administration (TIGTA) has highlighted the challenges faced by the IRS in enforcing tax compliance for virtual currency transactions. The anonymity of these transactions and the lack of consistent reporting from trading platforms complicate the agency’s efforts to identify and pursue tax evaders.

IRS Partners with Chainalysis and Hires Crypto Experts to Crack Down on Evasion

IRS officials have expressed growing concern about the rise in cryptocurrency-related tax crimes. Guy Ficco, chief of IRS criminal investigations, told CNBC that the agency expects to see an increase in “pure crypto tax crimes” this year. These crimes include failing to report any income generated from crypto sales or misrepresenting the true basis of cryptocurrency holdings.

The IRS views virtual currency as property, meaning that each time a taxpayer uses it as a medium of exchange, it potentially creates taxable consequences. This classification has led to complex reporting requirements that many taxpayers may not fully understand or choose to ignore.

Also read: The IRS Won’t Arrest You For Not Reporting $10K+ Crypto Transactions… Yet

The IRS partnered with the crypto analytics firm Chainalysis to track delinquents and tapped into their tools and applications to enhance their efforts.

Meanwhile, to further improve its enforcement efforts, the IRS recently recruited former crypto industry executives. In a recent announcement, the agency said that it hired Sulolit “Raj” Mukherjee, the former head of tax at ConsenSys and ex-Binance.US executive, and Seth Wilks, who previously worked for TaxBit, to serve as executive advisers. These experts will lead efforts on services and programs focused on digital assets.

“Seth and Raj expand our ability to understand this sector while designing systems for reporting of cryptocurrency and digital assets and related transactions. Improving employee capacity and access to tools in this rapidly evolving global landscape is a top IRS priority,” commented Doug O’Donnell, deputy commissioner for services and enforcement for the IRS back in February this year when the two hires were announced.

The Nature of Blockchain Technologies Creates Enforcement Challenges

The IRS struggles to track tax evaders and bring them to justice primarily amid the anonymity of blockchain transactions. This complicates the task of linking transactions to specific individuals.

Moreover, crypto trading may happen overseas through the use of virtual private networks (VPNs) and foreign exchanges, which makes it even more difficult to trace transactions as these entities are not forced to report their operations to US authorities.

In addition, certain protocols and cryptocurrencies (like Tornado Cash and Monero) make it even harder to trace crypto traders and investors. They use algorithms and smart contracts to mask their activities in various ways such as mixing tokens together anonymously and generating large webs of transactions.

The IRS has already launched several initiatives to address the growing challenge of cryptocurrency tax evasion.

In 2021, the IRS launched Operation Hidden Treasure, a partnership between the agency’s criminal and civil functions to identify taxpayers who fail to disclose their digital asset holdings on their tax returns.

However, TIGTA found that the operation’s primary purpose has been limited to the acquisition of tools and training rather than actively pursuing non-compliant taxpayers.

Meanwhile, the IRS Criminal Investigation Division has been leveraging advanced analytics tools to address virtual currency noncompliance. These tools help identify patterns and anomalies that may indicate tax evasion.

IRS and IIJA Act Prompt Exchanges and Service Providers to Help the IRS

The passage of the Infrastructure Investment and Jobs Act (IIJA) in November 2021 requires brokers to file information returns for digital asset transactions in a calendar year. In response, the IRS has created a new form (Form 1099-DA) to report the information needed to calculate gains or losses on crypto transactions.

The IRS has finalized the rules for this new scheme. These will be effective on January 1, 2025, for individual taxpayers while brokers will be required to report the cost basis for assets beginning in 2026.

Taxpayers must now report stablecoin holdings exceeding $10,000 along with non-fungible tokens (NFTs) worth over $600. This regulation is applicable to exchanges, custodians, and even wallet providers.

The US Treasury Department estimates that about 15 million people will be affected by the new rule, with approximately 5,000 firms needing to comply.

Moreover, the IRS is also working to strengthen its international cooperation efforts when it comes to tax enforcement. This includes information-sharing agreements with other countries and participation in global forums focused on cryptocurrency taxation.

Biden Administration Bolsters IRS Budget to Strengthen Enforcement

Although these efforts have the clear goal of increasing tax-collection revenues and enforcing existing laws, detractors of the IRS’s recent measures said that they have failed to keep up with changing times and new financial technologies.

As a result, they are now rushing and cutting corners by pushing forward laws and rules that fail to capture the uniqueness of digital assets, which industry groups and crypto enthusiasts claim should be treated differently than traditional assets.

Moreover, others have pointed out that the IRS simply lacks the personnel and technology to tackle the issue. To bolster the agency’s efforts, the Biden administration increased its budget via the Inflation Reduction Act of 2022 by $79 billion over the coming years – the majority of which will be allocated to toughening its enforcement efforts.

Thus far, reports claim that this budget increase is working. In July this year, the IRS said that it collected over $1 billion in past-due taxes from wealthy individuals.

“Funding from the Inflation Reduction Act is reversing a decade-long decline in our compliance work, including increasing our compliance work involving the wealthiest individuals and groups with tax issues. The collection results achieved in less than a year reveal the magnitude of what can be achieved over the long run as our Inflation Reduction enforcement continues to ramp up in the months ahead,” commented IRS Commissioner Danny Werfel.

Cryptocurrency tax evasion represents a growing challenge for US tax authorities, potentially resulting in significant lost revenue. While the IRS is taking steps to address this issue through new regulations, enhanced enforcement efforts, and the recruitment of industry experts, the rapidly evolving nature of the cryptocurrency landscape still presents ongoing difficulties to forcefully crack down on evasion.

As an adequate regulatory framework for this type of asset continues to be developed and enforcement capabilities keep improving, crypto investors should be aware of their tax obligations and the increasing scrutiny from authorities to avoid being hit with unnecessary penalties and legal proceedings.