Many investors are starting to worry that today’s artificial intelligence (AI) euphoria will pan out like the dot com bubble of the 1990s. Several leading observers have been talking about an “AI bubble” even as many others see the pivot for real. Taiwan Semiconductor Manufacturing Company or TSMC which produces high-end chips for companies like Nvidia and Advanced Micro Devices released its July revenue numbers today which seem to have shattered the “AI bubble” narrative – at least for now.

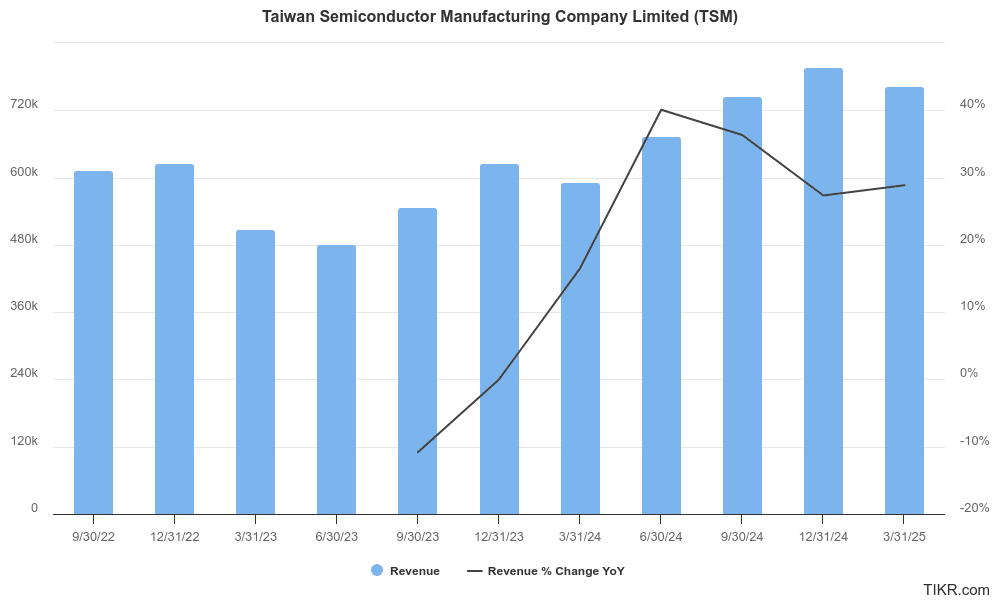

TSMC’s revenues rose 44.6% YoY and 23.6% month-on-month in July. During the earnings call last month, the company forecast revenues between $22.4 billion to $23.2 billion in Q3 which at the top end of the guidance implies a YoY rise of 37.4%. Wall Street analysts however seem a bit circumspect about TSMC hitting the top end of its guidance and are modeling revenues of $22.7 billion which implies a YoY rise of 36.2%.

TSMC Reported Strong Revenue Growth in July

Meanwhile, by delivering revenue growth far in excess of its quarterly guidance during the first month of the quarter, TSMC might have forced analysts to go back to their drawing board and increase their projections for the company’s revenues and profitability.

Markets have taken note of TSMC’s July revenues and the stock is up sharply in US premarket price action today. That said, the last few trading sessions have been quite volatile for chip companies, including TSMC.

$TSM TSMC Sales Grow 45% in July on Strong AI Chip Demand (Bloomberg)

– World’s leading contract chipmaker accelerated growth in Julycc $SMH $XSD pic.twitter.com/DqXgJTf2vY

— Christian Fromhertz 🇺🇸 (@cfromhertz) August 9, 2024

Chip Stocks Fell in Early August

Chip stocks and other AI plays, that led the stock market rally in the first half of the year have been quite volatile in August. One reason behind tech stocks briefly falling out of favor was their June quarter earnings. Among the so-called “Magnificent 7” stocks, only Meta Platforms could close with some meaningful gains following the Q2 earnings while Apple closed flat. While Apple’s earnings were better than expected, the company couldn’t really shatter estimates. Also, the report came at a time when global markets tanked and even Apple could not hold on to its gains.

Alphabet, Tesla, Amazon, and Microsoft all closed in the red after releasing their June quarter earnings. In Alphabet’s case, the stock closed in the red despite a beat on both the topline and bottomline as YouTube’s revenues fell short of estimates.

In a July note Albert Edwards, the chief global strategist for Societe Generale, warned of an impending crash, particularly in tech stocks. He said that markets have lofty expectations from tech companies and expect them to post earnings growth of 30% annually which is much higher than the 20% that they have historically delivered.

TSMC Stock Also Came Off Its Highs

After the earning reports, came the shocker from the Japanese central bank which raised rates which could put a lid on the popular yen carry trade. Rising tensions in the Middle East coupled with concerns over a US recession also added to the pessimism and US markets crashed on Monday.

TSMC which peaked at $193.47 in early July fell below $150 on Monday amid the tech crash. Notably, a section of the market has been apprehensive about the AI capex. Higher AI spending by tech companies had driven up demand for Nvidia’s chip which has a dominant 80% market share in that market.

Higher demand for Nvidia invariably leads to more revenues for TSMC whose foundries produce chips not only for Nvidia but also AMD. It is also the exclusive processor supplier for Apple iPhones whose demand is also expected to rise as the Tim Cook-led company launches its AI-enabled iPhone in September.

AI Continues to Drive Growth while Intel Faces Challenges: Latest Financial Reports from Major Wafer Foundries

Wafer foundries generally delivered impressive results in 2Q24 thanks to strong demand for advanced processes. TSMC, benefiting from robust demand for its 3nm and 5nm… pic.twitter.com/4tMcG5kHgB

— TrendForce (@trendforce) August 9, 2024

Sales of Advanced Chips Are Rising

There has been a wide divergence in the fortunes of chip makers this year and while Nvidia is among the top S&P 500 gainers, Intel is stacked at the bottom after the once iconic chip company badly missed its Q2 earnings and slashed its guidance.

While sales of chips used in PCs and smartphones have been tepid as their demand growth has sagged, AI chips are in high demand and companies are scrambling to grab Nvidia’s top-of-the-line chips.

In Q2, TSMC’s high-performance computing segment, which, among others, produces AI chips, accounted for 52% of its overall revenues. It was the first time that the segment accounted for over half of the company’s revenues and was a reflection of the chip industry’s changing dynamics.

The contribution is only expected to increase in the coming quarters as Big Tech companies have lined up billions of dollars in AI capex, a big chunk of which would be for buying Nvidia chips that TSMC produces. Notably, during the earnings call, TSMC raised its annual revenue guidance amid the strong demand for AI chips.

Analysts Are Bullish on TSMC Stock

Analysts are also bullish on TSMC stock as the company continues to benefit from higher demand for AI chips. Earlier this week, Morgan Stanley named the stock as a top pick “We like TSMC’s quality and defensive nature during an elongated semi downcycle. Price hike confirmation and ongoing AI capex strength should be key catalysts,” said the firm’s analyst Charlie Chan in a note.

Chan added, “Following the sector’s recent broad selloff, we think TSMC is attractive again at 16x our 2025 EPS estimate with higher quality company operations and financial outlook.”

The AI Bubble Debate Continues

All said the debate over AI being a bubble might not die down with TSMC as the view on AI’s impact on corporate earnings is quite nuanced. While a section of the market sees AI as a “bubble” like the dot com bubble, many others see the technology’s impact on corporate earnings as real and lasting. Last year Goldman Sachs said that AI could increase productivity by 1.5% annually which can increase S&P 500 profits by 30% or higher over the next 10 years.

There are varying estimates of how large the market for AI chips will eventually become. While Advanced Micro Devices (AMD) pegs the market to reach $400 billion by 2027, Intel expects it to be a trillion-dollar market by the end of this decade.

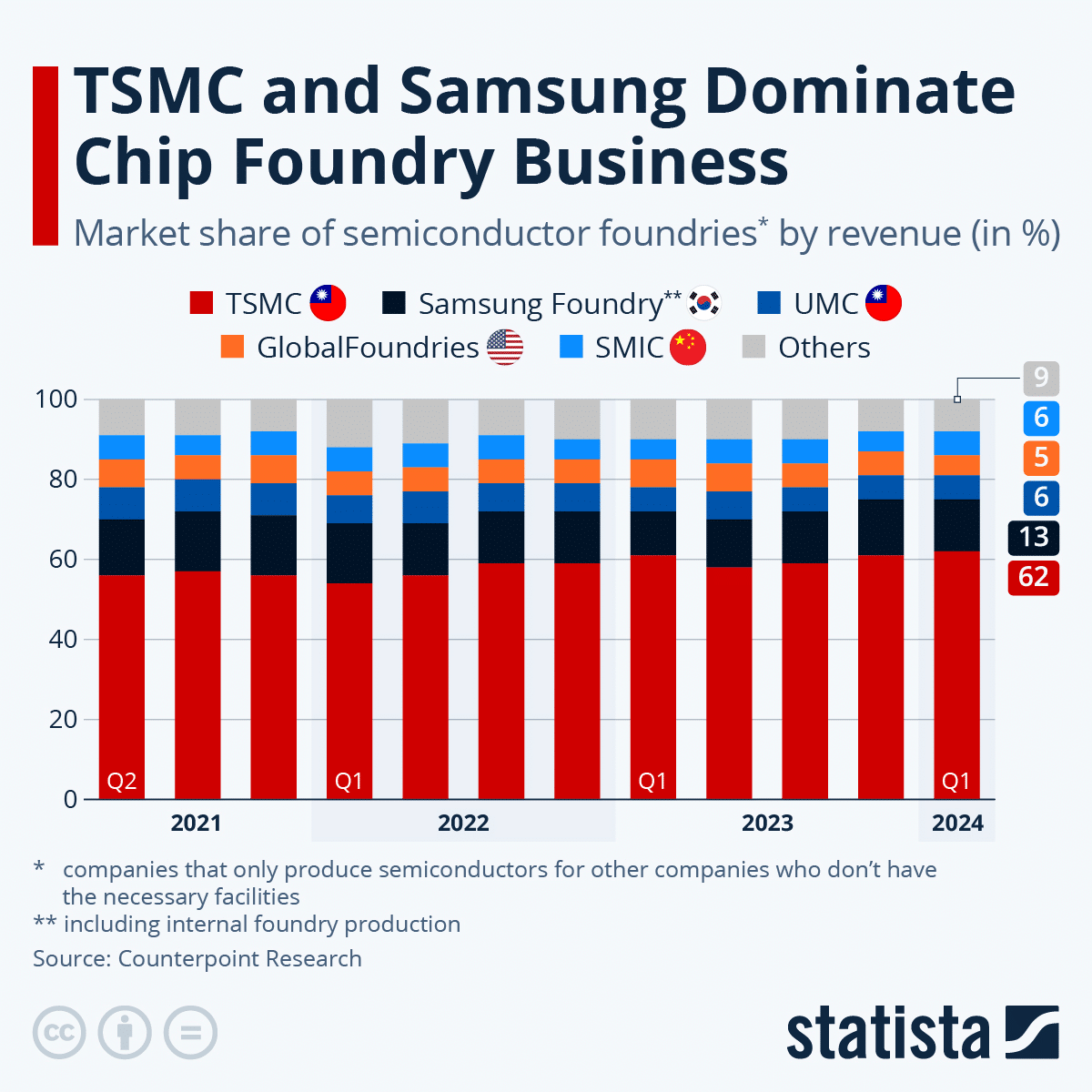

Currently, TSMC has a 62% market share of the foundry market with Samsung Foundry being a distant second with a 13% market share in Q1 2024. Intel is trying to break TSMC’s monopoly in the market and has pivoted to the foundry model along with working on its own chips.

Meanwhile remains to be seen whether Intel – whose share price still trades below the dot com highs – can compete with TSMC which has also read the global sentiments towards onshoring of chip production and is building a plant in Arizona and is considering building them in Europe also.